Free Acord 130 PDF Form

Misconceptions

Understanding the Acord 130 form is crucial for businesses seeking workers' compensation insurance. However, several misconceptions often arise regarding its purpose and requirements. Here are four common misconceptions:

- Misconception 1: The Acord 130 form is only for large businesses.

- Misconception 2: Completing the Acord 130 guarantees approval for coverage.

- Misconception 3: The form only requires basic information.

- Misconception 4: Once submitted, the information on the Acord 130 cannot be changed.

This is not true. The Acord 130 form is applicable to businesses of all sizes. Whether a sole proprietor or a corporation, any entity seeking workers' compensation coverage can use this form to apply for insurance.

Filling out the Acord 130 does not automatically ensure that coverage will be granted. Insurers will review the information provided and assess various factors before making a decision on approval.

In reality, the Acord 130 requires detailed information about the business, including employee classifications, payroll estimates, and prior loss history. Providing accurate and comprehensive information is essential for obtaining appropriate coverage.

This is incorrect. If there are changes in the business operations or employee status after submission, updates can be made. It's important to communicate any significant changes to the insurance provider to ensure that the coverage remains valid and adequate.

Documents used along the form

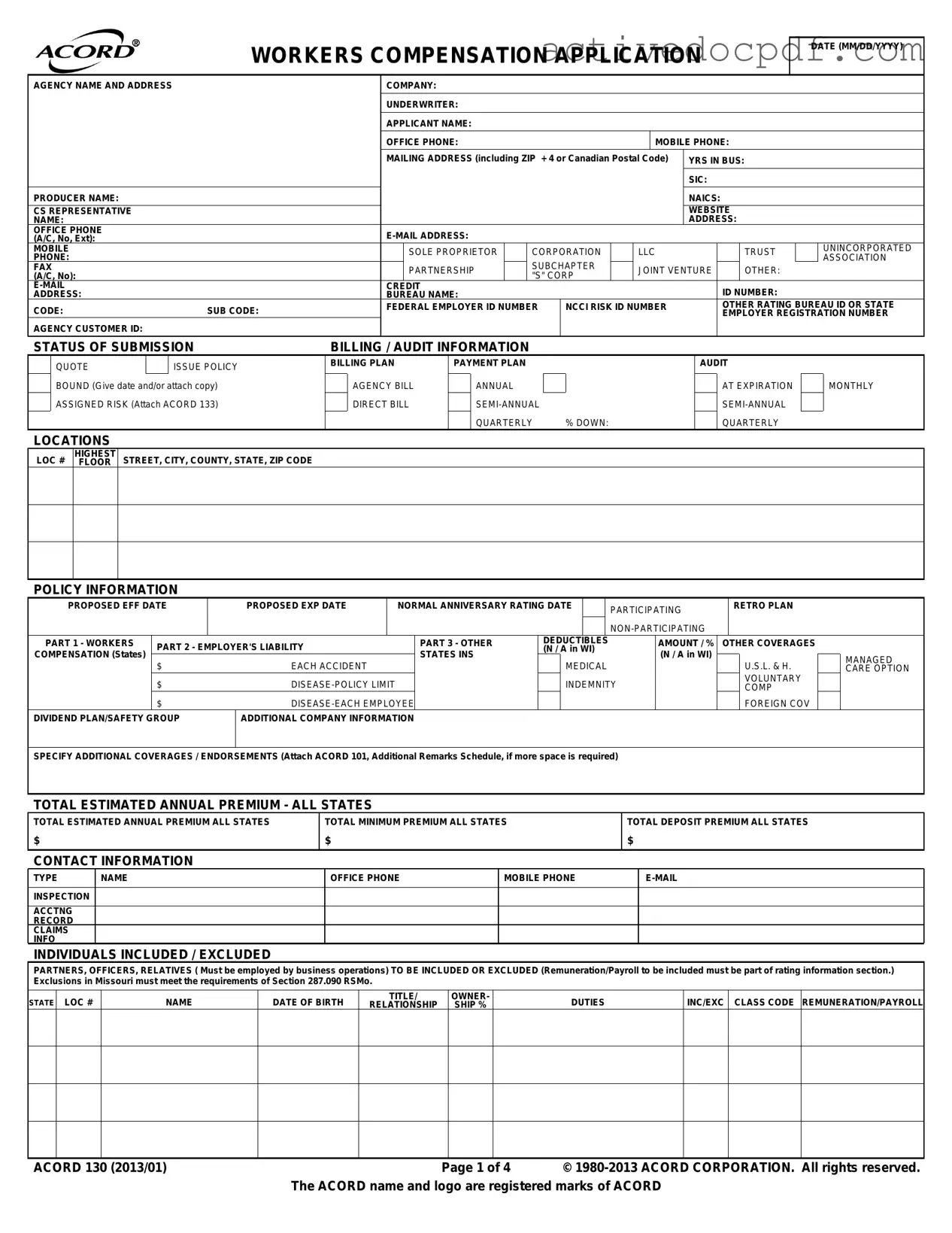

The Acord 130 form is a crucial document used in the application process for workers' compensation insurance. It collects essential information about the applicant's business, including details about the nature of operations, employee classifications, and coverage needs. Alongside the Acord 130, several other forms and documents are often utilized to ensure a comprehensive understanding of the applicant's situation and to facilitate the underwriting process. Below is a list of these related documents, each serving a specific purpose in the overall application process.

- Acord 133: This form is used to provide additional details when applying for workers' compensation insurance under the Assigned Risk Plan. It includes information about the business's operations and any special considerations that may affect coverage.

- Acord 101: The Additional Remarks Schedule allows applicants to provide further explanations or details that may not fit within the confines of the Acord 130. This could include unique business practices or specific coverage needs.

- Acord 25: This form is utilized for property insurance applications. It collects information about the property being insured, which can be relevant when assessing risk factors related to workers' compensation.

- Acord 140: The General Liability Application gathers information about the applicant's general liability coverage needs. This can help insurers understand the full scope of the applicant's risks.

- Loss Run Reports: These reports detail the applicant's claims history over a specified period, usually five years. Insurers review these reports to assess risk and determine premium rates based on past claims.

- Employment Verification Form: This essential document ensures the accuracy of employment status for applicants, facilitating processes such as insurance applications or benefits claims. More information can be found at documentonline.org.

- Business Plan: A comprehensive business plan outlines the operational structure, goals, and strategies of the business. It helps insurers understand the business's direction and potential risks involved.

- Employee Classification Codes: These codes categorize employees based on their job duties and associated risks. Accurate classification is essential for determining the appropriate premium rates for workers' compensation insurance.

- Safety Program Documentation: This includes records of safety policies and procedures implemented by the business. A robust safety program can positively influence the underwriting process and potentially lower premiums.

- Prior Carrier Information: This document provides details about the applicant's previous insurance coverage, including any claims or losses. Insurers use this information to evaluate the applicant's risk profile.

Each of these forms and documents plays a vital role in the workers' compensation application process. Together, they provide insurers with a comprehensive view of the applicant's business operations, risk factors, and coverage needs, ultimately helping to ensure that appropriate insurance solutions are tailored to meet the specific requirements of the business.

Check out Popular Documents

Texas Temporary Tag - Regulatory compliance is made simpler with the usage of this temporary tag form.

Completing your transaction with a well-organized Washington Motorcycle Bill of Sale is crucial for both buyers and sellers. This document not only serves as proof of ownership but also includes necessary details about the motorcycle, ensuring a smooth transfer. For more information, you can view the important Motorcycle Bill of Sale guidelines to help you through the process.

Dh 680 - Completing the form promptly is necessary to avoid issues with school enrollment.

Where to Find 1040 Form - Errors on the 1040 can lead to delays in processing refunds or complications with the IRS.

Key Details about Acord 130

What is the purpose of the Acord 130 form?

The Acord 130 form serves as a Workers Compensation Application. It collects essential information from businesses seeking workers' compensation insurance. This information helps insurance companies assess risk and determine appropriate coverage and premiums. The form includes details about the business, its operations, and employee classifications, which are crucial for underwriting decisions.

Who needs to fill out the Acord 130 form?

Any business that wishes to obtain workers' compensation insurance should complete the Acord 130 form. This includes sole proprietors, corporations, partnerships, and limited liability companies (LLCs). Regardless of the business structure, if employees are present, the form is necessary to ensure compliance with state workers' compensation laws.

What information is required on the Acord 130 form?

The form requests a variety of information, including:

- Agency name and address

- Applicant's name and contact details

- Business type (e.g., corporation, LLC, partnership)

- Years in business and industry classification (SIC and NAICS codes)

- Estimated annual payroll and number of employees

- Prior carrier information and loss history

- Details about business operations and any hazardous activities

Providing accurate and complete information is vital for obtaining the correct coverage and premium rates.

How does the Acord 130 form affect insurance premiums?

The information submitted on the Acord 130 form directly influences the insurance premiums. Insurers evaluate factors such as the type of business, employee classifications, and prior loss history to determine risk levels. A higher risk may lead to increased premiums, while a lower risk could result in discounts. Accurate reporting of payroll and employee duties is essential for fair premium assessment.

What is the significance of the loss history section?

The loss history section of the Acord 130 form provides insurers with insight into the applicant's past claims and losses. This information is crucial for assessing the likelihood of future claims. A history of frequent or severe claims may indicate higher risk, potentially leading to higher premiums or difficulty obtaining coverage.

What should be included in the business description?

The business description should clearly outline the nature of the operations, including:

- Type of products or services offered

- Processes involved in manufacturing or service delivery

- Any subcontracting arrangements

- Specific risks associated with the business activities

A thorough description helps insurers understand the business better and assess the associated risks accurately.

Are there any specific state requirements for the Acord 130 form?

Yes, certain states may have additional requirements or variations in the application process. For example, some states may require specific disclosures regarding prior coverage or unique business activities. It is important to consult with a local insurance agent or broker to ensure compliance with state-specific regulations when completing the Acord 130 form.

What happens if incorrect information is provided on the form?

Providing incorrect information on the Acord 130 form can have serious consequences. It may lead to denied claims, increased premiums, or even cancellation of the policy. Insurers rely on the accuracy of the information provided to make underwriting decisions. Therefore, it is crucial to review all entries carefully before submission.

Similar forms

- ACORD 133: This form is used to apply for workers' compensation insurance for businesses that fall under the assigned risk category. Like the Acord 130, it gathers essential information about the applicant's business and its operations.

- Free And Invoice PDF Form: This user-friendly document aids businesses and individuals in creating tailored invoices efficiently, similar in practicality to the ACORD forms. For more resources, visit PDF Documents Hub.

- ACORD 25: The ACORD 25 is a certificate of liability insurance. It serves a similar purpose in documenting insurance coverage but focuses more on general liability rather than workers' compensation. Both forms require detailed information about the insured and their business activities.

- ACORD 126: This is a commercial general liability application. It is similar to the Acord 130 in that it collects information about the business and its insurance needs. Both forms aim to assess risk and determine appropriate coverage.

- ACORD 140: This form is used for commercial property insurance applications. Like the Acord 130, it gathers comprehensive details about the business operations and property to evaluate coverage needs.

- ACORD 151: The ACORD 151 is a business auto application. It shares similarities with the Acord 130 as both forms collect information relevant to the applicant's operations, including the types of vehicles used and their purposes.

- ACORD 2: This is a general application for insurance. It is broader in scope but still collects vital information similar to what is found on the Acord 130, helping insurers assess risk across various types of coverage.

Guide to Filling Out Acord 130

Filling out the Acord 130 form is a crucial step in applying for workers' compensation insurance. Ensure that all information is accurate and complete to avoid delays in processing. Follow these steps to fill out the form effectively.

- Enter the date in the format MM/DD/YYYY.

- Provide the agency name and address.

- Fill in the company and underwriter information.

- Input the applicant name, office phone, and mobile phone.

- Complete the mailing address, including ZIP + 4 or Canadian Postal Code.

- Specify the number of years in business and SIC code.

- Provide producer name, NAICS, and CS representative information.

- Fill in the website name, address, office phone, and email address.

- Indicate the business structure (e.g., sole proprietor, corporation, LLC, etc.).

- Complete the credit ID number and address.

- Provide the bureau name, code, and sub code.

- Enter the federal employer ID number and NCCI risk ID number.

- Fill in any other rating bureau ID or state employer registration number.

- Complete the agency customer ID and the status of submission.

- Specify billing/audit information and the billing plan.

- Indicate the locations and highest street, city, county, state, ZIP code.

- Fill in the policy information, including proposed effective and expiration dates.

- Complete parts 1, 2, and 3 for workers compensation, employer's liability, and other deductibles.

- Provide total estimated annual premium and other premium information.

- List individuals included/excluded with their details.

- Complete the rating information for each state and include the prior carrier information.

- Provide nature of business and description of operations.

- Answer the general information questions, providing explanations for any "yes" responses.

- Sign the form as the applicant and include the date.

- Have the producer sign and include the national producer number.