Free Adp Pay Stub PDF Form

Misconceptions

Understanding the ADP Pay Stub form can be challenging due to various misconceptions that often circulate. Here is a list of eight common misunderstandings, along with clarifications to help clear up any confusion.

-

Misconception 1: The pay stub only shows gross earnings.

This is not true. While the pay stub does display gross earnings, it also details net pay, deductions, and taxes withheld, providing a comprehensive overview of an employee's earnings.

-

Misconception 2: All deductions are mandatory.

Not all deductions listed on a pay stub are required. Some, like retirement contributions or health insurance premiums, may be optional based on the employee's choices.

-

Misconception 3: The pay stub format is the same for all employees.

This is misleading. The format may vary depending on the employer's preferences and the specific payroll software used, resulting in different layouts and information presented.

-

Misconception 4: Pay stubs are only important for tax purposes.

While pay stubs are indeed essential for tax filing, they also serve other purposes, such as verifying income for loans, budgeting, and tracking hours worked.

-

Misconception 5: You don’t need to keep pay stubs once you receive your W-2.

This is not advisable. Keeping pay stubs can be beneficial for personal records and in case of discrepancies with your W-2 or payroll information.

-

Misconception 6: Employers are not required to provide pay stubs.

In many states, employers are legally obligated to provide pay stubs to employees. However, the specific requirements can vary by state, so it’s important to check local laws.

-

Misconception 7: Pay stubs are only for salaried employees.

This is incorrect. Both hourly and salaried employees receive pay stubs, which detail their earnings, deductions, and other relevant information regardless of how they are compensated.

-

Misconception 8: You can only access your pay stub if you are at the office.

Many employers now offer online access to pay stubs, allowing employees to view and download their pay information from anywhere, making it convenient and accessible.

By understanding these misconceptions, employees can better navigate their pay stubs and utilize them effectively for their financial planning and record-keeping.

Documents used along the form

The ADP Pay Stub form is an essential document for employees to understand their earnings and deductions. It provides a detailed breakdown of wages, taxes, and other withholdings. Along with the pay stub, there are several other forms and documents that individuals may encounter in relation to payroll and employment records. Below is a list of commonly used documents that often accompany the ADP Pay Stub form.

- W-2 Form: This form is issued annually by employers to report an employee's total earnings and taxes withheld for the year. It is essential for filing income tax returns.

- Employment Verification Form: To confirm work history and income details, employers often utilize the essential Employment Verification documentation to ensure accuracy and reliability.

- Direct Deposit Authorization Form: Employees complete this form to authorize their employer to deposit their pay directly into their bank account, ensuring timely access to funds.

- Employee Withholding Certificate (W-4): This form allows employees to indicate their tax withholding preferences. It helps employers determine the correct amount of federal income tax to withhold from paychecks.

- Pay Rate Change Form: When an employee's pay rate changes, this form documents the new rate and the effective date, ensuring accurate payroll processing.

- Time Sheet: Employees use this document to record hours worked, which is crucial for calculating pay, especially for hourly workers.

- Benefits Enrollment Form: This form is used by employees to enroll in or make changes to their benefit plans, such as health insurance or retirement savings.

- Termination Notice: When an employee leaves a job, this document outlines the terms of their departure and may include final pay details and benefits information.

Understanding these documents is vital for employees to manage their earnings, benefits, and tax obligations effectively. Each form serves a specific purpose and contributes to maintaining accurate payroll records and compliance with employment regulations.

Check out Popular Documents

Goodwill Donation Receipt Online - Your support helps fund critical training programs within Goodwill.

When transferring ownership of an all-terrain vehicle, it's crucial to have the appropriate documentation in place to protect both parties involved. The California ATV Bill of Sale form serves as an essential legal document for this purpose. This form not only provides proof of purchase but also ensures that the transaction is conducted smoothly and legally. For your convenience, you can access the necessary documentation, including the ATV Bill of Sale form, to facilitate the process.

How to Fill Out Passport Application - Applicants can track the status of their passport application after submitting the DS-11 form online or by phone.

Key Details about Adp Pay Stub

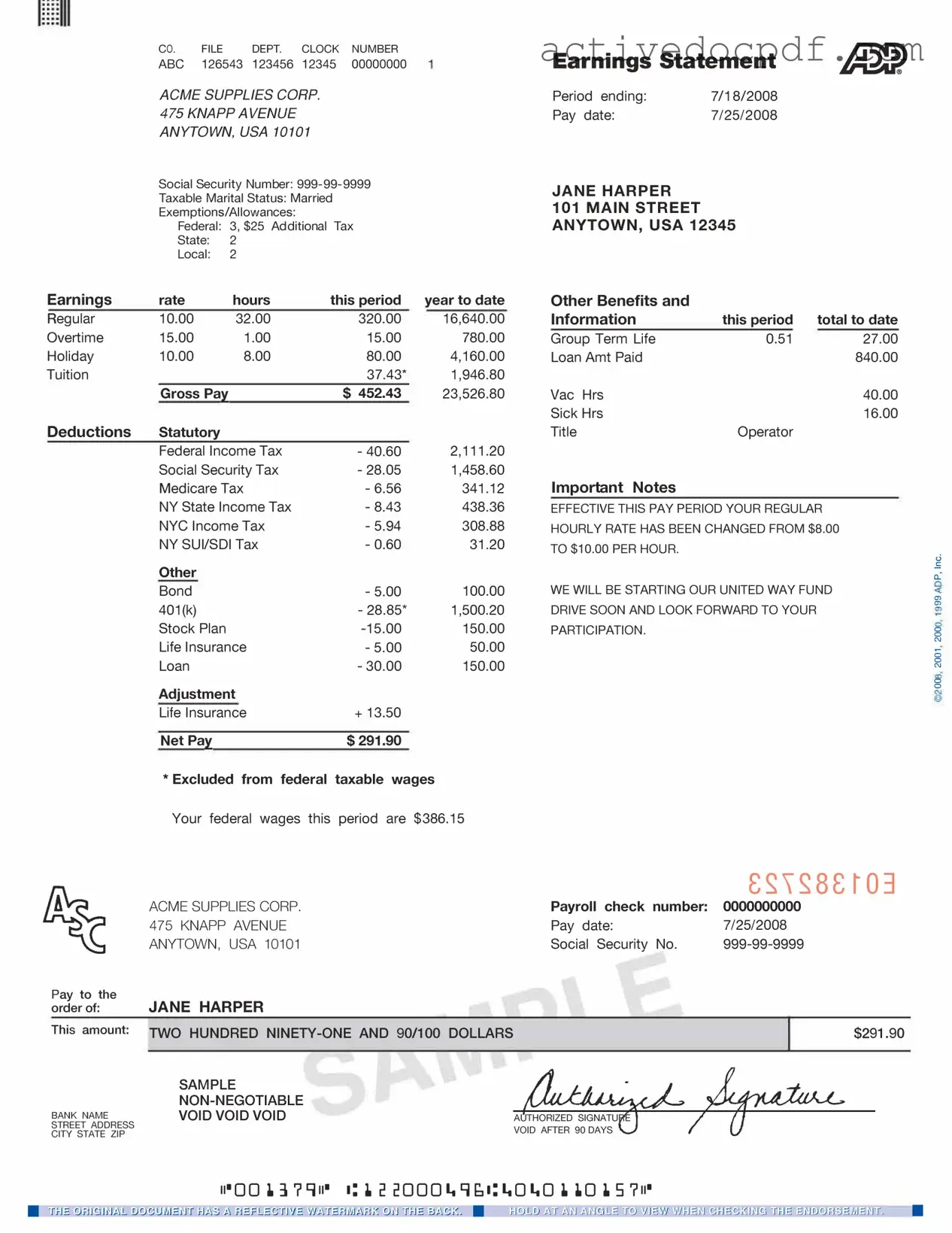

What is an ADP Pay Stub?

An ADP Pay Stub is a document provided by ADP, a payroll processing company, that outlines an employee's earnings for a specific pay period. It typically includes important details such as gross pay, deductions, and net pay. This form serves as a record of what an employee earned and how much was withheld for taxes, benefits, and other deductions.

How can I access my ADP Pay Stub?

Accessing your ADP Pay Stub is straightforward. You can follow these steps:

- Visit the ADP website or use the ADP mobile app.

- Log in using your credentials. If you don’t have an account, you may need to create one using your employee ID and other identifying information.

- Once logged in, navigate to the 'Pay' section to view your pay stubs.

- Select the pay period you wish to review, and your pay stub will be available for viewing or downloading.

What information is included on an ADP Pay Stub?

An ADP Pay Stub contains several key pieces of information:

- Employee Information: Name, address, and employee ID.

- Pay Period: The start and end dates of the pay period.

- Gross Pay: Total earnings before any deductions.

- Deductions: Amounts withheld for taxes, retirement plans, health insurance, and other benefits.

- Net Pay: The final amount you take home after all deductions.

What should I do if there is an error on my ADP Pay Stub?

If you notice an error on your ADP Pay Stub, it’s important to address it promptly. Here’s what you can do:

- Review the pay stub carefully to confirm the error.

- Contact your employer’s payroll department to report the discrepancy. It’s helpful to have your pay stub handy when you do this.

- Follow up to ensure that the issue is resolved and that any necessary corrections are made.

Being proactive about any discrepancies will help ensure that your records are accurate and up-to-date.

Similar forms

- W-2 Form: This document summarizes an employee's annual wages and the taxes withheld. Like the ADP Pay Stub, it provides essential information for tax filing.

- Paycheck: A physical or electronic payment issued to an employee for work performed. It includes similar details about earnings and deductions, just like the ADP Pay Stub.

- Residential Lease Agreement: It is crucial for landlords and tenants to have a sound understanding of the New York Residential Lease Agreement, which covers all necessary terms for renting a property. For more details, visit PDF Documents Hub.

- Direct Deposit Receipt: This document confirms that an employee's paycheck has been directly deposited into their bank account. It shares key information about earnings and deductions.

- Payroll Summary Report: This report provides a comprehensive overview of all employees' earnings and deductions for a specific pay period. It is similar to the ADP Pay Stub in its breakdown of financial information.

- Tax Withholding Statement: This document outlines the amount of federal and state taxes withheld from an employee's paycheck. It serves a similar purpose in detailing deductions.

- Expense Reimbursement Form: This form is used to request reimbursement for work-related expenses. It may include details about deductions, akin to the ADP Pay Stub.

- Benefit Statement: This document outlines the benefits an employee is entitled to, including health insurance and retirement contributions. It complements the ADP Pay Stub by providing additional financial context.

- Employment Verification Letter: This letter confirms an employee's job title and salary. While it serves a different purpose, it shares the focus on compensation details found in the ADP Pay Stub.

Guide to Filling Out Adp Pay Stub

Filling out the ADP Pay Stub form is straightforward. You'll need to provide specific information related to your employment and payment details. Follow these steps to ensure you complete the form accurately.

- Begin by entering your employee ID at the top of the form.

- Next, fill in your name as it appears on your official documents.

- Provide your address, including street, city, state, and zip code.

- Input your pay period dates, indicating the start and end of the pay period.

- List your hours worked for the pay period, including regular and overtime hours.

- Detail your gross pay, which is the total amount earned before any deductions.

- Include any deductions such as taxes, insurance, or retirement contributions.

- Finally, calculate and enter your net pay, which is the amount you will receive after deductions.