Free Alabama Mvt 20 1 PDF Form

Misconceptions

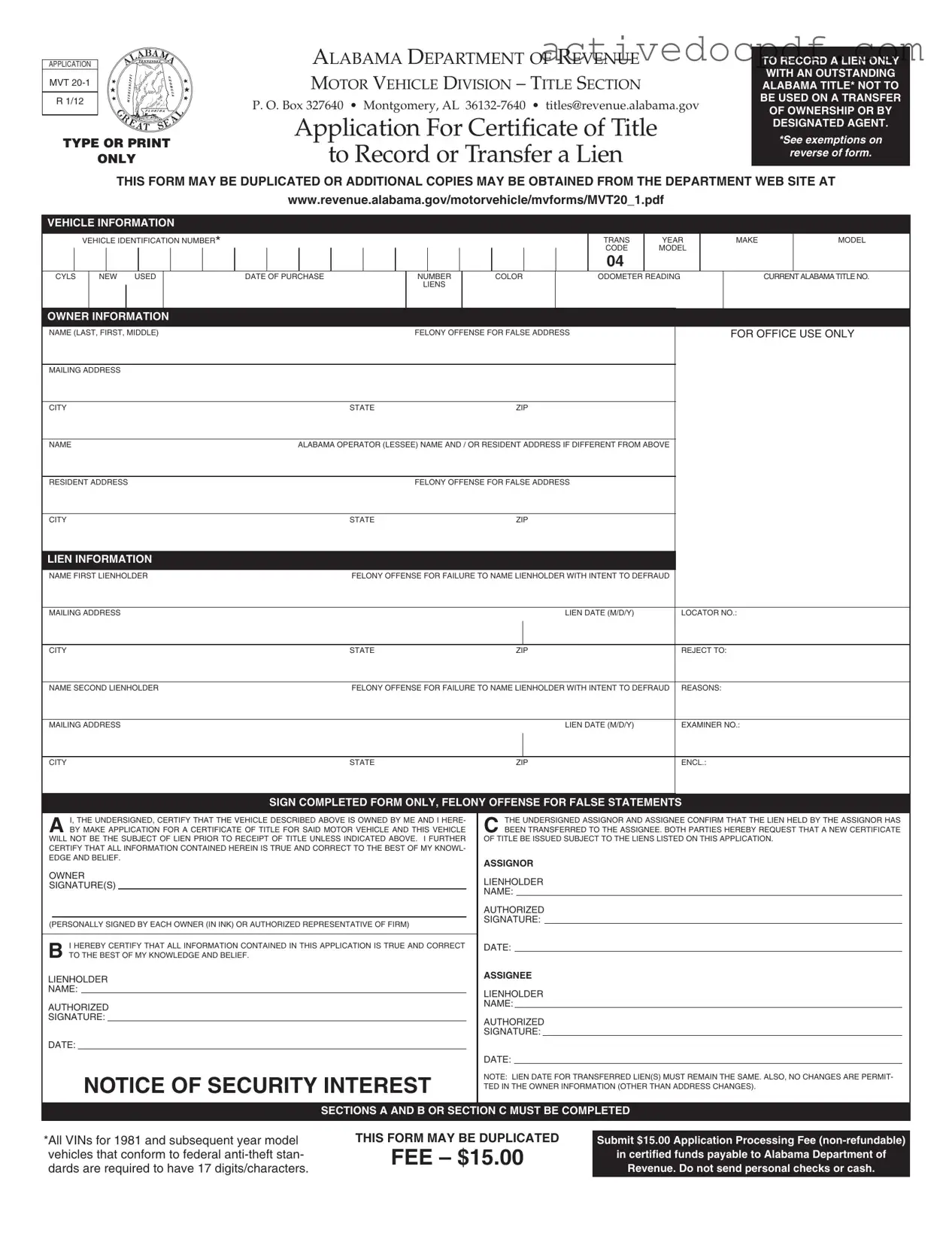

Understanding the Alabama Mvt 20 1 form can be challenging. Here are six common misconceptions regarding this form:

- This form can be used for transferring ownership. The Mvt 20 1 form is specifically designed for recording or transferring a lien only. It cannot be used for transferring ownership of a vehicle.

- Any individual can submit this form. Only lienholders or individuals with an outstanding Alabama title may use this form. It is not intended for designated agents or general public use.

- The form can be submitted without the current Alabama title. This form must be accompanied by the current Alabama title of the vehicle. Submitting it without the title will result in rejection.

- Illegible forms will be accepted if submitted with a fee. Illegible forms will be returned. It is crucial to type or print the information legibly to avoid delays.

- There are no fees associated with this form. A non-refundable application processing fee of $15.00 must be submitted in certified funds. Personal checks or cash are not accepted.

- All vehicles require a title. Certain vehicles, such as those more than thirty-five years old or specific types of trailers, may be exempt from titling. It is essential to verify the vehicle's eligibility before submitting the form.

Clarifying these misconceptions can help ensure a smoother process when dealing with the Alabama Mvt 20 1 form.

Documents used along the form

The Alabama MVT 20 1 form is specifically designed for recording or transferring a lien on a vehicle. When completing this process, several other documents may be required or helpful to ensure a smooth transaction. Below is a list of commonly used forms and documents that accompany the MVT 20 1 form.

- Alabama MVT 5-1E Form: This form is used by designated agents to record liens. Unlike the MVT 20 1, which is for lienholders, the MVT 5-1E is intended for agents acting on behalf of the vehicle owner.

- Power of Attorney Form: To grant authority to another individual, consider our detailed Power of Attorney form guidelines to ensure your wishes are properly documented.

- Current Alabama Title: The existing title for the vehicle must be submitted along with the MVT 20 1 form. This document verifies ownership and contains essential vehicle information necessary for processing the lien.

- Application Processing Fee: A fee of $15.00 in certified funds is required to process the application. This fee must accompany the MVT 20 1 form and the current title to complete the transaction.

- Notice of Security Interest: This document outlines the security interest held by the lienholder. It provides additional details regarding the lien and is important for both parties to understand their rights and obligations.

When preparing to file the MVT 20 1 form, it is crucial to gather these supporting documents to avoid delays. Ensuring that all required information is complete and accurate will facilitate a smoother process for recording the lien on the vehicle.

Check out Popular Documents

Army Award Form - This form avoids unnecessary complexity yet requires attention to detail for effective submissions.

A Last Will and Testament is a legal document that outlines how a person's assets and responsibilities should be handled after their death. This important form ensures that your wishes are honored and can provide peace of mind for both you and your loved ones. You can find more information and get started on securing your legacy by visiting PDF Documents Hub, where you can fill out the necessary forms.

How to Write a Continuance Letter for Court - Use this motion to ensure the court considers your request.

Key Details about Alabama Mvt 20 1

What is the purpose of the Alabama Mvt 20 1 form?

The Alabama Mvt 20 1 form is specifically designed for lienholders to record or transfer a lien on a motor vehicle that has an outstanding Alabama title. It is important to note that this form should not be used for transferring ownership of a vehicle or by designated agents. The application helps ensure that security interests in vehicles are properly documented according to Alabama law.

Who should complete the Mvt 20 1 form?

This form should be completed by the lienholder, which is typically a financial institution or individual that has provided a loan for the purchase of the vehicle. The owner of the vehicle must also provide their information. Both parties need to certify that the information is accurate and true to the best of their knowledge.

What information is required on the form?

The Mvt 20 1 form requires various pieces of information, including:

- Vehicle information such as the Vehicle Identification Number (VIN), make, model, year, and odometer reading.

- Owner information, including the owner's name, address, and any felony offenses related to false statements.

- Details about the lienholder, including their name, address, and the date of the lien.

It is crucial that the vehicle and owner information matches what is listed on the current Alabama title.

What fees are associated with submitting the Mvt 20 1 form?

There is a non-refundable application processing fee of $15. This fee must be submitted in certified funds made payable to the Alabama Department of Revenue. Personal checks and cash are not accepted. The payment should accompany the completed form and any required supporting documents.

What supporting documents must accompany the form?

When submitting the Mvt 20 1 form, it is necessary to include the current Alabama title for the vehicle. This is required to confirm ownership and to ensure that the lien can be recorded accurately. In addition, the application fee must be included as well.

Are there any exemptions for using the Mvt 20 1 form?

Yes, there are specific exemptions. For instance, no certificate of title will be issued for:

- Manufactured homes, trailers, and similar vehicles that are more than twenty years old.

- Motor vehicles that are more than thirty-five years old.

- Low-speed vehicles that do not meet certain safety standards.

These exemptions mean that if a vehicle falls into one of these categories, the Mvt 20 1 form cannot be used for titling or lien recording.

Similar forms

The Alabama Mvt 20 1 form is primarily used to record or transfer a lien on a vehicle with an outstanding Alabama title. Several other documents serve similar purposes in various contexts. Below is a list of ten documents that share similarities with the Alabama Mvt 20 1 form:

- Form MVT 5-1E: This form is specifically designed for designated agents to record liens. Unlike the Mvt 20 1, it is used when the ownership of the vehicle is being transferred.

- Room Rental Agreement: Just like other vital forms, a Room Rental Agreement establishes critical terms between the landlord and tenant, ensuring clarity and minimizing disputes. For further details, refer to the nyforms.com/room-rental-agreement-template.

- Form MVT 5-1: This document is used for the application of a certificate of title for a newly purchased vehicle. It includes similar information about the vehicle and the owner.

- Form MVT 10: This form is used to apply for a duplicate title when the original title is lost or damaged. It requires vehicle identification details, akin to the Mvt 20 1.

- Form MVT 7: This is the application for a certificate of title for a vehicle that has been rebuilt or reconstructed. It also focuses on the vehicle's history and ownership.

- Form MVT 8: This document is used to report the transfer of ownership of a vehicle. It contains similar owner and vehicle information but is focused on ownership rather than liens.

- Form MVT 4: This form is used for the application of a title for a vehicle that has been inherited. It requires information about the deceased owner and the inheritor.

- Form MVT 6: This form is for the application of a title for a vehicle that has been gifted. It includes details about the donor and recipient, similar to ownership transfer forms.

- Form MVT 1: This is the standard application for a certificate of title for a vehicle. It is used for new registrations and shares many common fields with the Mvt 20 1.

- Form MVT 9: This document is used for the application of a title for a vehicle that is being registered from out of state. It requires similar vehicle and owner information.

- Form MVT 3: This form is used for the application of a title for a vehicle that has been salvaged. It requires a detailed history of the vehicle, similar to the lien recording process.

Each of these documents plays a crucial role in vehicle ownership and lien management, ensuring that all necessary information is accurately recorded and maintained. Understanding the purpose of each form can help streamline the process of vehicle registration and lien recording.

Guide to Filling Out Alabama Mvt 20 1

Filling out the Alabama MVT 20 1 form requires careful attention to detail. After completing the form, it will need to be submitted along with the necessary fee and supporting documents to the Alabama Department of Revenue. Ensure that all information is accurate to avoid any delays in processing.

- Obtain the Form: Download the Alabama MVT 20 1 form from the Alabama Department of Revenue website or make a copy of the form.

- Fill Out Vehicle Information: Enter the Vehicle Identification Number (VIN), year, make, model, color, odometer reading, and current Alabama title number.

- Provide Owner Information: Fill in your name (last, first, middle), mailing address, city, state, and ZIP code. If applicable, include the resident address if different from the mailing address.

- Input Lien Information: List the first lienholder’s name, mailing address, city, state, ZIP code, and the lien date. If there is a second lienholder, provide their details as well.

- Sign the Form: Both the assignor and assignee must sign the form. Each owner or authorized representative should sign in ink.

- Prepare Payment: Include a $15.00 application processing fee in certified funds, payable to the Alabama Department of Revenue. Do not send personal checks or cash.

- Attach Supporting Documents: Include the current Alabama title for the vehicle with your application.

- Submit the Application: Mail the completed form, payment, and supporting documents to the Alabama Department of Revenue at the address provided on the form.