Free Authorization And Direction Pay PDF Form

Misconceptions

- Misconception 1: The Authorization and Direction to Pay form is only for auto accidents.

- Misconception 2: Only the vehicle owner can fill out this form.

- Misconception 3: The form guarantees payment from the insurance company.

- Misconception 4: The form must be notarized to be valid.

- Misconception 5: Once submitted, the form cannot be changed.

- Misconception 6: The insurance company will always send the check directly to the repair facility.

- Misconception 7: The form is only relevant during the claim process.

This form can be used for various types of claims, not just auto accidents. It applies to any situation where a payment needs to be directed to a repair facility or service provider.

While the vehicle owner typically completes the form, an authorized representative can also fill it out if they have permission from the owner.

Completing the form does not guarantee that the insurance company will pay the claim. It simply directs them to pay a specified amount to a designated party.

Notarization is not a requirement for this form. A signature from the customer is sufficient to authorize the payment direction.

Changes can be made to the form, but it typically requires the submission of a new form or an amendment, depending on the insurance company's policies.

While the form directs the insurance company to do so, mistakes can happen. If the check is sent to the vehicle owner by accident, they must notify the repair facility promptly.

This form can remain relevant even after a claim is settled, especially if there are disputes or issues regarding payment. Keeping a copy is advisable for future reference.

Documents used along the form

When dealing with insurance claims and payments, several forms and documents are commonly used alongside the Authorization and Direction to Pay form. Each of these documents serves a specific purpose in the claims process, ensuring that all parties are informed and agreements are documented properly. Below is a list of these important forms.

- Claim Form: This document initiates the claims process. It provides essential information about the incident, the insured party, and the damages incurred.

- Proof of Loss: This form details the specifics of the loss or damage. It is usually required by the insurance company to process the claim and may need to be submitted within a certain timeframe.

- Florida Hold Harmless Agreement Form: This legal document outlines the responsibilities and liabilities that each party assumes, ensuring that one party will not hold another accountable for risks associated with certain activities. For more details, you can refer to for the form.

- Repair Estimate: A detailed estimate from the repair facility outlining the costs associated with the repairs. This document helps the insurance company assess the claim amount.

- Release of Liability: This document releases the insurance company from any further claims related to the incident once the settlement is paid. It protects the insurer from future claims regarding the same issue.

- Settlement Agreement: This agreement outlines the terms of the settlement between the insured and the insurance company. It includes the amount to be paid and any conditions attached to the settlement.

- Subrogation Agreement: If another party is responsible for the damages, this document allows the insurance company to seek reimbursement from that party after paying the claim.

- Certificate of Insurance: This document provides proof of insurance coverage. It may be required by the repair facility or other parties involved in the claim process.

Having these documents prepared and organized can streamline the claims process. Ensure that each form is completed accurately and submitted promptly to avoid delays in receiving payment or processing your claim.

Check out Popular Documents

Cuddle Buddy Application Meme - Foster deep bonds through shared warmth and support.

To effectively navigate the complexities of legal decisions, it's crucial to have a reliable resource for filling out essential documents like the California Power of Attorney form. For those seeking guidance, documentonline.org offers valuable insights and templates to assist with this important legal task, ensuring your wishes are clearly expressed and respected.

P45 What Is It - P45 parts are unique and not available in copy form.

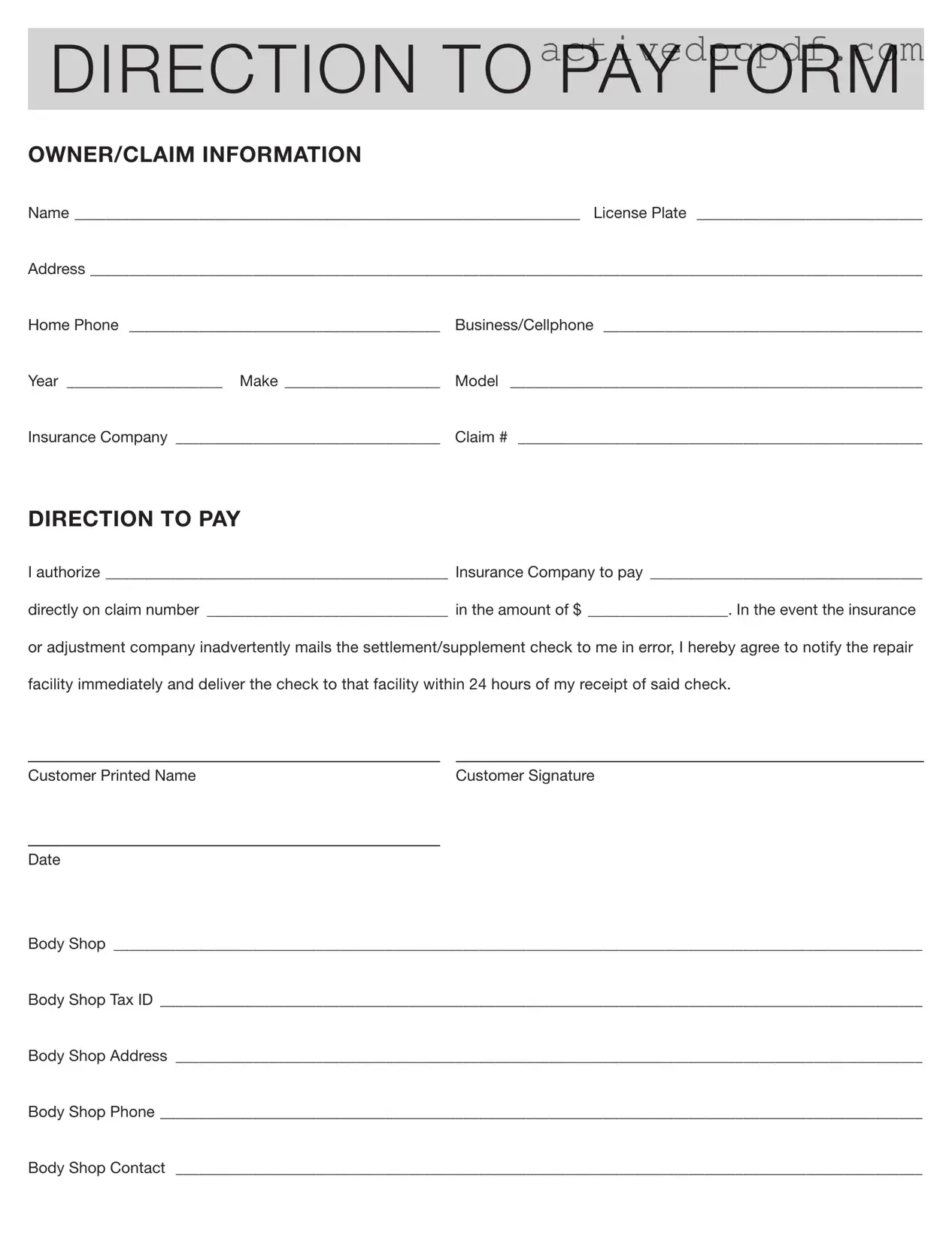

Key Details about Authorization And Direction Pay

What is the purpose of the Authorization and Direction Pay form?

The Authorization and Direction Pay form is designed to streamline the payment process between an insurance company and a repair facility. By completing this form, the owner of a vehicle authorizes their insurance company to pay the repair shop directly for services rendered. This helps ensure that payments are made promptly and reduces the likelihood of delays in repairs.

Who needs to fill out the Authorization and Direction Pay form?

The vehicle owner must fill out the form. They will need to provide their personal information, including name, address, and contact details. Additionally, information regarding the vehicle, such as the license plate number, make, model, and year, is required. The form also requires details about the insurance company and claim number, ensuring that all parties involved are accurately identified.

What happens if the insurance check is sent to the vehicle owner by mistake?

If the insurance company inadvertently sends the settlement or supplement check to the vehicle owner instead of the repair facility, the owner is responsible for notifying the repair shop immediately. They must then deliver the check to the repair facility within 24 hours of receiving it. This ensures that the repair process can continue without unnecessary delays.

Is the Authorization and Direction Pay form legally binding?

Yes, the Authorization and Direction Pay form is a legally binding document once signed by the vehicle owner. By signing the form, the owner agrees to the terms outlined, which include authorizing the insurance company to pay the repair facility directly. It is important for the vehicle owner to read and understand the form before signing, as it establishes a financial obligation between the parties involved.

How can I obtain the Authorization and Direction Pay form?

The Authorization and Direction Pay form is typically available at auto body shops or can be requested directly from your insurance company. Many repair facilities also provide the form on their websites for easy access. If you are unsure where to find it, contacting your insurance agent or the repair shop can help you obtain the necessary documentation.

Similar forms

The Authorization And Direction Pay form shares similarities with several other documents used in insurance and claims processes. Below are four such documents, each with a brief explanation of how they relate to the Authorization And Direction Pay form.

- Power of Attorney (POA): This document grants someone the authority to act on behalf of another person in legal or financial matters. Like the Authorization And Direction Pay form, a POA allows for direct action regarding payments and claims, ensuring that a designated individual can handle transactions and decisions.

- Assignment of Benefits (AOB): An AOB allows a policyholder to transfer their insurance benefits to a third party, such as a repair shop. Similar to the Authorization And Direction Pay form, it facilitates direct payment from the insurance company to the service provider, streamlining the claims process.

- Claim Assignment Form: This form is used to officially assign rights to a claim to another party. It operates in much the same way as the Authorization And Direction Pay form by allowing the claimant to direct payments to a specific entity, ensuring that funds are disbursed correctly.

- Non-disclosure Agreement: To safeguard your confidential information, complete the essential Non-disclosure Agreement resources and protect your trade secrets effectively.

- Release of Liability Form: While primarily used to release one party from liability, this document can also include payment direction provisions. It shares a common purpose with the Authorization And Direction Pay form in that both documents require the consent of the claimant for payments to be directed to another party.

Guide to Filling Out Authorization And Direction Pay

After completing the Authorization And Direction Pay form, the next steps involve submitting it to your insurance company or the relevant parties involved in your claim. Ensure that all information is accurate to avoid any delays in processing your payment. Follow the steps below to fill out the form correctly.

- Begin by entering your name in the designated space at the top of the form.

- Provide your license plate number beneath your name.

- Fill in your address, ensuring that all details are complete and accurate.

- Input your home phone number and business/cell phone number.

- Specify the year, make, and model of your vehicle.

- List the name of your insurance company and the claim number assigned to your case.

- In the "Direction to Pay" section, write the name of the insurance company authorized to make the payment.

- Identify the party who should receive the payment directly, filling in their name.

- Enter the claim number again for clarity.

- Indicate the amount to be paid in the specified space.

- Read the agreement regarding the handling of any checks sent to you in error, and ensure you understand your responsibilities.

- Print your name in the customer printed name section.

- Sign the form in the customer signature section.

- Include the date of signing.

- Provide the name of the body shop, along with their tax ID and address.

- Fill in the body shop's phone number and contact person’s name.