Free Auto Insurance Card PDF Form

Misconceptions

Misconceptions about the Auto Insurance Card form can lead to confusion for drivers. Understanding the facts can help clarify its purpose and requirements. Below are six common misconceptions:

- The Auto Insurance Card is optional. Many people believe that carrying this card is not necessary. However, it is a legal requirement in most states to have this card in your vehicle at all times.

- The information on the card is not important. Some individuals think that the details listed, such as the policy number and effective dates, are irrelevant. In reality, this information is crucial for verifying coverage during an accident or traffic stop.

- Only the driver needs to have the card. There is a misconception that only the person driving the vehicle must present the card. In fact, any occupant of the vehicle should be able to provide the card if requested by law enforcement or in the event of an accident.

- The card does not need to be updated. Some believe that once the card is issued, it remains valid indefinitely. However, it is essential to update the card whenever there is a change in coverage, vehicle, or policy details.

- It is acceptable to show a digital version of the card. While many states allow digital proof of insurance, not all do. It is best to check local laws to determine if a physical card is required.

- The reverse side of the card is unimportant. Many overlook the important notice on the back of the card. This section contains vital instructions on what to do in case of an accident, which can be crucial for ensuring proper reporting and documentation.

By addressing these misconceptions, drivers can better understand the significance of the Auto Insurance Card and ensure compliance with their state's regulations.

Documents used along the form

When navigating the world of auto insurance, several important documents accompany the Auto Insurance Card. Each of these forms serves a specific purpose, ensuring that both drivers and insurance providers have the necessary information to handle various situations effectively. Below is a list of common documents often used alongside the Auto Insurance Card.

- Insurance Policy Document: This comprehensive document outlines the terms and conditions of the insurance coverage. It details what is included in the policy, such as liability limits, deductibles, and any exclusions.

- Declaration Page: Often considered a summary of the insurance policy, this page provides essential information, including the insured's name, vehicle details, coverage limits, and premium amounts.

- Hold Harmless Agreement: To protect oneself from potential liabilities, refer to the comprehensive Hold Harmless Agreement resources that outline the necessary provisions and uses of this form.

- Claims Form: In the event of an accident, this form is used to report the incident to the insurance company. It collects information about the accident, damages, and any involved parties.

- Proof of Financial Responsibility: This document demonstrates that a driver has the required insurance coverage as mandated by state law. It may be requested by law enforcement during traffic stops or accidents.

- Vehicle Registration: This document proves that a vehicle is legally registered with the state. It includes information such as the vehicle identification number (VIN) and the owner's details.

- Inspection Report: Some states require vehicles to undergo regular inspections. This report confirms that the vehicle meets safety and emissions standards.

- SR-22 Form: For drivers with certain violations, an SR-22 is a certificate of financial responsibility that must be filed with the state. It verifies that the driver has the necessary insurance coverage.

- Power of Attorney: In some cases, this document allows a designated individual to act on behalf of the insured, particularly in matters related to claims or policy changes.

- Endorsements: These are modifications to the original insurance policy. Endorsements can add or change coverage, such as including additional drivers or vehicles.

Understanding these documents is essential for any vehicle owner. They help ensure that you are adequately protected and prepared for any situation that may arise while on the road. Keeping these forms organized and accessible can make a significant difference in the event of an accident or insurance claim.

Check out Popular Documents

How to File a Mechanics Lien in California - Submitting a Mechanics Lien is a way for workers to enforce their right to be paid.

Bad Business Bureau - Provide information related to a unresolved billing dispute with a business.

For anyone engaging in agreements that involve certain risks, a Hold Harmless Agreement is essential in ensuring both parties are protected. This legal document serves to prevent one party from holding the other accountable for any potential liabilities or losses incurred during the course of their transactions. To streamline the process of preparing this crucial document, you can access the form online at https://texasformspdf.com/fillable-hold-harmless-agreement-online, making it easier than ever to establish clear expectations and safeguard your interests.

How to Make a Job Application Form - Employment history should reflect your qualifications for the role.

Key Details about Auto Insurance Card

What is an Auto Insurance Card?

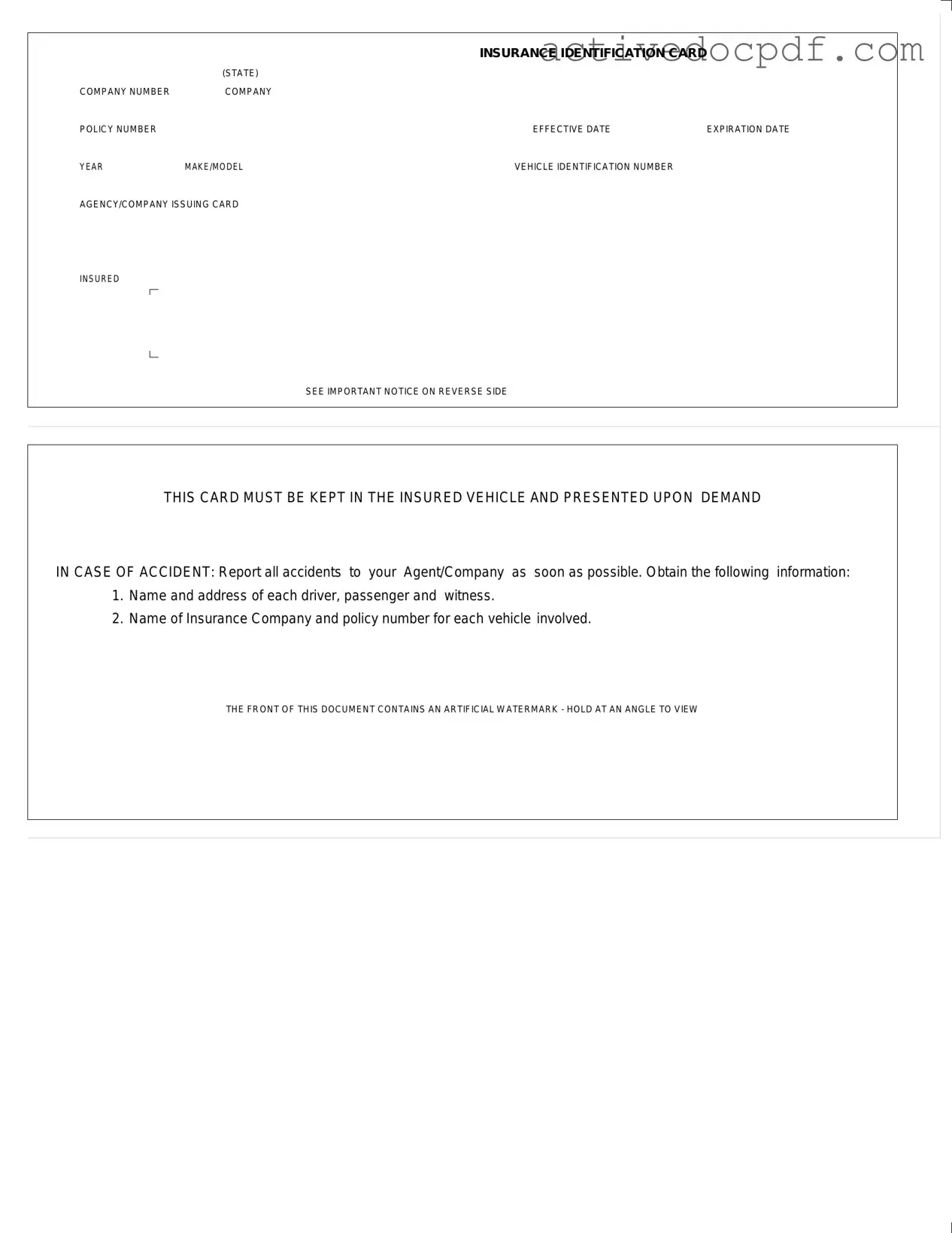

An Auto Insurance Card is a document that proves you have valid auto insurance coverage. It includes essential information such as your insurance company, policy number, and the effective dates of your coverage. Keeping this card in your vehicle is important, as you may need to present it during traffic stops or in the event of an accident.

What information is included on the Auto Insurance Card?

The card typically contains the following details:

- Insurance company name

- Company number

- Policy number

- Effective date of the policy

- Expiration date of the policy

- Year, make, and model of the insured vehicle

- Vehicle Identification Number (VIN)

- Agency or company issuing the card

Why is it important to keep the Auto Insurance Card in the vehicle?

Having the Auto Insurance Card in your vehicle is crucial because it serves as proof of insurance. In the event of an accident or traffic stop, law enforcement or other parties involved may request to see it. Failing to present this card can lead to fines or complications with your insurance claims.

What should I do if I lose my Auto Insurance Card?

If you lose your Auto Insurance Card, contact your insurance provider immediately. They can issue a replacement card. It’s advisable to keep a digital copy on your smartphone as a backup until you receive the new card.

Can I use a digital version of my Auto Insurance Card?

Many states allow the use of digital insurance cards. Check with your state’s regulations and your insurance company to confirm if a digital version is acceptable. It’s always a good idea to have a physical card as well, just in case.

What should I do if I get into an accident?

In the event of an accident, first ensure everyone's safety. Then, report the accident to your insurance agent or company as soon as possible. Gather information such as:

- Name and address of each driver, passenger, and witness

- Name of the insurance company and policy number for each vehicle involved

This information will be crucial for processing your claim.

What is the significance of the watermark on the Auto Insurance Card?

The front of the Auto Insurance Card features an artificial watermark. This is a security feature designed to prevent fraud. To view the watermark, hold the card at an angle. It helps verify the authenticity of the document.

How often should I check my Auto Insurance Card?

Regularly check your Auto Insurance Card, especially before long trips or when renewing your policy. Ensure that the information is current and that the card is not expired. Keeping your card updated helps avoid any potential issues on the road.

What happens if my Auto Insurance policy expires?

If your policy expires, you may be driving without coverage, which can lead to severe penalties. It’s essential to renew your policy before the expiration date to avoid lapses in coverage. Always keep your Auto Insurance Card updated with the new policy information.

Is there a penalty for not carrying my Auto Insurance Card?

Yes, there can be penalties for not carrying your Auto Insurance Card. If you are stopped by law enforcement or involved in an accident without proof of insurance, you may face fines, points on your license, or other legal consequences. Always keep the card in your vehicle to avoid these issues.

Similar forms

The Auto Insurance Card serves as a vital document for drivers, providing essential information about their insurance coverage. Several other documents share similarities with the Auto Insurance Card, each serving a specific purpose in the realm of vehicle ownership and operation. Here are seven documents that are comparable to the Auto Insurance Card:

- Vehicle Registration Card: This document proves that a vehicle is registered with the state. Like the Auto Insurance Card, it contains important details such as the vehicle identification number (VIN) and the owner's information, and it must be kept in the vehicle.

- Motorcycle Bill of Sale: This document is crucial for the transfer of ownership of a motorcycle, providing details such as buyer and seller information, motorcycle specifics, and sale price. For more information, visit PDF Documents Hub.

- Driver's License: A driver's license is a legal authorization for an individual to operate a vehicle. Similar to the Auto Insurance Card, it includes personal identification details and must be presented upon request by law enforcement.

- Proof of Insurance Certificate: This certificate is often issued by an insurance company, providing evidence of coverage. It contains similar information to the Auto Insurance Card, such as policy numbers and effective dates, and must be shown during traffic stops or accidents.

- Accident Report Form: After an accident, drivers often need to fill out this form to document the incident. It collects information about the parties involved, akin to the details required on the Auto Insurance Card for reporting purposes.

- Title Document: The title serves as legal proof of ownership of a vehicle. Like the Auto Insurance Card, it contains critical information about the vehicle and must be kept accessible, especially during the sale or transfer of ownership.

- Inspection Certificate: This document certifies that a vehicle has passed a safety or emissions inspection. Similar to the Auto Insurance Card, it is often required to be in the vehicle and can be requested by law enforcement.

- Rental Agreement: When renting a vehicle, the rental agreement outlines the terms of use and insurance coverage. It shares similarities with the Auto Insurance Card in that it provides proof of insurance and must be presented when driving the rental vehicle.

Guide to Filling Out Auto Insurance Card

Completing the Auto Insurance Card form is an important step in ensuring you have the necessary information readily available while driving. This card must be kept in your vehicle and presented if requested. Follow these steps to accurately fill out the form.

- Locate the INSURANCE IDENTIFICATION CARD section at the top of the form.

- Fill in the COMPANY NUMBER assigned to your insurance provider.

- Enter your COMPANY POLICY NUMBER in the designated space.

- Provide the EFFECTIVE DATE of your insurance policy.

- Input the EXPIRATION DATE of your insurance policy.

- Write down the YEAR of your vehicle.

- Fill in the MAKE/MODEL of your vehicle.

- Enter the VEHICLE IDENTIFICATION NUMBER (VIN) accurately.

- Identify the AGENCY/COMPANY ISSUING CARD and write it in the provided space.

- Review the form for any errors or omissions before finalizing it.

Once you have completed the form, ensure that it is stored in your vehicle. This will allow you to present it when required and help you stay compliant with state regulations.