Free Broker Price Opinion PDF Form

Misconceptions

Understanding the Broker Price Opinion (BPO) form is essential for anyone involved in real estate transactions. However, several misconceptions persist. Here are seven common misunderstandings:

- The BPO is the same as an appraisal. A BPO provides a price estimate based on market conditions and comparable sales, while an appraisal is a more detailed and formal assessment conducted by a licensed appraiser.

- Only licensed brokers can complete a BPO. While brokers are commonly involved, trained real estate agents can also complete a BPO as long as they follow industry guidelines.

- The BPO is a legally binding document. A BPO is an opinion of value and does not carry the same legal weight as an appraisal or a sales contract.

- The BPO can be completed without market research. Accurate BPOs require thorough research on current market conditions, comparable properties, and neighborhood trends.

- A BPO guarantees a sale price. The suggested price is an estimate based on current data; it does not guarantee that the property will sell for that amount.

- All BPOs are created equal. BPOs can vary significantly based on the broker's experience, the quality of the data used, and the specific market being evaluated.

- The BPO is only for foreclosures. While BPOs are often used in foreclosure situations, they can be utilized for any property needing a market value assessment.

Clearing up these misconceptions helps ensure a better understanding of the BPO process and its role in real estate transactions.

Documents used along the form

The Broker Price Opinion (BPO) form is often accompanied by several other important documents. Each of these documents plays a critical role in the property evaluation process, providing additional insights and supporting information. Below is a list of commonly used forms and documents that complement the BPO.

- Comparative Market Analysis (CMA): This document analyzes the prices of similar properties that have recently sold in the area. It helps to establish a fair market value by comparing features and sale prices of comparable homes.

- Property Inspection Report: This report outlines the condition of the property. It includes details about any repairs needed, structural issues, and overall maintenance, which can impact the property's marketability and value.

- Appraisal Report: Conducted by a licensed appraiser, this report provides an unbiased estimate of the property's value. It considers various factors, including location, condition, and recent sales data.

- Listing Agreement: This is a contract between the property owner and the real estate broker. It outlines the terms under which the property will be marketed and sold, including commission rates and listing duration.

- Non-disclosure Agreement: To safeguard sensitive information, consider completing the necessary Non-disclosure Agreement form for legal protection during transactions.

- Disclosure Statement: This document informs potential buyers about any known issues with the property, such as repairs, environmental hazards, or legal encumbrances. Transparency is crucial for building trust and ensuring compliance with legal requirements.

- Marketing Plan: A detailed strategy for promoting the property to potential buyers. It may include online listings, open houses, and targeted advertising efforts to attract interest and facilitate a sale.

Utilizing these documents alongside the Broker Price Opinion form ensures a comprehensive understanding of the property's value and condition. This approach ultimately aids in making informed decisions during the buying or selling process.

Check out Popular Documents

Army Award Form - This form is regularly updated to maintain relevance with military procedures and requirements.

How to Get a Copy of Birth Certificate - It is used for statistical purposes by public health agencies.

In addition to understanding the importance of the New York Rental Application form, landlords can streamline their process by using templates available online, such as the one found at nyforms.com/rental-application-template/, which provide a structured format to gather all necessary information efficiently.

Progressive B2b - Include your contact information for any follow-up questions.

Key Details about Broker Price Opinion

What is a Broker Price Opinion (BPO)?

A Broker Price Opinion is a professional assessment of a property's value, typically conducted by a licensed real estate broker or agent. It provides an estimated market value based on various factors, including recent sales of comparable properties, current market conditions, and the property's condition. This opinion is often used by lenders and financial institutions to make informed decisions regarding real estate transactions.

When is a BPO typically needed?

A BPO may be needed in several situations, including:

- When a property is being foreclosed and the lender needs to determine its value.

- For refinancing purposes, where the lender requires an updated valuation.

- During a short sale, to assess the property’s market value before proceeding.

- When a property is listed for sale, to set an appropriate listing price.

What information is included in a BPO?

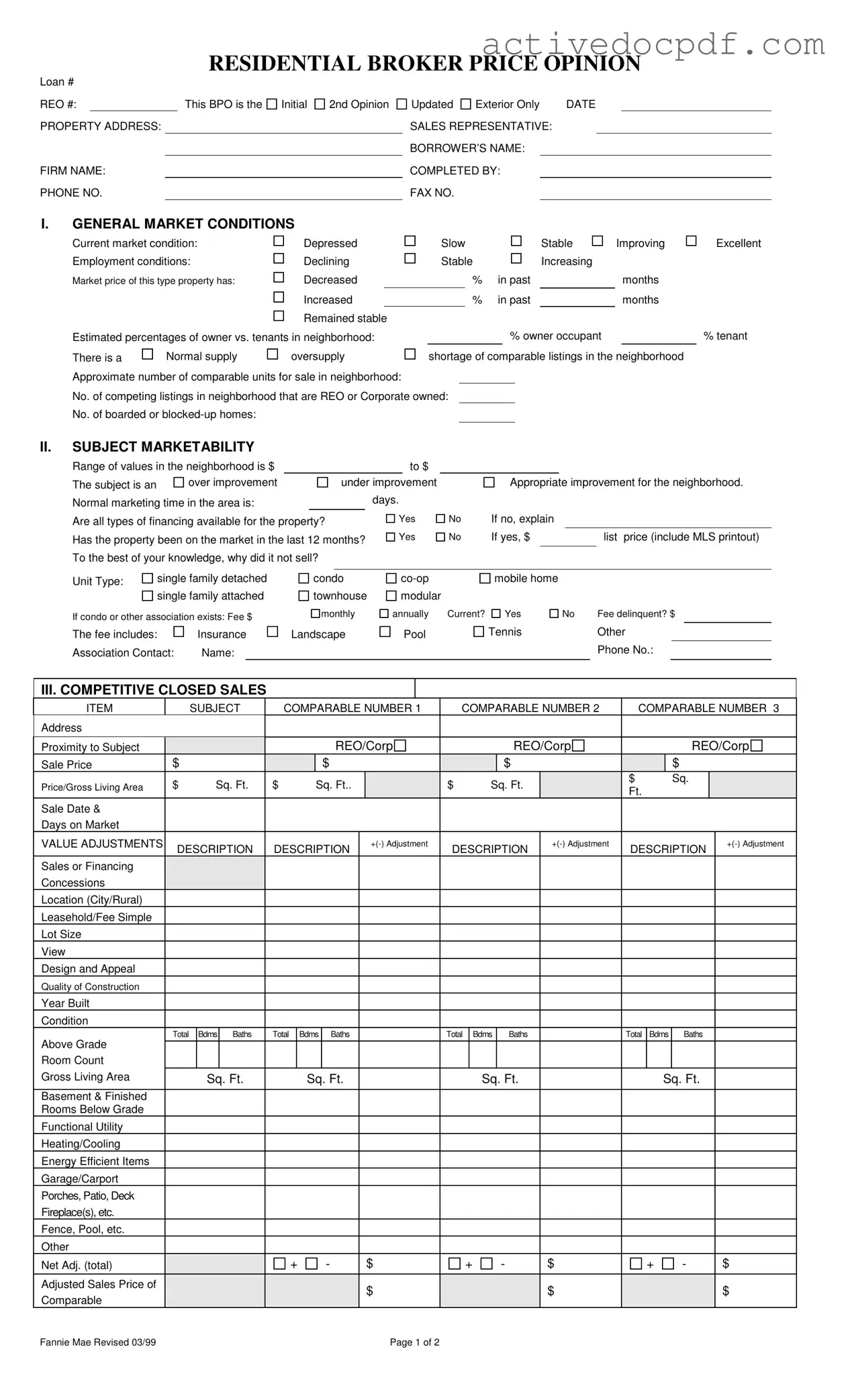

A BPO typically includes:

- General market conditions and employment statistics.

- A detailed analysis of the subject property and its marketability.

- Comparative sales data, including details about similar properties.

- Recommendations for repairs or improvements to enhance marketability.

- A suggested market value based on the analysis.

How is the value determined in a BPO?

The value in a BPO is determined by analyzing several factors, including:

- Recent sales of comparable properties in the area.

- The condition and features of the subject property.

- Current market trends and economic conditions.

- Any necessary repairs that may affect the property's value.

Who conducts a Broker Price Opinion?

A licensed real estate broker or agent typically conducts a BPO. These professionals have the expertise and knowledge of the local market to provide an accurate assessment. They utilize their experience and access to market data to evaluate the property effectively.

How long does it take to complete a BPO?

The time required to complete a BPO can vary, but it usually takes a few days to a week. Factors influencing this timeframe include the complexity of the property, the availability of comparable sales data, and the broker's workload. A thorough analysis ensures a more accurate valuation.

Can a BPO be used in place of an appraisal?

While a BPO provides valuable insights, it is not a substitute for a formal appraisal. An appraisal is a more comprehensive evaluation conducted by a licensed appraiser and is often required for certain transactions, such as mortgage financing. A BPO, however, can be a useful tool for quick assessments and preliminary valuations.

What should I do if I disagree with the BPO value?

If you disagree with the BPO value, consider discussing your concerns with the broker who conducted the opinion. Provide any additional information or data that may support your case. If necessary, you may also seek a formal appraisal for a more definitive valuation.

Are there any costs associated with obtaining a BPO?

Yes, there may be costs associated with obtaining a BPO. These fees can vary depending on the broker or real estate firm providing the service. It’s important to discuss any potential costs upfront to ensure you understand the financial implications before proceeding.

Similar forms

- Comparative Market Analysis (CMA): Like the Broker Price Opinion, a CMA assesses property values based on recent sales and current listings. It provides insights into market trends, helping sellers and buyers understand pricing dynamics.

- Appraisal Report: An appraisal report is a formal assessment conducted by a licensed appraiser. It evaluates a property's market value based on various factors, including location, condition, and comparable sales, similar to the BPO's approach.

- Listing Agreement: This document outlines the terms under which a property will be listed for sale. It includes pricing recommendations, which can be influenced by the findings of a Broker Price Opinion.

IRS Form 2553: This essential document allows small businesses to elect to be taxed as an S corporation, providing significant tax benefits. For more information, you can refer to PDF Documents Hub.

- Sales Contract: A sales contract details the terms of a property sale. It often references the property's value, which may be determined through a Broker Price Opinion or similar valuation methods.

- Market Analysis Report: This report provides a broader overview of market trends and statistics. It shares similarities with the BPO in analyzing market conditions and pricing strategies.

- Property Condition Report: This document assesses the physical state of a property. While the BPO focuses on market value, the condition report helps determine how physical attributes can impact that value.

- Investment Analysis Report: This report evaluates the potential return on investment for a property. It considers market conditions and property value, similar to the insights provided by a Broker Price Opinion.

- Tax Assessment Notice: This notice reflects the assessed value of a property for taxation purposes. It uses comparable sales data, much like the BPO, to determine property value in the market.

Guide to Filling Out Broker Price Opinion

Filling out the Broker Price Opinion (BPO) form is a crucial step in assessing the value of a property. This process requires careful attention to detail, as the information provided can significantly impact the evaluation. Below are the steps to guide you through completing the form accurately.

- Start with the Loan # and REO # at the top of the form.

- Fill in the PROPERTY ADDRESS, FIRM NAME, and PHONE NO..

- Indicate whether this BPO is an Initial, 2nd Opinion, or Updated Exterior Only.

- Enter the DATE, SALES REPRESENTATIVE, BORROWER’S NAME, and COMPLETED BY.

- Provide the FAX NO. if applicable.

- In the GENERAL MARKET CONDITIONS section, assess the current market condition and select from options like Depressed, Slow, Stable, or Improving.

- Evaluate the Employment conditions and select Declining, Stable, or Increasing.

- Indicate the market price trend by selecting Decreased, Increased, or Remained stable.

- Estimate the percentage of owner vs. tenants in the neighborhood.

- Determine if there is a normal supply, oversupply, or shortage of comparable listings.

- Provide the approximate number of comparable units for sale and the number of REO or corporate-owned listings.

- In the SUBJECT MARKETABILITY section, state the range of values in the neighborhood.

- Assess if the subject property is an over improvement, under improvement, or appropriate improvement.

- Estimate the normal marketing time in days.

- Answer whether all types of financing are available for the property.

- Indicate if the property has been on the market in the last 12 months and provide the list price.

- Identify the Unit Type (e.g., single-family detached, condo, etc.).

- If applicable, provide details about any association fees.

- In the COMPETITIVE CLOSED SALES section, fill in details for comparable properties, including address, proximity, sale price, and adjustments.

- Complete the MARKETING STRATEGY section by selecting the appropriate strategy.

- Document any repairs needed to bring the property to an average marketable condition.

- List the COMPETITIVE LISTINGS similarly to the competitive closed sales.

- Determine the MARKET VALUE and suggested list price.

- Finally, provide any COMMENTS regarding the property, and sign and date the form.