Free Business Credit Application PDF Form

Misconceptions

Understanding the Business Credit Application form can be challenging, especially with the many misconceptions that circulate. Here’s a list of common misunderstandings, along with clarifications to help you navigate the process more effectively.

- All businesses automatically qualify for credit. Many believe that simply submitting a Business Credit Application guarantees approval. In reality, lenders assess various factors, including credit history and financial stability.

- The application process is the same for all lenders. Different lenders have unique criteria and processes. It’s essential to research each lender’s requirements before applying.

- Only large businesses can obtain credit. Small businesses can also secure credit. Many lenders offer options specifically designed for smaller enterprises.

- A personal guarantee is always required. While some lenders may ask for a personal guarantee, others do not. It depends on the lender's policies and the applicant's creditworthiness.

- Credit applications are only about credit scores. Although credit scores play a significant role, lenders also consider business revenue, cash flow, and industry type.

- Once submitted, the application cannot be changed. Applicants can often update or amend their application before a decision is made. Communication with the lender is key.

- All information provided is confidential. While most lenders keep your information secure, some may share it with credit bureaus or other entities as part of their assessment process.

- The application is a one-time process. Businesses may need to reapply or update their application as their financial situation changes or as they seek additional credit.

- Approval guarantees funding. Even if a business is approved, funding may depend on additional factors, such as the business’s current financial condition or collateral.

By addressing these misconceptions, you can approach the Business Credit Application form with a clearer understanding, increasing your chances of success in securing the credit your business needs.

Documents used along the form

When applying for business credit, several other forms and documents are often necessary to support your application. These documents help lenders assess your business's creditworthiness and financial stability. Below is a list of commonly used forms that accompany the Business Credit Application.

- Personal Guarantee: This document states that an individual will be responsible for the debt if the business cannot pay. It adds a layer of security for the lender.

- Business Financial Statements: These include profit and loss statements, balance sheets, and cash flow statements. They provide insight into the financial health of your business.

- RV Bill of Sale: Essential for any transaction involving the sale of a recreational vehicle in Texas, ensuring the legal transfer of ownership and providing proof of the sale. For further details, refer to the Bill of Sale for a Camper.

- Tax Returns: Recent tax returns help verify your income and the financial status of your business. Lenders often require at least two years of returns.

- Bank Statements: Providing several months of bank statements shows your business's cash flow and spending habits. This information is crucial for lenders.

- Business License: A copy of your business license proves that your business is legally registered and authorized to operate.

- Trade References: This document lists other businesses that you have worked with. It helps lenders assess your payment history and reliability.

Gathering these documents can streamline the credit application process and improve your chances of approval. Ensure all information is accurate and up-to-date to present your business in the best possible light.

Check out Popular Documents

Which of These Items Is Checked in a Pre-trip Inspection - Test the horn to ensure it is working effectively.

Tuberculosis Risk Assessment Form - The form needs a clear indication of the PPD test result.

When engaging in the sale or purchase of a motorcycle, it's crucial to utilize the appropriate documentation to facilitate the process, and for those in New York, the New York Motorcycle Bill of Sale is essential. This legal document can be obtained easily through resources like PDF Documents Hub, ensuring that both buyers and sellers have the necessary information to secure their transaction and protect their interests.

Musicians Contract Template - The description of the performance is to be included.

Key Details about Business Credit Application

What is a Business Credit Application form?

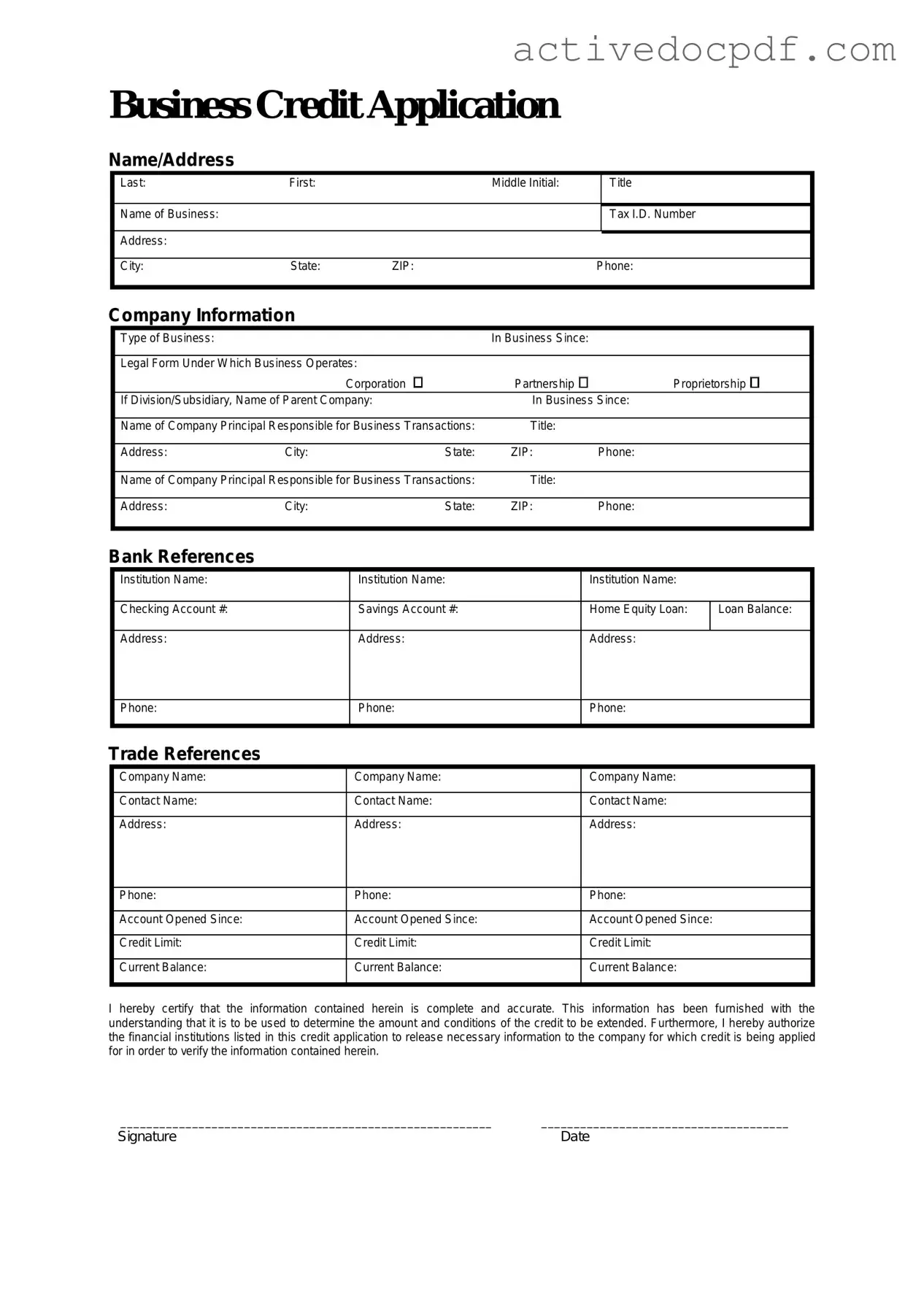

A Business Credit Application form is a document that a business submits to a lender or supplier to request credit. This form collects important information about the business, including its financial history, ownership details, and creditworthiness. Completing this form is essential for establishing a line of credit, which can help with cash flow and purchasing inventory or services.

Why do I need to fill out a Business Credit Application?

Filling out a Business Credit Application is necessary for several reasons:

- It helps lenders evaluate your business’s creditworthiness.

- It allows suppliers to understand your payment history and financial stability.

- It facilitates the establishment of trust between your business and potential creditors.

Without this application, you may find it challenging to secure credit or favorable terms from suppliers.

What information is typically required on the application?

The application usually requires various pieces of information, including:

- Business name and contact details.

- Type of business entity (e.g., LLC, corporation).

- Owner's personal information, such as name and Social Security number.

- Business financial statements, including income statements and balance sheets.

- Bank references and trade references.

Providing accurate and complete information helps expedite the review process.

How long does it take to process the application?

The processing time for a Business Credit Application can vary. Generally, it may take anywhere from a few days to a couple of weeks. Factors that influence the timeline include the lender’s workload and the complexity of your business’s financial situation. To help speed up the process, ensure all required information is complete and accurate.

What happens after I submit the application?

Once you submit the application, the lender or supplier will review the information provided. They may conduct a credit check and verify the details you supplied. After evaluation, they will either approve or deny your application. If approved, you will receive terms regarding your credit limit and repayment conditions.

Can I appeal if my application is denied?

Yes, if your Business Credit Application is denied, you have the right to request an explanation. You can ask the lender for specific reasons behind the decision. If you believe the denial was unjustified, you may appeal the decision. This process usually involves providing additional information or addressing the concerns raised by the lender.

Similar forms

Loan Application Form: Like the Business Credit Application, this document collects essential information about a business's financial health and its ability to repay a loan.

Vendor Credit Application: This form is similar as it gathers details about a business's creditworthiness for establishing trade credit with suppliers.

Partnership Agreement: While primarily a legal document, it often includes financial disclosures that can mirror the credit assessment aspects of a Business Credit Application.

Business Plan: This document outlines a company’s goals and financial projections, providing insights into its creditworthiness, similar to the Business Credit Application.

- Homeschool Letter of Intent Form: To officially notify your school district about homeschooling, complete the Homeschool Letter of Intent requirements to ensure compliance with state regulations.

Personal Guarantee Form: This form may accompany a Business Credit Application, ensuring that personal assets can back business debts, highlighting the personal financial responsibility involved.

Financial Statement: A detailed overview of a company’s financial status, this document supports the claims made in a Business Credit Application regarding income and expenses.

Tax Returns: Often required alongside a Business Credit Application, tax returns provide a historical view of a business's financial performance, similar to the application’s intent.

Credit Report Authorization Form: This document allows lenders to access a business's credit history, paralleling the credit evaluation process initiated by the Business Credit Application.

Business Registration Documents: These documents verify the legal standing of a business and may be requested to support the identity claims made in a Business Credit Application.

Guide to Filling Out Business Credit Application

Completing a Business Credit Application form is an important step in establishing credit for a business. This process requires careful attention to detail and accuracy, as the information provided will help lenders assess the creditworthiness of the business. Below are the steps to effectively fill out the form.

- Gather Necessary Information: Collect all relevant information about your business, including its legal name, address, and contact details.

- Provide Business Details: Fill in the business structure (e.g., sole proprietorship, partnership, corporation) and the date the business was established.

- List Ownership Information: Include the names and contact information of all owners or partners, along with their ownership percentages.

- Enter Financial Information: Provide details about your business's annual revenue, net profit, and any existing debts or liabilities.

- Include Banking Information: List your primary business bank account details, including the bank's name, address, and account number.

- Specify Trade References: Provide the names and contact information for at least three trade references who can vouch for your business's credit history.

- Review and Sign: Carefully review all information for accuracy before signing the application. Ensure that all required fields are completed.

After completing the application, it is advisable to keep a copy for your records. Submitting the form to the lender will initiate the credit assessment process, allowing your business to move forward in securing credit options.