Free California Death of a Joint Tenant Affidavit PDF Form

Misconceptions

Understanding the California Death of a Joint Tenant Affidavit form is important for anyone dealing with joint tenancy property. However, several misconceptions can lead to confusion. Here are eight common misunderstandings:

- Only one joint tenant needs to sign the affidavit. This is incorrect. All surviving joint tenants must sign the affidavit to transfer the property title.

- The affidavit is only needed for real estate. Many believe this form applies only to real property. In reality, it can also be used for other types of joint tenancy assets.

- The affidavit is automatically filed with the county. Some think that filing the affidavit is automatic. In fact, it must be submitted by the surviving joint tenants to the appropriate county office.

- The form is the same for all states. This is a misconception. Each state has its own requirements and forms, and California has specific rules governing this affidavit.

- It can be completed after the property is sold. Some people think they can fill out the affidavit after selling the property. However, it must be completed before any sale can take place to ensure proper title transfer.

- Notarization is required for the affidavit. While notarization is often recommended, it is not always a legal requirement in California. Check local regulations for specific needs.

- Only family members can be joint tenants. This is a common belief, but joint tenancy can exist between any parties, including friends or business partners.

- The affidavit eliminates the need for a will. Some think that using this affidavit negates the need for a will. However, it is still important to have a will to address other assets and personal wishes.

By understanding these misconceptions, individuals can navigate the process more effectively and ensure their property is handled according to their wishes.

Documents used along the form

The California Death of a Joint Tenant Affidavit form is an important document used to transfer property ownership when one joint tenant passes away. Along with this affidavit, several other forms and documents may be necessary to ensure a smooth transfer process. Below is a list of commonly used documents that can accompany the affidavit.

- Death Certificate: This official document proves the death of the joint tenant and is often required to complete the property transfer.

- IRS Form 2553: This form is vital for small businesses looking to elect S corporation status, potentially leading to significant tax advantages. More information can be found at PDF Documents Hub.

- Grant Deed: This document is used to formally transfer ownership of the property from the deceased joint tenant to the surviving tenant.

- Title Report: A title report provides information about the property’s ownership history and any liens or encumbrances that may affect the transfer.

- Property Tax Bill: A recent property tax bill may be needed to verify current ownership and ensure that taxes are up to date.

- Joint Tenancy Agreement: If available, this document outlines the terms of the joint tenancy and may be helpful in confirming the rights of the surviving tenant.

- Affidavit of Identity: This form can help establish the identity of the surviving tenant, especially if there are questions about ownership.

- Notarized Statement: Sometimes, a notarized statement from the surviving tenant may be required to confirm their claim to the property.

Having these documents ready can simplify the process of transferring property ownership after the death of a joint tenant. It's important to gather all necessary paperwork to avoid delays and ensure compliance with California laws.

Check out Popular Documents

1099 Pay Stub - The Independent Contractor Pay Stub offers clarity on payment terms agreed upon.

Consolation Tournament - Game 1 sets the tone for the bracket with fierce competition.

To effectively safeguard your proprietary information during negotiations, consider utilizing a strategic Non-disclosure Agreement guide to ensure clarity and protection in your business dealings. For more details, visit the detailed Non-disclosure Agreement resource.

Where to Find 1040 Form - Taxpayers have the option to electronically file their 1040 for a quicker processing time.

Key Details about California Death of a Joint Tenant Affidavit

What is the California Death of a Joint Tenant Affidavit?

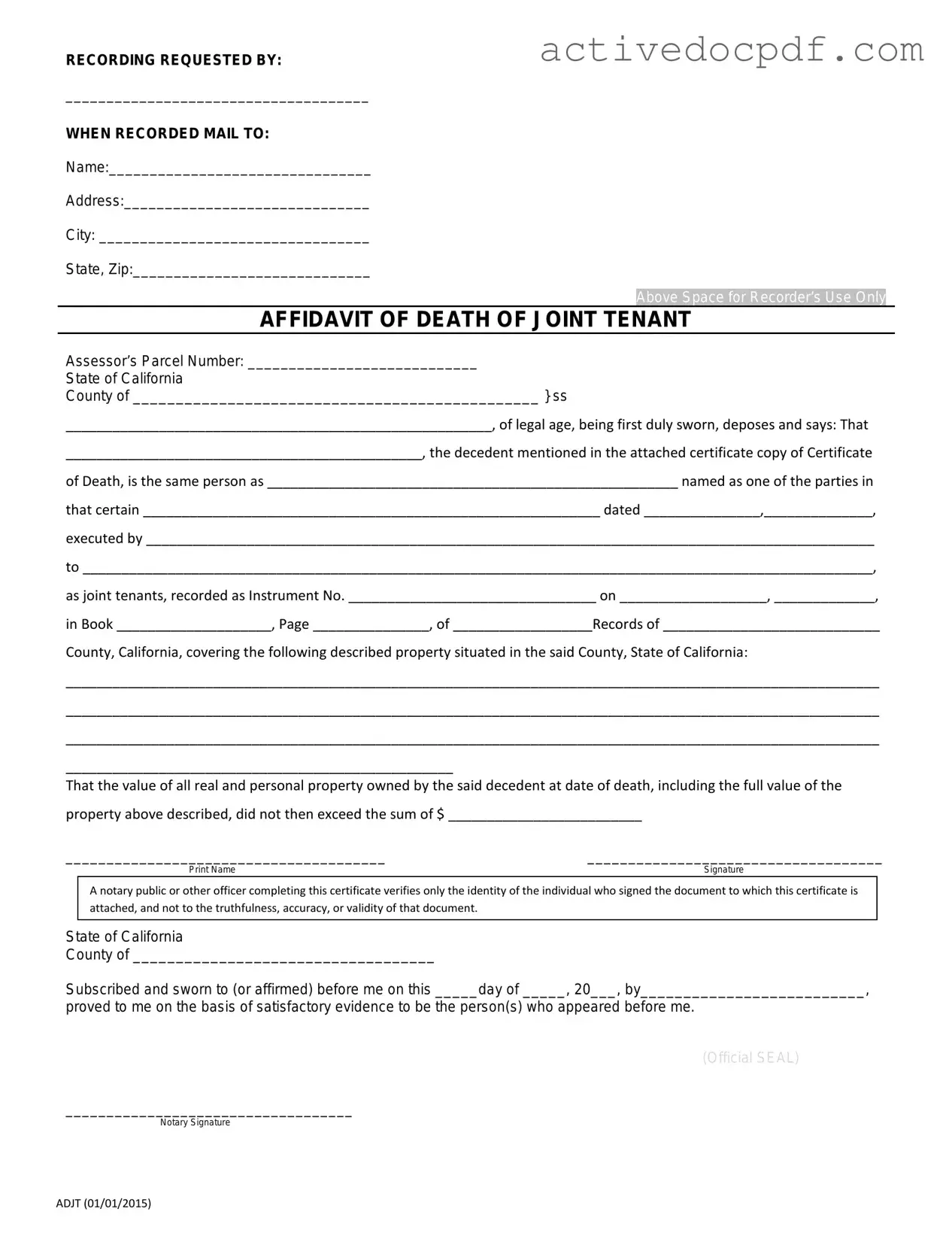

The California Death of a Joint Tenant Affidavit is a legal document used to transfer the interest of a deceased joint tenant to the surviving joint tenant(s). This affidavit simplifies the process of transferring property ownership without the need for probate, provided that the property was held in joint tenancy.

Who can file the affidavit?

The affidavit can be filed by the surviving joint tenant(s) of the deceased. It is essential that the surviving tenant(s) have the necessary documentation, such as the death certificate of the deceased joint tenant, to support the claim.

What information is required to complete the affidavit?

To complete the affidavit, the following information is typically required:

- Name and address of the deceased joint tenant

- Name and address of the surviving joint tenant(s)

- Date of death of the deceased joint tenant

- Legal description of the property

- Statement confirming the joint tenancy status

Is a death certificate necessary?

Yes, a certified copy of the death certificate is required to complete the affidavit. This document serves as proof of the joint tenant's death and is crucial for the transfer of property ownership.

Where should the affidavit be filed?

The completed affidavit must be filed with the county recorder's office in the county where the property is located. This filing officially updates the property records to reflect the change in ownership.

Are there any fees associated with filing the affidavit?

Yes, there are typically filing fees associated with submitting the affidavit to the county recorder's office. Fees may vary by county, so it is advisable to check with the local office for specific amounts.

What happens if there are multiple surviving joint tenants?

If there are multiple surviving joint tenants, each of them can sign the affidavit. The property will be transferred to all surviving joint tenants equally, unless otherwise specified in the joint tenancy agreement.

Can the affidavit be challenged?

Yes, the affidavit can be challenged by interested parties, such as heirs or creditors of the deceased. If a challenge arises, it may lead to legal disputes regarding the property ownership and could require court intervention.

How long does the process take?

The process of filing the affidavit is generally straightforward and can be completed relatively quickly, often within a few weeks. However, the time frame may vary based on the county's processing times and any potential challenges that may arise.

Similar forms

- Affidavit of Death: This document serves to establish the death of an individual and is often used in estate matters. It provides necessary details about the deceased, similar to the Death of a Joint Tenant Affidavit.

- Grant Deed: A Grant Deed transfers ownership of property from one party to another. It often accompanies the Death of a Joint Tenant Affidavit when property ownership changes after death.

- Will: A Will outlines how a person wishes their assets to be distributed upon death. Like the Death of a Joint Tenant Affidavit, it plays a crucial role in the transfer of property after someone passes away.

- Trust Document: A Trust Document establishes a trust to manage assets for beneficiaries. It can operate similarly by detailing how property is handled after death, particularly in joint ownership situations.

- Affidavit of Heirship: This affidavit identifies heirs of a deceased person and can help clarify property rights, akin to the Death of a Joint Tenant Affidavit in determining ownership after death.

- Rental Application Form: This essential form is utilized by landlords in New York to evaluate potential tenants before a lease is agreed upon. It gathers important details to determine if the applicant is suitable for the property. For a template, you can refer to https://nyforms.com/rental-application-template.

- Death Certificate: A Death Certificate is an official document confirming a person's death. It is often required when filing a Death of a Joint Tenant Affidavit to provide proof of the death.

- Power of Attorney: While not directly related to death, a Power of Attorney can influence property management before death. It may lead to similar legal considerations as the Death of a Joint Tenant Affidavit.

- Certificate of Trust: This document verifies the existence of a trust and its terms. It can be similar in function to the Death of a Joint Tenant Affidavit, particularly in how property is managed post-death.

- Real Property Transfer on Death Deed: This deed allows individuals to transfer property upon death without going through probate. It serves a similar purpose to the Death of a Joint Tenant Affidavit by facilitating property transfer.

- Notice of Death: A Notice of Death informs relevant parties about the passing of an individual. It can be related to the Death of a Joint Tenant Affidavit as it may trigger the need for property transfer documentation.

Guide to Filling Out California Death of a Joint Tenant Affidavit

Completing the California Death of a Joint Tenant Affidavit form is a crucial step in transferring property ownership after the death of a joint tenant. This process ensures that the remaining joint tenant can assert their rights to the property without complications. Follow these steps to fill out the form accurately.

- Obtain the California Death of a Joint Tenant Affidavit form. This can be found online or at a local courthouse.

- Enter the name of the deceased joint tenant in the designated section.

- Provide the date of death. This information is essential for the affidavit.

- Fill in the names of the remaining joint tenants. Ensure this is accurate to avoid future disputes.

- Include the property address where the joint tenancy existed. Be specific about the location.

- Sign the affidavit in the appropriate section. Your signature confirms the information provided is true.

- Have the affidavit notarized. This step is necessary for the document to be legally binding.

- Submit the completed affidavit to the county recorder's office. This finalizes the transfer of ownership.