Free Cash Drawer Count Sheet PDF Form

Misconceptions

Understanding the Cash Drawer Count Sheet form is crucial for managing cash flow in any business. However, several misconceptions can lead to confusion. Here’s a breakdown of seven common misunderstandings:

-

It’s only necessary for large businesses.

This form is useful for businesses of all sizes. Even small operations benefit from tracking cash accurately.

-

Only cash transactions need to be recorded.

While the form focuses on cash, it can also help track credit and debit transactions, providing a complete financial picture.

-

It’s a one-time task.

The Cash Drawer Count Sheet should be filled out regularly, ideally at the beginning and end of each business day, to ensure accuracy.

-

It’s just for accounting purposes.

This form also serves as a tool for preventing theft and ensuring that cash handling procedures are followed correctly.

-

Anyone can fill it out.

While many employees may have access to the cash drawer, it’s best practice for a designated person to complete the form to maintain accountability.

-

It’s not important if there are discrepancies.

Any discrepancies should be investigated immediately. Ignoring them can lead to larger issues down the line.

-

It’s too complicated to use.

The form is designed to be straightforward. With a little practice, most users find it easy to navigate and complete.

By addressing these misconceptions, businesses can better utilize the Cash Drawer Count Sheet to enhance their financial management practices.

Documents used along the form

The Cash Drawer Count Sheet is an essential tool for tracking cash flow and ensuring accurate financial reporting. To complement this form, several other documents are commonly utilized in cash management and financial operations. Below is a list of these documents, each serving a unique purpose in the overall cash handling process.

- Daily Sales Report: This document summarizes the total sales for a given day, including cash, credit, and other payment methods. It helps in reconciling cash drawer counts with sales data.

- Deposit Slip: A deposit slip is used to record the amount of cash being deposited into a bank account. It includes details like the date, account number, and total cash amount.

- Do Not Resuscitate Order Form: For individuals planning ahead, understanding the Do Not Resuscitate Order guidelines is critical to ensure personal wishes are respected during medical emergencies.

- Cash Disbursement Log: This log tracks all cash outflows, documenting who received the cash, the purpose of the disbursement, and the amount. It aids in monitoring cash expenses.

- Petty Cash Voucher: A petty cash voucher is used to authorize small cash expenditures. It typically includes the date, amount, purpose, and signature of the person requesting the funds.

- Cash Reconciliation Report: This report compares the cash counted in the drawer to the expected amount based on sales and disbursements. It identifies discrepancies and ensures accountability.

- End-of-Day Report: This report provides a comprehensive summary of all transactions, cash flow, and any discrepancies noted during the day. It serves as a final check before closing the cash drawer.

- Change Fund Request Form: This form is used to request an initial cash float for a cash register or drawer. It specifies the amount and denominations needed to start the day.

- Cash Handling Policy Document: This document outlines the procedures and protocols for handling cash within an organization. It ensures that all employees understand their responsibilities regarding cash management.

Utilizing these documents alongside the Cash Drawer Count Sheet promotes effective cash management and enhances financial accuracy. Each document plays a vital role in maintaining a transparent and accountable cash handling process.

Check out Popular Documents

Army Retirement Points - Details entered on the form contribute to a soldier's official military record.

Imm1294 Form - Your current mailing address must be provided for all correspondence regarding the application.

To facilitate this transaction, it's advisable to utilize resources that offer guidance on the proper completion of the form, such as PDF Documents Hub, which can simplify the process and help ensure all necessary information is accurately captured.

Bill of Ladings - This form is crucial for establishing the terms of the agreement between the shipper and the carrier.

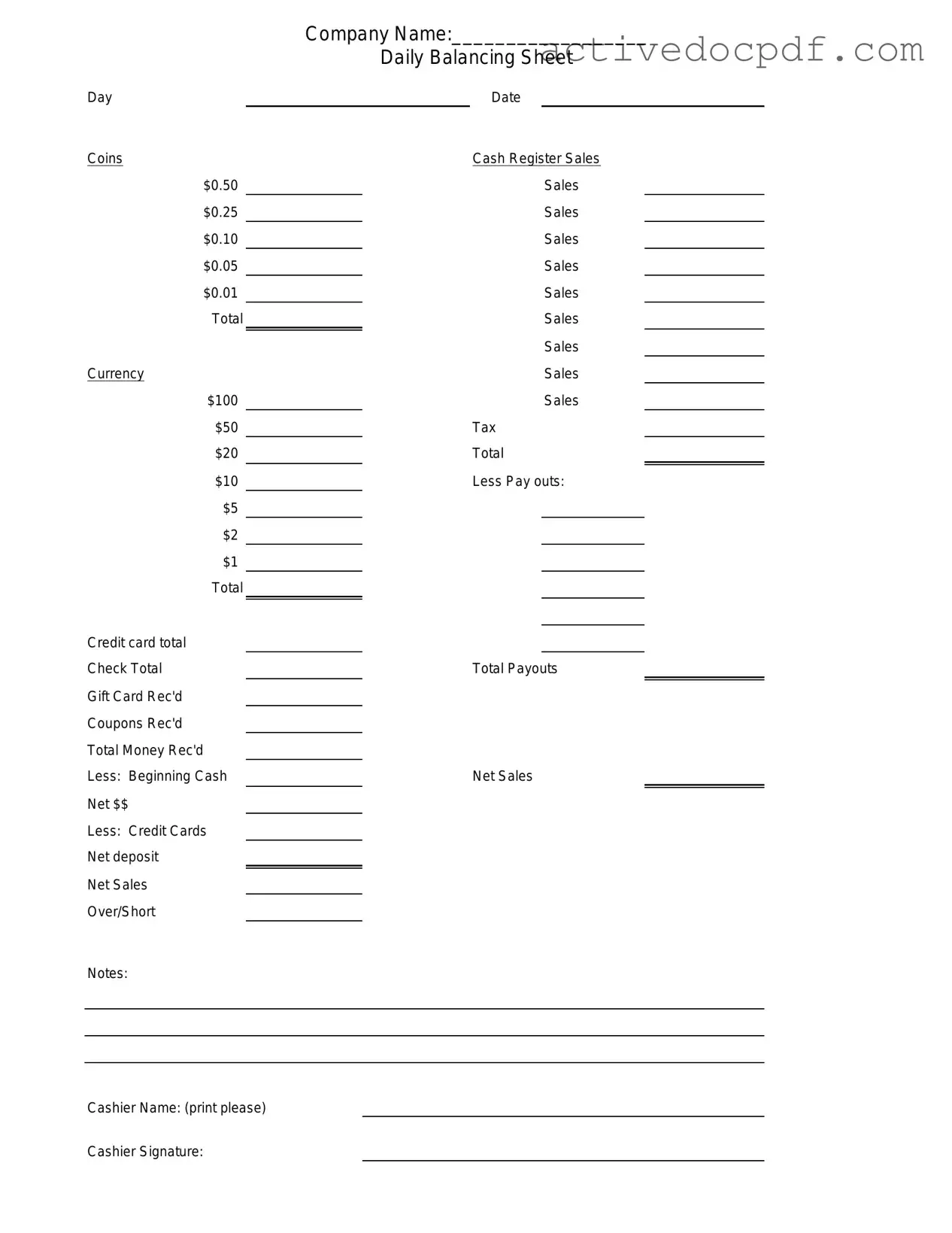

Key Details about Cash Drawer Count Sheet

What is a Cash Drawer Count Sheet?

A Cash Drawer Count Sheet is a document used by businesses to record the amount of cash in a cash drawer at a specific time. It helps ensure that the cash on hand matches the sales recorded during a shift or day. This form is essential for maintaining accurate financial records and preventing discrepancies.

Why is it important to use a Cash Drawer Count Sheet?

Using a Cash Drawer Count Sheet is crucial for several reasons:

- It helps track cash flow, ensuring that all transactions are accounted for.

- Regular counts can identify discrepancies early, reducing the risk of theft or errors.

- The sheet serves as a record for audits and financial reviews, providing transparency in cash handling.

How often should I complete a Cash Drawer Count Sheet?

The frequency of completing a Cash Drawer Count Sheet can vary based on the business's needs. Generally, it is advisable to complete the count at the end of each shift or day. For businesses with high cash volume, more frequent counts may be necessary to maintain accuracy.

What information should be included on the Cash Drawer Count Sheet?

A comprehensive Cash Drawer Count Sheet should include:

- The date and time of the count

- The name of the person conducting the count

- The starting cash balance

- The total sales for the period

- The ending cash balance

- Any discrepancies or notes regarding the count

How do I handle discrepancies found during the cash count?

If a discrepancy is found during the cash count, it is important to take immediate action. First, double-check the count to ensure accuracy. If the discrepancy persists, document it on the Cash Drawer Count Sheet, noting any potential reasons for the difference. Report the issue to a supervisor or manager, who may conduct a further investigation to determine if there was an error or if theft occurred.

Can I use a digital format for the Cash Drawer Count Sheet?

Yes, many businesses opt for digital formats for their Cash Drawer Count Sheets. Using spreadsheet software or specialized accounting applications can streamline the counting process and make it easier to track historical data. However, ensure that digital records are backed up and secure to prevent data loss.

Is training necessary for employees using the Cash Drawer Count Sheet?

Training is highly recommended for employees responsible for cash handling. Proper training ensures that staff understand how to accurately complete the Cash Drawer Count Sheet and recognize the importance of maintaining accurate records. This can help minimize errors and foster a culture of accountability.

What should I do if my business has multiple cash drawers?

For businesses with multiple cash drawers, it is essential to maintain a separate Cash Drawer Count Sheet for each drawer. This practice allows for precise tracking of cash in each location. Additionally, consider implementing a system to consolidate the data for overall cash management.

How long should I keep the Cash Drawer Count Sheets?

Cash Drawer Count Sheets should be retained for a minimum of three years, in line with standard financial record-keeping practices. Keeping these records can be beneficial for audits, tax purposes, and internal reviews. Ensure that they are stored securely to protect sensitive financial information.

Similar forms

The Cash Drawer Count Sheet form is a valuable tool for tracking cash flow and ensuring accuracy in financial transactions. It shares similarities with several other documents used in financial and retail settings. Below are seven documents that are comparable to the Cash Drawer Count Sheet:

- Daily Sales Report: This document summarizes total sales for a given day, providing a snapshot of cash inflows, similar to how the Cash Drawer Count Sheet records cash amounts at the end of a shift.

- Bank Deposit Slip: A bank deposit slip details the cash and checks being deposited into a bank account. Like the Cash Drawer Count Sheet, it ensures that all funds are accounted for before being submitted to the bank.

-

Child Support Texas Form: This document outlines the payment obligations for child support in Texas. For a straightforward guide on how to fill out the form and ensure you meet all legal requirements, visit https://texasformspdf.com/fillable-child-support-texas-online.

- Petty Cash Log: A petty cash log tracks small cash transactions and expenditures. It serves a similar purpose of monitoring cash flow, just on a smaller scale than the Cash Drawer Count Sheet.

- End-of-Day Reconciliation Report: This report compares the cash in the drawer with sales data to identify discrepancies. It is closely aligned with the Cash Drawer Count Sheet, as both aim to verify cash accuracy.

- Cash Register Tape: The cash register tape provides a detailed record of all transactions processed during a specific period. It complements the Cash Drawer Count Sheet by giving a breakdown of sales leading to the cash amount counted.

- Inventory Count Sheet: An inventory count sheet tracks the quantity of goods on hand. While it focuses on products rather than cash, both documents are essential for maintaining accurate financial records in a business.

- Sales Receipt: A sales receipt is issued to customers after a transaction, documenting the sale. This document, like the Cash Drawer Count Sheet, is important for keeping track of financial exchanges and ensuring accuracy in cash handling.

Guide to Filling Out Cash Drawer Count Sheet

After gathering all necessary cash and coins, you are ready to fill out the Cash Drawer Count Sheet. This form will help ensure that your cash drawer balances accurately at the end of your shift. Follow the steps below carefully to complete the form.

- Start by entering the date at the top of the form.

- Write your name in the designated section to identify who is completing the count.

- List the denominations of cash you have in the drawer. This typically includes $1, $5, $10, $20, $50, and $100 bills.

- For each denomination, count the number of bills and enter that number in the corresponding column.

- Calculate the total amount for each denomination by multiplying the number of bills by the bill value. Write the total in the appropriate column.

- Count all coins in the drawer. Include pennies, nickels, dimes, quarters, and any other coins you may have.

- Record the number of each type of coin in the designated area.

- Calculate the total amount for the coins and write it in the appropriate section.

- Add the totals for cash and coins to find the overall total amount in the drawer.

- Double-check all entries for accuracy before submitting the form.

Once the Cash Drawer Count Sheet is completed, it should be submitted to the appropriate supervisor or manager for review. Make sure to keep a copy for your records, as it may be needed for future reference.