Free Cash Receipt PDF Form

Misconceptions

Understanding the Cash Receipt form is crucial for both businesses and individuals handling transactions. However, several misconceptions exist about this form. Here are nine common misunderstandings:

- All cash transactions require a Cash Receipt form. Not every cash transaction necessitates this form. Smaller transactions may not need formal documentation, depending on the business's policies.

- The Cash Receipt form is only for businesses. Individuals can also use this form for personal transactions, such as selling items or receiving payments for services.

- Cash Receipt forms are only for cash payments. While primarily used for cash, these forms can also document payments made by check or credit card.

- Once a Cash Receipt form is filled out, it cannot be changed. Corrections can be made, but they should be documented properly to maintain accurate records.

- The Cash Receipt form is not legally binding. While it serves as a record of the transaction, it can hold legal significance in disputes if properly completed.

- Only one copy of the Cash Receipt form is needed. It is advisable to keep multiple copies: one for the payer, one for the payee, and one for record-keeping.

- The form must be filled out in ink. Electronic versions of the Cash Receipt form are acceptable, and many businesses use digital methods for documentation.

- The Cash Receipt form is the same as an invoice. These documents serve different purposes; an invoice requests payment, while a Cash Receipt confirms that payment has been made.

- Cash Receipt forms are only necessary for large transactions. They are important for all transactions, regardless of size, to ensure proper record-keeping.

By clarifying these misconceptions, individuals and businesses can use the Cash Receipt form more effectively and maintain accurate financial records.

Documents used along the form

When managing financial transactions, a Cash Receipt form is just one piece of the puzzle. Several other forms and documents often accompany it to ensure accurate record-keeping and compliance. Below is a list of these important documents, each serving a unique purpose in the financial process.

- Invoice: This document outlines the goods or services provided, along with the amount due. It serves as a formal request for payment from the buyer to the seller.

- Payment Voucher: This form is used to authorize a payment. It details the amount to be paid and the purpose of the payment, ensuring that all transactions are properly documented.

- Deposit Slip: When cash or checks are deposited into a bank account, a deposit slip is completed. It lists the amounts being deposited and helps maintain accurate banking records.

- Bank Statement: This monthly document from the bank summarizes all transactions in an account. It is essential for reconciling records and verifying cash flow.

- Dirt Bike Bill of Sale: A legal document essential for proving the purchase and transfer of ownership of a dirt bike in New York; you can find the form at PDF Documents Hub.

- Expense Report: Employees use this document to request reimbursement for business-related expenses. It itemizes costs and provides necessary details for approval.

- Purchase Order: This document is created by a buyer to authorize a purchase transaction. It outlines the items being ordered and serves as a contract between the buyer and seller.

- Credit Memo: Issued by a seller, this document acknowledges a reduction in the amount owed by a buyer, often due to returned goods or billing errors.

- Financial Statement: A summary of the financial performance and position of a business. It includes income statements, balance sheets, and cash flow statements, providing a comprehensive view of financial health.

These documents collectively enhance the efficiency and accuracy of financial transactions. By maintaining thorough records, businesses can ensure transparency and accountability in their financial dealings.

Check out Popular Documents

Complaint for Divorce Form Michigan - The Michigan Complaint Divorce form initiates the legal process for divorce in Michigan.

For anyone navigating end-of-life care decisions, understanding the implications of a legal document like a Do Not Resuscitate Order is vital. This guide provides insight into completing this important document and ensuring your healthcare preferences are respected. For further information, visit the significance of the Do Not Resuscitate Order form.

Girlfriend Application Form Funny - Build excitement for what a relationship could bring.

Key Details about Cash Receipt

What is a Cash Receipt form?

A Cash Receipt form is a document used to record the receipt of cash payments. It serves as proof that a payment has been made and is essential for both accounting and record-keeping purposes. This form helps businesses track incoming cash and ensures accurate financial reporting.

When should I use a Cash Receipt form?

You should use a Cash Receipt form whenever you receive cash payments from customers or clients. This includes payments for goods, services, deposits, or any other transactions where cash is exchanged. It’s important to document these transactions to maintain accurate financial records.

What information is required on a Cash Receipt form?

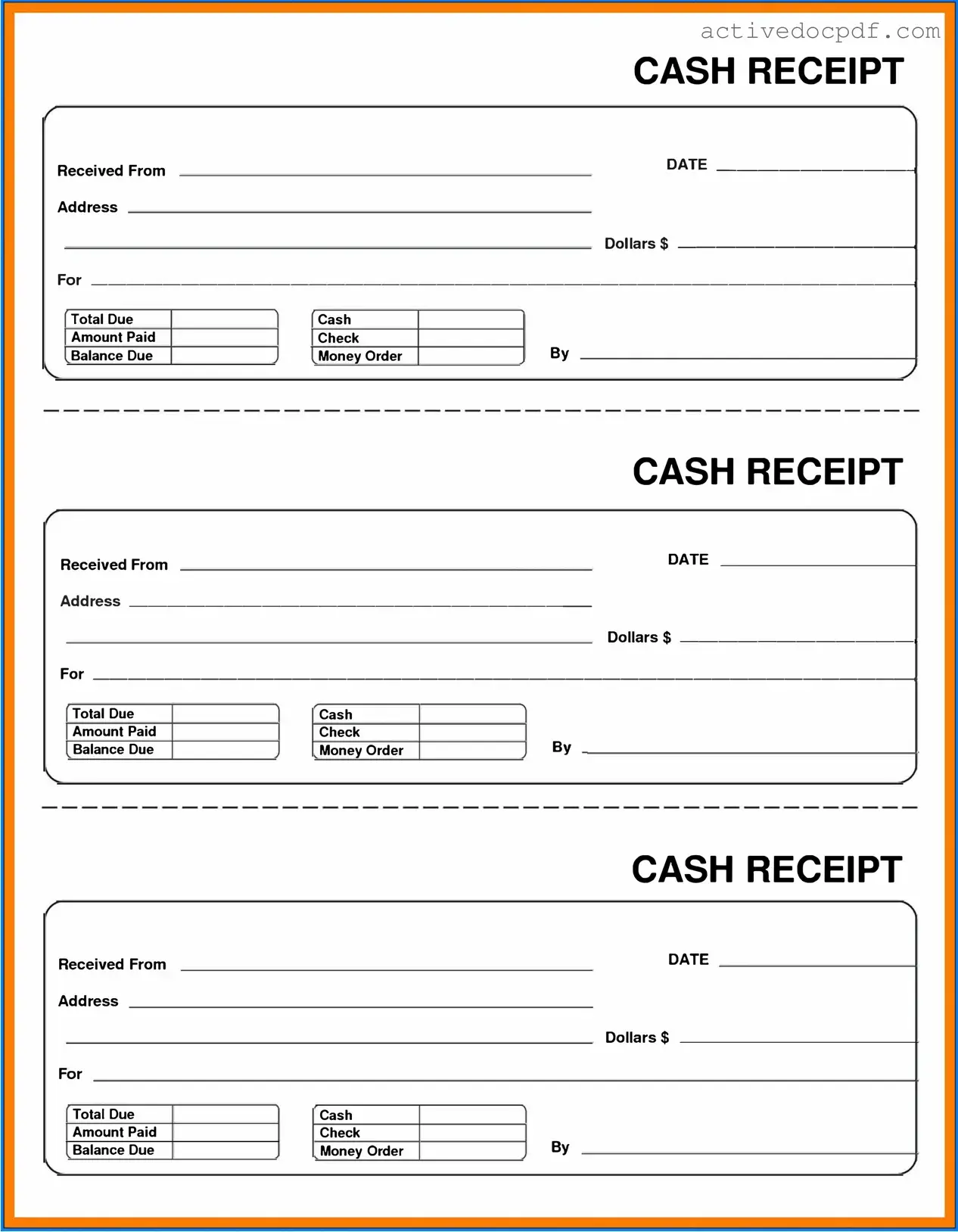

A typical Cash Receipt form includes the following information:

- Date of the transaction

- Name of the payer

- Amount received

- Method of payment (cash, check, etc.)

- Description of the transaction

- Signature of the person receiving the payment

Providing complete information ensures clarity and helps avoid discrepancies in the future.

How do I fill out a Cash Receipt form?

To fill out a Cash Receipt form, start by entering the date of the transaction. Next, write the name of the payer and the amount received. Indicate the payment method and provide a brief description of the transaction. Finally, sign the form to confirm the receipt of payment. Always keep a copy for your records.

Can I use a Cash Receipt form for electronic payments?

Yes, a Cash Receipt form can also be used for electronic payments, such as credit card transactions or online payments. In this case, you would indicate the payment method as electronic and include any relevant transaction details to ensure proper documentation.

What should I do if I make a mistake on the Cash Receipt form?

If you make a mistake on a Cash Receipt form, it’s best to cross out the error neatly and write the correct information next to it. Initial the change to indicate it was corrected. If the mistake is significant, consider creating a new form to maintain clarity and accuracy.

How long should I keep Cash Receipt forms?

It is recommended to keep Cash Receipt forms for at least three to seven years, depending on your business’s record-keeping policy and any applicable tax regulations. Retaining these forms helps in case of audits or financial reviews.

Is a Cash Receipt form the same as an invoice?

No, a Cash Receipt form and an invoice serve different purposes. An invoice is a request for payment sent to a customer before payment is received, while a Cash Receipt form confirms that payment has been made. Both documents are important in the financial process but are used at different stages.

Can I customize my Cash Receipt form?

Absolutely! Many businesses choose to customize their Cash Receipt forms to include their logo, specific fields, or additional information relevant to their operations. Customization can enhance professionalism and ensure that all necessary details are captured.

Where can I obtain a Cash Receipt form?

Cash Receipt forms can be obtained from various sources. You can create one using a word processing or spreadsheet application, download templates from online resources, or purchase pre-printed forms from office supply stores. Ensure that the form meets your business needs and includes all required information.

Similar forms

The Cash Receipt form serves a vital role in financial transactions, and it shares similarities with several other important documents. Understanding these similarities can enhance clarity and efficiency in financial record-keeping. Below are four documents that resemble the Cash Receipt form, along with an explanation of their similarities.

- Invoice: An invoice requests payment for goods or services rendered. Like the Cash Receipt form, it includes details such as the date, amount due, and a description of the transaction. Both documents serve as evidence of a financial exchange.

- Sales Receipt: A sales receipt is provided to customers upon payment, confirming that a transaction has been completed. Similar to the Cash Receipt form, it contains information about the date, amount paid, and items purchased, thus serving as a record of the transaction.

- Durable Power of Attorney: A durable power of attorney form allows individuals to designate someone to make decisions on their behalf, ensuring that their financial and legal matters are managed effectively even if they become incapacitated. For a convenient way to complete this essential document, visit https://texasformspdf.com/fillable-durable-power-of-attorney-online/.

- Payment Voucher: A payment voucher is used to authorize a payment. It typically includes the amount, purpose, and recipient details. Like the Cash Receipt form, it documents a financial transaction and helps maintain an accurate record of payments made.

- Bank Deposit Slip: A bank deposit slip is used when depositing cash or checks into a bank account. It includes the amount being deposited and the account details. Both the Cash Receipt form and the bank deposit slip confirm the receipt of funds, serving as proof of a financial transaction.

Guide to Filling Out Cash Receipt

Once you have the Cash Receipt form ready, you will need to provide specific information to ensure it is completed correctly. Following these steps will help you fill out the form accurately and efficiently.

- Start by entering the date of the transaction in the designated field.

- Write the name of the person or organization making the payment.

- Specify the amount received in the appropriate currency format.

- Indicate the method of payment, such as cash, check, or credit card.

- Provide a brief description of the purpose of the payment.

- Include any relevant invoice or reference numbers if applicable.

- Sign and date the form to validate the transaction.

After completing these steps, review the form for accuracy. Ensure all fields are filled out clearly to avoid any confusion in the future.