Free Cg 20 10 07 04 Liability Endorsement PDF Form

Misconceptions

Understanding the CG 20 10 07 04 Liability Endorsement form is crucial for anyone involved in commercial liability insurance. However, several misconceptions can lead to confusion. Here are four common misunderstandings:

- This endorsement automatically provides full coverage for all additional insureds. Many believe that adding someone as an additional insured guarantees comprehensive coverage. In reality, the coverage is limited to specific liabilities and is contingent upon the terms of the underlying policy and any applicable contracts.

- Once an additional insured is named, they are covered indefinitely. This is not the case. Coverage only applies while ongoing operations are being conducted. Once the work is completed or the project is put to its intended use, coverage for that specific operation ceases.

- The limits of insurance increase with the addition of an additional insured. Some think that naming additional insureds expands the coverage limits. However, the endorsement clearly states that it does not increase the applicable limits of insurance, meaning the coverage remains within the original policy limits.

- All types of injuries or damages are covered. This endorsement does not provide blanket coverage for all incidents. Exclusions apply, particularly for injuries or damages that occur after the work has been completed or when the work has been put to its intended use.

Being aware of these misconceptions can help ensure that all parties involved have a clearer understanding of their coverage and obligations under the CG 20 10 07 04 Liability Endorsement form.

Documents used along the form

The CG 20 10 07 04 Liability Endorsement form is an important document in commercial general liability insurance. It provides coverage for additional insured parties, typically owners, lessees, or contractors, for specific liabilities arising from the insured's operations. Along with this endorsement, several other forms and documents are commonly used to ensure comprehensive coverage and compliance. Below is a list of these documents, each accompanied by a brief description.

- Commercial General Liability (CGL) Policy: This is the main insurance policy that provides coverage for bodily injury, property damage, and personal injury claims. The CG 20 10 07 04 endorsement modifies this policy to add additional insured parties.

- Certificate of Insurance: This document serves as proof of insurance coverage. It outlines the types of coverage, policy limits, and the insured parties. Often required by contract, it helps verify that the additional insured is indeed covered.

- Additional Insured Endorsement: Similar to the CG 20 10 07 04 form, this document specifically adds parties to the insurance policy. It details the extent of coverage for those additional insureds and can vary based on contractual obligations.

- Affidavit of Gift Form: This form is crucial when gifting a vehicle, as it provides proof of the transaction without expectation of payment. For more information, visit https://texasformspdf.com/fillable-affidavit-of-gift-online.

- Indemnity Agreement: This is a contractual arrangement where one party agrees to compensate another for certain damages or losses. It often works in tandem with liability coverage, clarifying responsibilities in case of a claim.

- Contractual Risk Transfer Agreement: This document outlines the transfer of risk from one party to another, typically through a contract. It specifies how liabilities are managed and ensures that the appropriate insurance coverage is in place for additional insureds.

- Exclusion Endorsements: These documents detail specific exclusions from coverage under the main policy. They clarify what types of claims or damages are not covered, helping to manage expectations for all parties involved.

Understanding these documents and their purposes is essential for anyone involved in commercial operations. Properly managing liability and ensuring adequate coverage can help protect against unforeseen risks and financial losses.

Check out Popular Documents

Puppy Health Record - Set reminders for vaccinations and other important health events.

To simplify your transaction process, it's wise to obtain the necessary documentation in advance, such as the New York Bill of Sale, which can be accessed easily through PDF Documents Hub, ensuring a smooth transfer of ownership and compliance with legal requirements.

How to Make a Rental Lease Agreement - Guests can only stay with written consent; unauthorized guests may lead to consequences under the lease.

Key Details about Cg 20 10 07 04 Liability Endorsement

What is the purpose of the CG 20 10 07 04 Liability Endorsement form?

The CG 20 10 07 04 Liability Endorsement form serves to add additional insured parties to a commercial general liability policy. This endorsement is particularly useful for contractors or service providers who need to provide coverage for owners, lessees, or contractors as specified in a contract or agreement.

Who qualifies as an additional insured under this endorsement?

Additional insureds are specified in a schedule within the endorsement. They can include individuals or organizations that the policyholder is required to cover under a contract. This coverage is limited to liability for bodily injury, property damage, or personal and advertising injury that arises from the acts or omissions of the policyholder or those acting on their behalf.

What types of injuries or damages are covered?

The endorsement covers bodily injury, property damage, and personal and advertising injury. However, this coverage only applies if the injury or damage is caused, in whole or in part, by the acts or omissions of the policyholder during their ongoing operations for the additional insured at the specified locations.

Are there any limitations on the coverage provided?

Yes, there are limitations. The coverage only applies to the extent permitted by law. Additionally, if the contract or agreement requires coverage for the additional insured, the insurance provided cannot be broader than what is required by that contract.

What exclusions apply to the coverage for additional insureds?

The endorsement specifies that coverage does not apply to bodily injury or property damage occurring after certain conditions. These include:

- All work related to the project has been completed, including any materials, parts, or equipment.

- The portion of the work that caused the injury or damage has been put to its intended use by someone other than another contractor or subcontractor involved in the same project.

How does the endorsement affect the limits of insurance?

The endorsement does not increase the applicable limits of insurance. If the contract requires coverage for the additional insured, the maximum amount payable is the lesser of the amount required by the contract or the available limits of insurance.

Is there a requirement for the policyholder to notify the additional insured?

Can the endorsement be modified or canceled?

Modifications or cancellations of the endorsement typically depend on the terms of the underlying policy and any contractual agreements. It is essential to review these documents to understand the process for making changes.

Where can I find more information about this endorsement?

For more information, refer to the insurance policy documents or consult with an insurance professional. They can provide specific guidance based on individual circumstances and needs.

Similar forms

- CG 20 10 07 01 - Additional Insured - Owners, Lessees or Contractors: This endorsement is similar as it also provides coverage to additional insured parties, specifically owners or contractors, for liabilities arising from ongoing operations. Both documents emphasize the need for a schedule listing the additional insureds.

Employment Verification Form: This form is essential for confirming the job status of employees, mirroring aspects found in regulatory forms like Fast PDF Templates. It is vital for various applications, including housing and loans, providing clarity and reassurance to all parties involved.

- CG 20 10 07 03 - Additional Insured - Owners, Lessees or Contractors - Completed Operations: Like the CG 20 10 07 04, this endorsement extends coverage to additional insureds but focuses on completed operations rather than ongoing ones. Both forms include limitations based on contractual obligations.

- CG 20 10 07 06 - Additional Insured - Designated Projects: This document is similar as it provides coverage for additional insureds on specific projects. Both endorsements require a schedule that identifies the additional insured parties and their respective locations.

- CG 20 10 12 01 - Additional Insured - Automatic Status When Required in Construction Agreement: This endorsement grants automatic additional insured status based on a construction agreement. Both documents outline the conditions under which coverage applies, emphasizing the relationship between the insured and the additional insured.

- CG 20 37 12 19 - Additional Insured - Owners, Lessees or Contractors - Automatic Coverage: This form provides automatic coverage for additional insureds without needing a separate endorsement for each. Both documents highlight the importance of contractual obligations and define the extent of coverage.

- CG 20 10 11 19 - Additional Insured - Managers or Lessors of Premises: This endorsement extends coverage to managers or lessors of premises, similar to how the CG 20 10 07 04 covers additional insureds. Both documents specify the need for a schedule and outline the conditions for coverage.

- CG 20 10 09 19 - Additional Insured - Vendors: This endorsement provides coverage for vendors as additional insureds, mirroring the CG 20 10 07 04 in its approach to liability for bodily injury and property damage. Both forms require a clear identification of the additional insureds and their operations.

Guide to Filling Out Cg 20 10 07 04 Liability Endorsement

After gathering the necessary information, the next steps involve accurately completing the CG 20 10 07 04 Liability Endorsement form. This form requires specific details about the additional insured parties and the locations of covered operations. Careful attention to each section will ensure that the form is filled out correctly.

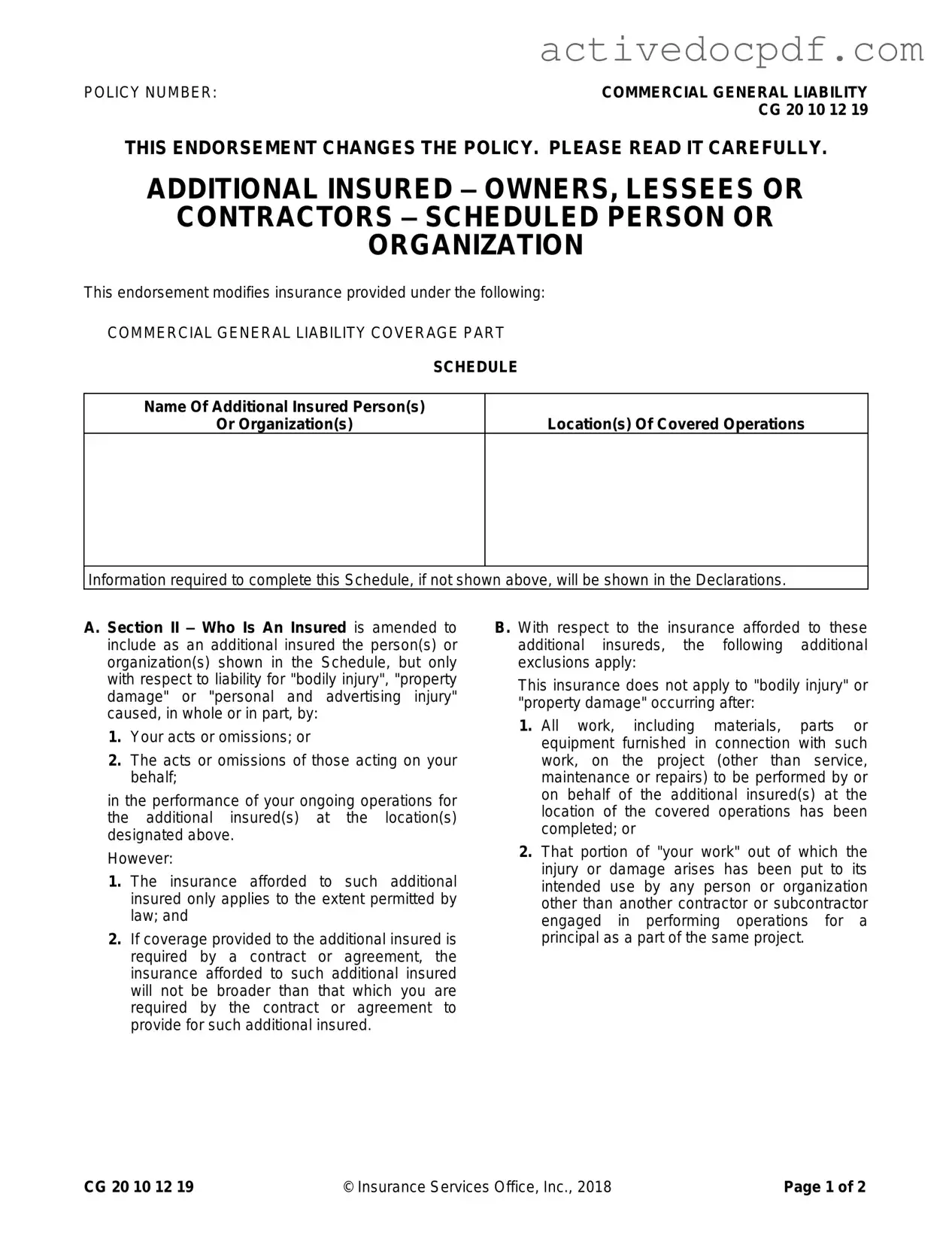

- Locate the section labeled POLICY NUMBER at the top of the form. Enter the policy number associated with the Commercial General Liability coverage.

- Find the section titled ADDITIONAL INSURED – OWNERS, LESSEES OR CONTRACTORS – SCHEDULE. Here, write the name(s) of the additional insured person(s) or organization(s) that need to be covered.

- Next, identify the Location(s) Of Covered Operations section. Provide the specific locations where the covered operations will take place.

- If there is any information required to complete the schedule that is not shown above, ensure it is included in the Declarations section of the policy.

- Review the form to confirm that all entries are accurate and complete. Make any necessary corrections before finalizing.