Free Childcare Receipt PDF Form

Misconceptions

- Misconception 1: The Childcare Receipt form is only necessary for tax purposes.

- Misconception 2: Any handwritten note can serve as a valid receipt.

- Misconception 3: Only licensed providers can issue a Childcare Receipt.

- Misconception 4: The receipt must be issued immediately after payment.

While many people associate the receipt with tax deductions, it serves a broader purpose. Parents may need it for record-keeping, verifying payments, or even for disputes regarding childcare services.

A simple handwritten note does not fulfill the requirements of a proper receipt. The Childcare Receipt form includes specific fields that must be completed, such as the date, amount, and provider’s signature, to ensure it is legally recognized.

While licensed providers often use this form, unlicensed caregivers can also issue receipts. However, it is essential that the receipt contains all necessary details to be considered valid.

Although it is best practice to provide the receipt at the time of payment, it is not a strict requirement. Providers can issue the receipt later, as long as all information is accurately documented and provided to the parent.

Documents used along the form

When managing childcare services, several important documents often accompany the Childcare Receipt form. Each of these documents serves a specific purpose, helping to ensure clarity and accountability between parents and childcare providers. Below is a list of commonly used forms that may complement the Childcare Receipt.

- Childcare Agreement: This document outlines the terms and conditions of the childcare services. It typically includes details such as hours of operation, payment terms, and responsibilities of both the provider and the parent.

- Emergency Contact Form: This form provides essential information about whom to contact in case of an emergency. It usually includes names, phone numbers, and any pertinent medical information about the child.

- Enrollment Form: An enrollment form collects necessary information about the child, including their name, age, and any special needs. This document helps the provider understand the child's background and requirements.

- Health and Immunization Records: These records are vital for ensuring the child's health and safety. They document vaccinations and any medical conditions that the childcare provider should be aware of.

- Motor Vehicle Bill of Sale Form: This crucial document records the sale of a vehicle, capturing essential details like make, model, year, and VIN. It's vital for ownership transfer and legal protection in transactions; the form is available here.

- Payment Agreement: This document details the payment structure for childcare services. It specifies the amount due, payment methods, and any late fees that may apply.

- Daily Log Sheet: A daily log sheet tracks the child's activities, meals, and any incidents that occur during the day. This helps parents stay informed about their child's day-to-day experiences.

Utilizing these documents alongside the Childcare Receipt form can help foster a transparent and organized relationship between parents and childcare providers. Each form plays a vital role in ensuring that all parties are on the same page, ultimately contributing to a positive childcare experience.

Check out Popular Documents

Employee Change of Status Form - Document a reduction in employee hours using this form.

When utilizing the FedEx Release Form, it is essential to understand that this document grants FedEx the authority to leave your package in a designated spot if you are unavailable at the time of delivery. This process is designed for your convenience, and you can specify precise instructions for where to leave the package. To learn more about completing the form and ensuring your delivery goes smoothly, you can visit https://documentonline.org/ for detailed information.

Tuberculosis Risk Assessment Form - A blank section may lead to complications in test results reporting.

Key Details about Childcare Receipt

What is the Childcare Receipt form used for?

The Childcare Receipt form is used to document payments made for childcare services. It provides a clear record for both parents and childcare providers, ensuring transparency in financial transactions.

What information do I need to fill out on the form?

You will need to provide the following information:

- Date of payment

- Amount paid

- Name of the person making the payment

- Name(s) of the child(ren) receiving care

- Dates of the childcare services provided

- Provider’s signature

Who should fill out the Childcare Receipt form?

The childcare provider should fill out the form upon receiving payment. This ensures that all necessary details are accurately recorded and acknowledged.

Can I use the same form for multiple payments?

Yes, you can use the same form for multiple payments, but it is recommended to fill out a separate form for each payment period. This helps keep records organized and clear.

Is the Childcare Receipt form necessary for tax purposes?

Yes, keeping a copy of the Childcare Receipt form is important for tax purposes. It can serve as proof of childcare expenses when filing taxes, which may qualify you for certain deductions or credits.

What should I do if I lose the Childcare Receipt form?

If you lose the form, contact your childcare provider to request a duplicate. They should have a record of the transaction and can issue a new receipt for your records.

How can I ensure the receipt is valid?

To ensure the receipt is valid, make sure it includes all required information and is signed by the childcare provider. Keeping a copy for your records is also a good practice.

Can I edit the information on the Childcare Receipt form?

It is not advisable to edit the form after it has been filled out. If there is an error, it is better to create a new receipt to maintain accurate records.

How often should I request a Childcare Receipt?

You should request a Childcare Receipt each time you make a payment for services. This will help you keep track of your expenses and ensure that you have proper documentation for your records.

Where can I obtain a Childcare Receipt form?

You can typically obtain a Childcare Receipt form directly from your childcare provider. They may also have a template available for you to fill out. Alternatively, you can create your own using the required information.

Similar forms

The Childcare Receipt form is an important document for parents and childcare providers. It serves as proof of payment for childcare services. Here are nine other documents that are similar to the Childcare Receipt form:

- Invoice for Childcare Services: Like the receipt, an invoice details the services provided and the amount due, but it is typically sent before payment is made.

- Payment Confirmation Receipt: This document confirms that a payment has been made, similar to the Childcare Receipt, but may not include details about the services rendered.

- Tuition Receipt: For educational childcare settings, this receipt confirms payment of tuition fees, much like the Childcare Receipt confirms payment for care services.

- Service Agreement: This outlines the terms of the childcare services, including costs, which complements the receipt by providing context for the payment.

- Monthly Statement: This document summarizes all transactions over a month, similar to the receipt, but provides a broader view of payments and services.

- Tax Receipt: This is used for tax purposes and confirms payments made for childcare, similar to the Childcare Receipt, but specifically for tax deductions.

- Payment Plan Agreement: This outlines the payment schedule for childcare services, similar to the receipt as it relates to financial obligations.

- Childcare Enrollment Form: This document registers a child for care services and may include payment information, much like the receipt confirms enrollment through payment.

- Rental Agreement: This document outlines the terms and conditions of renting a property, ensuring both landlord and tenant understand their rights and responsibilities, similar to a Rental Agreement for leasing terms.

- Refund Request Form: If a refund is needed, this form documents the request, similar to the receipt in that it addresses financial transactions.

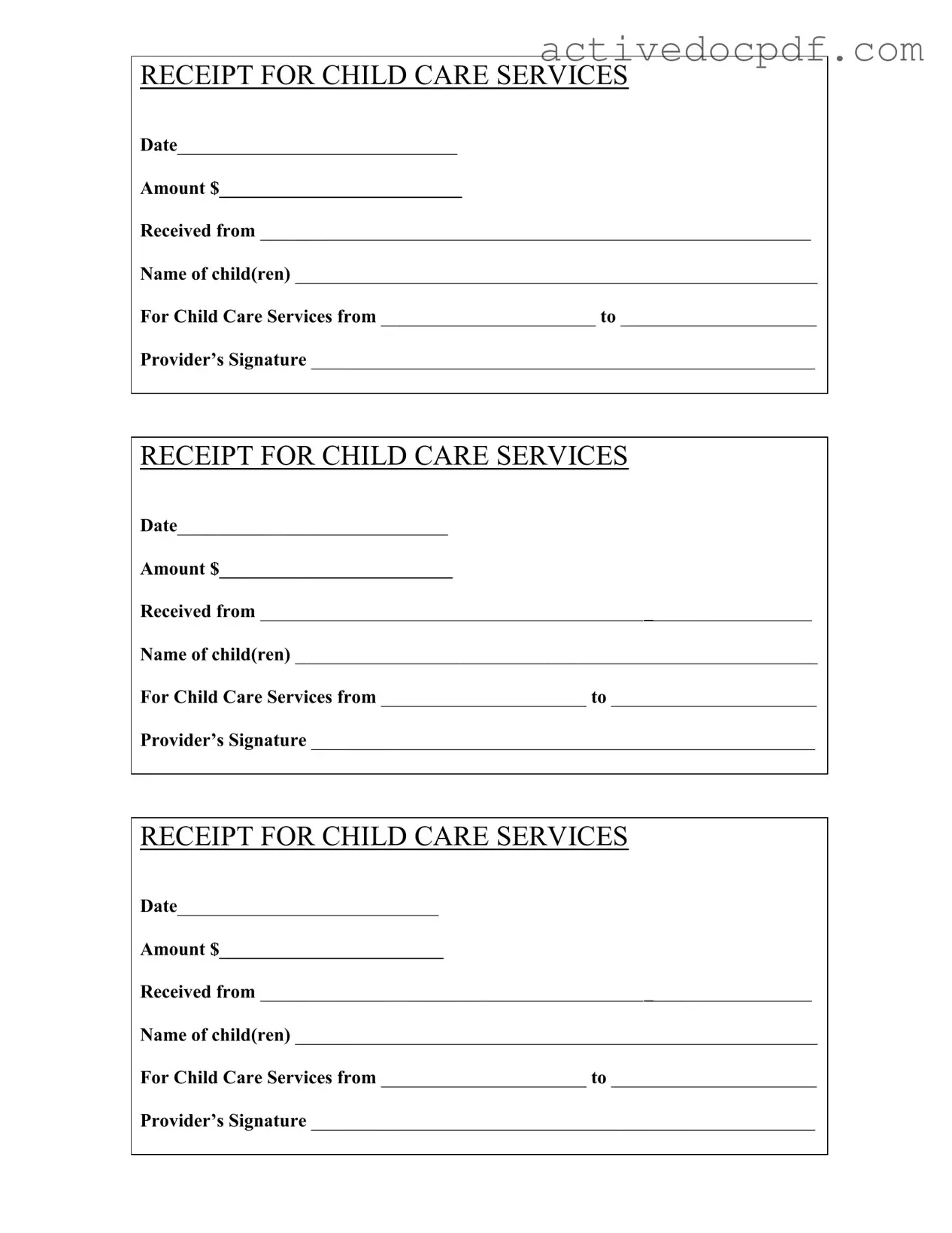

Guide to Filling Out Childcare Receipt

Once you have the Childcare Receipt form in hand, it's time to fill it out accurately. This form is essential for documenting childcare services rendered. Follow these steps to ensure all necessary information is included and clear.

- Write the current date in the space provided for Date.

- Enter the total amount paid for childcare services in the Amount field.

- Fill in the name of the person who made the payment in the Received from section.

- List the names of the child(ren) receiving care in the Name of child(ren) area.

- Indicate the start date of childcare services in the For Child Care Services from section.

- Indicate the end date of childcare services in the to section.

- Have the childcare provider sign the form in the Provider’s Signature space.

After completing the form, make sure to keep a copy for your records. This will help you track payments and services provided. You can now submit the form as needed.