Free Citibank Direct Deposit PDF Form

Misconceptions

Many people have questions about the Citibank Direct Deposit form. Misunderstandings can lead to confusion. Here are four common misconceptions:

- Direct deposit is only for payroll. Some believe that direct deposit can only be used for salary payments. In reality, you can use it for various types of deposits, such as government benefits, tax refunds, and even regular payments from clients.

- Setting up direct deposit is complicated. Many think that the process is lengthy and difficult. However, filling out the Citibank Direct Deposit form is straightforward. Most people can complete it in just a few minutes.

- Once set up, direct deposits are permanent. Some assume that once they set up direct deposit, it will always remain the same. This is not true. You can change your direct deposit information whenever necessary, such as when you switch jobs or change banks.

- Direct deposit eliminates all banking fees. Some believe that using direct deposit means they will never face any banking fees. While direct deposit can help you avoid certain fees, it's important to be aware of your bank's policies regarding account maintenance and other charges.

Understanding these misconceptions can help you make the most of your banking experience with Citibank. If you have further questions, consider reaching out to your bank for clarification.

Documents used along the form

When setting up direct deposit with Citibank, several other forms and documents may be necessary to ensure a smooth process. Each document serves a specific purpose, helping to facilitate the transaction and verify the information provided. Here’s a list of commonly used forms that might accompany the Citibank Direct Deposit form:

- W-4 Form: This form is used by employees to indicate their tax withholding preferences. It helps employers determine how much federal income tax to withhold from an employee's paycheck.

- Bank Account Verification Letter: This document, often provided by the bank, confirms the account holder's details, including the account number and routing number, ensuring accuracy for direct deposit.

- Employment Verification Form: Employers may use this form to confirm an employee's job status, salary, and length of employment, which can be necessary for setting up direct deposit.

- Direct Deposit Authorization Form: Similar to the Citibank form, this document gives permission to the employer or payer to deposit funds directly into the specified bank account.

- Paystub or Earnings Statement: A recent paystub may be required to verify income levels and confirm the frequency of payments for direct deposit.

- Identification Documents: A government-issued ID, such as a driver's license or passport, may be needed to verify the identity of the account holder.

- Hold Harmless Agreement: For those involved in activities that require liability protection, the essential Hold Harmless Agreement resources ensure you are safeguarded against unforeseen risks.

- Tax Identification Number (TIN) Form: This form provides the IRS with the taxpayer's identification number, which is necessary for tax reporting purposes.

- Change of Address Form: If an employee has recently moved, this form updates their address with the employer, ensuring that all documentation, including tax forms, is sent to the correct location.

- Payroll Deduction Authorization Form: This document allows employees to authorize deductions from their paycheck for various purposes, such as retirement savings or health insurance premiums.

- Employer's Direct Deposit Policy: This document outlines the employer's policies regarding direct deposit, including deadlines and procedures for setting it up.

Understanding these forms can help streamline the direct deposit setup process. By ensuring that all necessary documents are in order, employees can avoid delays and enjoy the convenience of having their paychecks deposited directly into their accounts.

Check out Popular Documents

Shower Sheets for Cna - Document skin temperature abnormalities to assess circulation issues.

A California Lease Agreement form is a legally binding document outlining the terms and conditions between a landlord and tenant for renting residential or commercial property in California. This form serves to protect the rights of both parties and ensure clear communication regarding rental obligations. For those looking to create or understand this essential document, resources like Fast PDF Templates can be invaluable in facilitating a smoother leasing process.

Dd Form 2870 Army Pubs - Proper use of the form helps in documenting family health care history.

Key Details about Citibank Direct Deposit

What is the Citibank Direct Deposit form?

The Citibank Direct Deposit form is a document that allows you to authorize your employer or other payers to deposit your paycheck or other funds directly into your Citibank account. This process ensures that your funds are available to you quickly and securely, eliminating the need for paper checks.

How do I obtain the Citibank Direct Deposit form?

You can obtain the Citibank Direct Deposit form in several ways:

- Visit the Citibank website and download the form directly from their resources section.

- Request a physical copy from your local Citibank branch.

- Ask your employer if they provide the form as part of their payroll setup.

What information do I need to fill out the form?

To complete the Citibank Direct Deposit form, you will need to provide:

- Your personal information, including your name and address.

- Your Citibank account number.

- Your bank's routing number.

- Details about your employer or payer.

How long does it take for direct deposit to start?

The time it takes for direct deposit to begin can vary. Generally, it may take one to two pay cycles for your employer to process your request. It's advisable to check with your employer for specific timelines.

What should I do if I change my bank account?

If you change your bank account, you will need to complete a new Citibank Direct Deposit form. Submit the updated form to your employer or payer to ensure that future deposits go to your new account. Make sure to do this well in advance of your next payment date to avoid any delays.

Can I use the direct deposit for multiple accounts?

What should I do if I encounter issues with my direct deposit?

If you experience issues with your direct deposit, first check with your employer to confirm that they have processed your request correctly. If everything appears to be in order on their end, contact Citibank customer service for assistance. They can help you resolve any banking-related issues.

Similar forms

W-4 Form: This form is used by employees to indicate their tax withholding preferences. Like the Direct Deposit form, it requires personal information and ensures that payments are processed correctly.

Bank Account Application: This document is necessary for opening a new bank account. It shares similarities with the Direct Deposit form in that both require personal and banking details to facilitate transactions.

Payroll Authorization Form: This form allows employees to authorize their employer to deposit their wages directly into their bank account. It serves the same purpose as the Direct Deposit form, ensuring timely and accurate payments.

- New York Motorcycle Bill of Sale: This legal document serves as proof of ownership transfer for a motorcycle, detailing buyer and seller information, motorcycle specifics, and sale price. To learn more, visit PDF Documents Hub.

Change of Address Form: This document is used to update your address with financial institutions. Similar to the Direct Deposit form, it helps maintain accurate records for processing payments and communications.

Guide to Filling Out Citibank Direct Deposit

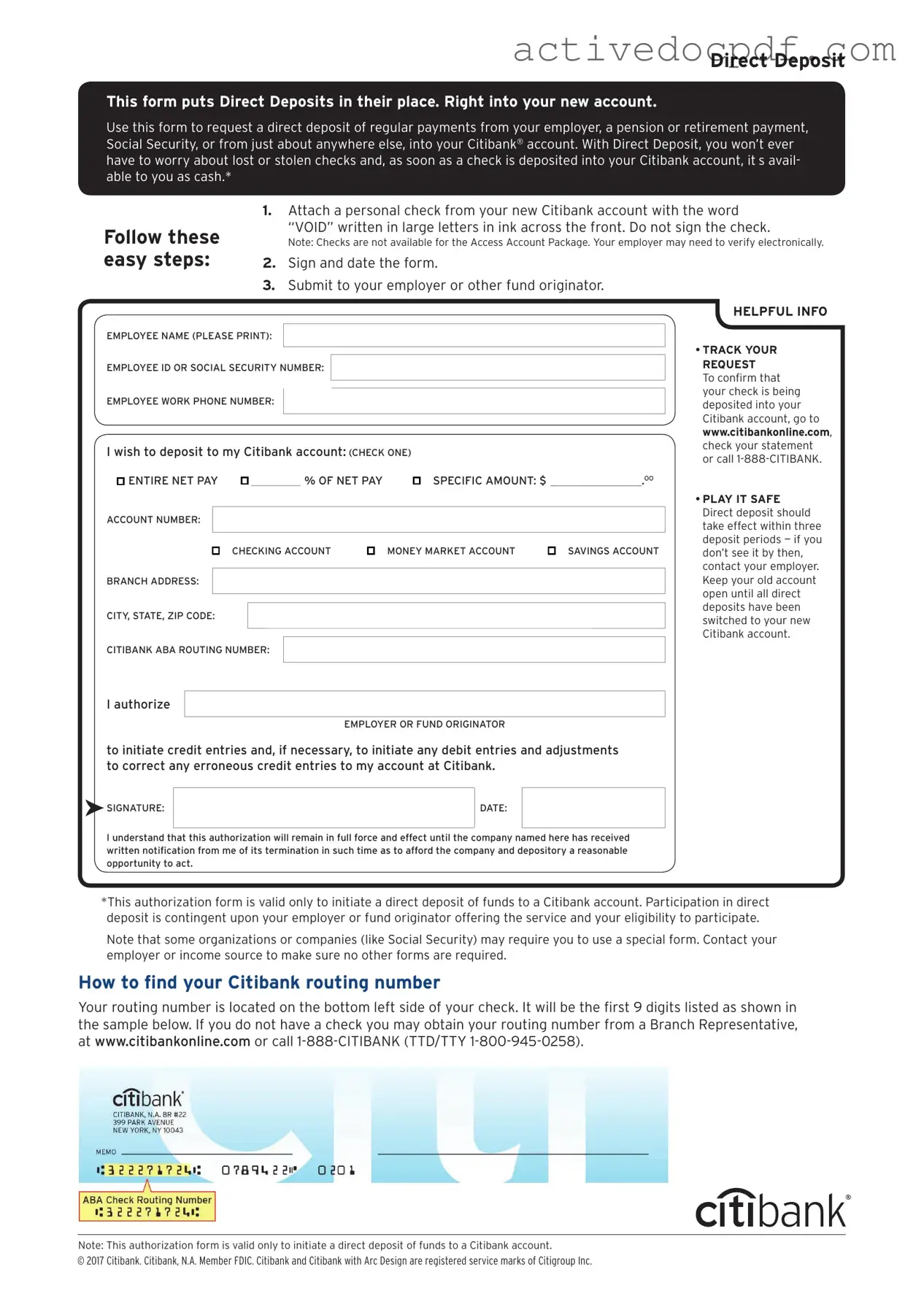

Once you have the Citibank Direct Deposit form in hand, you’re ready to begin the process of setting up your direct deposit. This form will help ensure that your funds are deposited directly into your Citibank account. Follow these steps carefully to complete the form accurately.

- Start by entering your personal information at the top of the form. This includes your full name, address, and contact number.

- Next, provide your Social Security Number (SSN) or Tax Identification Number (TIN) in the designated space.

- Locate the section for your bank account details. Here, you’ll need to write down your Citibank account number. Double-check this number for accuracy.

- In the same section, you will find a spot for your bank routing number. This number is essential for directing your deposits correctly. It can usually be found on your checks or by contacting Citibank directly.

- After filling in your account and routing numbers, review the information you’ve provided to ensure everything is correct.

- Sign and date the form at the bottom. Your signature indicates that you authorize the direct deposit.

- Finally, submit the completed form to your employer or the entity that will be processing your direct deposit. Keep a copy for your records.

Once submitted, your employer will process the form, and you should see your direct deposits begin shortly. Be sure to monitor your account statements to confirm that the deposits are being made correctly.