Free Employee Advance PDF Form

Misconceptions

Understanding the Employee Advance form is essential for both employees and employers. However, several misconceptions can lead to confusion. Here are eight common misconceptions about the Employee Advance form:

- 1. It’s only for emergencies. Many believe that the Employee Advance form is strictly for urgent situations. In reality, it can be used for various purposes, including planned expenses.

- 2. It must be paid back immediately. Some think that once an advance is received, it must be repaid within a short timeframe. However, repayment terms can vary based on company policy.

- 3. Only full-time employees can apply. A common belief is that only full-time employees are eligible for advances. Part-time employees may also qualify, depending on the employer’s guidelines.

- 4. It affects your credit score. Many worry that taking an employee advance will impact their credit rating. Since this is a company-specific arrangement, it typically does not affect personal credit scores.

- 5. The process is complicated. Some employees think the application process is overly complex. In fact, most companies strive to make it straightforward and user-friendly.

- 6. You need to provide receipts for everything. A misconception exists that every expense must be documented with a receipt. While documentation is often required, some companies may allow for estimated expenses.

- 7. It’s a loan. Many confuse an advance with a traditional loan. An employee advance is typically a reimbursement for future expenses rather than a loan that accrues interest.

- 8. Approval is guaranteed. Some employees believe that submitting the form guarantees approval. However, approval is subject to company policy and the discretion of management.

By clearing up these misconceptions, employees can better navigate the Employee Advance form and utilize it effectively when needed.

Documents used along the form

When handling employee advances, several other forms and documents are commonly utilized to ensure proper record-keeping and compliance with company policies. Each of these documents plays a vital role in the process, making it easier for both employees and employers to manage financial transactions efficiently.

- Employee Reimbursement Form: This form allows employees to request reimbursement for expenses they have incurred on behalf of the company. It typically requires receipts and details about the nature of the expenses.

- Expense Report: An expense report provides a comprehensive overview of all expenses incurred during a specific period. It often includes categories for different types of expenses and helps in budgeting and financial tracking.

- IRS W-9 Form: This form is essential for verifying the Taxpayer Identification Number (TIN) of employees or vendors. If you need assistance in completing the W-9 form, you can refer to resources like PDF Documents Hub for guidance.

- Payroll Deduction Authorization Form: This document authorizes the company to deduct the amount of the advance from the employee’s future paychecks. It ensures that both parties agree on the repayment terms.

- Employee Agreement Form: This form outlines the terms and conditions of the advance, including repayment schedules and any applicable interest rates. It serves as a formal agreement between the employee and the employer.

- Tax Withholding Form: This form is used to determine the amount of taxes that should be withheld from an employee’s paycheck. It may need to be updated if an advance affects the employee’s taxable income.

- Financial Policy Acknowledgment: Employees may be required to sign this document to acknowledge their understanding of the company’s financial policies, including those related to advances and reimbursements.

- Direct Deposit Authorization Form: This form allows employees to set up direct deposit for their paychecks, including any reimbursements or advances. It simplifies the payment process and ensures timely transactions.

Utilizing these forms in conjunction with the Employee Advance form helps maintain clarity and accountability in financial dealings within the workplace. Proper documentation not only protects the interests of both employees and employers but also fosters a culture of transparency and trust.

Check out Popular Documents

Daily Activity Security Guard Daily Report Sample - Clear documentation of incidents ensures accurate communication with law enforcement.

When preparing to engage in activities that carry inherent risks, it is essential to utilize a legal tool such as the Florida Hold Harmless Agreement. This form not only safeguards parties involved by delineating respective responsibilities but also plays a critical role in risk management. For those interested in drafting such an agreement, you can find specific details and templates for the form that suit various situations, including events and construction projects.

Hurt Feelings Report - Document how and when your feelings were impacted most deeply.

Key Details about Employee Advance

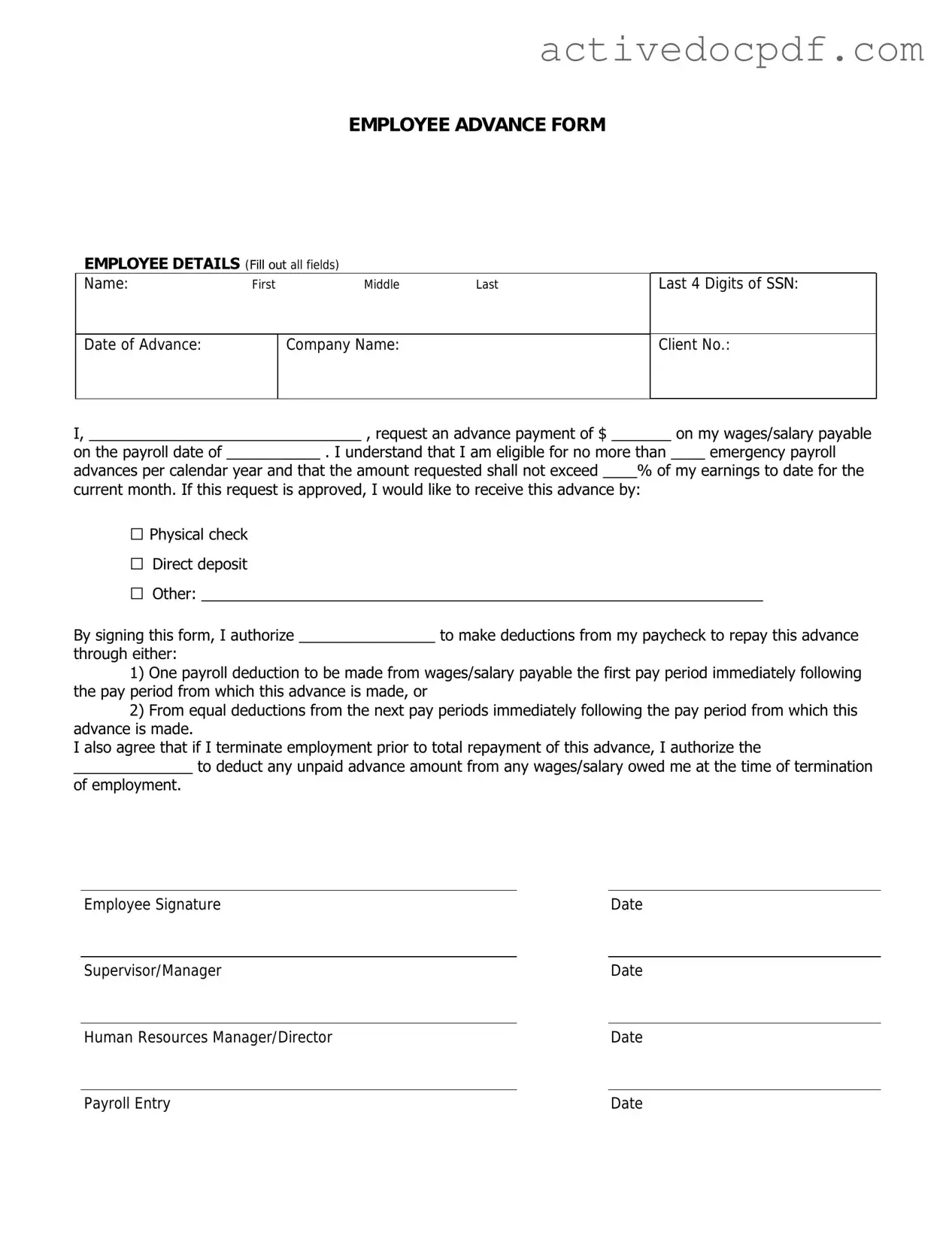

What is the Employee Advance form?

The Employee Advance form is a document that allows employees to request an advance on their salary or wages. This can be helpful for individuals facing unexpected expenses or financial emergencies. By submitting this form, employees can outline the amount they wish to receive and provide a reason for the request.

Who is eligible to request an advance?

Generally, all employees who have been with the company for a certain period may be eligible to request an advance. However, eligibility can vary based on company policy. It's essential to check with your human resources department to understand the specific criteria that apply to your situation.

How do I fill out the Employee Advance form?

Filling out the Employee Advance form typically involves several steps:

- Provide your personal information, including your name, employee ID, and department.

- Clearly state the amount you wish to request.

- Explain the reason for your advance request in a concise manner.

- Sign and date the form to confirm your request.

Make sure to review your form for accuracy before submitting it to ensure a smooth processing experience.

How long does it take to process the request?

The processing time for an Employee Advance request can vary. Typically, it may take anywhere from a few days to a week. Factors that influence this timeline include the company's internal review processes and the volume of requests being handled at the time. It’s always a good idea to follow up with your HR department if you haven’t received a response within the expected timeframe.

Will the advance be deducted from my future paychecks?

Yes, in most cases, the amount advanced will be deducted from your future paychecks. The specific terms of repayment should be outlined in the approval notification you receive after your request is processed. Understanding the repayment schedule is crucial, so be sure to clarify any questions with HR.

What happens if my request is denied?

If your request for an advance is denied, you should receive a notification explaining the reasons for the denial. Common reasons may include insufficient tenure with the company or not meeting specific eligibility criteria. If you believe your situation warrants reconsideration, don’t hesitate to discuss it with your supervisor or HR representative.

Can I appeal a denied request?

Yes, many companies allow employees to appeal a denied advance request. The process for appealing typically involves submitting a written explanation of why you believe the advance should be granted. Be sure to include any supporting documentation that could strengthen your case. Check your company’s policy for specific guidelines on the appeals process.

Similar forms

Expense Reimbursement Form: Both documents allow employees to request funds for business-related expenses. They require detailed documentation of expenses incurred.

Travel Authorization Form: Similar to the Employee Advance form, this document is used to gain approval for travel expenses before they are incurred.

Payroll Advance Request: This form enables employees to request an advance on their salary, similar to how the Employee Advance form provides funds for expenses.

Loan Application Form: Both forms involve requesting financial assistance, though the loan application typically requires more extensive financial information.

Purchase Order Request: This document is used to authorize purchases on behalf of the company, similar to how the Employee Advance form authorizes funds for expenses.

Budget Request Form: Employees use this form to request funding for projects or initiatives, paralleling the request for an advance in the Employee Advance form.

Grant Application Form: Like the Employee Advance form, this document seeks financial support for specific projects, requiring justification for the funds requested.

- Power of Attorney Form: To ensure your wishes are respected in legal matters, consider using the crucial Power of Attorney documentation designed to grant authority to an agent for decision-making.

Vendor Payment Request: This form is used to initiate payments to vendors, similar to how the Employee Advance form facilitates employee payments for business expenses.

Reimbursement for Training Expenses: Employees submit this form to reclaim costs associated with professional development, akin to the advance for work-related expenses.

Guide to Filling Out Employee Advance

After you complete the Employee Advance form, it will be submitted for review and approval. Make sure all required information is accurate and clear to avoid any delays in processing.

- Begin by entering your full name in the designated field.

- Provide your employee ID number. This number is typically found on your ID badge or pay stub.

- Fill in the date of the request. Use the format MM/DD/YYYY.

- Specify the amount you are requesting as an advance. Ensure this amount is within the allowed limits.

- In the next section, explain the purpose of the advance. Be concise but provide enough detail for clarity.

- Indicate the date by which you expect to repay the advance. This should align with your pay schedule.

- Sign and date the form at the bottom to confirm your request.

- Submit the completed form to your supervisor or the designated department for processing.