Free Erc Broker Market Analysis PDF Form

Misconceptions

- Misconception 1: The Erc Broker Market Analysis form is an appraisal.

- Misconception 2: The form includes a home inspection.

- Misconception 3: The Most Likely Sales Price is guaranteed.

- Misconception 4: The form is standardized across all states.

- Misconception 5: The form can be used for financing purposes.

- Misconception 6: All property characteristics must be included.

- Misconception 7: The form is only for residential properties.

- Misconception 8: The form is valid indefinitely.

- Misconception 9: The analysis can be completed without client input.

This form is not an appraisal. It is a comparative market analysis designed to estimate the Most Likely Sales Price based on the property’s condition and market factors.

While the form may note property conditions, it does not serve as a home inspection. It focuses on market analysis rather than detailed inspections of the property.

The estimated price is based on current market conditions and is not a guarantee of sale. Market fluctuations can affect the actual sale price.

The form must comply with state-specific disclosure requirements. Users should include any necessary disclosures based on local laws.

This form is not intended for financing evaluations. It is strictly for market analysis and should not be used to secure loans or financing.

While comprehensive, the form allows for the inclusion of relevant characteristics. Not every detail needs to be filled out if it does not apply to the property.

This form can be utilized for various property types, including condos, townhouses, and mixed-use properties, as indicated in the options provided.

The form has an expiration date. Users should ensure they are using the most current version to comply with regulations.

Client input is often necessary for accurate analysis. Brokers should communicate with clients to gather essential information about the property.

Documents used along the form

The ERC Broker Market Analysis form is a crucial tool for real estate brokers, allowing them to assess a property’s market position and estimate its most likely sales price. Along with this form, several other documents are commonly utilized to provide a comprehensive view of the property and its market context. Below is a list of these documents, each serving a specific purpose in the real estate analysis process.

- Property Disclosure Statement: This document outlines any known issues with the property, such as structural problems or environmental hazards. Sellers are typically required to provide this to inform potential buyers of any defects.

- Comparative Market Analysis (CMA): A CMA evaluates similar properties in the area that have recently sold, are currently for sale, or were previously listed. This helps establish a competitive price range for the subject property.

- Inspection Report: Conducted by a licensed inspector, this report details the physical condition of the property, identifying any repairs or maintenance issues that may affect its value.

- Appraisal Report: An independent assessment of the property’s value conducted by a licensed appraiser. This report is often required by lenders to determine how much they are willing to finance.

- Florida Vehicle POA form 82053: This legal document allows one person to appoint another to manage vehicle-related tasks on their behalf. For more convenience, you can download an editable document.

- Title Report: This document provides information about the property’s ownership history and any liens or encumbrances that may affect the sale. It ensures the buyer will receive clear title upon purchase.

- HOA Documents: For properties within a homeowners association, these documents outline the rules, regulations, and fees associated with the community. They can impact a buyer’s decision based on the terms set forth.

- Financing Pre-Approval Letter: A letter from a lender indicating that a buyer is pre-approved for a mortgage. This shows sellers that the buyer is serious and financially capable of purchasing the property.

- Marketing Plan: A strategic outline detailing how the property will be marketed to potential buyers. This may include online listings, open houses, and promotional materials.

- Sales Contract: The formal agreement between the buyer and seller outlining the terms of the sale, including price, contingencies, and closing details. This is a critical document once an offer is accepted.

These documents collectively enhance the understanding of the property’s value and marketability. They also facilitate a smoother transaction process by ensuring that all parties are informed and prepared at each stage of the real estate transaction.

Check out Popular Documents

USCIS Form I-864 - The I-864 requires transparency and accuracy to avoid complications.

When preparing to use the FedEx Release Form, it’s important to understand its purpose and implications to ensure successful package delivery. This essential document allows you to authorize the delivery of your package when you are unable to be home. By filling out this form, you enable FedEx to leave your package at a specified location, provided that the requirements are met. Be sure to follow the instructions carefully for a smooth delivery process. For more details, visit PDF Documents Hub to access the necessary forms and guidelines.

Dh 680 - Additional immunizations may not be medically necessary to complete at certain times while using the form.

Da From - Extensions for leave require additional documentation and signatures from authority figures.

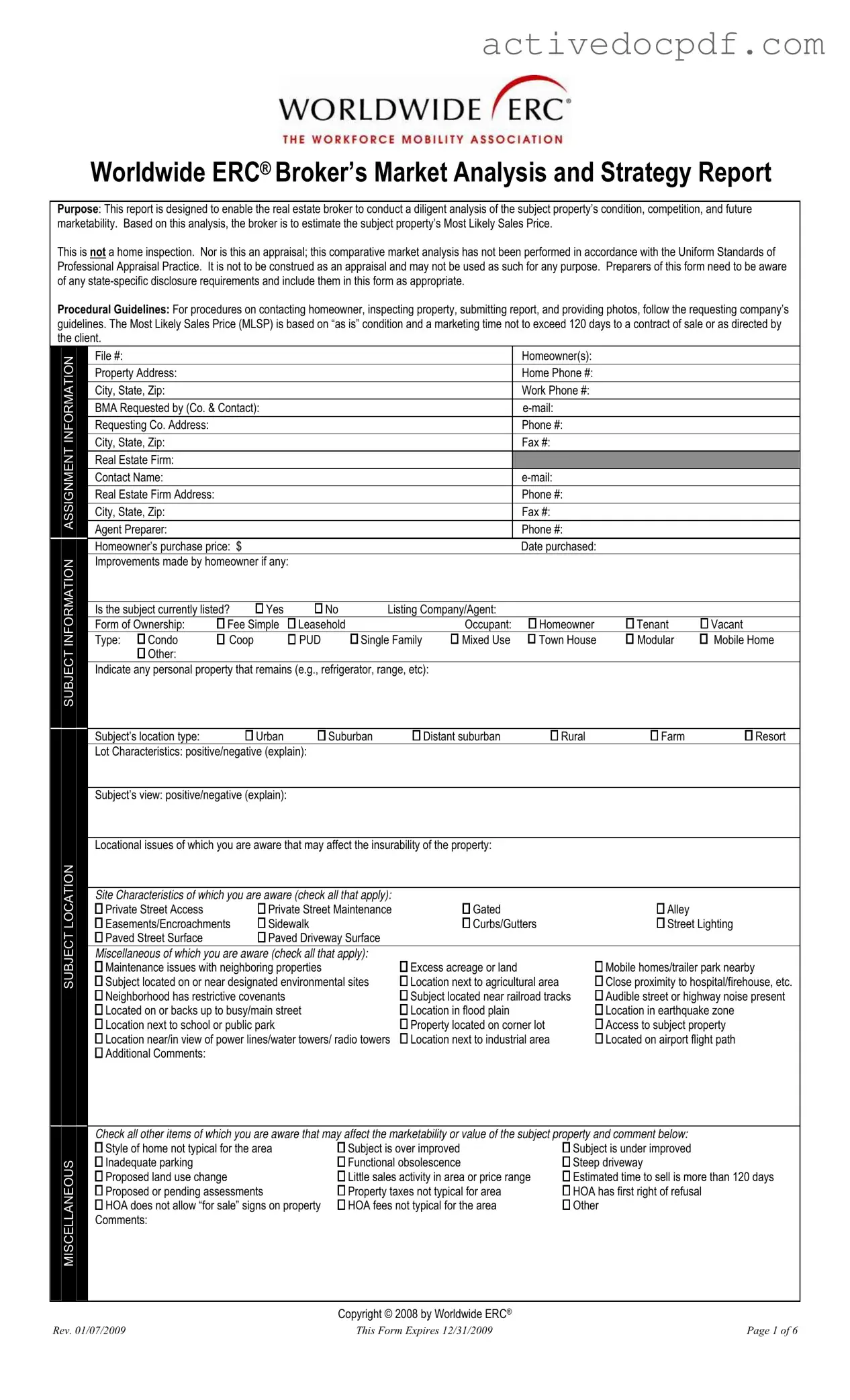

Key Details about Erc Broker Market Analysis

What is the purpose of the ERC Broker Market Analysis form?

The ERC Broker Market Analysis form serves to assist real estate brokers in conducting a thorough evaluation of a property's condition, competition, and potential marketability. This analysis ultimately helps brokers estimate the property's Most Likely Sales Price (MLSP). It is important to note that this form is not an appraisal or home inspection and should not be used as such.

Who is responsible for completing the ERC Broker Market Analysis form?

The form is typically completed by a licensed real estate broker or agent. They are responsible for gathering all necessary information about the property, including its condition, market conditions, and comparable properties. The broker must also ensure compliance with any state-specific disclosure requirements.

What information is required on the form?

The form requires various pieces of information, including:

- Property details such as address, homeowner contact information, and property type.

- Information about the property's condition, including any improvements made and issues observed.

- Details about the local market, including competing listings and recent sales.

- Financing options and potential issues that may affect the sale.

How is the Most Likely Sales Price (MLSP) determined?

The MLSP is based on an analysis of the property in its current condition and assumes a marketing time not exceeding 120 days. Brokers consider various factors such as comparable sales, current market trends, and property condition when estimating this price.

What are some common issues that can affect a property's marketability?

Several factors can impact a property's marketability, including:

- Location-related issues, such as proximity to undesirable areas or environmental concerns.

- Condition of the property, including any deferred maintenance or necessary repairs.

- Market conditions, including low sales activity or economic downturns in the area.

What should I do if I have questions about the form or its contents?

If you have questions regarding the ERC Broker Market Analysis form, it is advisable to consult with a qualified real estate professional. They can provide guidance on how to accurately complete the form and address any specific concerns you may have about the property or market conditions.

Similar forms

- Comparative Market Analysis (CMA): Similar to the ERC Broker Market Analysis, a CMA helps real estate agents estimate a property's value by comparing it to similar properties that have recently sold in the area.

- Property Condition Report: This document focuses on the physical state of a property. Like the ERC form, it identifies issues that may affect marketability but emphasizes specific repairs and improvements needed.

- Appraisal Report: An appraisal provides an estimated value of a property based on a thorough analysis. While the ERC form estimates the Most Likely Sales Price, an appraisal is a more formal valuation that follows strict guidelines.

- Listing Agreement: This document outlines the terms under which a property will be listed for sale. Similar to the ERC form, it contains details about the property and expectations but is focused on the relationship between the seller and the broker.

Bill of Sale Form: A Bill of Sale form is essential for formalizing the transfer of ownership of personal property. It ensures clarity in the transaction and provides proof for both parties involved. For more details on this form, visit documentonline.org/.

- Inspection Report: This report details the findings of a property inspection. While the ERC form includes some inspection elements, a full inspection report provides a more comprehensive look at the property's condition.

- Market Research Report: This document analyzes broader market trends and economic conditions. It shares similarities with the ERC form in assessing marketability but typically covers a wider geographic area and more extensive data.

Guide to Filling Out Erc Broker Market Analysis

Filling out the ERC Broker Market Analysis form is an important step in assessing a property's condition and marketability. Once you have completed the form, you will be able to provide a comprehensive analysis to help estimate the Most Likely Sales Price. This process involves gathering various details about the property, the surrounding neighborhood, and any relevant market conditions.

- Begin by entering the File # and Homeowner(s) information at the top of the form.

- Fill in the Property Address, including the City, State, and Zip code.

- Provide both Home Phone # and Work Phone # for the homeowner.

- List the BMA Requested by company and contact person, along with their e-mail address.

- Complete the Requesting Co. Address, including Phone #, City, State, and Zip.

- Fill out the Real Estate Firm and Contact Name sections, including their e-mail and address.

- Enter the Agent Preparer information and their Phone #.

- Document the homeowner’s purchase price and the Date purchased.

- Note any Improvements made by homeowner and whether the property is currently listed.

- Specify the Form of Ownership and the Occupant type.

- Indicate the Type of property (e.g., Condo, Single Family, etc.) and any personal property that remains.

- Describe the Subject’s location type and provide insights on Lot Characteristics and Subject’s view.

- List any Locational issues that may affect insurability.

- Check all relevant Site Characteristics and Miscellaneous

- Document the Property Condition and any Recommended Repairs and Improvements.

- Fill in the Financing section, detailing the anticipated means of financing and any potential issues.

- Describe the Subject Neighborhood and provide details on current economic conditions.

- List Competing Listings and Comparable Sales with relevant details for each.

- Review the form for completeness and accuracy before submitting it as per the requesting company’s guidelines.