Free Florida Commercial Contract PDF Form

Misconceptions

Understanding the Florida Commercial Contract form is essential for anyone involved in real estate transactions in the state. However, there are several misconceptions that can lead to confusion. Here’s a list of ten common misconceptions along with clarifications to help you navigate the process more effectively.

- Misconception 1: The contract is only for large commercial properties.

- Misconception 2: The contract is overly complicated and hard to understand.

- Misconception 3: The contract guarantees financing.

- Misconception 4: Once signed, the contract cannot be changed.

- Misconception 5: The seller is responsible for all repairs before closing.

- Misconception 6: There is no need for a title search.

- Misconception 7: The closing date is flexible and can be changed at any time.

- Misconception 8: The contract does not protect the buyer.

- Misconception 9: Escrow agents are responsible for ensuring the contract terms are met.

- Misconception 10: The contract is the same as a residential contract.

The Florida Commercial Contract can be used for a variety of commercial properties, not just large ones. It applies to any commercial real estate transaction.

While the contract includes specific legal terms, it is designed to be clear and straightforward. Buyers and sellers can ask for explanations to ensure they understand all aspects.

The contract includes provisions for financing, but it does not guarantee that financing will be approved. Buyers must still apply and meet lender requirements.

Changes can be made to the contract, but they must be documented in writing and signed by all parties involved. Flexibility is built into the process.

Typically, the property is sold "as is," meaning the buyer accepts it in its current condition. Any repairs or issues must be addressed during the due diligence period.

A title search is a crucial step in the process. It helps ensure that the property is free of liens or encumbrances that could affect ownership.

The closing date is a critical component of the contract. While it can be adjusted if agreed upon by both parties, it should not be taken lightly.

The contract contains numerous provisions that safeguard the buyer's interests, including contingencies for financing and inspections.

While escrow agents handle the funds and documents, they do not ensure that all terms of the contract are fulfilled. That responsibility lies with the buyer and seller.

The Florida Commercial Contract is distinct from residential contracts. It addresses different legal and financial considerations specific to commercial transactions.

By dispelling these misconceptions, parties involved in commercial real estate transactions can approach the Florida Commercial Contract with greater confidence and understanding.

Documents used along the form

The Florida Commercial Contract form serves as a foundational document in real estate transactions, particularly for commercial properties. Alongside this contract, various other forms and documents are often utilized to ensure that all aspects of the transaction are adequately addressed. Below is a list of key documents that typically accompany the Florida Commercial Contract, each playing a vital role in the process.

- Purchase and Sale Agreement: This document outlines the terms of the sale, including the purchase price, contingencies, and closing date. It formalizes the agreement between the buyer and seller.

- Escrow Agreement: This agreement details the responsibilities of the escrow agent in holding and managing the funds and documents during the transaction, ensuring that both parties meet their obligations.

- Title Insurance Policy: This policy protects the buyer from potential defects in the title of the property. It provides assurance that the seller has the legal right to sell the property free of liens or encumbrances.

- Due Diligence Checklist: This document outlines the various inspections, assessments, and investigations the buyer should conduct to evaluate the property’s condition and suitability for their intended use.

- Financing Contingency Addendum: This addendum specifies the terms and conditions under which the buyer can secure financing for the purchase, including deadlines and requirements for loan approval.

- Lease Agreements: If the property is leased, these agreements outline the terms under which tenants occupy the space, including rent, duration, and responsibilities of both parties.

- Proof of Employment Letter: A document used to verify an individual's employment status and history, which can be critical in the evaluation process for applicants. Often required for rental agreements or loan applications, this letter serves to substantiate claims made by the candidate and is typically requested from former employers or HR departments. For more information, refer to the Proof of Employment Letter.

- Environmental Disclosure Statement: This document informs the buyer of any known environmental hazards or issues related to the property, such as contamination or zoning restrictions.

- Brokerage Agreement: This agreement details the relationship between the buyer or seller and their real estate broker, including commission rates and services provided.

- Closing Statement: This document summarizes all financial transactions related to the closing, including the purchase price, closing costs, and any adjustments made at settlement.

- Warranty Deed: This legal document transfers ownership of the property from the seller to the buyer, ensuring that the title is conveyed free of any claims against it.

Each of these documents plays a critical role in facilitating a smooth and legally sound transaction. Understanding their purpose and function can help both buyers and sellers navigate the complexities of commercial real estate deals in Florida.

Check out Popular Documents

I983 - Employers must commit to providing a structured training experience.

Verizon Protection Plan Claim - This document enhances transparency in customer service operations.

For those in need of a thorough documentation process, this essential Motorcycle Bill of Sale template can simplify your transaction and ensure that all required information is accurately recorded. Access the Motorcycle Bill of Sale form to begin the ownership transfer process effectively.

Hurt Feelings Report - Your emotional journey is important; share it here.

Key Details about Florida Commercial Contract

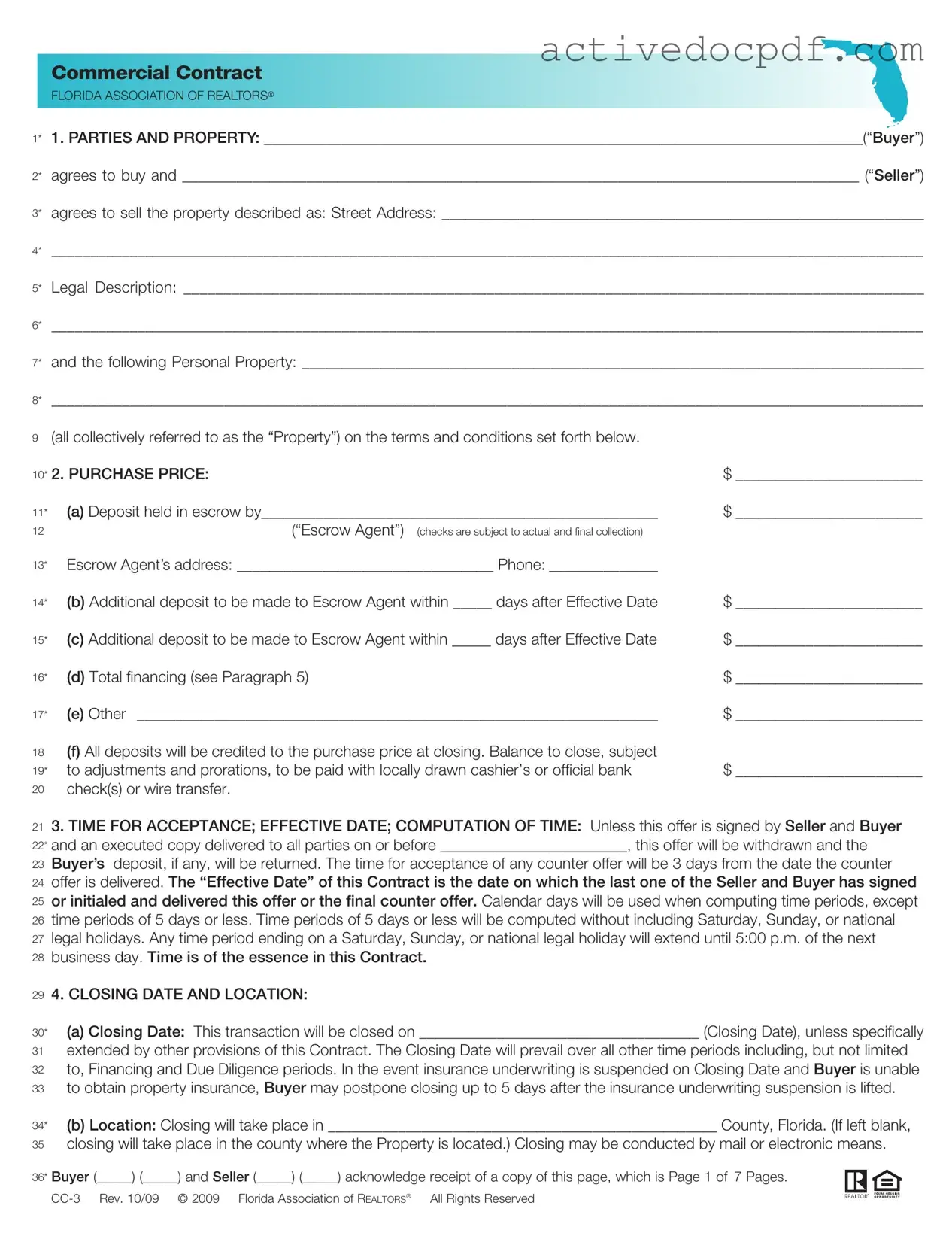

What is the Florida Commercial Contract form?

The Florida Commercial Contract form is a legal document used in real estate transactions involving commercial properties in Florida. It outlines the terms and conditions under which a buyer agrees to purchase property from a seller. The form includes details such as the parties involved, property description, purchase price, financing terms, and closing procedures.

Who are the parties involved in the contract?

The parties involved in the Florida Commercial Contract are typically the buyer and the seller. The buyer is the individual or entity purchasing the property, while the seller is the individual or entity selling the property. Both parties must sign the contract for it to be legally binding.

What information is required in the property description section?

The property description section requires specific details about the property being sold. This includes:

- The street address of the property.

- The legal description of the property, which may include parcel numbers or lot descriptions.

- A list of any personal property included in the sale, such as fixtures or equipment.

How is the purchase price structured?

The purchase price is a critical component of the contract. It includes the total amount the buyer agrees to pay for the property, any deposits made, and how those deposits will be credited at closing. The contract specifies the amounts for initial deposits, additional deposits, and the balance due at closing.

What happens if the buyer cannot obtain financing?

If the buyer is unable to secure financing, the contract includes provisions for cancellation. The buyer must use good faith efforts to obtain loan approval by a specified date. If unsuccessful, the buyer can notify the seller to either waive the financing contingency or cancel the contract. If neither action is taken, the seller may cancel the contract at any time thereafter.

What is the closing process outlined in the contract?

The closing process is detailed in the contract and includes the following key elements:

- The closing date, which is the date the transaction is finalized.

- The location of the closing, typically in the county where the property is located.

- Responsibilities of both parties regarding documentation, fees, and the transfer of possession.

Both parties must ensure that all required documents and payments are in order for a successful closing.

What are the consequences of defaulting on the contract?

Defaulting on the contract can have serious consequences. If the seller fails to close the sale due to reasons other than title issues, the buyer can either receive a refund of their deposit or seek specific performance. Conversely, if the buyer defaults, the seller may retain the deposit as liquidated damages or seek specific performance to enforce the contract.

Similar forms

- Florida Residential Contract for Sale and Purchase: This document outlines the terms for the sale of residential property, similar to the Commercial Contract but tailored for residential transactions, focusing on buyer and seller obligations, financing, and closing procedures.

- Florida Lease Agreement: Like the Commercial Contract, this document establishes terms between a landlord and tenant, detailing property use, payment terms, and responsibilities, but it is specifically for rental agreements rather than sales.

- Florida Option to Purchase Agreement: This document grants a buyer the option to purchase property at a later date, similar to the Commercial Contract in its structure and intent, but it focuses on the right rather than the obligation to buy.

- FR44 Florida Form: This form is essential for motor vehicle operators in Florida, as it verifies compliance with state-required insurance coverage limits. For more details, you can open the pdf.

- Florida Commercial Lease Agreement: This agreement outlines the lease terms for commercial properties, sharing similarities with the Commercial Contract in its treatment of property use and obligations but differing in that it pertains to rental rather than sale.

- Florida Real Estate Purchase Agreement: This document serves a similar purpose as the Commercial Contract, detailing the terms of sale for real estate, including purchase price, contingencies, and closing details.

- Florida Joint Venture Agreement: This agreement outlines the terms between parties collaborating on a real estate project, similar in its legal structure and purpose to the Commercial Contract but focused on joint ownership and development rather than a single transaction.

- Florida Real Estate Development Agreement: This document governs the development of property, similar to the Commercial Contract in that it sets forth terms and conditions, but it is specifically for development projects rather than sales.

- Florida Property Management Agreement: This agreement establishes the relationship between property owners and managers, akin to the Commercial Contract in defining roles and responsibilities, but it focuses on ongoing management rather than a sale.

Guide to Filling Out Florida Commercial Contract

Filling out the Florida Commercial Contract form is an important step in the process of buying or selling commercial property. This form serves as a formal agreement between the buyer and seller, outlining the terms of the transaction. To ensure that all necessary information is accurately provided, follow these steps carefully.

- Identify the Parties: In the first section, fill in the names of the buyer and seller. Clearly state the full legal names of both parties.

- Describe the Property: Provide the street address and legal description of the property being sold. Ensure that this information is complete and accurate.

- List Personal Property: If there are any personal items included in the sale, list them in the designated area.

- Enter Purchase Price: Specify the total purchase price of the property. Include details about any deposits and financing arrangements.

- Set Timeframes: Indicate the time for acceptance of the offer and the effective date of the contract. This is crucial for establishing deadlines.

- Specify Closing Details: Fill in the closing date and location. If the location is left blank, it will default to the county where the property is located.

- Detail Financing Terms: If applicable, provide information regarding third-party financing, including amounts and terms.

- Outline Title Information: Indicate how the seller will convey title and any conditions related to title insurance or surveys.

- Property Condition: State whether the buyer accepts the property "as is" or if there will be a due diligence period for inspections.

- Closing Procedures: Describe the procedures for closing, including who will provide necessary documents and how costs will be allocated.

- Include Additional Clauses: If there are any specific clauses or contingencies that need to be added, ensure they are clearly stated.

- Signatures: Finally, both parties must sign and date the contract to make it legally binding. Ensure that all necessary signatures are obtained.

Once the form is completed, both parties should keep a copy for their records. This contract will serve as the foundation for the transaction and should be reviewed carefully to avoid any misunderstandings in the future.