Free Generic Direct Deposit PDF Form

Misconceptions

When it comes to the Generic Direct Deposit form, many people hold misconceptions that can lead to confusion or even mistakes. Let’s clarify some of these common misunderstandings.

- Misconception 1: The form is only for new accounts.

- Misconception 2: Only one signature is needed.

- Misconception 3: You can use any routing number.

- Misconception 4: The account number can include spaces or special symbols.

- Misconception 5: The form doesn’t need to be signed.

- Misconception 6: You can verify your routing number using a deposit slip.

- Misconception 7: The effective date can be filled in later.

- Misconception 8: Once submitted, the form cannot be changed.

Many believe that the Generic Direct Deposit form is only necessary when setting up a new account. In reality, it can also be used to change existing account information or to cancel a direct deposit arrangement.

If the account is a joint account, both account holders must sign the form. This ensures that everyone involved agrees to the direct deposit terms.

Some people think any routing number will work. However, it's crucial to verify the routing transit number with your financial institution to ensure accuracy.

This is not true. The account number should be entered without spaces or special symbols, and any hyphens must be included as specified.

Signing the form is essential. Without a signature, the authorization is not valid, and the direct deposit cannot be processed.

This is a common error. It’s advised to confirm your routing number directly with your bank, as deposit slips can sometimes be misleading.

It's important to complete the effective date on the form at the time of submission. Leaving this blank can delay the processing of your direct deposit.

This is incorrect. If you need to make changes after submitting the form, you can do so by filling out a new form and following the proper procedures for updates.

Understanding these misconceptions can help you navigate the process of setting up direct deposit more smoothly. Always take the time to read the instructions carefully and verify your information with your financial institution.

Documents used along the form

When setting up direct deposit, several additional forms and documents may be required to ensure a smooth process. Each of these documents serves a specific purpose and can facilitate the management of your financial transactions. Below is a list of common forms associated with the Generic Direct Deposit form.

- W-4 Form: This form is used to determine the amount of federal income tax to withhold from your paycheck. It allows you to claim allowances and exemptions, which can affect your take-home pay.

- Motorcycle Bill of Sale: This document serves as proof of ownership transfer for a motorcycle, including buyer and seller information, motorcycle specifics, and sale price. For more information, visit PDF Documents Hub.

- Bank Verification Letter: This document is provided by your bank and confirms your account details, including the account number and routing number. It is often required to ensure accuracy in direct deposit setups.

- Employment Verification Letter: Issued by your employer, this letter confirms your employment status and salary. It may be necessary for certain financial transactions or applications.

- Pay Stub: A pay stub provides a detailed breakdown of your earnings and deductions for a specific pay period. It serves as proof of income and can be useful for various financial applications.

- Authorization for Automatic Payments: This form authorizes a company or service provider to automatically withdraw payments from your bank account. It is often used for recurring bills, such as utilities or subscriptions.

Understanding these documents can help you navigate the direct deposit process more effectively. Ensuring that you have all necessary forms completed and submitted will contribute to a seamless experience in managing your finances.

Check out Popular Documents

Cg 2010 07/04 - The endorsement modifies coverage to include liability related to bodily injury and property damage.

Employee Change of Status Form - This form is used to document changes in employee status.

For those engaging in potentially risky activities, understanding the Hold Harmless Agreement essentials is crucial. This legal form serves to outline the responsibilities of each party, ensuring protection from liabilities during events or rentals. To learn more about this important documentation, visit our guide on the critical Hold Harmless Agreement requirements.

Western Union Money Transfer Receipt PDF - Affordable transfer fees that suit your budget.

Key Details about Generic Direct Deposit

What is the Generic Direct Deposit form used for?

The Generic Direct Deposit form is used to authorize your employer or another organization to deposit funds directly into your bank account. This can include payroll, expense reimbursements, or other payments. By completing this form, you provide the necessary details for the financial institution to process these deposits efficiently.

How do I fill out the Generic Direct Deposit form?

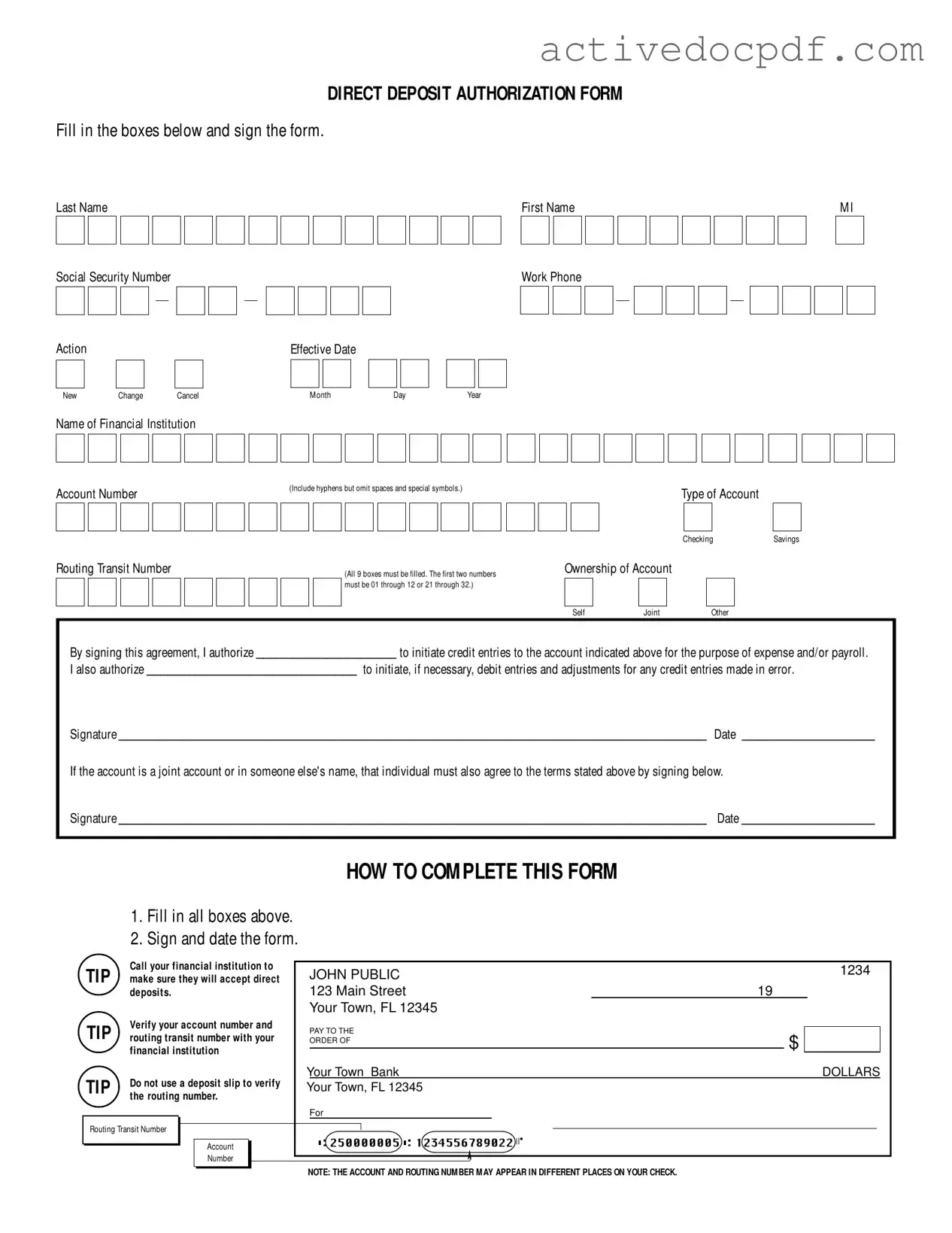

To complete the form, follow these steps:

- Fill in your last name, first name, and middle initial.

- Enter your Social Security Number.

- Indicate the action you are taking: new, change, or cancel.

- Provide the effective date for this action.

- Include your work phone number.

- List the name of your financial institution.

- Enter your account number, ensuring you include hyphens and omit spaces or special symbols.

- Select the type of account: savings or checking.

- Fill in the routing transit number, ensuring all nine boxes are filled correctly.

- Indicate the ownership of the account (self, joint, or other).

- Sign and date the form.

It is advisable to verify your account and routing numbers with your financial institution to ensure accuracy.

What should I do if I have a joint account?

If you have a joint account, the other account holder must also sign the form. This ensures that both parties agree to the terms and authorize the direct deposit. Without the second signature, the form may not be processed.

Can I use a deposit slip to verify my account information?

No, it is not recommended to use a deposit slip to verify your routing transit number. Instead, contact your financial institution directly. They can provide you with the correct routing number and ensure that your account details are accurate.

What happens if I make a mistake on the form?

If you make a mistake while filling out the form, it is best to start over with a new form. Ensure that all information is accurate before submitting it. Errors in your account number or routing number could lead to delays or issues with your direct deposit.

How long does it take for direct deposit to begin after I submit the form?

Similar forms

- W-4 Form: This form is used by employees to indicate their tax situation to their employer. Like the Direct Deposit form, it requires personal information and signatures to authorize payroll actions.

- Bank Account Application: When opening a new bank account, individuals provide personal details and authorize the bank to manage their funds. Both forms require account numbers and personal identification.

- Payroll Authorization Form: Similar to the Direct Deposit form, this document allows employees to authorize deductions from their paychecks for benefits or contributions, necessitating personal information and signatures.

- Hold Harmless Agreement Form: This essential legal document protects parties from liability by ensuring that one party agrees not to hold the other responsible for any losses. For those looking to fill out this type of form, you can easily do so at texasformspdf.com/fillable-hold-harmless-agreement-online.

- Automatic Payment Authorization: This form allows businesses to withdraw funds directly from a customer’s account for recurring payments. It shares the same structure of account details and consent.

- Direct Debit Mandate: Used in various transactions, this document permits a third party to withdraw funds from an individual's account. It requires similar account information and authorization.

- Tax Refund Direct Deposit Form: This form allows taxpayers to specify where their tax refunds should be deposited. It requires bank details and personal identification, mirroring the Direct Deposit form's requirements.

- Employer Verification Form: This document is used to verify employment status and income. It often requires similar personal information and signatures as the Direct Deposit form.

- Loan Application: When applying for a loan, individuals must provide personal and financial information, including bank details. This parallels the Direct Deposit form in terms of information required.

- Retirement Account Contribution Form: This form allows individuals to set up contributions to retirement accounts. It requires personal and account information, similar to the Direct Deposit process.

- Health Insurance Enrollment Form: This document collects personal information to enroll in health benefits. It also requires signatures, akin to the Direct Deposit form's authorization process.

Guide to Filling Out Generic Direct Deposit

After completing the Generic Direct Deposit form, you will need to submit it to your employer or the relevant financial department. Ensure that all information is accurate to avoid any delays in processing your direct deposit. Follow the steps below to fill out the form correctly.

- Enter your Last Name, First Name, and Middle Initial in the designated boxes.

- Provide your Social Security Number in the format XXX-XX-XXXX.

- Select the appropriate Action: New, Change, or Cancel.

- Fill in the Effective Date by entering the month, day, and year.

- Input your Work Phone number in the format XXX-XXX-XXXX.

- Write the Name of Financial Institution where your account is held.

- Fill in your Account Number, including hyphens and omitting spaces and special symbols.

- Select the type of account: Savings or Checking.

- Enter the Routing Transit Number, ensuring all 9 boxes are filled correctly.

- Indicate the Ownership of Account: Self, Joint, or Other.

- Sign the form to authorize credit entries to your account.

- Enter the Date of your signature.

- If applicable, have the other account holder sign below and date the form.