Free Gift Letter PDF Form

Misconceptions

Many people have misunderstandings about the Gift Letter form. Here are seven common misconceptions:

-

Gift letters are only for large sums of money.

This is not true. Gift letters can be used for any amount of money, whether it’s a small contribution or a larger sum.

-

Only family members can provide gift letters.

While family members often give gifts, friends and other individuals can also provide gift letters. There are no strict rules about who can give a gift.

-

Gift letters are not necessary for loans.

This is misleading. Lenders often require gift letters to confirm that the money is a gift and not a loan, which can affect the borrower’s financial profile.

-

Gift letters must be notarized.

Notarization is not a requirement for gift letters. A simple signed letter is usually sufficient.

-

All gifts need to be reported to the IRS.

This is only partially true. Gifts under a certain amount do not need to be reported. It’s important to know the current limits set by the IRS.

-

You can’t use gift money for a down payment.

This is incorrect. Gift money is often used for down payments on homes, as long as proper documentation is provided.

-

Gift letters are the same as promissory notes.

This is a misunderstanding. Gift letters state that the money is a gift, while promissory notes outline a loan agreement that requires repayment.

Documents used along the form

A Gift Letter form is commonly used in real estate transactions, particularly when a buyer receives financial assistance from a family member or friend to help with a down payment. Along with the Gift Letter, several other forms and documents are often required to ensure clarity and compliance with lending guidelines. Below is a list of these documents, each accompanied by a brief description.

- Loan Application: This document collects essential information about the borrower, including financial history, employment status, and the amount of the loan requested.

- Child Support Texas Form: This essential document outlines the obligations of the individual ordered to pay child support in Texas, ensuring that children's financial needs are met. For guidance on filling out this form, visit https://texasformspdf.com/fillable-child-support-texas-online/.

- Bank Statements: Recent bank statements provide evidence of the borrower's financial stability and ability to cover mortgage payments, as well as verifying the source of the gift funds.

- Gift Tax Return: If the gift amount exceeds a certain threshold, the donor may need to file a gift tax return to report the transaction to the IRS.

- Proof of Relationship: Documentation that establishes the relationship between the donor and the recipient may be required to validate the nature of the gift.

- Purchase Agreement: This contract outlines the terms of the property sale, including the purchase price and contingencies, and is essential for the mortgage process.

- Title Report: A title report verifies the legal ownership of the property and checks for any liens or claims against it, ensuring the buyer can obtain clear title.

- Credit Report: Lenders will review the borrower's credit report to assess creditworthiness and determine eligibility for the loan.

- Closing Disclosure: This document provides a detailed account of the final loan terms and closing costs, ensuring transparency in the transaction.

These documents work together to provide a comprehensive view of the financial situation surrounding the purchase of a home. Ensuring that all necessary forms are completed accurately can facilitate a smoother transaction process.

Check out Popular Documents

Direct Deposit Authorization Form - Use the effective date wisely to align with payroll schedules.

California Correction Deed - The Scrivener's Affidavit enhances the overall quality of legal documentation.

For those looking to ensure a seamless transaction, using the Dirt Bike Bill of Sale is highly recommended, as it provides essential documentation of the purchase process. By utilizing resources like PDF Documents Hub, buyers and sellers can efficiently create and manage this crucial paperwork, thereby facilitating a smoother ownership transfer and maintaining accurate records.

Roof Certification Template - It establishes a timeline for accountability regarding roof condition.

Key Details about Gift Letter

What is a Gift Letter?

A Gift Letter is a document that states a financial gift has been given to a borrower. It is often used in real estate transactions to confirm that the funds are a gift and not a loan. This helps lenders ensure that the borrower is not taking on additional debt that could affect their ability to repay a mortgage.

Why do I need a Gift Letter?

You need a Gift Letter to clarify the source of your down payment funds. Lenders require this letter to verify that the money is a gift, which can improve your chances of getting approved for a mortgage. It also helps to avoid any misunderstandings about repayment expectations.

Who can provide a Gift Letter?

A Gift Letter can be provided by anyone who is giving you the gift, typically family members or close friends. The key is that the person giving the gift should be able to confirm their relationship to you and the nature of the gift.

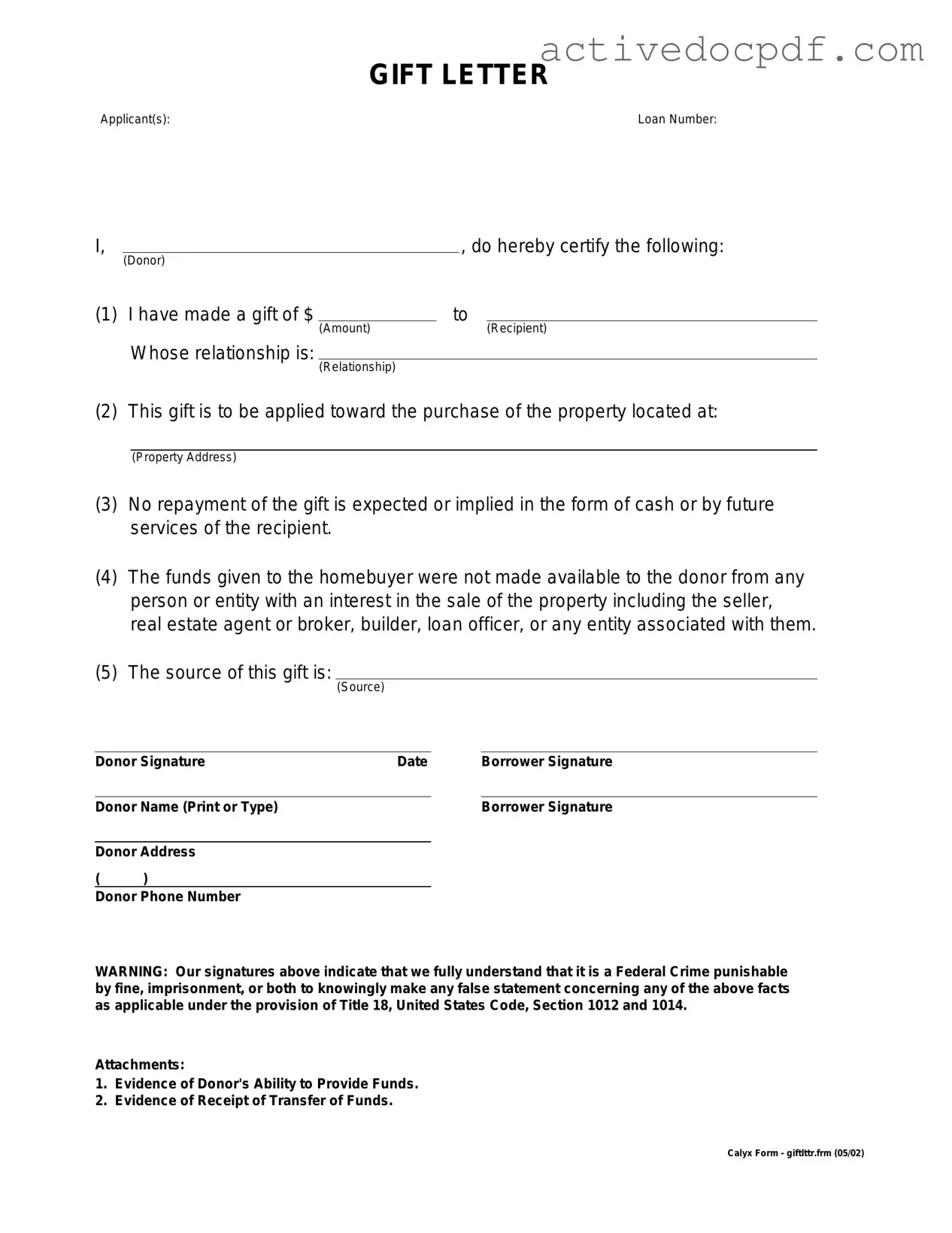

What information is included in a Gift Letter?

A Gift Letter should include the following information:

- The name and address of the donor.

- The name and address of the recipient.

- The amount of the gift.

- A statement that the funds are a gift and do not need to be repaid.

- The relationship between the donor and recipient.

- The date the gift was given.

Do I need to provide proof of the gift?

Yes, lenders often require proof of the gift. This can include bank statements showing the transfer of funds or a copy of the check used for the gift. Providing this documentation helps to validate the information in the Gift Letter.

Is there a limit on how much I can receive as a gift?

While there is no specific limit set by lenders, the IRS has guidelines on gift tax exclusions. As of 2023, an individual can give up to $17,000 per year to another person without needing to file a gift tax return. If the gift exceeds this amount, the donor may need to report it to the IRS.

Can I use a Gift Letter for any type of loan?

Gift Letters are most commonly used for mortgage loans, particularly for first-time homebuyers. However, they can also be used in other types of loans, depending on the lender's policies. Always check with your lender to understand their specific requirements.

What if my donor lives in another state?

The location of the donor does not typically affect the validity of a Gift Letter. However, it is important that the letter includes all necessary information and is signed by the donor. If there are any specific state laws or regulations, your lender will inform you.

Can a Gift Letter be handwritten?

A Gift Letter can be handwritten as long as it includes all the required information and is signed by the donor. However, a typed letter may look more professional and be easier to read. Make sure the letter is clear and legible, regardless of how it is created.

What should I do if my lender requests a Gift Letter?

If your lender requests a Gift Letter, reach out to the person providing the gift and explain what is needed. Provide them with a template or examples if necessary. Ensure that the letter is completed accurately and submitted to your lender as soon as possible to avoid delays in your loan process.

Similar forms

The Gift Letter form is a specific document used to confirm that a monetary gift is being given without the expectation of repayment. It serves a clear purpose in various financial situations. Below are six documents that share similarities with the Gift Letter form:

- Affidavit of Support: This document is used to show that a person is financially supporting another individual. Like the Gift Letter, it confirms that funds are provided without any obligation for repayment.

- Loan Agreement: While a loan agreement outlines the terms of borrowing money, it also requires a clear understanding of the financial relationship. Both documents clarify the source and intention of the funds involved.

- Promissory Note: This document is a written promise to pay back borrowed money. Similar to a Gift Letter, it specifies the amount of money involved, but unlike the Gift Letter, it involves a repayment obligation.

- Financial Statement: A financial statement provides an overview of an individual’s financial situation. It can complement a Gift Letter by demonstrating the giver’s ability to provide the gift without affecting their financial stability.

- Bank Statement: This document shows transactions and balances in a bank account. It can support a Gift Letter by providing proof of the funds available for gifting.

- Arizona Annual Report: The Arizona Annual Report form is a crucial document that businesses must file with the Arizona Corporation Commission, detailing their operations for the previous year. This form not only captures essential company information but also ensures compliance with state regulations, and can be found at https://arizonapdfs.com/arizona-annual-report-template.

- Tax Return: A tax return reflects an individual’s income and financial status. Similar to a Gift Letter, it can help validate the giver’s financial capability to make a gift without any strings attached.

Guide to Filling Out Gift Letter

Filling out the Gift Letter form is an important step in documenting financial support. This letter serves as a formal acknowledgment of a gift, which can be essential for various financial processes. Follow these steps to ensure the form is completed accurately.

- Begin by entering the date at the top of the form.

- Fill in the name of the donor, including their full legal name.

- Provide the donor's address, ensuring it is complete with city, state, and zip code.

- Next, enter the recipient's name and address in the designated section.

- Specify the amount of the gift clearly in the space provided.

- Include a brief description of the purpose of the gift, if applicable.

- Have the donor sign and date the form at the bottom.

- Make a copy of the completed form for your records before submission.

Once the form is filled out, it should be submitted to the relevant party as required. This could be a lender, financial institution, or any other entity that requires proof of the gift. Ensure that all information is accurate to avoid any delays in processing.