Free Goodwill donation receipt PDF Form

Misconceptions

- Misconception 1: The receipt is only for tax purposes.

- Misconception 2: You can only claim what you paid for the items.

- Misconception 3: You need to itemize your donations to benefit.

- Misconception 4: Goodwill only accepts certain types of donations.

- Misconception 5: You cannot get a receipt for smaller donations.

- Misconception 6: The receipt must list every item donated.

- Misconception 7: You can only donate items in perfect condition.

- Misconception 8: Donations are not tax-deductible if you don’t have a receipt.

- Misconception 9: Goodwill donations only help the organization.

While many people think the Goodwill donation receipt is solely for tax deductions, it also serves as proof of your charitable contribution. This can be important for personal record-keeping and for tracking your donations over time.

Some believe that the value of donated items is limited to their original purchase price. In reality, the IRS allows you to estimate the fair market value of your items, which may be less than or greater than what you originally paid.

Many think that only those who itemize their deductions can benefit from donations. However, even if you take the standard deduction, you can still claim up to a certain amount for cash donations made to charities, including Goodwill.

People often assume that Goodwill only takes clothing and household items. In fact, they accept a wide range of donations, including electronics, furniture, and even vehicles, as long as they are in good condition.

Some individuals think that if they donate a small amount, they won’t receive a receipt. Goodwill provides receipts for all donations, regardless of size. Every contribution counts and deserves acknowledgment.

Many believe that the receipt needs to detail each item. However, you can simply list categories of items (like "clothing" or "household goods") instead of specifying every single item, which makes the process easier.

There is a common belief that only new or like-new items can be donated. Goodwill accepts gently used items, and even those with minor flaws, as they can still be sold or recycled.

Some think that without a receipt, donations cannot be claimed on taxes. While it’s always best to have a receipt, you may still be able to estimate your donation value if you have other proof, like bank statements.

Many people believe that donations only benefit Goodwill itself. In reality, your contributions help fund job training programs and other community services, making a positive impact on the lives of many individuals.

Documents used along the form

The Goodwill donation receipt form serves as a crucial document for individuals donating items to Goodwill Industries. However, several other forms and documents often accompany this receipt, each serving a unique purpose in the donation process. Below is a list of commonly used documents that may be relevant when making a donation.

- Donation Inventory List: This list details the items being donated, including descriptions and estimated values. It helps donors keep track of their contributions.

- Tax Deduction Worksheet: This worksheet assists donors in calculating potential tax deductions based on the value of their donated items, ensuring they have accurate records for tax purposes.

- Appraisal Form: For high-value items, an appraisal form may be necessary. It provides a professional assessment of the item's worth, which can be useful for tax documentation.

- Charitable Contribution Statement: This statement outlines the donor's total contributions for the year, summarizing all donations made to charitable organizations, including Goodwill.

- Receipt Acknowledgment Form: This form is signed by the donor and the organization, acknowledging the receipt of the donated items and their condition at the time of donation.

- Itemized Donation Summary: This summary provides a detailed account of each item donated, along with its condition and estimated value, which can help during tax filing.

- Goodwill Membership Application: Some donors may choose to become members of Goodwill. This application form collects necessary information to facilitate membership benefits.

- Lease Agreement Form: A PDF Documents Hub can provide an online version to help both landlords and tenants easily access and complete their legal obligations regarding property rental.

- Donation Guidelines: These guidelines outline what items are acceptable for donation, helping donors ensure their contributions meet the organization's needs.

- Volunteer Application: Individuals interested in supporting Goodwill through volunteering may fill out this application, which helps the organization recruit and manage volunteers.

Understanding these documents enhances the donation experience and ensures that all parties involved maintain accurate records. Proper documentation not only benefits the donor but also supports Goodwill in its mission to provide community services.

Check out Popular Documents

Automation in Business Credit - This form helps businesses apply for credit to support their operations.

For individuals looking to ensure their preferences are respected, filling out a legal Power of Attorney document is a crucial step. This form empowers a designated agent to manage affairs and make decisions, providing peace of mind that one's wishes will be honored.

Free Gift Certificate Template - Match the gift to their unique tastes and preferences.

Complaint for Divorce Form Michigan - It's important to accurately fill out the personal information sections.

Key Details about Goodwill donation receipt

What is a Goodwill donation receipt form?

A Goodwill donation receipt form is a document provided by Goodwill Industries to donors as proof of their charitable contributions. This receipt can be used for tax purposes to verify the value of items donated.

How can I obtain a Goodwill donation receipt?

You can obtain a Goodwill donation receipt at the time of your donation. When you drop off your items at a Goodwill location, staff will typically provide you with a receipt. If you forget to ask for one, you can request a duplicate by contacting the specific Goodwill location where you made your donation.

What items can I donate to Goodwill?

Goodwill accepts a wide range of items, including:

- Clothing and shoes

- Household goods

- Electronics

- Furniture

- Toys and games

However, there are restrictions on certain items. Items that are damaged, hazardous, or recalled cannot be accepted.

Is there a limit to the value of items I can donate?

No, there is no limit to the value of items you can donate. However, the IRS requires that you assess the fair market value of your donated items for tax deduction purposes. Goodwill provides guidelines to help you determine this value.

Do I need to itemize my donations on the receipt?

While it is not required to list each item on the receipt, it is advisable to keep a detailed record of what you donated. This can include a description of each item and its estimated value. Such documentation can be helpful during tax preparation.

Can I claim a tax deduction for my Goodwill donations?

Yes, you can claim a tax deduction for your donations to Goodwill, provided you itemize your deductions on your tax return. The amount you can deduct is based on the fair market value of the items donated.

What should I do if I lose my Goodwill donation receipt?

If you lose your donation receipt, you can contact the Goodwill location where you made the donation. They may be able to provide a duplicate receipt. It is also helpful to keep a personal record of the items donated for your own reference.

Can I donate items that I purchased at Goodwill?

Yes, you can donate items that you previously purchased at Goodwill. However, it is recommended to assess the condition of these items to ensure they meet Goodwill's donation guidelines.

Are donations to Goodwill tax-deductible?

Yes, donations to Goodwill are generally tax-deductible. It is important to keep your receipt and any other documentation related to your donation for tax purposes.

How does Goodwill use the funds generated from donations?

Goodwill uses the funds generated from the sale of donated items to support its mission of providing job training, employment placement services, and other community programs. The organization aims to help individuals achieve self-sufficiency through work.

Similar forms

The Goodwill donation receipt form serves as a valuable document for individuals who donate items to Goodwill Industries. It provides a record of the donation for tax purposes and reflects the charitable nature of the contribution. Several other documents share similarities with this receipt form, each serving a specific purpose in the realm of charitable giving and tax documentation. Below is a list of seven such documents:

- Charitable Contribution Receipt: Similar to the Goodwill receipt, this document is issued by various nonprofit organizations to acknowledge donations. It includes details about the donor, the date of the donation, and the value of the items donated.

- IRS Form 8283: This form is used for noncash charitable contributions exceeding $500. While it requires more detailed information, it also serves to substantiate the value of donated items, much like the Goodwill receipt.

- Cash Donation Receipt: When cash is donated to a charity, a receipt is provided to the donor. This document, like the Goodwill receipt, confirms the amount donated and the organization receiving the funds.

- Donation Acknowledgment Letter: Many charities send a letter thanking donors for their contributions. This letter typically includes the donation amount and serves a similar purpose as the Goodwill receipt in providing proof of the donation.

- Tax Deduction Worksheet: While not a receipt, this worksheet helps donors calculate the value of their contributions. It complements the Goodwill receipt by providing a structured way to assess the total value of multiple donations.

- Inventory List of Donated Items: Some donors create a list of items donated, which can accompany the Goodwill receipt. This inventory helps in determining the value of the donation and serves as a personal record for tax purposes.

- Room Rental Agreement: This form is essential for establishing the terms of renting a room, ensuring both parties are aware of their rights and responsibilities. For more information, you can refer to the detailed template available at https://nyforms.com/room-rental-agreement-template/.

- End-of-Year Giving Summary: Some organizations provide donors with a summary of all donations made throughout the year. This document aggregates contributions, similar to how the Goodwill receipt summarizes a single donation.

Understanding these documents can enhance your charitable giving experience and ensure you have the necessary records for tax deductions. Each document serves a unique role but ultimately supports the same goal: to recognize and substantiate your generous contributions.

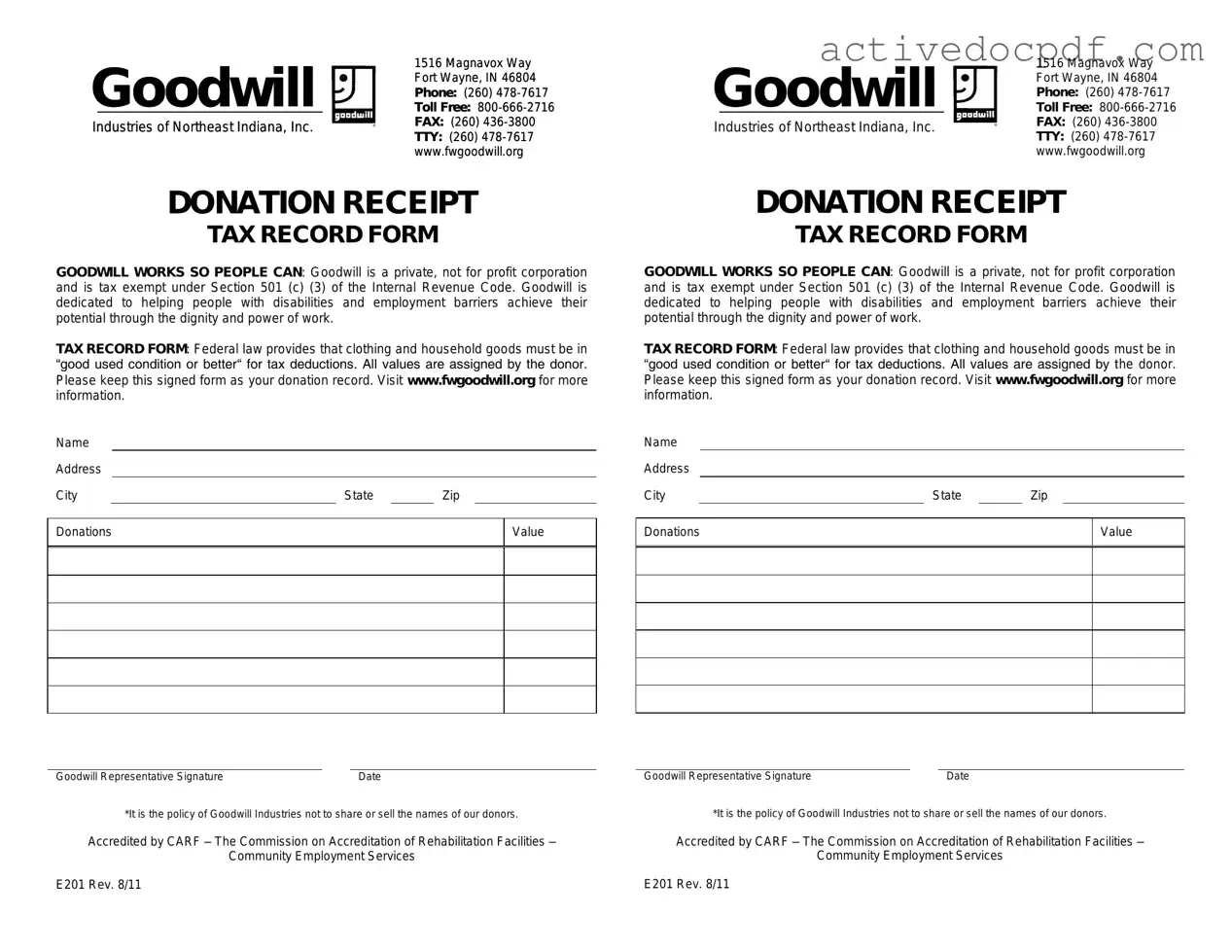

Guide to Filling Out Goodwill donation receipt

After gathering your items for donation, you'll need to complete the Goodwill donation receipt form. This form serves as a record of your contributions and can be useful for tax purposes. Follow these steps to fill it out correctly.

- Begin by writing the date of your donation at the top of the form.

- Fill in your name and address in the designated sections.

- List the items you are donating. Be specific about each item and its condition.

- Estimate the fair market value of each item. This is what you believe the item could sell for in a thrift store.

- Sign the form to confirm that the information you provided is accurate.

- Keep a copy of the completed form for your records.

Once you've filled out the form, you can hand it to the Goodwill representative. They will keep the original for their records. Make sure to retain your copy for your own documentation.