Free Independent Contractor Pay Stub PDF Form

Misconceptions

Understanding the Independent Contractor Pay Stub form can be tricky. Here are eight common misconceptions about this form, along with explanations to clarify them.

- Independent contractors do not need a pay stub. Many people believe that pay stubs are only for employees. However, independent contractors can benefit from having a pay stub for record-keeping and tax purposes.

- All independent contractors are paid the same way. Payment methods can vary widely. Some contractors receive checks, while others may be paid via direct deposit or other electronic methods.

- Pay stubs are only necessary for tax filings. While they are important for taxes, pay stubs also help contractors track their earnings and expenses throughout the year.

- Independent contractors do not have to report their income. This is false. Contractors must report all income, and having a pay stub can simplify this process.

- Pay stubs must include specific information. There is no one-size-fits-all format for pay stubs. However, they typically include details like payment date, amount earned, and any deductions.

- Independent contractors can ignore deductions. Contractors may have deductions, such as taxes or retirement contributions, just like employees. Understanding these deductions is crucial for accurate financial planning.

- Receiving a pay stub means you are an employee. This is not true. Independent contractors can receive pay stubs while still maintaining their status as self-employed individuals.

- Pay stubs are only useful for large contracts. Even small jobs can benefit from having a pay stub. It helps maintain clear financial records, regardless of the contract size.

By addressing these misconceptions, independent contractors can better navigate their financial responsibilities and ensure they have the necessary documentation for their work.

Documents used along the form

When working with independent contractors, several forms and documents complement the Independent Contractor Pay Stub form. Each document serves a specific purpose to ensure clarity and compliance in the working relationship. Below is a list of commonly used forms.

- Independent Contractor Agreement: This document outlines the terms and conditions of the working relationship, including payment terms, scope of work, and duration of the contract.

- W-9 Form: Contractors complete this form to provide their taxpayer identification number, which is necessary for tax reporting purposes.

- Invoice: This document is submitted by the contractor to request payment for services rendered, detailing the work completed and the amount due.

- 1099-MISC Form: At the end of the year, this form is used to report payments made to independent contractors to the IRS, ensuring proper tax documentation.

- Time Sheet: A record of hours worked by the contractor, this document helps track time spent on various tasks and can support invoicing.

- Motor Vehicle Power of Attorney Form: This form allows individuals to appoint someone to manage vehicle-related matters on their behalf, ensuring smooth handling of tasks such as registration and titling. To utilize this form, you can download and complete the form.

- Non-Disclosure Agreement (NDA): This agreement protects sensitive information shared between the contractor and the hiring party, ensuring confidentiality.

- Work Product Agreement: This document clarifies ownership rights to the work produced by the contractor during the engagement, specifying who retains the rights to the final product.

Using these forms together with the Independent Contractor Pay Stub can help establish a clear and professional relationship between contractors and clients. Proper documentation fosters trust and ensures compliance with legal requirements.

Check out Popular Documents

Da - Several copies of the form may be necessary for multiple parties involved in a transaction.

A Power of Attorney (POA) form is essential for ensuring that your wishes are respected when you are unable to make decisions for yourself. It can be customized to handle various aspects of your life, including financial obligations and healthcare preferences. For those looking to simplify this process, obtaining a POA can be a crucial step towards safeguarding your interests.

Facial Consent Form - Applies to all types of facial treatments offered.

Direct Deposit Authorization Form - Enter your personal information including name and Social Security Number.

Key Details about Independent Contractor Pay Stub

What is an Independent Contractor Pay Stub?

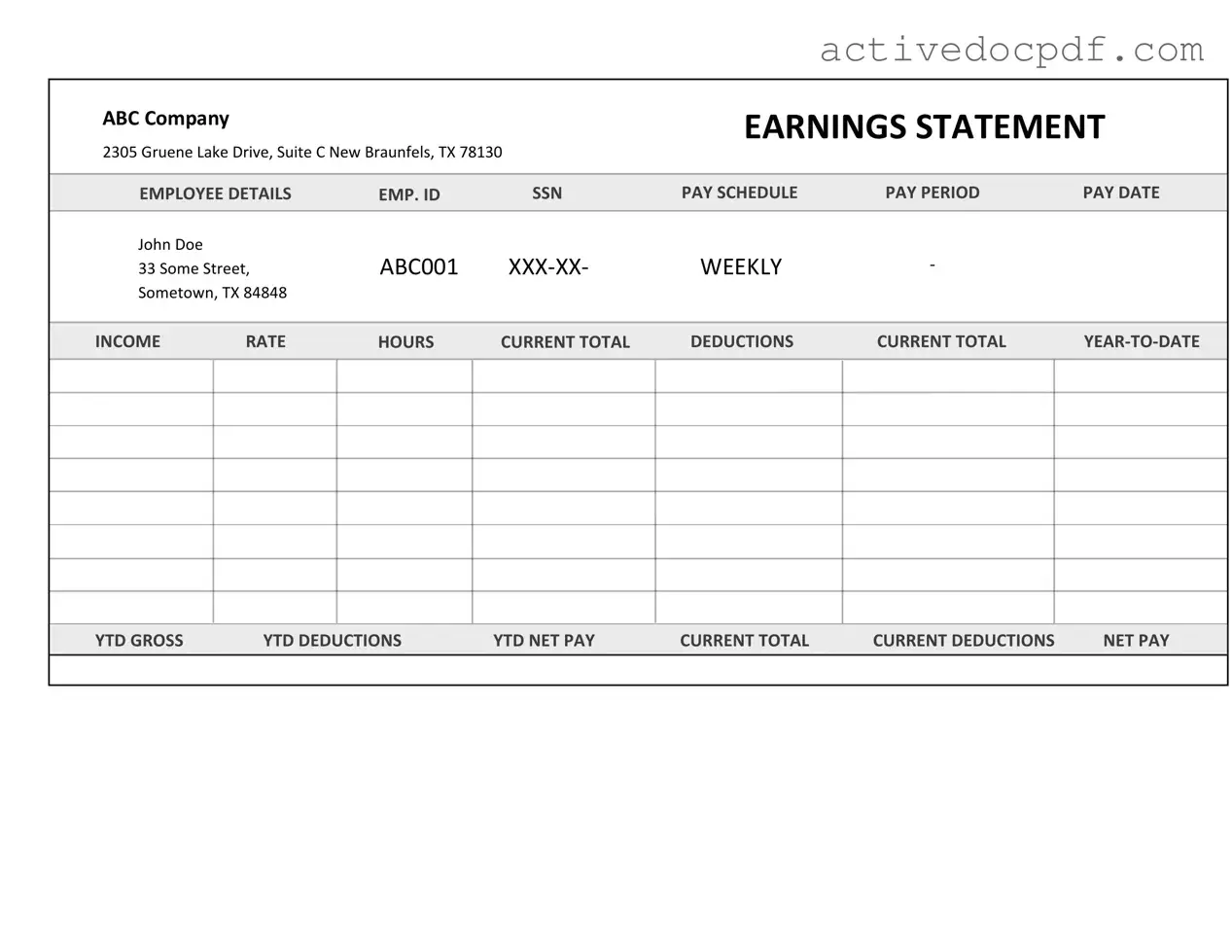

An Independent Contractor Pay Stub is a document that outlines the earnings and deductions for a contractor who is not classified as an employee. This pay stub serves as a record of payment for services rendered. It typically includes details such as the contractor's name, payment period, total earnings, and any deductions for taxes or other expenses.

Why do I need an Independent Contractor Pay Stub?

Having an Independent Contractor Pay Stub is essential for several reasons:

- It provides proof of income for tax purposes.

- It helps contractors track their earnings over time.

- It serves as documentation in case of disputes regarding payment.

- It assists in budgeting and financial planning.

What information should be included on the pay stub?

An Independent Contractor Pay Stub should include the following key information:

- Contractor's name and contact information.

- Business name of the hiring entity.

- Payment period (start and end dates).

- Total amount earned during that period.

- Any deductions, such as taxes or fees.

- Net payment amount (the amount the contractor receives).

How often should I issue pay stubs to contractors?

Pay stubs should be issued at regular intervals, similar to a payroll schedule. Common practices include weekly, bi-weekly, or monthly payments. Consistency is key. Regular issuance helps contractors manage their finances effectively and ensures they have the necessary documentation for tax purposes.

Are there legal requirements for providing pay stubs to independent contractors?

While federal law does not mandate pay stubs for independent contractors, some states have specific requirements. It is advisable to check local regulations to ensure compliance. Providing pay stubs is a good practice, as it fosters transparency and can help avoid misunderstandings about payments.

Similar forms

- W-2 Form: This document is used by employers to report wages paid to employees and the taxes withheld. Similar to the Independent Contractor Pay Stub, it provides a summary of earnings, but it is specifically for employees rather than independent contractors.

- Dirt Bike Bill of Sale: This form is essential for New York buyers and sellers to finalize the sale of a dirt bike, ensuring all details are documented accurately, as outlined by PDF Documents Hub.

- 1099-MISC Form: Independent contractors receive this form to report income earned from clients. Like the Pay Stub, it details the amount paid, but it focuses on income received rather than deductions or taxes withheld.

- Paycheck Stub: Commonly provided to employees, this document outlines gross pay, deductions, and net pay. The Independent Contractor Pay Stub serves a similar purpose, detailing earnings and any applicable deductions, though it is tailored for contractors.

- Invoice: Contractors often send invoices to clients for services rendered. While an invoice requests payment, the Pay Stub confirms payment received, making both essential for tracking income.

- Contractor Agreement: This document outlines the terms of engagement between a contractor and a client. While it does not provide payment details, it establishes the framework under which the Pay Stub is generated.

- Expense Report: Contractors often submit expense reports to claim reimbursements. Similar to the Pay Stub, it provides a summary of financial transactions but focuses on expenses rather than income.

- Payroll Register: This internal document tracks all payroll transactions for a company. It shares similarities with the Pay Stub in that it provides a comprehensive view of payments, but it is typically used for employees.

- Financial Statement: A broader overview of a contractor’s financial status, this document includes income, expenses, and profits. While it offers a snapshot of overall finances, the Pay Stub focuses specifically on individual transactions.

Guide to Filling Out Independent Contractor Pay Stub

Completing the Independent Contractor Pay Stub form is a straightforward process. By accurately filling out this document, you ensure clear communication regarding payments and services rendered. Follow the steps below to fill out the form correctly.

- Gather Necessary Information: Collect all relevant details, including your name, address, and tax identification number. Also, have your contractor's name and address ready.

- Enter Contractor Information: In the designated section, fill in the contractor's name and address. This identifies who is receiving the payment.

- Provide Your Information: Next, input your name and address. This information confirms who is issuing the payment.

- Input Payment Details: Indicate the payment date, the total amount paid, and any deductions or taxes withheld. Be precise to avoid discrepancies.

- Detail Services Rendered: Describe the services provided by the contractor. Include dates and a brief description to clarify the work completed.

- Review the Information: Carefully check all entries for accuracy. Ensure that names, amounts, and services are correctly listed.

- Sign and Date the Form: Finally, sign and date the form to validate it. This step is essential for both parties to acknowledge the transaction.