Free Intent To Lien Florida PDF Form

Misconceptions

Understanding the Intent To Lien form in Florida is crucial for property owners and contractors alike. Here are eight common misconceptions about this important document:

- It is a lien itself. Many people believe that the Intent To Lien form is a lien. In reality, it is a notice that someone intends to file a lien if payment is not made.

- It can be filed anytime. Some think that the Intent To Lien can be filed at any time. However, Florida law requires that it be served at least 45 days before an actual lien is recorded.

- It guarantees payment. There is a misconception that sending this notice guarantees payment. While it serves as a warning, it does not ensure that the property owner will pay.

- It is only for contractors. Many believe only contractors can file an Intent To Lien. In fact, anyone who provides labor or materials can use this form to protect their rights.

- It does not require a response. Some assume that they can ignore this notice. Ignoring it can lead to a lien being filed, so it is important to respond promptly.

- It is only a formality. Some people think this notice is just a formality. In reality, it is a serious step that can lead to significant legal consequences if not addressed.

- It can be ignored if there is a dispute. Many believe that a dispute over payment means they can ignore the Intent To Lien. However, it is essential to respond to avoid further legal action.

- It eliminates the need for a contract. Some think that filing an Intent To Lien makes a contract unnecessary. However, having a written contract is still important for clarity and legal protection.

Being informed about these misconceptions can help you navigate the process more effectively. If you receive an Intent To Lien, take it seriously and consider seeking legal advice to understand your options.

Documents used along the form

When dealing with the Intent to Lien Florida form, several other documents often accompany it to ensure a comprehensive approach to lien enforcement. Each of these documents serves a specific purpose and helps clarify the situation between the involved parties.

- Claim of Lien: This document officially records the lien against the property. It outlines the amount owed and provides a legal claim to the property until the debt is settled.

- Notice of Non-Payment: This notice is sent to inform the property owner that payment has not been received. It serves as a reminder and a precursor to further legal action.

- Chick-fil-A Job Application: To apply for a position, individuals must complete the documentonline.org/ which collects essential information about their work history and availability.

- Waiver of Lien: A waiver is a document that relinquishes the right to file a lien. It is often used when payments are made, ensuring that the contractor or supplier cannot later claim a lien for the same work.

- Release of Lien: This document is issued once payment is made. It formally releases the lien and clears the property title, ensuring that the owner is free from any claims.

- Notice to Owner: This is a notification sent to the property owner by subcontractors or suppliers, informing them of their involvement in the project and their right to file a lien if not paid.

- Affidavit of Non-Payment: This affidavit is a sworn statement declaring that payment has not been received for services or materials provided. It can be used in legal proceedings to support the claim for a lien.

Understanding these documents can help property owners and contractors navigate the complexities of lien laws in Florida. Being informed is essential for protecting rights and ensuring timely payments in construction projects.

Check out Popular Documents

Example of No Trespass Letter - The form is designed to inform individuals of their lack of permission to access the mentioned property.

When preparing your estate plan, it's crucial to have a well-drafted Last Will and Testament, which is a legal document that outlines how your assets and responsibilities will be handled after your passing. This important form not only ensures that your wishes are honored but also provides peace of mind for you and your loved ones. For more resources, you can visit PDF Documents Hub to help you get started on securing your legacy.

How Long Does It Take to Get Section 8 Voucher After Approval - Don’t hesitate to ask for help while completing this form.

Key Details about Intent To Lien Florida

What is the purpose of the Intent To Lien Florida form?

The Intent To Lien Florida form serves as a formal notice to property owners that a lien may be placed on their property due to non-payment for services rendered or materials supplied. This document is typically sent by contractors, subcontractors, or suppliers who have not received payment for their work. The notice informs the property owner of the outstanding amount and the intention to file a Claim of Lien if payment is not made within a specified timeframe.

What are the requirements for sending the Intent To Lien notice?

To properly send the Intent To Lien notice, the following requirements must be met:

- The notice must be sent at least 45 days before filing a Claim of Lien.

- The notice should include the full legal names and addresses of the property owner and, if applicable, the general contractor.

- The notice must specify the property description, including the street address and legal description.

- It should clearly state the amount owed for the services or materials provided.

What happens if the property owner does not respond to the notice?

If the property owner fails to respond or make payment within 30 days of receiving the Intent To Lien notice, the sender may proceed to record a Claim of Lien against the property. This action can lead to foreclosure proceedings, meaning the property could be sold to satisfy the debt. Additionally, the property owner may incur attorney fees, court costs, and other related expenses.

Can a property owner dispute the claim made in the Intent To Lien notice?

Yes, a property owner can dispute the claim made in the Intent To Lien notice. It is advisable for the property owner to communicate with the sender as soon as possible to resolve any discrepancies. If there is a legitimate reason for non-payment, discussing the issue may lead to an amicable resolution without the need for further legal action.

Is there a way to avoid a lien being placed on the property?

To avoid a lien being placed on the property, it is crucial for the property owner to respond promptly to the Intent To Lien notice. Arranging payment for the outstanding amount or reaching a satisfactory agreement with the sender can prevent the recording of a lien. Additionally, ensuring that all contractors and suppliers are paid on time can help avoid similar situations in the future.

Similar forms

The Intent to Lien form in Florida serves a specific purpose in the construction industry, primarily notifying property owners of an impending lien due to non-payment. Several other documents share similarities with this form in terms of function and legal context. Below is a list of eight such documents:

- Notice of Lien: This document is filed after the Intent to Lien if payment is not received. It formally claims a right to the property until the debt is settled.

- Room Rental Agreement: This form is essential for establishing clear terms between landlords and tenants in a rental situation. For those looking for a comprehensive template, visit nyforms.com/room-rental-agreement-template/ to ensure all necessary clauses are included and legal standards are met.

- Claim of Lien: Similar to the Notice of Lien, this document is a legal claim against the property itself, asserting that the contractor or supplier has not been paid for services rendered.

- Notice to Owner: This document informs the property owner of the contractors or subcontractors working on their property, ensuring they are aware of who is involved in the project.

- Preliminary Notice: Often used in various states, this notice alerts property owners and general contractors that a subcontractor or supplier is working on the project and may file a lien if not paid.

- Release of Lien: This document is issued to remove the lien from the property once payment is made, similar in function to the Intent to Lien but focused on clearing the claim.

- Mechanic's Lien: This is a specific type of lien that can be filed by contractors or suppliers to secure payment for work performed on a property, closely related to the Intent to Lien.

- Notice of Non-Payment: This document serves as a warning to the property owner that payment has not been received and may lead to a lien if the situation is not resolved.

- Affidavit of Service: This document verifies that the Intent to Lien has been properly served to the property owner, ensuring compliance with legal requirements.

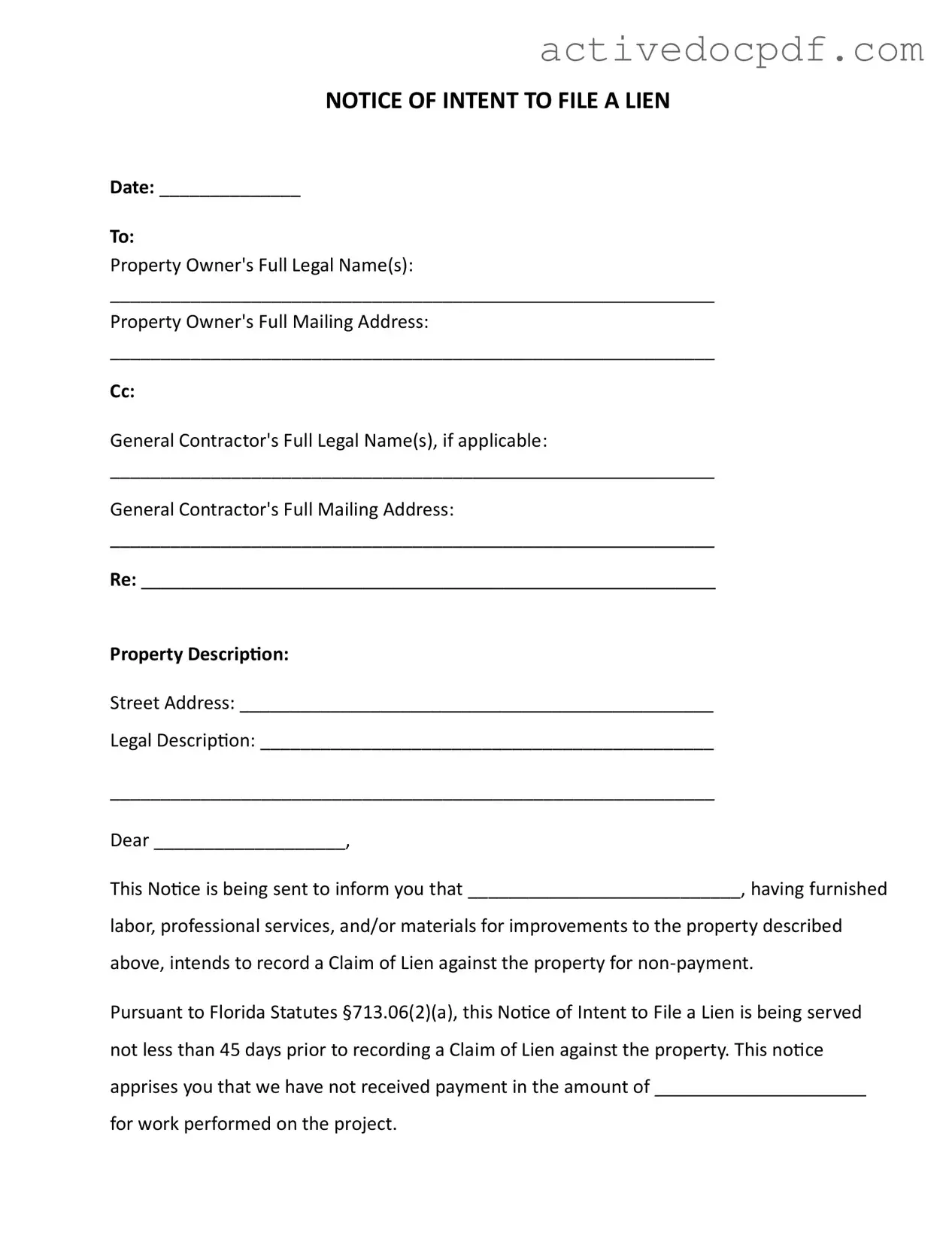

Guide to Filling Out Intent To Lien Florida

After completing the Intent to Lien form, the next steps involve ensuring that it is properly served to the property owner and any relevant parties. This is crucial to maintain compliance with Florida law and to protect your rights regarding payment for services rendered. Following the instructions below will help you accurately fill out the form.

- Date: Write the current date at the top of the form.

- Property Owner's Full Legal Name(s): Fill in the complete legal names of the property owner(s).

- Property Owner's Full Mailing Address: Enter the full mailing address of the property owner(s).

- Cc: General Contractor's Full Legal Name(s), if applicable: If there is a general contractor involved, provide their full legal name(s).

- General Contractor's Full Mailing Address: Include the mailing address for the general contractor, if applicable.

- Re: Specify the subject of the notice, which may include the project name or reference.

- Property Description: Write the street address of the property.

- Legal Description: Include the legal description of the property, which can often be found in the property deed.

- Dear: Address the letter to the property owner by name.

- Intention Statement: Clearly state your intention to file a lien due to non-payment, including the name of the party who furnished labor or materials.

- Payment Amount: Specify the amount that has not been paid for the work performed.

- Response Time: Remind the property owner that they have 30 days to respond before a lien is recorded.

- Contact Information: Provide your name, title, phone number, and email address at the end of the notice.

- Certificate of Service: Complete the section certifying that a copy of the notice was served, including the date and method of delivery.

- Name and Signature: Sign the form and print your name below your signature.