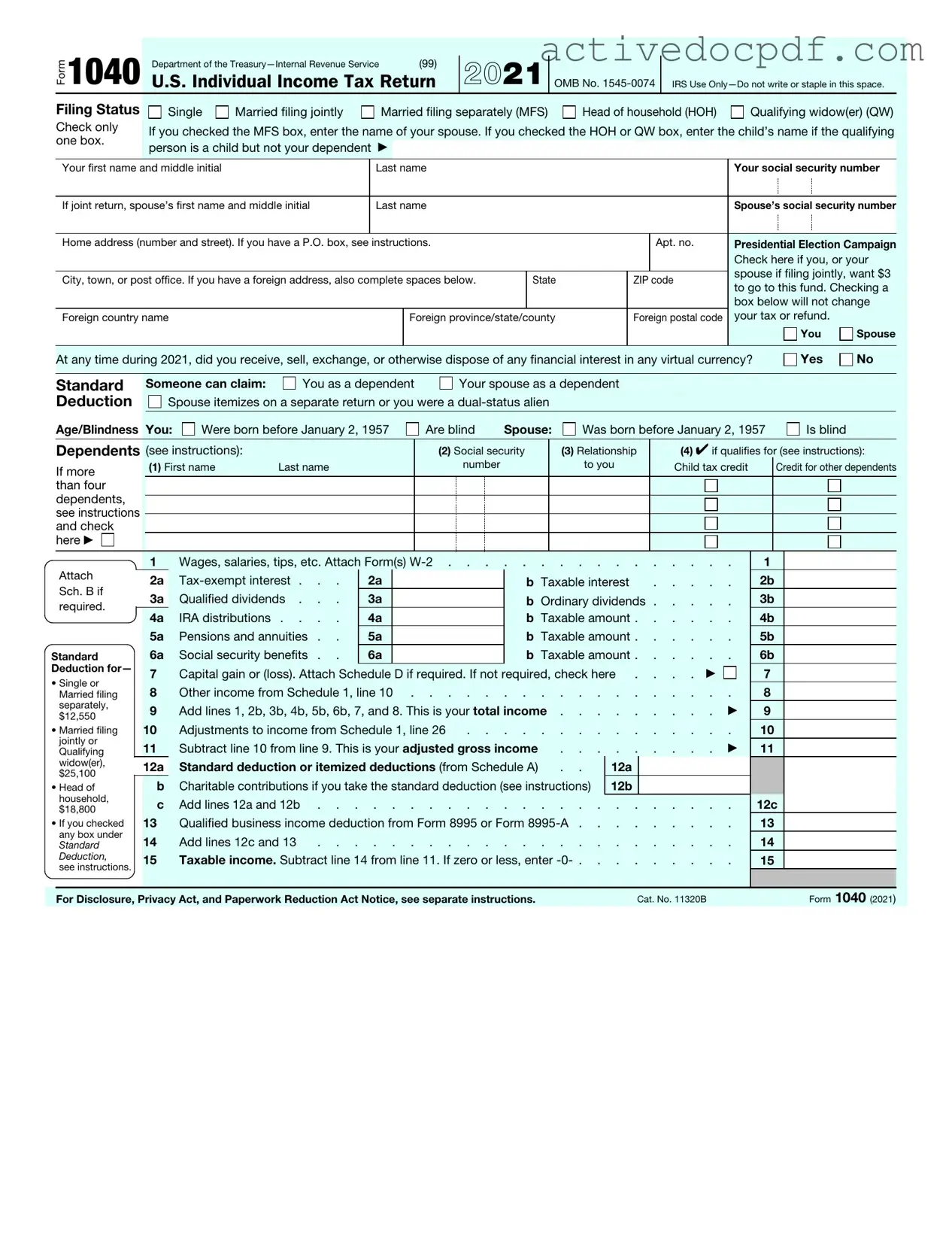

Free IRS 1040 PDF Form

Misconceptions

Understanding the IRS 1040 form is crucial for accurate tax filing. However, several misconceptions can lead to confusion. Here are six common misunderstandings about the 1040 form:

-

Everyone must use the 1040 form.

Not all taxpayers are required to use the 1040 form. Some individuals may qualify to use simpler forms like the 1040A or 1040EZ, depending on their income level and filing status.

-

Filing the 1040 form guarantees a refund.

A refund is not guaranteed just because a taxpayer files the 1040 form. The amount of refund depends on various factors, including total income, deductions, and credits claimed.

-

All income is taxable on the 1040 form.

Not all income is taxable. Certain types of income, such as some Social Security benefits or specific gifts, may not be subject to federal income tax and should be reported accordingly.

-

Only employees need to file a 1040 form.

Self-employed individuals, freelancers, and independent contractors also need to file a 1040 form. Their income, regardless of its source, must be reported for tax purposes.

-

Filing late always results in penalties.

While late filing can incur penalties, there are exceptions. Taxpayers may qualify for penalty relief if they can show reasonable cause for the delay.

-

You can only claim deductions on the 1040 form.

In addition to deductions, taxpayers can also claim various credits on the 1040 form. Credits can directly reduce the amount of tax owed, making them valuable for taxpayers.

Clarifying these misconceptions can lead to a smoother tax filing experience and ensure compliance with IRS regulations.

Documents used along the form

The IRS 1040 form is a crucial document for individual taxpayers in the United States, as it serves as the primary tax return form. However, several other forms and documents are often used in conjunction with the 1040 to ensure accurate reporting of income, deductions, and credits. Below is a list of commonly associated forms and documents.

- W-2 Form: Issued by employers, this form reports an employee's annual wages and the taxes withheld from their paycheck. It is essential for reporting income accurately.

- 1099 Form: This series of forms is used to report various types of income other than wages, salaries, and tips. Common types include the 1099-MISC for freelance work and the 1099-INT for interest income.

- Schedule A: This form allows taxpayers to itemize deductions instead of taking the standard deduction. It includes expenses such as mortgage interest, charitable contributions, and medical expenses.

- Schedule C: Used by self-employed individuals, this form reports income and expenses related to a business or profession. It is essential for calculating net profit or loss.

- Schedule D: This form is used to report capital gains and losses from the sale of assets, such as stocks or real estate. It helps determine tax liability on investment income.

- Form 8862: This form is required for taxpayers who have previously been denied the Earned Income Tax Credit (EITC) and wish to claim it again. It helps establish eligibility for the credit.

- Non-disclosure Agreement: It is essential to protect sensitive information shared during business dealings. You can find the document in pdf to facilitate these arrangements.

- Form 8889: Used by taxpayers who have a Health Savings Account (HSA), this form reports contributions and distributions, helping to determine tax implications related to HSAs.

- Form 1040-ES: This form is used for estimated tax payments, allowing taxpayers to pay taxes on income that is not subject to withholding, such as self-employment income.

- Form 2441: This form is used to claim the Child and Dependent Care Credit, which provides tax relief for taxpayers who incur expenses for the care of qualifying dependents.

Each of these forms plays a vital role in the overall tax filing process. Understanding their purpose can help ensure that all income is reported accurately and that eligible deductions and credits are claimed. Proper documentation can lead to a smoother tax filing experience and potentially reduce tax liability.

Check out Popular Documents

Rx Pad - Communication regarding medication changes can be streamlined using this form.

Filing the IRS Form 2553 is a critical step for small businesses aiming to achieve S Corporation status, which helps in minimizing double taxation by allowing income and deductions to be passed through to shareholders. To ensure accuracy and compliance during the process, businesses can refer to resources available at documentonline.org/, which provide valuable guidance on completing the form correctly.

Baseball Tryout Evaluation Form - Standard procedures ensure that assessments are consistent across all teams.

Act of Donation Form - The form helps mitigate issues related to ownership disputes in the future.

Key Details about IRS 1040

What is the IRS 1040 form?

The IRS 1040 form is the standard individual income tax return form used by U.S. taxpayers to report their annual income. It allows individuals to calculate their tax liability, claim deductions and credits, and determine whether they owe additional taxes or are entitled to a refund.

Who needs to file a 1040 form?

Generally, anyone who earns income in the United States must file a 1040 form. This includes:

- Employees receiving wages or salaries.

- Self-employed individuals.

- Individuals receiving unemployment benefits.

- Those with investment income.

However, specific income thresholds and other factors may affect the requirement to file, so it's important to check the IRS guidelines each tax year.

What are the different versions of the 1040 form?

The IRS offers several variations of the 1040 form to accommodate different taxpayer situations:

- Form 1040: The standard form for most taxpayers.

- Form 1040-SR: Designed for seniors, featuring larger print and a simpler layout.

- Form 1040-NR: For non-resident aliens who need to report U.S. income.

- Form 1040-X: Used to amend a previously filed 1040 form.

What information do I need to complete the 1040 form?

To fill out the 1040 form, gather the following information:

- Your Social Security number.

- Income statements such as W-2s and 1099s.

- Records of deductible expenses, like mortgage interest and medical expenses.

- Information about any tax credits you may qualify for.

Having this information on hand will make the process smoother and more accurate.

How do I file my 1040 form?

You can file your 1040 form in several ways:

- Electronically: Use tax preparation software or hire a tax professional to e-file.

- By mail: Print and complete the form, then send it to the appropriate IRS address based on your state.

Filing electronically is often faster and can help you receive your refund more quickly.

What is the deadline for filing the 1040 form?

The typical deadline for filing your 1040 form is April 15th of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. You can also request an extension, which gives you until October 15th to file, but remember that any taxes owed are still due by the original deadline.

Can I amend my 1040 form if I made a mistake?

Yes, if you discover an error after filing, you can amend your 1040 form using Form 1040-X. This form allows you to correct mistakes related to income, deductions, or credits. Be sure to file the amendment as soon as possible to avoid potential penalties or interest on any taxes owed.

What should I do if I can't pay my taxes?

If you're unable to pay the full amount of taxes owed, don't panic. The IRS offers several options, including:

- Installment agreements: Set up a payment plan to pay off your tax debt over time.

- Offer in compromise: Negotiate a settlement for less than the total amount owed.

It's important to communicate with the IRS and explore these options rather than ignoring the situation.

What happens if I miss the filing deadline?

Missing the filing deadline can lead to penalties and interest on any taxes owed. If you fail to file your return on time, the IRS may impose a failure-to-file penalty. If you owe taxes and do not pay by the deadline, a failure-to-pay penalty may also apply. To minimize consequences, file your return as soon as possible, even if you cannot pay the full amount.

Where can I find help with my 1040 form?

If you need assistance with your 1040 form, consider the following resources:

- The IRS website offers a wealth of information and resources.

- Tax preparation software can guide you through the process.

- Local tax professionals can provide personalized assistance.

Using these resources can help ensure your tax return is accurate and complete.

Similar forms

- W-2 Form: This document reports an employee's annual wages and the taxes withheld from their paycheck. Like the 1040, it is essential for filing income tax returns.

- 1099 Form: Used to report various types of income other than wages, salaries, or tips. Similar to the 1040, it helps taxpayers report their total income accurately.

Texas Durable Power of Attorney: This essential document allows an individual to grant authority for decision-making in their absence, ensuring trusted management of their affairs. For further assistance, you can conveniently fill out the form online at https://texasformspdf.com/fillable-durable-power-of-attorney-online/.

- Schedule C: This form is for reporting income or loss from a business operated as a sole proprietorship. It complements the 1040 by detailing self-employment income.

- Schedule A: This document is used for itemizing deductions. It works alongside the 1040 to potentially lower taxable income.

- Form 8862: This form is used to claim the Earned Income Credit after it has been disallowed in previous years. It is filed with the 1040 to ensure eligibility for the credit.

- Form 8889: This form is for reporting Health Savings Account (HSA) contributions and distributions. It is attached to the 1040 to provide a complete picture of health-related expenses.

Guide to Filling Out IRS 1040

Completing the IRS 1040 form is an essential step in filing your federal income tax return. After gathering your financial documents, follow these steps to accurately fill out the form.

- Start with your personal information. Enter your name, address, and Social Security number at the top of the form.

- Indicate your filing status. Choose from options such as single, married filing jointly, or head of household.

- Report your income. Fill in the total income from all sources, including wages, dividends, and interest.

- Claim adjustments to income. If applicable, list any deductions such as student loan interest or retirement contributions.

- Calculate your adjusted gross income (AGI). This is your total income minus any adjustments.

- Determine your standard deduction or itemized deductions. Choose the one that gives you the largest deduction.

- Subtract your deductions from your AGI to find your taxable income.

- Apply the tax rates to your taxable income. Use the tax tables provided in the IRS instructions to find your tax liability.

- Account for any tax credits. List any credits that apply to you, such as the Earned Income Tax Credit.

- Calculate your total tax. Add your tax liability and subtract any credits to find the total amount owed.

- Report any payments you have already made, such as withholding and estimated tax payments.

- Determine if you owe money or if you will receive a refund. Subtract your total payments from your total tax.

- Sign and date the form. If filing jointly, ensure both spouses sign the form.

After completing the form, review all entries for accuracy. Make sure to keep a copy for your records before submitting it to the IRS.