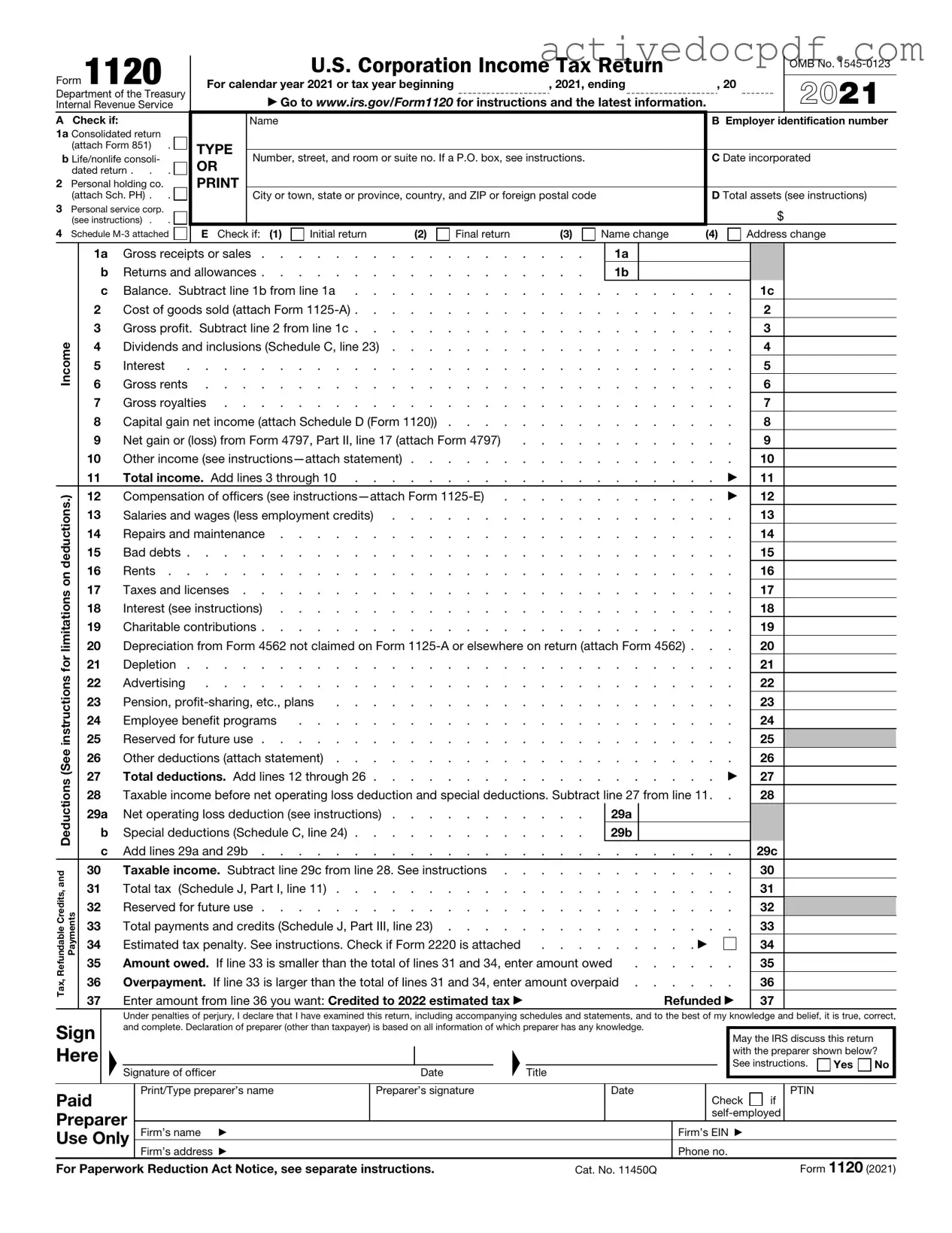

Free IRS 1120 PDF Form

Misconceptions

The IRS Form 1120 is used by corporations to report their income, gains, losses, deductions, and credits. However, several misconceptions exist regarding this form. Below are five common misunderstandings.

-

Only C Corporations Need to File Form 1120.

This is not true. While Form 1120 is primarily for C Corporations, certain other entities may also need to file, depending on their structure and tax situation.

-

Filing Form 1120 Guarantees a Tax Refund.

Many believe that submitting Form 1120 will automatically result in a tax refund. However, refunds depend on the corporation’s overall tax situation, including income and deductions.

-

All Income Must Be Reported on Form 1120.

Some think that only income generated within the U.S. needs to be reported. In fact, corporations must report worldwide income, including foreign earnings.

-

Form 1120 Is the Same as Personal Tax Returns.

This misconception arises because both involve reporting income. However, Form 1120 is specific to corporations and has different requirements compared to personal tax returns.

-

Filing Form 1120 Is Optional for Corporations.

Some corporations mistakenly believe they can choose whether to file. In reality, filing Form 1120 is mandatory for corporations that meet specific criteria.

Documents used along the form

The IRS Form 1120 is essential for corporations in the United States to report their income, gains, losses, deductions, and credits. However, several other forms and documents are often used alongside it to ensure compliance with tax regulations and to provide a complete picture of the corporation's financial situation. Below is a list of these important documents.

- Schedule C: This schedule is used to report income or loss from a sole proprietorship. It provides details on business income and expenses, helping to calculate the net profit or loss.

- Form 941: Employers use this form to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. It is filed quarterly and is crucial for payroll tax compliance.

- Invoice PDF Form: For convenient invoicing, consider utilizing the PDF Documents Hub which offers customizable options for generating professional invoices.

- Form 1099: This series of forms is used to report various types of income other than wages, salaries, and tips. Businesses often issue Form 1099 to independent contractors and freelancers.

- Schedule D: This schedule is used to report capital gains and losses from the sale of assets. It helps corporations calculate their tax liability on investment income.

- Form 4562: This form is utilized to claim depreciation and amortization deductions. It is important for businesses to account for the wear and tear on their assets.

- Form 1125-A: This form reports the cost of goods sold. It is essential for corporations that manufacture or sell products, as it helps determine gross profit.

- Form 1125-E: This form is used to report compensation of officers. It provides transparency regarding how much corporate officers are paid, which can affect tax calculations.

Each of these forms plays a critical role in the overall tax reporting process for corporations. Properly completing them ensures compliance with tax laws and can help avoid potential penalties. Understanding their purpose and requirements can significantly ease the burden of corporate tax obligations.

Check out Popular Documents

Miscellaneous Information - All payments reported must be reported using the recipient's Taxpayer Identification Number (TIN) to avoid delays.

For anyone considering a motorcycle purchase, having a well-prepared document is vital. Be sure to check out this informative resource for a reliable Washington motorcycle bill of sale guide that will help you navigate the details required for your transaction.

Puppy Health Record - With this form, pet owners can maintain a clear record of their dog's vaccinations.

Key Details about IRS 1120

What is the IRS Form 1120?

The IRS Form 1120 is the U.S. Corporation Income Tax Return. Corporations use this form to report their income, gains, losses, deductions, and credits to the Internal Revenue Service (IRS). It is essential for C corporations, which are separate legal entities from their owners, to file this form annually. The information reported on Form 1120 helps determine the corporation's tax liability.

Who is required to file Form 1120?

Any domestic corporation that is classified as a C corporation must file Form 1120. This includes corporations formed under state laws and those that have elected to be taxed as corporations. However, certain entities, such as S corporations, partnerships, and sole proprietorships, do not use this form. Instead, they have different tax filing requirements.

When is Form 1120 due?

Form 1120 is generally due on the 15th day of the fourth month after the end of the corporation's tax year. For most corporations that operate on a calendar year basis, this means the due date is April 15. If a corporation needs more time, it can file Form 7004 to request a six-month extension. However, it's important to note that this extension only applies to filing the form, not to paying any taxes owed.

What information is required to complete Form 1120?

To complete Form 1120, corporations must provide various types of information, including:

- The corporation's name, address, and Employer Identification Number (EIN).

- Income details, including gross receipts or sales, dividends, and interest.

- Deductions for business expenses, such as salaries, rents, and depreciation.

- Tax credits that the corporation may qualify for.

Accurate record-keeping throughout the year will facilitate the completion of this form.

What are the consequences of not filing Form 1120?

Failing to file Form 1120 can lead to significant penalties. The IRS imposes a penalty for late filing, which can be substantial depending on how late the return is submitted. Additionally, if a corporation does not file, it may lose its corporate status and face further tax complications. It is crucial for corporations to stay compliant with their filing requirements to avoid these issues.

Can Form 1120 be filed electronically?

Yes, Form 1120 can be filed electronically. The IRS encourages electronic filing as it is generally faster and more secure than paper filing. Many tax software programs and professional tax preparers offer e-filing options. Corporations should ensure that they use IRS-approved software to file electronically, as this helps streamline the process and reduce errors.

Similar forms

- IRS Form 1065: Similar to Form 1120, this form is used by partnerships to report income, deductions, gains, and losses. Both forms require detailed financial information but differ in the entity type being reported.

- IRS Form 1120-S: This form is for S corporations, allowing income to pass through to shareholders. While both forms report corporate income, Form 1120-S is specifically for entities that meet S corporation requirements.

- IRS Form 990: Nonprofit organizations use this form to report their financial activities. Like Form 1120, it requires comprehensive financial data, but it focuses on tax-exempt entities rather than for-profit corporations.

- IRS Form 941: Employers file this form to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. Both forms are essential for tax compliance, but Form 941 focuses on payroll rather than corporate income.

- IRS Form 1040: Individual taxpayers use this form to report personal income. While Form 1120 is for corporations, both require detailed reporting of income and deductions, emphasizing the importance of accurate financial documentation.

-

Florida Vehicle POA form 82053: This form allows someone to appoint another person to handle vehicle-related tasks on their behalf, such as registration, titling, or sale. For convenience, you can download and fill out the form.

- IRS Form 1099: This form is used to report various types of income other than wages, salaries, and tips. Both Forms 1120 and 1099 serve the purpose of reporting income, but 1099 is directed at independent contractors and other non-employees.

- IRS Form 1120-POL: Political organizations use this form to report their income and expenses. It shares similarities with Form 1120 in terms of structure and reporting requirements but is tailored for political entities.

Guide to Filling Out IRS 1120

Filling out the IRS 1120 form is an essential task for corporations in the United States. By completing this form, you report your corporation's income, gains, losses, deductions, and credits. To ensure accuracy and compliance, follow these steps carefully.

- Begin by gathering all necessary financial documents, including income statements, balance sheets, and any other relevant records.

- At the top of the form, enter your corporation's name, address, and Employer Identification Number (EIN).

- Fill in the date of incorporation and the total assets of your corporation at the end of the tax year.

- Report your corporation's income on the designated lines. This includes gross receipts or sales, dividends, interest, and any other income sources.

- Deduct allowable expenses from your total income. These may include salaries, rent, and other business expenses.

- Calculate your corporation's taxable income by subtracting total deductions from total income.

- Determine your tax liability based on the current corporate tax rates. Fill in this amount in the appropriate section.

- Complete any additional schedules that apply to your corporation, such as Schedule C for dividends and Schedule J for tax computation.

- Review all information for accuracy and ensure that all necessary signatures are included.

- Submit the completed form to the IRS by the due date, either electronically or via mail, depending on your filing preference.

Once you've filled out the form, it's crucial to keep a copy for your records. Make sure to stay informed about any changes in tax laws that may affect your future filings.