Free IRS 2553 PDF Form

Misconceptions

The IRS Form 2553 is an important document for small business owners who want to elect S Corporation status. However, there are several misconceptions surrounding this form. Here are five common misunderstandings:

- It’s only for new businesses. Many people think that only newly formed businesses can file Form 2553. In reality, existing corporations can also elect S Corporation status by submitting this form.

- All businesses qualify for S Corporation status. Not every business can become an S Corporation. There are specific eligibility requirements, such as having a limited number of shareholders and being a domestic corporation.

- Filing Form 2553 is a one-time event. Some believe that once they file Form 2553, they are set for life. In truth, if certain conditions change, such as exceeding the shareholder limit, the business may need to revoke its S Corporation status.

- Form 2553 guarantees tax benefits. While electing S Corporation status can provide tax advantages, it does not automatically guarantee them. The benefits depend on various factors, including how the business is structured and its income.

- Filing is too complicated. Many people feel overwhelmed by the idea of filing Form 2553. However, the process is relatively straightforward, and resources are available to help guide business owners through it.

Understanding these misconceptions can help you make informed decisions about your business structure and tax obligations.

Documents used along the form

When forming an S Corporation, the IRS Form 2553 is a crucial document that allows a corporation to elect S Corporation status. However, several other forms and documents are often used in conjunction with the IRS 2553 to ensure compliance and proper management of the business. Below is a list of these important documents.

- IRS Form 1120S: This is the annual tax return form specifically for S Corporations. It reports the income, deductions, and credits of the corporation and is essential for maintaining S Corporation status.

- IRS Form 941: Employers use this form to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. Filing this form quarterly is necessary for compliance with federal payroll tax obligations.

- IRS Form SS-4: This form is used to apply for an Employer Identification Number (EIN). An EIN is essential for tax purposes and is required for opening a business bank account and hiring employees.

- Operating Agreement: While not a formal IRS document, this internal document outlines the management structure and operating procedures of the S Corporation. It helps clarify roles and responsibilities among shareholders.

- Non-disclosure Agreement: Ensure the protection of sensitive information with a Non-disclosure Agreement form, which is crucial for safeguarding your business's intellectual property and trade secrets.

- State-Level S Corporation Election: Some states require a separate form to elect S Corporation status at the state level. This form varies by state and is necessary to ensure compliance with local tax laws.

These forms and documents play a vital role in the establishment and ongoing operation of an S Corporation. Properly managing these requirements can help ensure that your business remains compliant and operates smoothly.

Check out Popular Documents

Hurt Feelings Report - This form is designed for those who feel their feelings have been hurt.

Bill of Ladings - A precise Bill of Lading can bolster customer trust through clear communication of shipment details.

For those navigating equine transactions, understanding the significance of a well-drafted Horse Bill of Sale document can streamline the ownership transfer process. This form not only serves as a testament to the agreement but also ensures both parties are protected during the sale. You can find a reliable template at comprehensive Horse Bill of Sale guideline.

Check My Transcript - It displays both personal and dependent information relevant to the tax period.

Key Details about IRS 2553

What is IRS Form 2553?

IRS Form 2553 is used by small businesses to elect to be taxed as an S corporation. This election allows the business to avoid double taxation on corporate income, as profits and losses can pass directly to shareholders' personal tax returns. To qualify, the business must meet specific criteria set by the IRS.

Who is eligible to file Form 2553?

To be eligible for S corporation status, a business must meet the following requirements:

- It must be a domestic corporation.

- It must have no more than 100 shareholders.

- All shareholders must be individuals, certain trusts, or estates. Partnerships and corporations cannot be shareholders.

- It can only have one class of stock.

- It must not be an ineligible corporation, such as certain financial institutions, insurance companies, and domestic international sales corporations.

When should Form 2553 be filed?

Form 2553 should be filed within two months and 15 days of the beginning of the tax year when the S corporation election is intended to take effect. If you miss this deadline, you may still be able to file late if you can show reasonable cause for the delay.

What information is required on Form 2553?

The form requires several key pieces of information, including:

- The name and address of the corporation.

- The date of incorporation.

- The tax year the corporation will use.

- The names and addresses of all shareholders, along with their consent to the S corporation election.

- Any additional information that may be necessary for the IRS to process the election.

What happens after filing Form 2553?

Once Form 2553 is filed, the IRS will review the application. If approved, the corporation will be granted S corporation status. This status will allow the business to benefit from pass-through taxation. If the application is denied, the corporation will be taxed as a regular C corporation unless it re-files and meets the requirements.

Can Form 2553 be revoked?

Yes, a corporation can revoke its S corporation election by filing a statement with the IRS. This statement must be signed by shareholders holding more than 50% of the shares. Revocation can be effective immediately or at the end of the tax year, depending on the corporation's preference.

Similar forms

- Form 1065: This form is used by partnerships to report income, deductions, gains, and losses. Like Form 2553, it is essential for tax classification and ensures that the entity is taxed correctly.

- New York Residential Lease Agreement: Understanding this legally binding contract is essential for both landlords and tenants. For more information, you can visit PDF Documents Hub to access helpful resources.

- Form 1120: Corporations use this form to report their income, gains, losses, and deductions. Similar to Form 2553, it helps define the tax structure of the business entity.

- Form 1120S: This form is specifically for S corporations. It allows for the reporting of income, deductions, and credits, paralleling the purpose of Form 2553 in establishing S corporation status.

- Form 941: Employers use this form to report payroll taxes. It shares a commonality with Form 2553 in that both forms are critical for compliance with tax obligations.

- Form 990: Nonprofit organizations file this form to provide information about their activities and finances. Like Form 2553, it is necessary for maintaining tax-exempt status.

- Form W-2: Employers issue this form to report wages paid to employees and taxes withheld. It is similar to Form 2553 in that both are integral to the tax reporting process for different business structures.

Guide to Filling Out IRS 2553

After obtaining the IRS 2553 form, the next steps involve carefully filling it out to ensure accurate submission. This form is essential for certain businesses to elect to be treated as an S Corporation for tax purposes. Follow the steps below to complete the form correctly.

- Download the IRS 2553 form from the official IRS website or obtain a physical copy.

- Begin by entering the name of the corporation at the top of the form.

- Provide the corporation's address, including the city, state, and ZIP code.

- Fill in the date of incorporation and the state where the corporation was formed.

- Indicate the tax year the corporation will be using. This is typically a calendar year unless otherwise specified.

- List the names and addresses of all shareholders, along with their respective ownership percentages.

- Check the box indicating the eligibility criteria for S Corporation status. Ensure all conditions are met.

- Sign and date the form. The person signing should be an authorized officer of the corporation.

- Make copies of the completed form for your records.

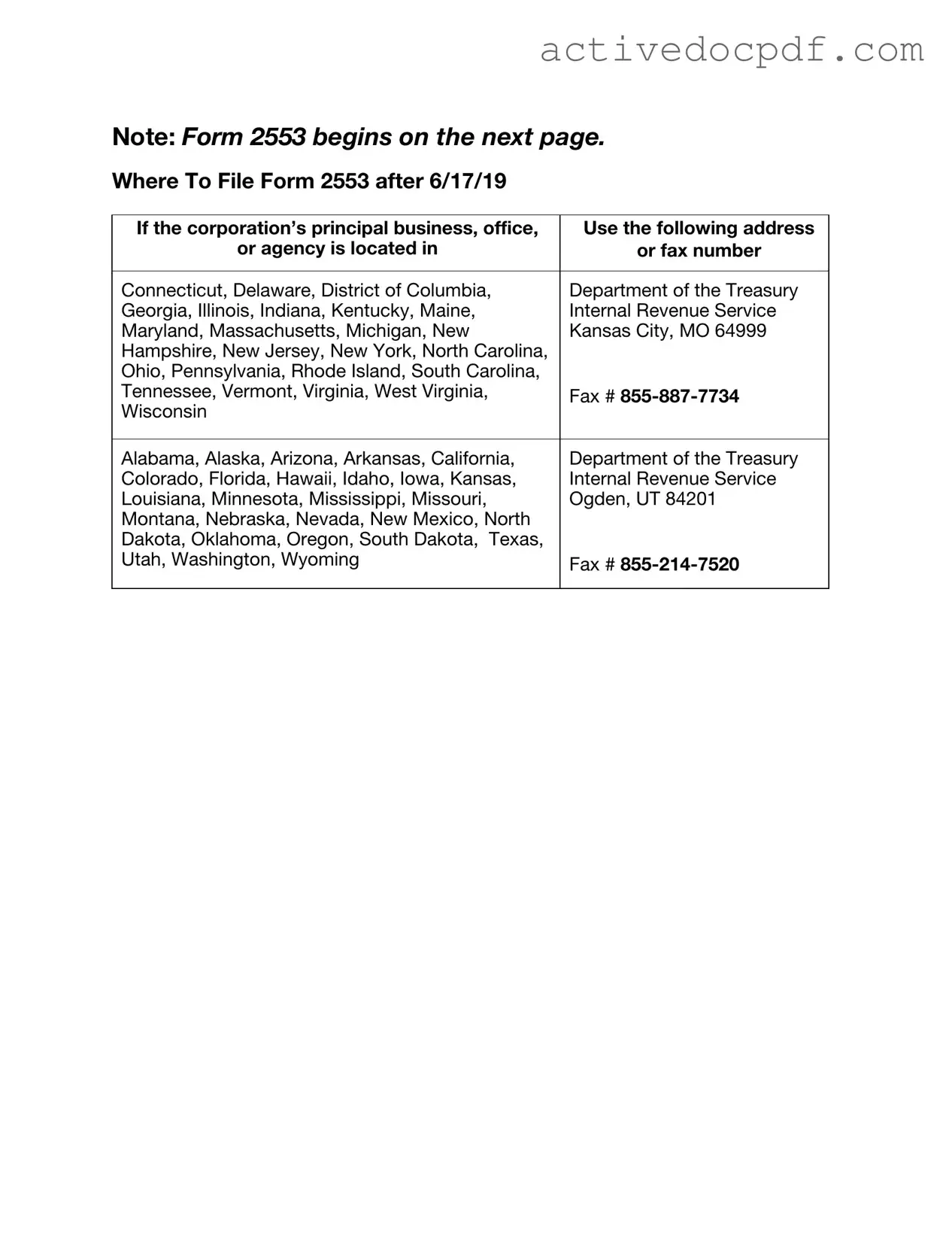

- Submit the form to the IRS by mail or electronically, depending on the instructions provided.

After submission, the IRS will process the form and notify the corporation of its S Corporation status. Keep an eye out for any correspondence from the IRS to confirm acceptance or request further information.