Free IRS 941 PDF Form

Misconceptions

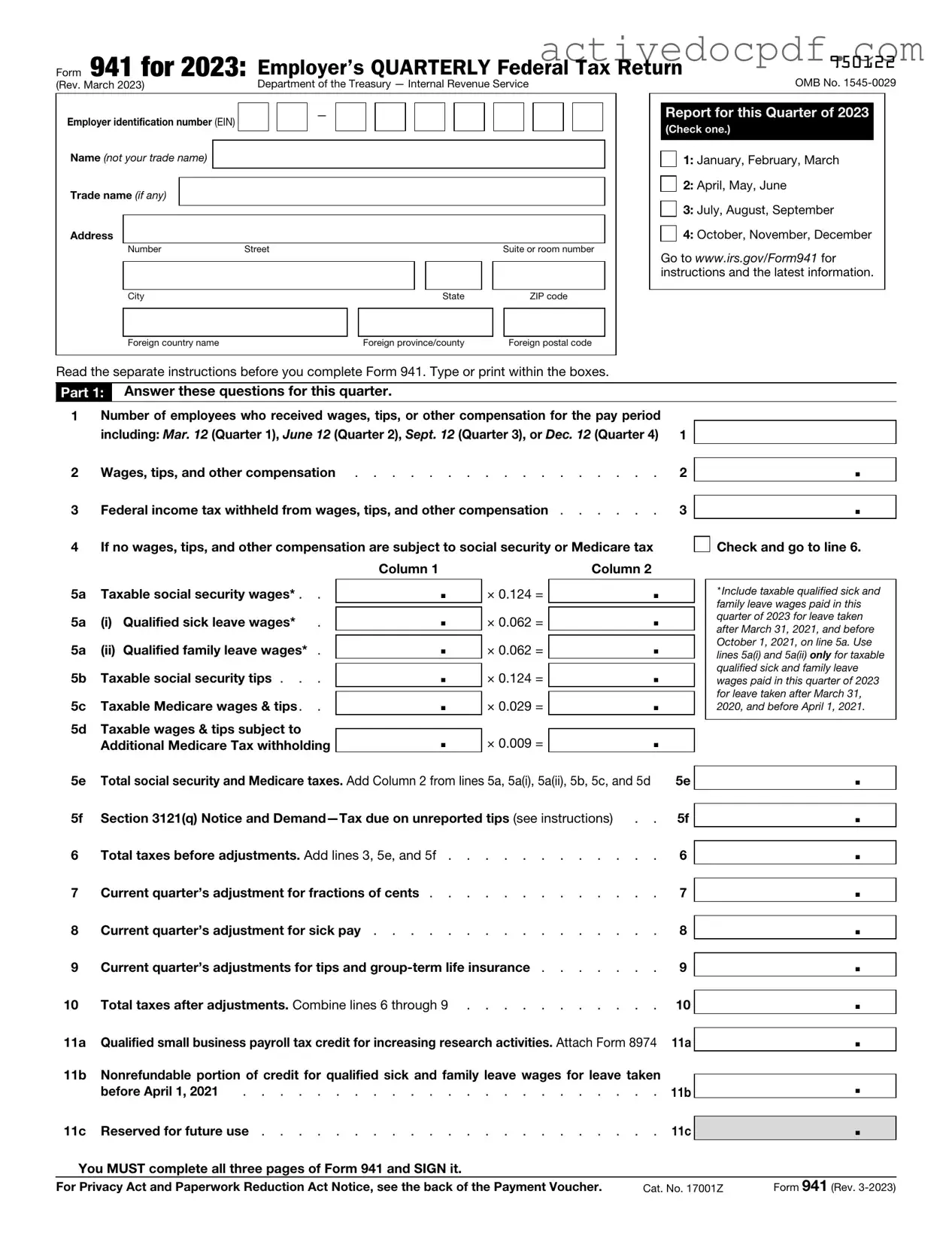

The IRS Form 941, also known as the Employer's Quarterly Federal Tax Return, can be a source of confusion for many. Here are six common misconceptions about this important form:

- Only large businesses need to file Form 941. Many small businesses also have to file this form if they have employees. If you pay wages subject to federal income tax withholding, you are required to file.

- Form 941 is only for reporting employee wages. While it's true that the form reports wages, it also covers federal income tax withheld, Social Security, and Medicare taxes. It’s a comprehensive look at your payroll tax obligations.

- Filing Form 941 is optional if you have no employees. If you have no employees during a quarter, you are still required to file Form 941, but you will indicate that you had no wages or taxes to report.

- Form 941 can be filed anytime during the year. This is incorrect. Form 941 must be filed quarterly, with specific deadlines for each quarter. Missing these deadlines can result in penalties.

- Once filed, you cannot make changes to Form 941. If you discover an error after filing, you can correct it by submitting Form 941-X, which is specifically designed for making adjustments to previously filed 941 forms.

- All businesses use the same version of Form 941. There are different versions of Form 941 for different tax years, and businesses must ensure they are using the correct version for the year they are filing.

Understanding these misconceptions can help ensure that you remain compliant and avoid unnecessary complications with the IRS. Always consult with a tax professional if you have specific questions regarding your situation.

Documents used along the form

The IRS Form 941 is an essential document used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. Alongside this form, several other documents may be necessary to ensure comprehensive compliance with federal tax regulations. Below is a list of commonly used forms and documents that often accompany the IRS Form 941.

- IRS Form 940: This form is used to report and pay unemployment taxes. Employers must file it annually to report their Federal Unemployment Tax Act (FUTA) liability.

- IRS Form W-2: This form provides a summary of an employee's annual wages and the taxes withheld. Employers must issue W-2s to employees by the end of January each year.

- IRS Form W-3: This is a transmittal form that summarizes all W-2 forms submitted by an employer. It is filed with the Social Security Administration to report total wages and taxes withheld.

- California Boat Bill of Sale: This document is vital for establishing the transfer of boat ownership between a seller and a buyer, containing essential details such as the boat’s description, sale price, and signatures. For more information, visit https://documentonline.org.

- IRS Form 1099: This form is used to report various types of income other than wages, salaries, and tips. Independent contractors and freelancers typically receive a 1099 form for their services.

- Payroll Records: Employers must maintain accurate payroll records, including time sheets, wage rates, and employee classifications, to substantiate the information reported on Form 941.

- State Tax Forms: Depending on the state, employers may need to file additional tax forms related to state income tax withholding and unemployment insurance. These forms vary by state.

Understanding these accompanying documents is crucial for maintaining compliance and ensuring accurate reporting of tax liabilities. Each form plays a vital role in the overall tax process, contributing to a clearer picture of an employer's financial responsibilities.

Check out Popular Documents

Bad Business Bureau - Describe your experience with a company that was untrustworthy in its dealings.

To create a legally binding agreement, individuals can utilize a nyforms.com/promissory-note-template that provides a clear structure for a New York Promissory Note, ensuring all necessary details are included and understood by both the lender and the borrower.

How to File a Mechanics Lien in California - Specific statutory language must often be included in the Mechanics Lien filing.

Child Custody Affidavit - It is a critical legal tool that provides structure to the process of relinquishment and future family arrangements.

Key Details about IRS 941

What is IRS Form 941?

IRS Form 941, also known as the Employer's Quarterly Federal Tax Return, is a form that employers use to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. It is filed quarterly and provides the IRS with information on the taxes you owe and the taxes you have already paid.

Who needs to file Form 941?

Any employer who pays wages to employees must file Form 941. This includes businesses of all sizes, as well as tax-exempt organizations and governmental entities. If you have no employees or do not withhold taxes, you do not need to file this form.

When is Form 941 due?

Form 941 is due on the last day of the month following the end of each quarter. The deadlines are as follows:

- 1st Quarter (January - March): Due by April 30

- 2nd Quarter (April - June): Due by July 31

- 3rd Quarter (July - September): Due by October 31

- 4th Quarter (October - December): Due by January 31

How do I file Form 941?

You can file Form 941 electronically using the IRS e-file system or by mailing a paper form to the appropriate address listed in the form instructions. Electronic filing is often faster and more secure.

What information do I need to complete Form 941?

To complete Form 941, you will need the following information:

- Your business name, address, and Employer Identification Number (EIN).

- The total number of employees you paid during the quarter.

- The total wages paid to employees.

- The total amount of federal income tax withheld.

- The total amount of Social Security and Medicare taxes owed.

What happens if I miss the filing deadline?

If you miss the filing deadline for Form 941, you may face penalties and interest on any unpaid taxes. It is important to file as soon as possible, even if you cannot pay the full amount owed. The IRS may offer payment plans for those who need assistance.

Can I amend a filed Form 941?

Yes, you can amend a filed Form 941 by submitting Form 941-X, Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund. This form allows you to correct any mistakes or report changes in your previously filed Form 941.

What if I have no tax liability for a quarter?

If you have no tax liability for a quarter, you still need to file Form 941. You can indicate that you had no wages or taxes due on the form. Failing to file, even with no liability, can lead to penalties.

Where can I find additional resources or help with Form 941?

You can find additional resources on the IRS website, including detailed instructions for completing Form 941 and FAQs. If you need personalized assistance, consider consulting a tax professional or accountant who can provide guidance specific to your situation.

Similar forms

- IRS Form 940: This form is used to report annual unemployment taxes. Like Form 941, it is filed by employers to report taxes withheld from employee wages.

- IRS Form 943: This form is specifically for agricultural employers. It reports income taxes withheld from farmworkers, similar to how Form 941 reports for general employees.

- IRS Form 944: This is an annual version of Form 941 for smaller employers. It simplifies reporting for those with a lower payroll tax liability.

- IRS Form W-2: This form provides a summary of an employee’s earnings and taxes withheld for the year. It complements Form 941 by detailing individual employee information.

- IRS Form W-3: This is a summary form that accompanies W-2s. It reports the total earnings and taxes withheld for all employees, similar to the aggregate data reported on Form 941.

- IRS Form 1099-MISC: Used for reporting payments made to non-employees, this form shares similarities with Form 941 in that it tracks payments and tax obligations.

- IRS Form 1096: This is a summary form for information returns, including 1099s. Like Form 941, it consolidates information for tax reporting purposes.

- Free And Invoice PDF Form: This user-friendly document enables businesses and individuals to create tailored invoices efficiently, streamlining the process and ensuring clear presentation of necessary information. For more information, visit PDF Documents Hub.

- State Payroll Tax Forms: Many states require similar forms to report payroll taxes. These forms function similarly to Form 941 by tracking employee wages and tax withholdings at the state level.

Guide to Filling Out IRS 941

After gathering all necessary information and documents, you are ready to fill out the IRS Form 941. This form is used to report payroll taxes and is typically filed quarterly. Ensure that you have the correct tax year and quarter in mind as you proceed.

- Begin by entering your employer identification number (EIN) at the top of the form. This unique number identifies your business.

- Fill in your business name and address. Make sure this information matches what the IRS has on file.

- Indicate the number of employees you had during the quarter. This helps the IRS understand your payroll size.

- Enter the total wages, tips, and other compensation paid to employees during the quarter in the appropriate box.

- Calculate and report the total federal income tax withheld from employees’ paychecks. This amount should reflect the sum withheld throughout the quarter.

- Determine the total taxable social security and Medicare wages. Ensure you separate these amounts correctly.

- Compute the social security and Medicare taxes owed based on the wages reported. These calculations will be essential for the next section.

- Account for any adjustments, such as overreported amounts from previous quarters. This ensures accuracy in your reporting.

- Fill in the section for nonrefundable credits, if applicable. This can include credits for sick leave or family leave.

- Complete the payment section if you owe taxes. Include any payments made with the form if applicable.

- Sign and date the form. The signature confirms that the information provided is accurate to the best of your knowledge.

Once you have completed the form, review it carefully for any errors or omissions. After verifying that all information is correct, submit it to the IRS by the due date to avoid penalties. Keep a copy for your records.