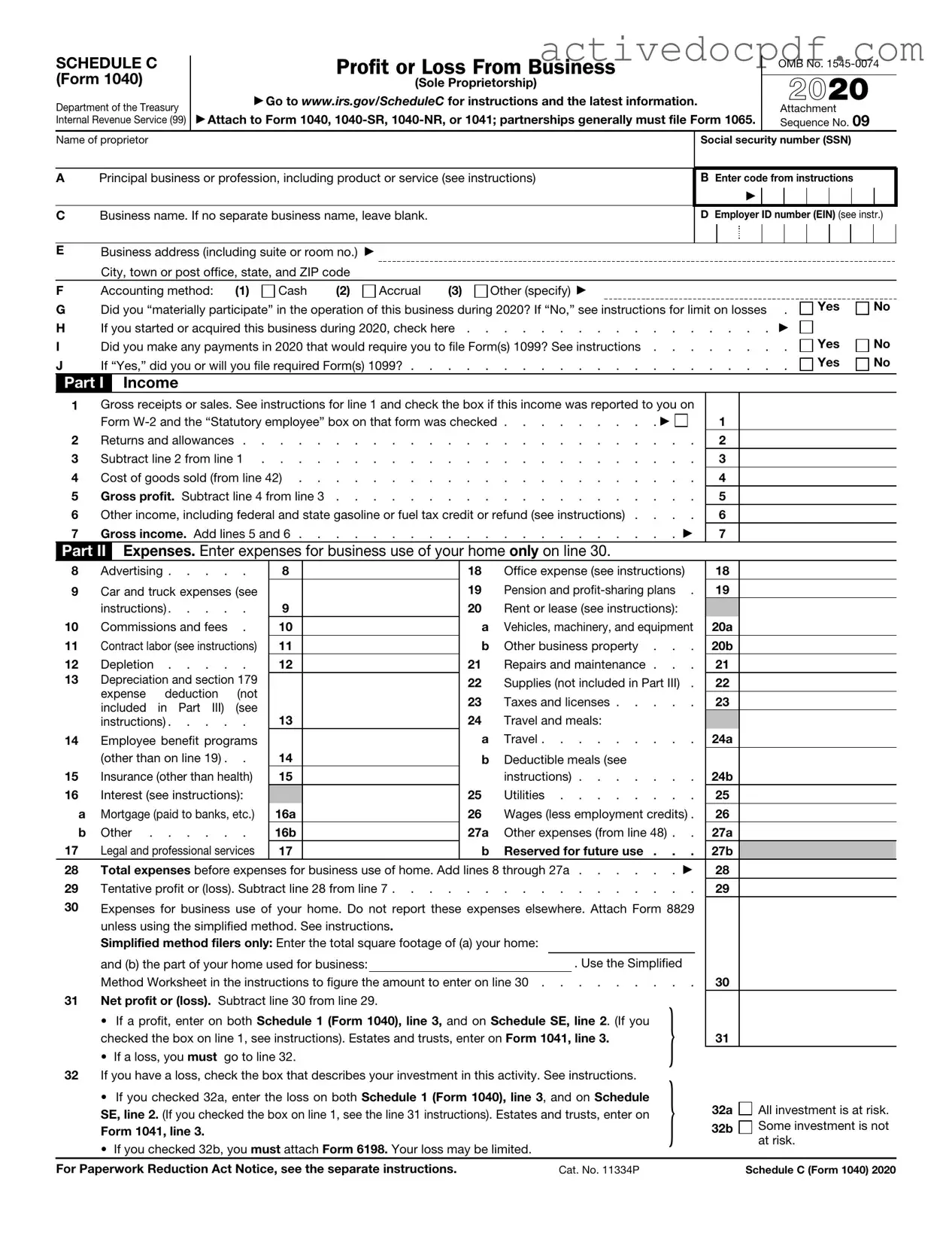

Free IRS Schedule C 1040 PDF Form

Misconceptions

The IRS Schedule C (Form 1040) is an important document for self-employed individuals and small business owners. However, several misconceptions surround this form. Below are five common misunderstandings.

-

Only Large Businesses Need to File Schedule C.

This is not true. Any individual who earns income from self-employment, regardless of the size of the business, must file Schedule C. This includes freelancers, consultants, and small business owners.

-

All Income Must Be Reported on Schedule C.

While most self-employment income should be reported, there are exceptions. For instance, certain types of income, such as rental income from real estate, may require different forms.

-

Expenses Can Be Deducted Without Documentation.

This is a misconception. To claim expenses on Schedule C, proper documentation is necessary. Receipts, invoices, and records must be kept to substantiate any deductions claimed.

-

Filing Schedule C Guarantees a Tax Refund.

Filing this form does not guarantee a refund. Refunds depend on overall tax liability and the amount of taxes already paid throughout the year.

-

Schedule C is Only for Sole Proprietorships.

While Schedule C is primarily designed for sole proprietors, it can also be used by single-member LLCs. These entities report income and expenses similarly to sole proprietorships.

Documents used along the form

When filing your taxes as a self-employed individual or a sole proprietor, it is essential to have all necessary forms and documents ready. The IRS Schedule C (Form 1040) is a critical document for reporting income and expenses related to your business. However, several other forms often accompany it to ensure a complete and accurate tax return. Below is a list of important documents you may need.

- IRS Form 1040: This is the standard individual income tax return form. It summarizes your total income, deductions, and tax liability. Schedule C is attached to this form to report business income and expenses.

- IRS Schedule SE: This form is used to calculate self-employment tax. If you earn $400 or more from self-employment, you must complete this form to determine your contribution to Social Security and Medicare.

- IRS Form 4562: This form is necessary for claiming depreciation and amortization on business assets. If you purchase equipment or property for your business, you will need this form to report the depreciation expense.

- Dirt Bike Bill of Sale: The PDF Documents Hub provides an essential form that serves as proof of the purchase and transfer of ownership of a dirt bike in New York, including vital transaction details.

- IRS Form 8829: If you use part of your home for business purposes, this form allows you to calculate and report home office expenses. It helps you determine the allowable deduction for home office use.

- IRS Form 1099-MISC or 1099-NEC: These forms report income received from clients or customers who paid you $600 or more in a tax year. They are essential for accurately reporting your business income on Schedule C.

Gathering these documents will help streamline the tax preparation process and ensure compliance with IRS regulations. Make sure to review each form carefully and consult with a tax professional if needed to avoid any potential issues.

Check out Popular Documents

Aws Welder Certification - Correct entries in this form support traceability and accountability in welding operations.

Pdf Puppy Health Guarantee Template - Communication with the breeder is encouraged if any questions or concerns about the puppy arise.

For those navigating the complexities of child support obligations in Texas, understanding the process and requirements is crucial, and resources are available to assist you. To get more information on filling out the necessary forms, including the Child Support Texas form, visit https://texasformspdf.com/fillable-child-support-texas-online/, which provides a comprehensive guide to help you through the procedure efficiently and effectively.

Panel Schedule - Analyze the circuit capacity and performance trends over time.

Key Details about IRS Schedule C 1040

What is the IRS Schedule C 1040 form?

The IRS Schedule C 1040 form is used by sole proprietors to report income or loss from their business. It is part of the individual income tax return, Form 1040. This form allows individuals to detail their business earnings, expenses, and net profit or loss, which is then included in their overall income tax calculation.

Who needs to file a Schedule C?

Individuals who operate a business as a sole proprietorship must file Schedule C. This includes freelancers, independent contractors, and anyone who runs a business without forming a separate legal entity. If the business has generated income, filing Schedule C is necessary to report that income to the IRS.

What types of income should be reported on Schedule C?

All income earned from the business should be reported on Schedule C. This includes:

- Sales revenue

- Service income

- Commissions

- Other business-related income

Any income received in cash, checks, or electronic payments must be included. It is essential to keep accurate records of all income sources throughout the year.

What expenses can be deducted on Schedule C?

Various business expenses can be deducted on Schedule C to reduce taxable income. Common deductible expenses include:

- Cost of goods sold

- Rent or lease payments for business property

- Utilities and office supplies

- Advertising costs

- Travel expenses related to business

- Wages paid to employees

It is important to maintain documentation for all expenses claimed to ensure compliance with IRS regulations.

How do I calculate my net profit or loss on Schedule C?

To calculate net profit or loss, total income from the business is first determined. Then, all allowable business expenses are subtracted from this total. The formula is:

Net Profit or Loss = Total Income - Total Expenses

If the result is positive, it indicates a net profit. A negative result indicates a net loss, which may affect overall tax liability.

When is the deadline to file Schedule C?

Schedule C must be filed by the same deadline as the individual income tax return, Form 1040. Typically, this is April 15 of each year. If additional time is needed, individuals may file for an extension, which generally extends the deadline to October 15. However, any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Similar forms

- Form 1040: This is the individual income tax return form. Schedule C is attached to Form 1040 to report income or loss from a business operated as a sole proprietorship.

- Schedule SE: This form calculates self-employment tax. If you report income on Schedule C, you must also file Schedule SE to determine your tax liability for Social Security and Medicare.

- Form 1065: Used by partnerships to report income, deductions, and profits. While Schedule C is for sole proprietors, Form 1065 serves a similar purpose for partnerships.

- Form 1120: This is the corporate income tax return. Corporations use this form to report their income, similar to how sole proprietors use Schedule C for their business income.

- Form 990: Nonprofit organizations use this form to report their income, expenses, and activities. Like Schedule C, it provides a detailed view of financial operations, though for different entity types.

- Illinois Bill of Sale: Essential for personal property transactions, it serves as proof of ownership transfer. For more information, visit https://documentonline.org/.

- Schedule E: This form is for reporting supplemental income and loss, such as rental income. It parallels Schedule C in that it details income from specific sources, though it focuses on different types of earnings.

Guide to Filling Out IRS Schedule C 1040

Completing the IRS Schedule C (Form 1040) is an essential step for self-employed individuals or sole proprietors reporting income or loss from their business. This guide will help you navigate the process smoothly, ensuring you provide all necessary information accurately.

- Gather your documents: Collect all relevant financial records, including income statements, expense receipts, and any other documentation related to your business activities.

- Start with your personal information: Fill in your name, Social Security number, and business name if applicable at the top of the form.

- Describe your business: Indicate the type of business you operate. This could include your principal product or service and the business address.

- Report your income: In Part I, list your gross receipts or sales. If you received any returns or allowances, subtract those amounts to arrive at your total income.

- Detail your expenses: In Part II, categorize your business expenses. Common categories include advertising, car and truck expenses, and supplies. Be thorough and accurate.

- Calculate your net profit or loss: Subtract your total expenses from your total income. This figure will be reported on your Form 1040.

- Complete the rest of the form: Fill in any additional sections that apply to your situation, such as information about your vehicle if you claimed car expenses.

- Review your information: Double-check all entries for accuracy. Ensure that numbers are correct and that you have included all necessary documentation.

- Sign and date the form: After verifying everything, sign and date the form. If someone else prepared it, they should also sign it.

- Submit your form: File your Schedule C along with your Form 1040 by the tax deadline. You can submit it electronically or by mail, depending on your preference.

Following these steps will help ensure that you complete your Schedule C accurately. This attention to detail can make a significant difference in your tax filing experience.