Free IRS W-9 PDF Form

Misconceptions

The IRS W-9 form is a commonly used document, yet many people hold misconceptions about its purpose and usage. Here are ten common misunderstandings:

- W-9 is only for freelancers. Many believe that only freelancers need to fill out a W-9 form. In reality, any individual or business that receives income from another entity may be required to complete this form.

- W-9 is a tax return. Some think the W-9 form is a tax return. However, it is merely a request for taxpayer identification information, not a document that reports income.

- Submitting a W-9 means you owe taxes. Filling out a W-9 does not mean you owe taxes. It simply provides your taxpayer identification number to the entity requesting it.

- W-9 is only for U.S. citizens. While U.S. citizens commonly use the W-9, non-resident aliens and foreign entities can also fill out a W-9 if they have a valid taxpayer identification number.

- W-9 information is kept private. Many assume that their information on the W-9 is confidential. In reality, the entity receiving the form may share it with the IRS or other parties as required by law.

- W-9 must be submitted every year. Some believe they need to resubmit a W-9 annually. In fact, you only need to submit a new form if your information changes.

- W-9 is the same as a W-4. The W-9 and W-4 forms serve different purposes. The W-4 is used by employees to determine withholding, while the W-9 is for reporting income.

- You can refuse to fill out a W-9. While you can refuse, doing so may result in backup withholding on payments made to you. It’s often in your best interest to provide the requested information.

- W-9 is only for independent contractors. This form can be used by various entities, including corporations and partnerships, not just independent contractors.

- W-9 is not important. Some may think the W-9 is unimportant. However, it is crucial for accurate tax reporting and avoiding potential penalties.

Understanding these misconceptions can help individuals and businesses navigate the requirements of the W-9 form more effectively.

Documents used along the form

The IRS W-9 form is a crucial document for individuals and businesses in the United States. It is primarily used to provide taxpayer identification information to entities that need to report income paid to the taxpayer. However, several other forms and documents are often utilized in conjunction with the W-9 to ensure compliance and facilitate various financial transactions. Below is a list of these documents, along with brief descriptions of their purposes.

- IRS 1099-MISC: This form is used to report miscellaneous income paid to non-employees, such as freelancers or independent contractors. It is essential for reporting payments made for services rendered, rents, prizes, and other types of income.

- Georgia Bill of Sale Form: When transferring property ownership, use the essential Georgia bill of sale form documentation to ensure all requirements are fulfilled.

- IRS 1099-NEC: This form specifically reports non-employee compensation. It is typically used to report payments made to independent contractors and freelancers, replacing the relevant section of the 1099-MISC starting in tax year 2020.

- IRS 1040: This is the standard individual income tax return form used by U.S. citizens and residents. Taxpayers report their income, deductions, and credits to determine their tax liability.

- Form W-4: Employees use this form to indicate their tax withholding preferences to their employer. It helps determine the amount of federal income tax to withhold from an employee's paycheck.

- Form 1040-SR: Designed for seniors, this form is a simplified version of the standard 1040. It allows older taxpayers to report their income and claim deductions more easily.

- Form 8821: This form authorizes an individual or organization to receive and inspect a taxpayer's confidential information from the IRS. It is often used when a tax professional is involved in preparing a taxpayer's return.

- Form SS-4: This application is used to apply for an Employer Identification Number (EIN). Businesses need an EIN for various tax and reporting purposes, including hiring employees and opening bank accounts.

Understanding these documents and their purposes is vital for ensuring compliance with tax regulations and managing financial transactions effectively. Each form serves a specific function, contributing to the overall tax reporting and payment process.

Check out Popular Documents

Membership Interest Issuance/transfer Ledger - This form aids in the seamless transition of membership interests between parties.

To ensure you have a complete understanding of your rights and obligations, you may want to review the PDF Documents Hub, which provides valuable resources related to the New York Residential Lease Agreement and can guide you through the essential details of this important contract.

Bdsm Limit List - Willingness to engage in aftercare practices post-scene.

Key Details about IRS W-9

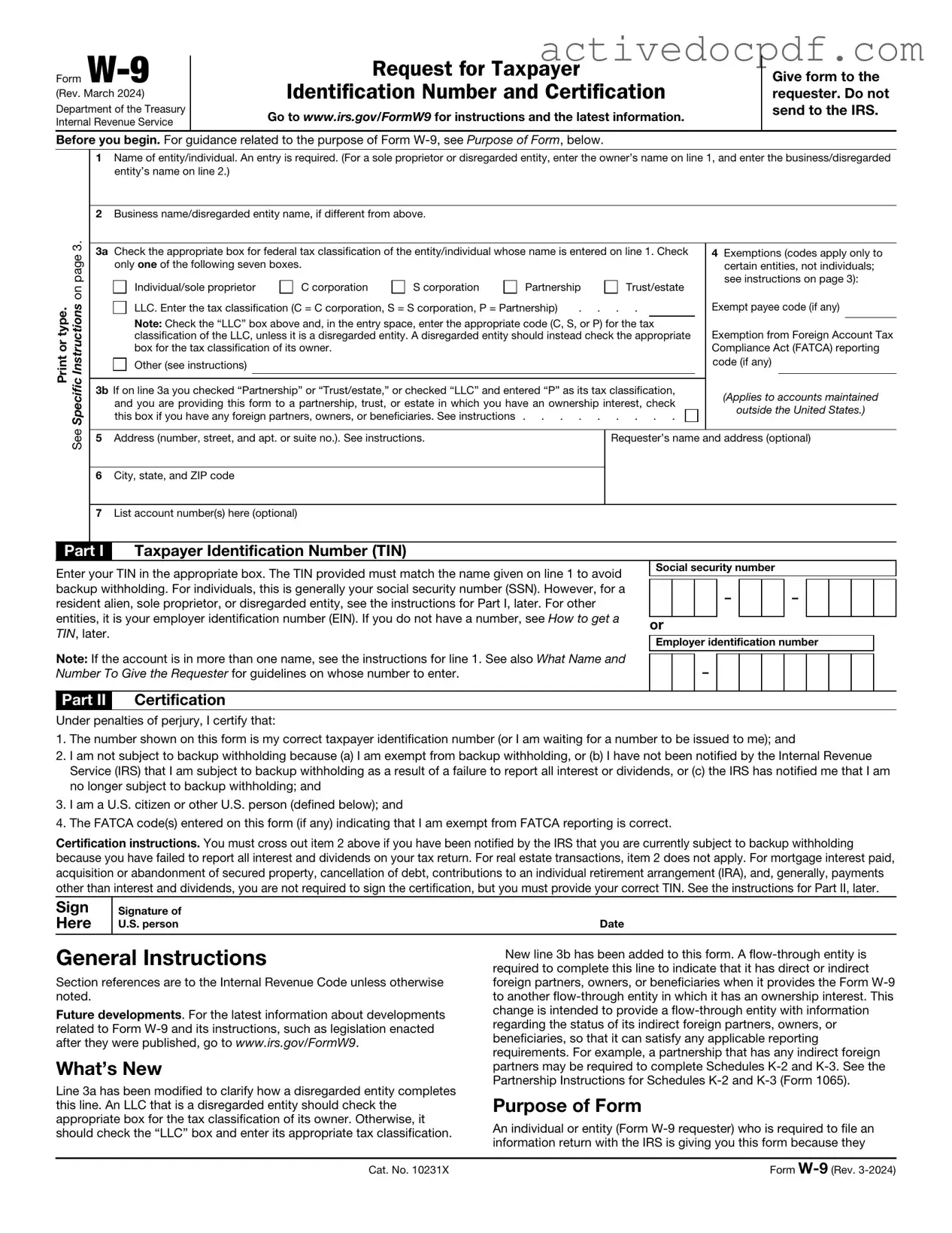

What is the IRS W-9 form?

The IRS W-9 form is a document used in the United States by individuals and businesses to provide their taxpayer identification information. This form is often requested by companies when they need to report payments made to contractors or freelancers. It helps ensure that the correct tax information is reported to the IRS.

Who needs to fill out a W-9 form?

Any individual or business that receives income that must be reported to the IRS may need to fill out a W-9 form. This includes freelancers, independent contractors, and certain vendors. If you’re providing services and getting paid, the requesting party may ask you to complete a W-9.

What information do I need to provide on the W-9?

When filling out a W-9 form, you’ll need to provide:

- Your name or business name

- Your business entity type (individual, corporation, partnership, etc.)

- Your address

- Your Social Security Number (SSN) or Employer Identification Number (EIN)

- Signature and date

Why do I need to submit a W-9 form?

Submitting a W-9 form helps the entity requesting it to accurately report the payments they make to you to the IRS. This ensures that you and the payer are compliant with tax laws. If you don’t provide a W-9, they may withhold taxes from your payments.

Is the W-9 form the same as a 1099 form?

No, the W-9 form and the 1099 form are different. The W-9 is used to provide your taxpayer information, while the 1099 form is issued by the payer to report the income you earned. The payer uses the information from your W-9 to complete the 1099 form accurately.

How do I submit the W-9 form?

You typically submit the W-9 form directly to the person or business that requested it. This can be done via email or regular mail, depending on their preference. Keep in mind that you should not send the W-9 form to the IRS.

What should I do if my information changes?

If your name, address, or taxpayer identification number changes, you should fill out a new W-9 form and submit it to the requesting party. It’s important to keep your information up to date to avoid issues with tax reporting.

What happens if I don’t submit a W-9?

If you don’t submit a W-9 form when requested, the payer may withhold a portion of your payments for tax purposes. This is known as backup withholding. The withheld amount is sent to the IRS, and you may still be responsible for reporting the full amount of your income.

Similar forms

The IRS W-9 form is primarily used for tax purposes, specifically to provide taxpayer identification information. Several other documents serve similar functions in terms of collecting and reporting information. Below are seven documents that share similarities with the W-9 form:

- Form W-4: This form is used by employees to indicate their tax withholding preferences. Like the W-9, it collects personal information such as name and Social Security number, which helps employers determine the correct amount of federal income tax to withhold from an employee's paycheck.

- Form 1099: This document is issued by businesses to report various types of income other than wages, salaries, and tips. It requires the recipient's taxpayer identification number, similar to the W-9, to ensure accurate reporting to the IRS.

- Form 1040: As the standard individual income tax return form, the 1040 collects comprehensive financial information. It requires personal identification details, including Social Security numbers, paralleling the W-9's purpose of identifying taxpayers.

- Form SS-4: This form is used to apply for an Employer Identification Number (EIN). It gathers information about the entity applying for the EIN, akin to how the W-9 collects information about individuals or businesses for tax identification purposes.

- Form 4506-T: This form is used to request a transcript of a tax return. It requires personal information, including Social Security numbers, similar to the W-9, to verify the identity of the requester.

- Horse Bill of Sale Form: To ensure legal ownership transfer of your horse, consult our comprehensive horse bill of sale documentation for accurate record-keeping.

- Form 8821: This document allows taxpayers to authorize an individual to receive their confidential tax information. It collects identifying details, including taxpayer identification numbers, much like the W-9.

- Form 941: This is the employer's quarterly federal tax return, which reports income taxes, Social Security tax, and Medicare tax withheld from employee wages. It requires information about the employer and employees, paralleling the W-9's focus on taxpayer identification.

Guide to Filling Out IRS W-9

Once you have the IRS W-9 form, you will need to complete it accurately to ensure that your taxpayer information is correctly reported. After filling it out, you will typically submit it to the requester, who may need it for various purposes such as tax reporting.

- Begin by downloading the IRS W-9 form from the official IRS website or obtaining a physical copy.

- In the first section, enter your name as it appears on your tax return.

- If applicable, provide your business name or disregarded entity name in the second line.

- In the next section, check the appropriate box for your federal tax classification. Options include individual, corporation, partnership, or others.

- Fill in your address, including street address, city, state, and ZIP code.

- Provide your taxpayer identification number (TIN). This can be your Social Security Number (SSN) or Employer Identification Number (EIN).

- If you are exempt from backup withholding, indicate that by writing the appropriate code in the provided space.

- Sign and date the form at the bottom. Ensure that the signature matches the name provided at the top.

After completing the form, review it for accuracy. Once confirmed, send it to the person or organization that requested it.