Legal Last Will and Testament Template

State-specific Guides for Last Will and Testament Templates

Last Will and Testament Document Categories

Misconceptions

Understanding the Last Will and Testament is crucial for effective estate planning. Here are ten common misconceptions about this important legal document:

- A will only matters if you have a lot of money. Many believe that only wealthy individuals need a will. In reality, a will is important for anyone who wants to ensure their wishes are honored after their passing, regardless of their financial situation.

- Wills are only for the elderly. Some people think that wills are only necessary for older adults. However, unexpected events can happen at any age, making it wise for everyone to have a will in place.

- Handwritten wills are always valid. While some states recognize handwritten wills, they must meet specific criteria. It’s best to consult state laws to ensure validity.

- Once a will is created, it cannot be changed. This is incorrect. Wills can be updated or revoked at any time, as long as the individual is of sound mind.

- Having a will avoids probate entirely. While a will can streamline the probate process, it does not eliminate it. Probate is often necessary to validate the will and distribute assets.

- Only lawyers can create a will. Although legal assistance is recommended, individuals can create their own wills using templates or online services, as long as they follow state laws.

- All assets will automatically go to the beneficiaries named in the will. Some assets, like those held in joint ownership or designated beneficiaries, may bypass the will. Understanding how different assets are treated is essential.

- Wills are only for distributing property. Wills can also address guardianship for minor children and specify funeral arrangements, making them multifaceted documents.

- Once you have a will, you don’t need to think about it again. Life changes, such as marriage, divorce, or the birth of children, can affect your wishes. Regularly reviewing and updating your will is important.

- Creating a will is too complicated. While it may seem daunting, creating a will can be straightforward with the right resources and guidance. Taking the first step is often the hardest part.

Addressing these misconceptions can help individuals make informed decisions about their estate planning needs.

Documents used along the form

A Last Will and Testament is a critical document in estate planning, but it often works in conjunction with several other forms and documents. Each of these plays a unique role in ensuring that an individual's wishes are respected and that their estate is managed according to their preferences. Below is a list of documents commonly used alongside a Last Will and Testament.

- Living Trust: A legal entity that holds an individual's assets during their lifetime and specifies how those assets should be distributed after death. This can help avoid probate and provide more privacy regarding the estate.

- Lease Agreement Form: To simplify your rental process, refer to the essential Lease Agreement document templates that outline key terms and conditions for both parties.

- Durable Power of Attorney: This document allows an individual to designate someone to make financial and legal decisions on their behalf if they become incapacitated. It ensures that someone they trust can manage their affairs.

- Healthcare Proxy: Also known as a medical power of attorney, this document designates an individual to make healthcare decisions for someone who is unable to do so themselves, ensuring that their medical wishes are honored.

- Living Will: This document outlines an individual’s preferences regarding medical treatment and end-of-life care. It provides guidance to healthcare providers and loved ones about the type of care desired in critical situations.

- Beneficiary Designations: Many financial accounts, such as life insurance policies and retirement accounts, require specific beneficiary designations. These designations dictate who will receive assets upon the account holder's death, often bypassing the will.

- Letter of Intent: While not a legally binding document, a letter of intent can provide additional instructions regarding the distribution of assets, funeral arrangements, or any personal messages the individual wishes to convey to their loved ones.

- Affidavit of Heirship: This document is often used to establish the heirs of a deceased person when there is no will. It can help clarify who is entitled to inherit property and can be particularly useful in informal situations.

- Estate Tax Return: If an estate exceeds certain thresholds, it may be required to file an estate tax return. This document details the value of the estate and calculates any taxes owed, ensuring compliance with federal and state tax laws.

- Trustee Appointment: This document names a trustee who will manage a trust according to its terms. It is essential for ensuring that the trust operates smoothly and that the trustee understands their responsibilities.

Each of these documents serves a specific purpose and contributes to a comprehensive estate plan. By understanding and utilizing these forms, individuals can better ensure that their wishes are fulfilled and that their loved ones are taken care of after their passing.

Fill out More Forms

Mobile Home Clipart - A Mobile Home Bill of Sale transfers ownership of a mobile home.

For those looking to simplify the process of drafting this important document, resources from PDF Documents Hub can be invaluable, providing templates and guidance to ensure everything is properly completed and compliant with legal requirements.

Buying a Mobile Home From Owner in Florida - Can include contingency clauses for sale based on buyer securing financing.

Key Details about Last Will and Testament

- It ensures that your assets are distributed according to your wishes.

- It allows you to name guardians for your children, ensuring they are cared for by someone you trust.

- It can simplify the probate process, making it easier for your loved ones to settle your estate.

- It helps prevent family disputes over your estate, as your intentions are clearly documented.

- Your personal information, including your full name and address.

- A statement revoking any previous wills.

- Designation of an executor to carry out your wishes.

- Specific bequests, detailing who receives particular items or amounts of money.

- Instructions for the distribution of your remaining assets.

- Appointment of guardians for minor children, if applicable.

- Your signature and the signatures of witnesses, if required by state law.

- Writing the will in a clear and organized manner.

- Signing the will in the presence of at least two witnesses.

- Ensuring that the witnesses are not beneficiaries of the will.

- Having the will notarized, if required by your state.

What is a Last Will and Testament?

A Last Will and Testament is a legal document that outlines how a person's assets and affairs should be handled after their death. It allows individuals to specify who will inherit their property, appoint guardians for minor children, and designate an executor to manage the estate. This document is essential for ensuring that a person's wishes are followed and can help avoid disputes among family members.

Why is it important to have a Last Will and Testament?

Having a Last Will and Testament is crucial for several reasons:

Who can create a Last Will and Testament?

Generally, any adult who is of sound mind can create a Last Will and Testament. This means you should be at least 18 years old and capable of understanding the implications of your decisions. Additionally, you should not be under undue influence or pressure from others when making your will.

What should be included in a Last Will and Testament?

A comprehensive Last Will and Testament typically includes the following elements:

How do I make my Last Will and Testament legally binding?

To make your Last Will and Testament legally binding, you must follow your state’s specific requirements. Generally, this involves:

Can I change my Last Will and Testament after it is created?

Yes, you can change your Last Will and Testament at any time as long as you are of sound mind. This can be done by creating a new will or by adding a codicil, which is an amendment to the existing will. It’s important to follow the same legal requirements for signing and witnessing when making changes to ensure the updated document is valid.

What happens if I die without a Last Will and Testament?

If you die without a Last Will and Testament, you are considered to have died "intestate." In this case, your assets will be distributed according to your state’s intestacy laws. These laws typically dictate that your assets will go to your closest relatives, which may not align with your wishes. This can lead to complications and disputes among family members.

How often should I review my Last Will and Testament?

It is advisable to review your Last Will and Testament every few years or after significant life events. Events such as marriage, divorce, the birth of a child, or the death of a beneficiary can all impact your wishes. Regular reviews ensure that your will accurately reflects your current circumstances and intentions.

Can I write my Last Will and Testament myself?

While it is possible to write your Last Will and Testament yourself, it is often recommended to seek legal assistance. A lawyer can help ensure that the document complies with state laws and accurately reflects your wishes. If you choose to write it yourself, be sure to follow all legal requirements to avoid any issues during probate.

Similar forms

- Living Will: A living will outlines your preferences for medical treatment in case you become unable to communicate your wishes. Like a Last Will and Testament, it addresses your wishes but focuses on healthcare decisions rather than the distribution of assets.

- Durable Power of Attorney: This document allows you to appoint someone to make financial or legal decisions on your behalf if you are unable to do so. Similar to a Last Will, it involves planning for the future, but it activates during your lifetime rather than after death.

- Health Care Proxy: A health care proxy designates a person to make medical decisions for you if you cannot. Both documents ensure that your wishes are honored, but a health care proxy specifically addresses healthcare choices.

- Trust: A trust allows you to transfer assets to a trustee for the benefit of your beneficiaries. While a Last Will distributes your assets after death, a trust can manage and distribute them both during your lifetime and after.

- Letter of Intent: This informal document provides guidance to your executor or family regarding your wishes. It can complement a Last Will by offering additional context about your desires for asset distribution and funeral arrangements.

- Codicil: A codicil is an amendment to an existing will, allowing you to make changes without drafting a new will. It serves a similar purpose as a Last Will, as it still governs the distribution of your estate.

- Beneficiary Designation Forms: These forms are used to designate beneficiaries for specific accounts, like life insurance or retirement plans. Similar to a Last Will, they determine who receives your assets but do so outside the probate process.

- Guardianship Designation: This document names a guardian for your minor children in the event of your death. Like a Last Will, it ensures that your wishes regarding the care of your children are respected.

Bill of Sale: A Bill of Sale is a legal document that records the transfer of ownership of an asset from one party to another. This form serves as proof of the transaction, detailing the terms agreed upon by both the seller and buyer. To streamline your own transactions, consider filling out the Bill of Sale form by clicking the button below.

- Memorial Instructions: These instructions detail your preferences for funeral or memorial services. While a Last Will primarily addresses asset distribution, memorial instructions focus on how you wish to be remembered.

- Estate Plan: An estate plan encompasses various documents, including a Last Will, trusts, and powers of attorney. It provides a comprehensive approach to managing your assets and healthcare decisions, ensuring your wishes are fulfilled.

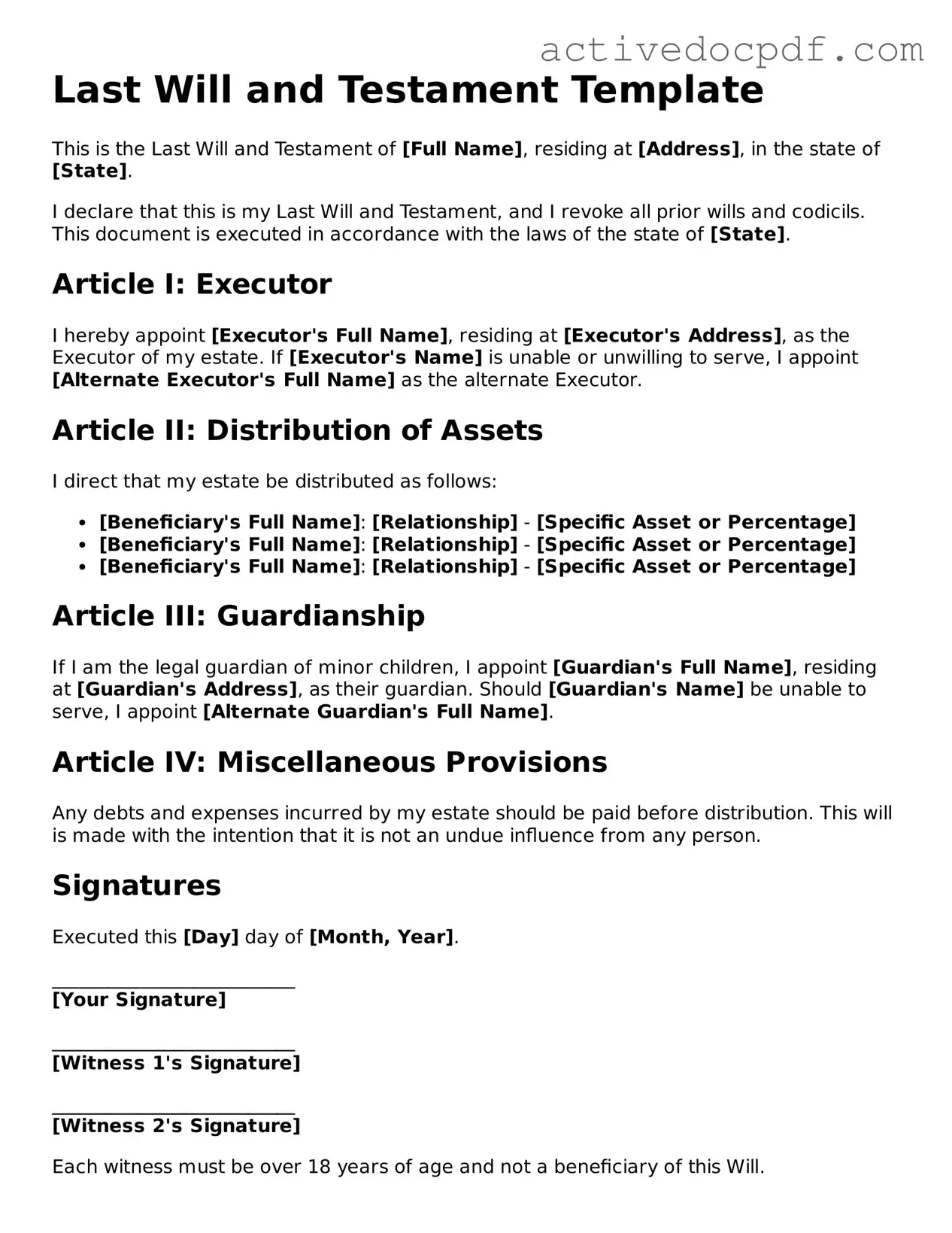

Guide to Filling Out Last Will and Testament

Filling out a Last Will and Testament form is a straightforward process that allows you to specify how you want your assets distributed after your death. Once you complete the form, it is essential to sign it in the presence of witnesses to ensure its validity.

- Begin by clearly writing your full name and address at the top of the form.

- State that this document is your Last Will and Testament.

- Identify yourself as the testator, affirming that you are of sound mind and legal age to create a will.

- List your beneficiaries. Include their full names and relationship to you.

- Specify what each beneficiary will receive. Be clear and detailed about the distribution of your assets.

- Designate an executor. This person will be responsible for ensuring your wishes are carried out.

- Include any specific wishes regarding guardianship for minor children, if applicable.

- Sign the document at the bottom. Ensure you do this in front of witnesses.

- Have at least two witnesses sign the form, confirming that they observed you sign it.

- Consider having the will notarized for added legal protection, although this is not always required.