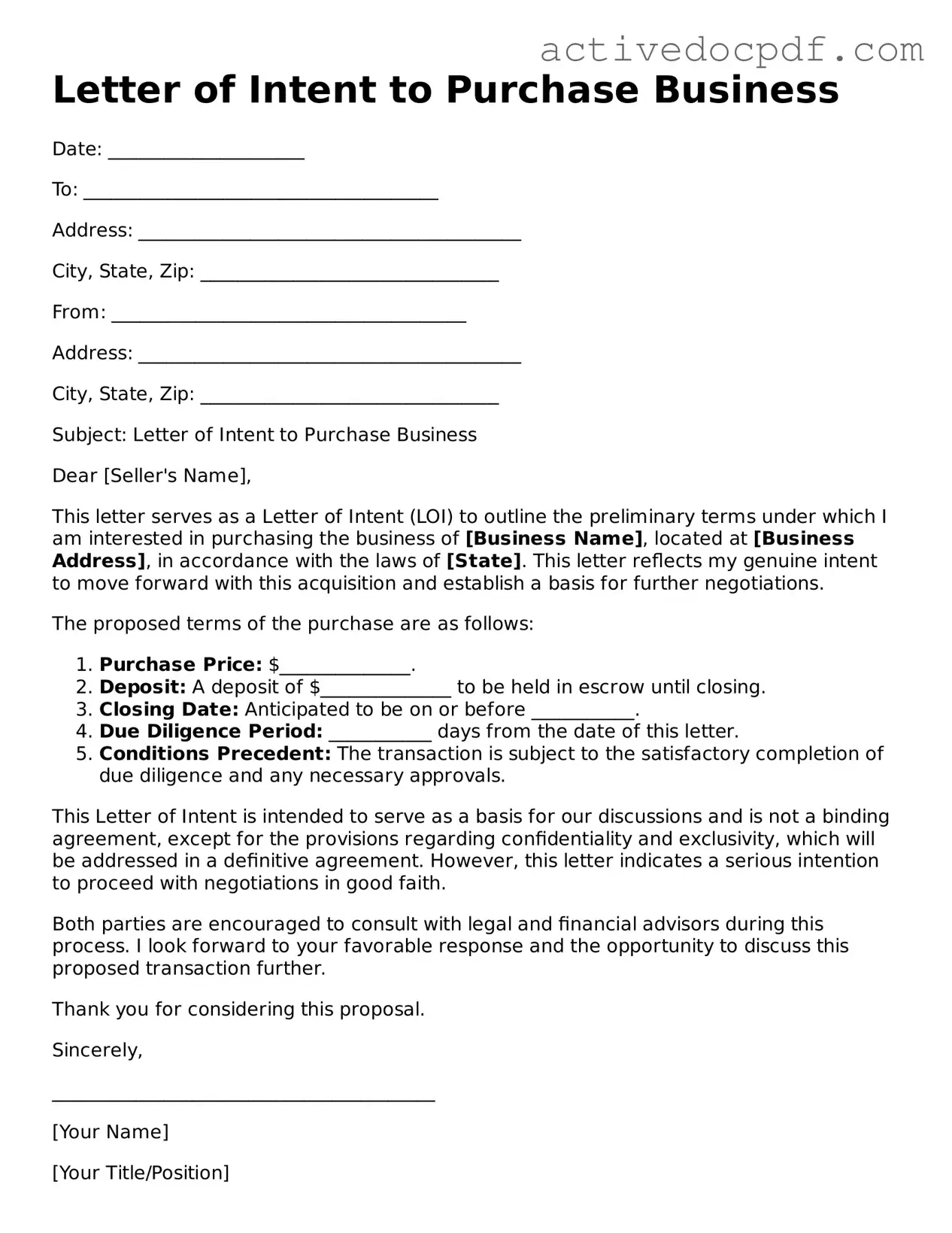

Legal Letter of Intent to Purchase Business Template

Misconceptions

Understanding the Letter of Intent to Purchase Business form is crucial for anyone involved in a business transaction. Here are eight common misconceptions about this important document:

- It is a legally binding contract. Many believe that a Letter of Intent (LOI) is a binding agreement. In reality, it typically outlines the intentions of the parties and is often non-binding, unless specified otherwise.

- It guarantees the sale of the business. An LOI does not guarantee that the sale will happen. It simply indicates that the parties are interested in pursuing a transaction.

- All terms must be finalized in the LOI. Some think that every detail must be settled in the LOI. However, it can be a preliminary document that leaves room for negotiation.

- It is only for large transactions. This form is useful for businesses of all sizes. Small businesses can benefit just as much from having a clear outline of intentions.

- It replaces the need for a formal contract. An LOI does not replace a formal purchase agreement. It serves as a starting point for further negotiations.

- It is only necessary for buyers. Both buyers and sellers can use an LOI to clarify their intentions and expectations, making it beneficial for all parties involved.

- It is a waste of time. Some consider the LOI unnecessary. However, it can save time and resources by establishing a mutual understanding before detailed negotiations.

- Once signed, it cannot be changed. Many assume that an LOI is final once signed. In fact, it can be amended or renegotiated as discussions progress.

Clarifying these misconceptions can lead to a smoother transaction process and better communication between parties.

Documents used along the form

A Letter of Intent to Purchase Business is an important document that outlines the preliminary understanding between a buyer and a seller regarding the sale of a business. However, several other forms and documents often accompany this letter to ensure clarity and legal protection for both parties involved. Below is a list of such documents, along with brief descriptions of their purposes.

- Purchase Agreement: This is a comprehensive contract that details the terms of the sale, including the purchase price, payment terms, and any conditions that must be met before the sale is finalized.

- Confidentiality Agreement: Also known as a non-disclosure agreement, this document protects sensitive information shared during negotiations, ensuring that both parties keep proprietary details confidential.

- Due Diligence Checklist: This is a list of items that the buyer needs to review before completing the purchase. It often includes financial statements, tax returns, and contracts with suppliers or customers.

- Asset List: This document outlines all the assets included in the sale, such as equipment, inventory, and intellectual property, helping both parties understand what is being transferred.

- Financial Statements: These documents provide a snapshot of the business's financial health, including balance sheets and income statements, allowing the buyer to assess the value of the business.

- Letter of Intent to Lease: If the business operates in a leased space, this letter outlines the buyer's intent to assume the lease or negotiate a new one, ensuring continuity of operations.

- Employee Agreements: These documents clarify the status of current employees, including their roles and any agreements regarding their employment post-sale.

- Regulatory Approvals: Depending on the nature of the business, certain approvals or licenses may be required for the sale to proceed legally, ensuring compliance with local laws.

- Homeschool Letter of Intent: This essential document notifies the local school system of your intent to homeschool, and a blank form is here for your convenience.

- Financing Documents: If the buyer is securing financing to purchase the business, these documents outline the terms of the loan or investment, detailing repayment schedules and interest rates.

- Closing Statement: This document summarizes the final financial terms of the sale, including any adjustments made at closing, ensuring both parties agree on the final transaction details.

Each of these documents plays a crucial role in the business acquisition process, helping to establish a clear framework for the transaction. By understanding and preparing these forms, both buyers and sellers can navigate the complexities of purchasing a business more effectively.

More Types of Letter of Intent to Purchase Business Templates:

Letter of Intent to Invest - A preliminary document outlining the terms for a potential investment opportunity.

The Arizona Homeschool Letter of Intent is a formal document that parents or guardians submit to notify the state of their decision to homeschool their children. This letter serves as an essential first step in the homeschooling process, ensuring compliance with state regulations. For those looking to begin their homeschooling journey, it is vital to understand how to properly complete and submit this form, which can be found at https://hsintentletter.com/arizona-homeschool-letter-of-intent-form/, for a smooth homeschooling experience.

Key Details about Letter of Intent to Purchase Business

What is a Letter of Intent to Purchase Business?

A Letter of Intent (LOI) to Purchase Business is a document that outlines the preliminary agreement between a buyer and a seller regarding the sale of a business. It serves as a starting point for negotiations and typically includes key terms such as the purchase price, payment structure, and timelines. While it is not legally binding, it indicates the serious intent of the buyer to proceed with the purchase.

What should be included in a Letter of Intent?

An effective Letter of Intent should cover several important elements:

- Parties Involved: Clearly identify the buyer and seller.

- Business Description: Provide a brief overview of the business being sold.

- Purchase Price: State the proposed price and any conditions related to it.

- Payment Terms: Outline how the payment will be made (e.g., lump sum, installments).

- Due Diligence: Specify the timeframe for conducting due diligence.

- Confidentiality Clause: Include terms that protect sensitive information.

- Exclusivity Period: If applicable, mention any exclusivity agreements during negotiations.

Is a Letter of Intent legally binding?

Generally, a Letter of Intent is not legally binding. However, certain sections, such as confidentiality and exclusivity clauses, may be enforceable. It’s crucial to clarify which parts of the LOI are intended to be binding and which are not. This distinction helps prevent misunderstandings as negotiations progress.

Why is a Letter of Intent important?

A Letter of Intent is important because it lays the groundwork for the transaction. It helps both parties clarify their intentions and expectations before diving into more detailed agreements. By addressing key terms early on, it can save time and reduce the likelihood of disputes later in the process.

How does a Letter of Intent affect the negotiation process?

The Letter of Intent can significantly impact the negotiation process. It serves as a roadmap, guiding discussions and helping to align both parties' interests. By establishing a mutual understanding of the main terms, it can facilitate smoother negotiations. However, if either party feels that the LOI misrepresents their intentions, it may lead to complications.

Can a Letter of Intent be revised?

Yes, a Letter of Intent can be revised. As negotiations progress, either party may propose changes to the terms outlined in the LOI. Open communication is essential during this process. Both parties should be willing to discuss modifications to ensure that the document accurately reflects their intentions and agreements.

What happens after a Letter of Intent is signed?

Once a Letter of Intent is signed, the next steps typically involve conducting due diligence and drafting a formal purchase agreement. During due diligence, the buyer will investigate the business's financial, legal, and operational aspects. This phase is crucial for confirming the information provided by the seller. After due diligence is complete, both parties can move forward with finalizing the purchase agreement, which will be a legally binding document.

Similar forms

- Purchase Agreement: This document outlines the final terms of the sale. It includes details such as price, payment terms, and conditions. Like a Letter of Intent, it signifies the buyer's commitment.

- Memorandum of Understanding (MOU): An MOU expresses mutual understanding between parties. It is less formal than a contract but serves a similar purpose in outlining intentions.

- Investment Letter of Intent: This form is a crucial document that outlines the initial terms and conditions for investment interest, ensuring clarity in negotiations. For further details, visit https://pdftemplates.info.

- Non-Disclosure Agreement (NDA): An NDA protects sensitive information shared during negotiations. It ensures that both parties keep details confidential, similar to how a Letter of Intent may include confidentiality clauses.

- Term Sheet: This document summarizes the key points of a deal. It serves as a blueprint for the final agreement, similar to how a Letter of Intent outlines basic terms.

- Letter of Intent to Lease: This document is used when leasing property instead of purchasing a business. It expresses the intention to lease under specific terms, much like a Letter of Intent for buying a business.

- Business Plan: A business plan outlines the goals and strategies of a business. While it is more comprehensive, it shares the intent to pursue a specific direction, akin to a Letter of Intent.

- Sales Proposal: A sales proposal outlines how a product or service will be provided. It presents intentions similar to a Letter of Intent, focusing on the potential transaction.

- Joint Venture Agreement: This document details the terms of a partnership between two businesses. It shows a commitment to work together, similar to the intentions expressed in a Letter of Intent.

- Franchise Agreement: A franchise agreement establishes the terms under which a franchise operates. It reflects a commitment to a business model, similar to the intentions laid out in a Letter of Intent.

- Asset Purchase Agreement: This document is specific to buying certain assets of a business. It outlines the terms of the transaction, similar to how a Letter of Intent sets the stage for negotiations.

Guide to Filling Out Letter of Intent to Purchase Business

After obtaining the Letter of Intent to Purchase Business form, you will need to complete it accurately to ensure all necessary details are included. This will help facilitate the next steps in the purchasing process.

- Read the form carefully. Familiarize yourself with all sections before starting to fill it out.

- Enter your information. Fill in your name, address, and contact details at the top of the form.

- Provide the seller's information. Include the name and contact details of the business owner or representative you are negotiating with.

- Describe the business. Clearly state the name and address of the business you intend to purchase.

- Outline the purchase terms. Specify the proposed purchase price and any conditions that apply to the sale.

- Include a timeline. Indicate any deadlines for the completion of the sale or due diligence process.

- Sign and date the form. Ensure that you sign the document and include the date of signing.

Once you have completed the form, review it for accuracy before submitting it to the appropriate parties. This will help ensure a smooth transition into the next phase of the purchasing process.