Legal LLC Share Purchase Agreement Template

Misconceptions

Understanding the LLC Share Purchase Agreement can be challenging, and several misconceptions often arise. Here are ten common misunderstandings, along with clarifications:

- All LLCs require a Share Purchase Agreement. Not all LLCs issue shares. Some are member-managed, and ownership is represented by membership interests, not shares.

- Every LLC Share Purchase Agreement is the same. Each agreement can vary based on the specific terms negotiated by the parties involved. Customization is often necessary to fit unique situations.

- A Share Purchase Agreement only covers the sale price. While price is a key component, the agreement also includes terms regarding payment, representations, warranties, and conditions of the sale.

- Once signed, the agreement cannot be changed. Parties can amend the agreement if both agree to the changes. However, it’s essential to document any amendments properly.

- Only lawyers can draft a Share Purchase Agreement. While legal expertise is beneficial, parties can draft their own agreements. However, it is advisable to seek legal advice to ensure compliance with laws.

- A Share Purchase Agreement is unnecessary if the sale is informal. Even informal sales benefit from a written agreement to protect both parties and clarify the terms of the transaction.

- Signing the agreement means the sale is complete. The signing of the agreement is just one step. Other conditions may need to be met before the sale is finalized.

- All LLC members must agree to the sale. Depending on the operating agreement, not all members may need to consent to a sale. Check the specific terms outlined in the LLC's operating agreement.

- A Share Purchase Agreement is only for large transactions. These agreements can be used for both small and large transactions. The size of the deal does not determine the necessity of a formal agreement.

- Once the sale is complete, the agreement is irrelevant. The agreement remains important for reference and to resolve any potential disputes that may arise after the sale.

By addressing these misconceptions, individuals can better navigate the complexities of LLC transactions and ensure they are adequately protected throughout the process.

Documents used along the form

The LLC Share Purchase Agreement is a key document in the process of buying or selling shares in a limited liability company. However, several other forms and documents are often needed to support this transaction. Each document plays a unique role in ensuring that the process is clear and legally sound.

- Operating Agreement: This document outlines the management structure and operating procedures of the LLC. It details the rights and responsibilities of the members and can help clarify how shares are to be transferred.

- Letter of Intent: This is a preliminary agreement that outlines the basic terms of the proposed transaction. It serves as a roadmap for negotiations and demonstrates the intent of the parties to move forward.

- Articles of Incorporation: To establish a corporation in Colorado, it's essential to understand the key elements of the Articles of Incorporation form that lays the groundwork for your business entity.

- Due Diligence Checklist: This list helps the buyer conduct a thorough investigation of the LLC. It includes items such as financial statements, tax returns, and any pending legal issues.

- Disclosure Schedule: This document provides detailed information about the LLC's assets, liabilities, and any other material facts that the buyer should know before completing the purchase.

- Bill of Sale: This document officially transfers ownership of the shares from the seller to the buyer. It serves as proof of the transaction and can be important for record-keeping.

- Consent of Members: This form may be required to obtain approval from existing members of the LLC for the sale of shares. It ensures that all parties are aware of and agree to the transaction.

- Closing Statement: This document summarizes the final terms of the transaction and outlines any financial adjustments made at closing. It is essential for ensuring that all parties understand their obligations.

These documents collectively support the LLC Share Purchase Agreement by providing necessary details, ensuring compliance, and facilitating a smooth transaction. Each one contributes to a clearer understanding between the parties involved and helps protect their interests.

Fill out More Forms

Hiv Eclia Test Normal Range - Report time is crucial for timely communication of results.

When completing the transaction for the purchase of a trailer, it is crucial to utilize the appropriate documentation to ensure a smooth process. The New York Trailer Bill of Sale form is specifically designed for this purpose, providing all necessary information for both parties involved in the sale. For those looking to acquire a reliable template for this transaction, you can find one at https://nyforms.com/trailer-bill-of-sale-template/, which aids in ensuring that all requirements are met for a successful ownership transfer.

Deed in Lieu of Foreclosure Meaning - This option may be less damaging to a homeowner’s credit score compared to foreclosure.

Key Details about LLC Share Purchase Agreement

What is an LLC Share Purchase Agreement?

An LLC Share Purchase Agreement is a legal document that outlines the terms and conditions under which shares of an LLC (Limited Liability Company) are bought and sold. This agreement serves to protect both the buyer and the seller by clearly defining the rights and responsibilities of each party involved in the transaction.

Why is an LLC Share Purchase Agreement important?

This agreement is crucial for several reasons:

- It provides clarity on the terms of the sale, including the purchase price and payment method.

- It establishes the rights of the buyer and seller, helping to avoid misunderstandings or disputes.

- It ensures compliance with relevant laws and regulations, protecting both parties from potential legal issues.

Who should use an LLC Share Purchase Agreement?

Any individual or entity involved in the buying or selling of shares in an LLC should utilize this agreement. This includes:

- Current members of the LLC looking to sell their shares.

- New investors interested in purchasing shares to become members.

- Business partners involved in a transaction related to the LLC.

What key elements should be included in the agreement?

When drafting an LLC Share Purchase Agreement, consider including the following elements:

- The names and addresses of the buyer and seller.

- A description of the shares being sold, including the number and class of shares.

- The purchase price and payment terms.

- Representations and warranties from both parties.

- Conditions for closing the sale.

How is the purchase price determined?

The purchase price can be determined through various methods. Common approaches include:

- Mutual agreement between the buyer and seller based on market value.

- Valuation performed by a third-party expert.

- Using a formula outlined in the LLC's operating agreement, if applicable.

Can an LLC Share Purchase Agreement be modified?

Yes, the agreement can be modified, but any changes must be documented in writing and signed by both parties. This ensures that all modifications are legally binding and acknowledged by everyone involved.

What happens if one party breaches the agreement?

If a breach occurs, the non-breaching party may have several options, including:

- Seeking damages for any losses incurred due to the breach.

- Requesting specific performance, which compels the breaching party to fulfill their obligations under the agreement.

- Negotiating a settlement or amendment to the agreement.

Is legal advice recommended when creating an LLC Share Purchase Agreement?

Yes, seeking legal advice is highly recommended. An attorney experienced in business transactions can provide valuable insights and ensure that the agreement complies with state laws and adequately protects your interests.

Similar forms

- Stock Purchase Agreement: This document outlines the terms under which shares of stock are bought and sold. Like the LLC Share Purchase Agreement, it specifies the purchase price, payment terms, and representations of the seller.

- Membership Interest Purchase Agreement: This agreement is similar in that it governs the sale of membership interests in an LLC. It details the rights and obligations of both the buyer and seller, much like the LLC Share Purchase Agreement.

-

General Bill of Sale: This essential document transfer ownership of personal property and includes vital transaction details. It ensures the protection of both parties' rights and outlines the terms of the agreement, making it a fundamental component in the sale process. For more information, refer to Templates and Guide.

- Asset Purchase Agreement: While focusing on the purchase of specific assets rather than shares or membership interests, this document shares similarities in structure. It includes terms related to price, payment, and warranties from the seller.

- Operating Agreement: Although it serves a different purpose, the Operating Agreement can include provisions about the transfer of ownership interests. It complements the LLC Share Purchase Agreement by detailing how ownership changes are managed within the LLC.

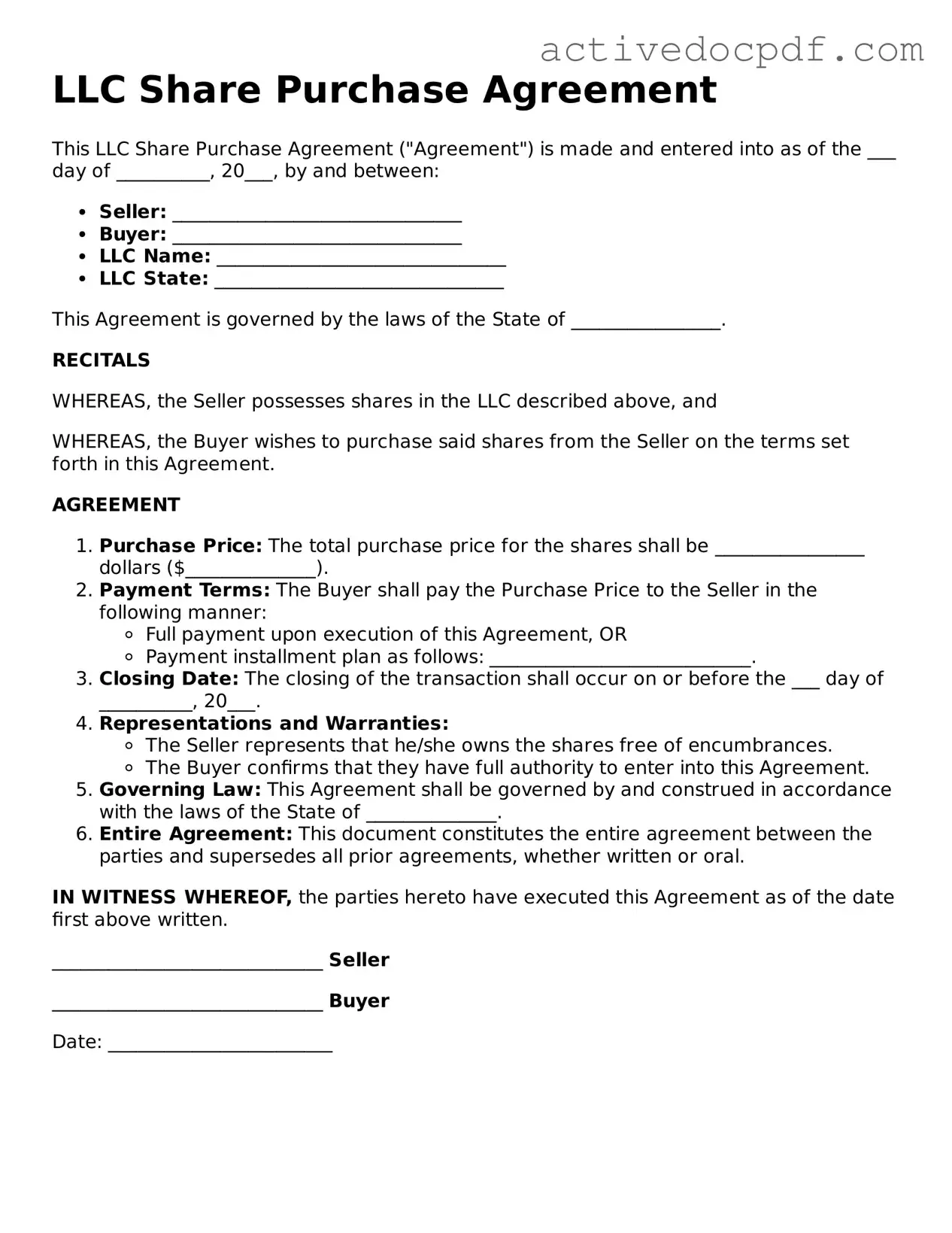

Guide to Filling Out LLC Share Purchase Agreement

Completing the LLC Share Purchase Agreement form is essential for finalizing the sale of shares in a limited liability company. This document serves as a formal record of the transaction and outlines the rights and obligations of both the buyer and the seller. Follow the steps below to ensure accurate completion of the form.

- Begin by entering the date at the top of the form. This should reflect the date on which the agreement is being executed.

- Fill in the names and addresses of both the buyer and the seller. Make sure to provide accurate and complete information for both parties.

- Clearly state the number of shares being sold. Specify the class of shares if applicable.

- Indicate the purchase price for the shares. This should be the total amount agreed upon by both parties.

- Include any payment terms, such as payment method and due dates. Be specific about how and when the payment will be made.

- Detail any representations and warranties made by the seller regarding the shares. This may include statements about ownership and the condition of the shares.

- Specify any conditions that must be met before the sale can be finalized. This could involve approvals or other requirements.

- Include a section for signatures. Both the buyer and seller must sign and date the agreement to make it binding.

- Make copies of the completed form for both parties. Retain a copy for your records as well.