Legal Loan Agreement Template

State-specific Guides for Loan Agreement Templates

Loan Agreement Document Categories

Misconceptions

Loan agreements are often misunderstood. Here are five common misconceptions about them:

-

All loan agreements are the same.

This is not true. Loan agreements can vary widely depending on the lender, the type of loan, and the specific terms negotiated between the parties. Each agreement should be tailored to meet the needs of both the borrower and the lender.

-

Verbal agreements are sufficient.

Many people believe that a verbal agreement is enough to secure a loan. However, without a written document, it can be difficult to enforce the terms of the agreement. A written loan agreement provides clarity and serves as legal evidence of the terms.

-

Loan agreements only protect the lender.

This misconception overlooks the fact that loan agreements also protect the borrower. They outline the responsibilities of both parties, including payment terms and what happens in case of default, ensuring that both sides understand their obligations.

-

Once signed, a loan agreement cannot be changed.

While it is true that a signed agreement is binding, parties can negotiate changes if both agree. Amendments can be made to the original document, but they must be documented in writing and signed by both parties to be enforceable.

-

Only banks use loan agreements.

This is a common misconception. Loan agreements are used by various lenders, including credit unions, private lenders, and even individuals lending money to friends or family. Any time money is borrowed, a loan agreement can be beneficial.

Documents used along the form

When entering into a loan agreement, several other forms and documents may be necessary to ensure clarity and legal protection for all parties involved. These documents help outline the terms, responsibilities, and rights of each party, creating a comprehensive understanding of the loan arrangement. Below is a list of commonly used forms that accompany a loan agreement.

- Promissory Note: This document serves as a written promise from the borrower to repay the loan amount. It outlines the repayment terms, including interest rates and due dates.

- Loan Application: A form completed by the borrower detailing their financial situation, credit history, and purpose for the loan. This helps lenders assess the borrower's eligibility.

- Credit Report Authorization: This document allows the lender to obtain the borrower’s credit report. It is essential for evaluating creditworthiness and determining loan terms.

- Guaranty Agreement: If a third party agrees to guarantee the loan, this document outlines their responsibility to repay the loan if the borrower defaults.

- Security Agreement: When the loan is secured by collateral, this document specifies the assets pledged by the borrower and the lender's rights to them in case of default.

- Disclosure Statement: This form provides important information about the loan, including fees, interest rates, and any potential penalties, ensuring transparency for the borrower.

- Amortization Schedule: This document details the repayment plan, showing how much of each payment goes toward principal and interest over the life of the loan.

- Durable Power of Attorney: This form allows you to appoint someone to make decisions on your behalf, ensuring your wishes are respected when you cannot communicate them yourself. To take control of your future, consider filling out the Durable Power of Attorney form.

- Loan Closing Statement: At the end of the loan process, this document summarizes the final terms of the loan, including the total amount financed, closing costs, and any other fees.

Understanding these documents can empower borrowers and lenders alike, ensuring that both parties are fully informed and protected throughout the lending process. Each form plays a crucial role in establishing a solid foundation for the financial relationship, minimizing misunderstandings and disputes.

Fill out More Forms

Employee Change of Status Form - Report a switch from contract to full-time employment using this form.

For families embarking on the homeschooling journey, understanding the importance of the Homeschool Letter of Intent form is crucial. This document serves as an official notification to the school district, marking a significant step in the educational process. By submitting this form, parents ensure they are abiding by state regulations and providing their children with a tailored educational experience. For more insights, refer to our guide on the essential aspects of the Homeschool Letter of Intent requirement at our website.

How to File Operating Agreement Llc - A well-crafted Operating Agreement can be beneficial in attracting potential investors by showing a solid framework.

Key Details about Loan Agreement

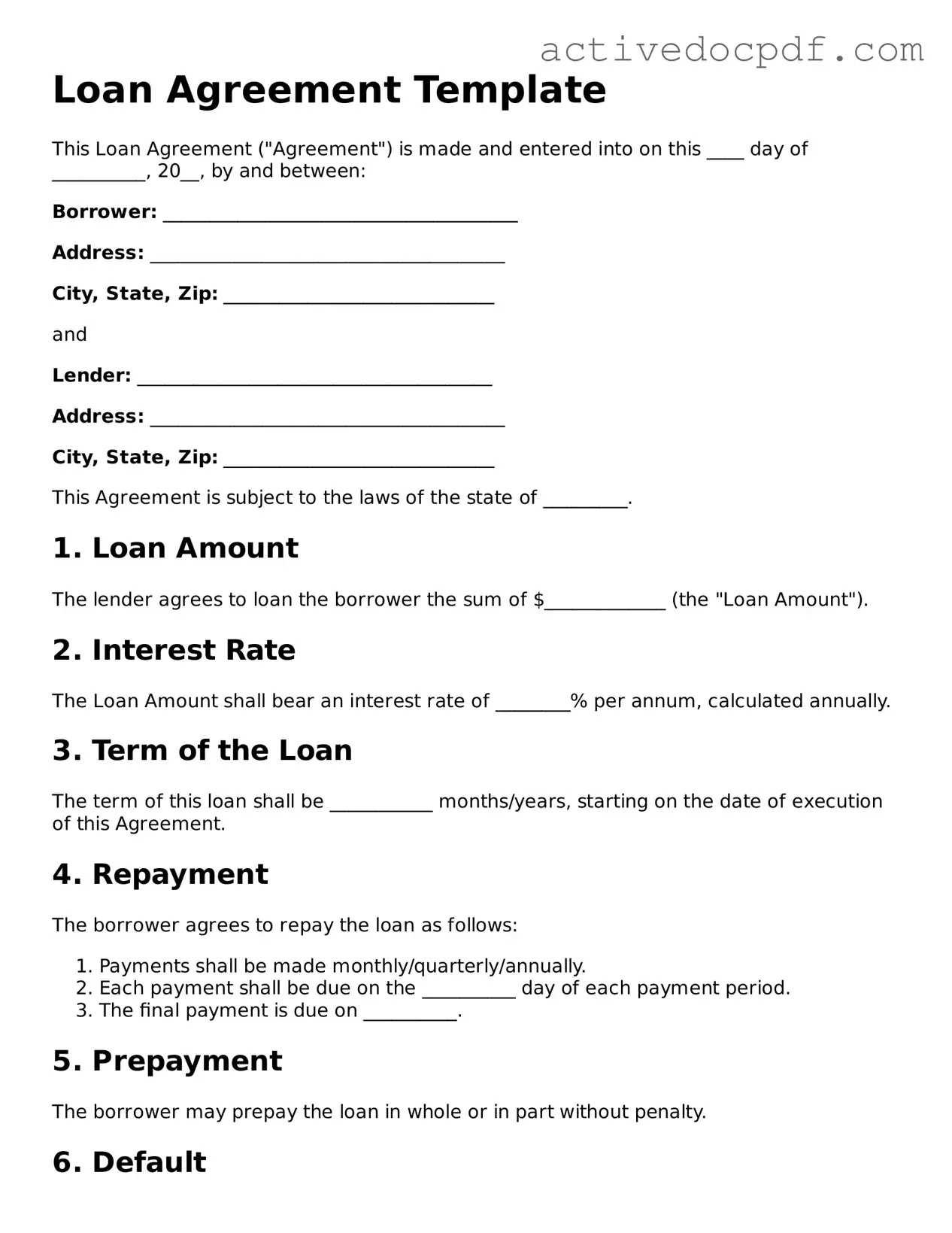

What is a Loan Agreement form?

A Loan Agreement form is a legal document that outlines the terms and conditions of a loan between a lender and a borrower. It serves to protect both parties by clearly defining the amount borrowed, interest rates, repayment schedule, and any collateral involved. This form is essential for ensuring that both the lender and borrower understand their rights and obligations.

What information do I need to provide when filling out the Loan Agreement form?

When completing a Loan Agreement form, you typically need to provide the following information:

- Borrower Information: Name, address, and contact details of the borrower.

- Lender Information: Name, address, and contact details of the lender.

- Loan Amount: The total sum being borrowed.

- Interest Rate: The percentage charged on the loan amount.

- Repayment Terms: Details on how and when the borrower will repay the loan.

- Collateral: Any assets pledged to secure the loan, if applicable.

Providing accurate and complete information is crucial for the validity of the agreement.

What happens if I can't repay the loan on time?

If a borrower fails to repay the loan on time, several consequences may occur. The lender may charge late fees, increase the interest rate, or take legal action to recover the owed amount. In some cases, if collateral was provided, the lender has the right to seize the asset. It’s important to communicate with the lender if repayment issues arise, as they may offer alternatives or solutions to avoid negative repercussions.

Can I modify the terms of the Loan Agreement after it has been signed?

Yes, it is possible to modify the terms of a Loan Agreement after it has been signed, but both parties must agree to the changes. This usually involves drafting an amendment to the original agreement, which should be signed by both the lender and borrower. It’s essential to document any changes in writing to maintain clarity and avoid misunderstandings in the future.

Is a Loan Agreement form legally binding?

Yes, a Loan Agreement form is legally binding, provided it meets certain criteria. Both parties must have the legal capacity to enter into a contract, and the agreement must include clear terms regarding the loan. If all necessary elements are present, the agreement can be enforced in a court of law, which underscores the importance of understanding the terms before signing.

Similar forms

The Loan Agreement form serves as a crucial document in financial transactions, establishing the terms and conditions between a lender and a borrower. Several other documents share similarities with a Loan Agreement, each serving specific purposes in various financial contexts. Here are eight documents that align closely with a Loan Agreement:

- Promissory Note: This document outlines the borrower's promise to repay a loan, detailing the amount, interest rate, and repayment schedule, much like a Loan Agreement.

- Mortgage Agreement: Similar to a Loan Agreement, this document secures a loan with real property, specifying the terms of the loan and the rights of the lender in case of default.

- Credit Agreement: This document governs the terms under which a lender extends credit to a borrower, including repayment terms and interest rates, akin to a Loan Agreement.

-

Operating Agreement: The operating agreement is crucial for LLCs, as it clarifies how the business will be managed, sets forth the rights and duties of members, and ensures legal compliance. For more guidance, visit PDF Documents Hub.

- Lease Agreement: While primarily for rental arrangements, this document shares the structure of outlining terms and obligations between parties, similar to a Loan Agreement's format.

- Security Agreement: This document provides the lender with a security interest in specific collateral, paralleling the Loan Agreement's focus on securing the lender's investment.

- Debt Settlement Agreement: This document outlines the terms under which a borrower settles a debt for less than the full amount owed, sharing the negotiation aspect found in Loan Agreements.

- Guaranty Agreement: This document involves a third party agreeing to repay a loan if the borrower defaults, emphasizing the obligation aspect similar to that of a Loan Agreement.

- Forbearance Agreement: This document allows a borrower to temporarily postpone payments, detailing terms that resemble those found in a Loan Agreement regarding obligations and conditions.

Guide to Filling Out Loan Agreement

After you’ve gathered all necessary information, it’s time to fill out the Loan Agreement form. This document is crucial for outlining the terms of your loan, ensuring that both parties are on the same page. Follow these steps carefully to complete the form accurately.

- Read the Instructions: Before you start, familiarize yourself with any instructions provided with the form. This will help you understand what information is required.

- Fill in Your Information: Start by entering your name, address, and contact details in the designated sections. Make sure this information is accurate.

- Provide Borrower Details: If you are not the borrower, include the borrower’s name and contact information. This ensures clarity about who is receiving the loan.

- Enter Loan Amount: Clearly state the total amount of money being borrowed. Double-check this figure to avoid mistakes.

- Specify Interest Rate: Indicate the interest rate for the loan. This is usually expressed as a percentage and is essential for calculating repayment amounts.

- Outline Repayment Terms: Describe how and when the borrower will repay the loan. Include details like the repayment schedule and due dates.

- Sign and Date: Both parties must sign and date the agreement. This step is crucial as it signifies that both parties agree to the terms laid out in the document.

Once the form is filled out and signed, ensure that each party retains a copy for their records. This will help avoid any confusion in the future.