Free Louisiana act of donation PDF Form

Misconceptions

The Louisiana act of donation form is an important legal document, but there are several misconceptions surrounding it. Understanding these misconceptions can help individuals navigate the process more effectively. Here are nine common misunderstandings:

- It is only for wealthy individuals. Many people believe that the act of donation is only necessary for those with substantial assets. In reality, anyone can use this form to donate property, regardless of their financial status.

- It requires a lawyer to complete. While having legal assistance can be beneficial, it is not mandatory. Individuals can fill out the form on their own, provided they understand the requirements and implications of their donation.

- It can only be used for real estate. Some think that the act of donation applies solely to real estate transactions. However, it can also be used for personal property, such as vehicles or valuable items.

- Once signed, it cannot be changed. Many assume that the act of donation is final and unchangeable. In fact, donors can revoke or modify their donation under certain circumstances, as long as they follow the proper procedures.

- It is the same as a will. There is a common belief that the act of donation serves the same purpose as a will. However, a will distributes assets after death, while an act of donation transfers ownership during the donor's lifetime.

- It must be notarized to be valid. While notarization can add an extra layer of security, it is not always a requirement for the act of donation to be legally binding. It is essential to check the specific requirements for your situation.

- Only family members can be beneficiaries. Some people think that donations can only be made to relatives. In truth, individuals can donate to anyone they choose, including friends, charities, or organizations.

- It has no tax implications. Many believe that donating property is entirely tax-free. However, there may be tax consequences for both the donor and the recipient, depending on the value of the donated property.

- It is a complicated process. A common misconception is that completing the act of donation is overly complex. While there are specific steps to follow, the process can be straightforward if one takes the time to understand the requirements.

By dispelling these misconceptions, individuals can make more informed decisions regarding the Louisiana act of donation form and ensure that their intentions are properly documented and executed.

Documents used along the form

The Louisiana Act of Donation form is a key document used to transfer property ownership without compensation. However, there are several other forms and documents that often accompany this act to ensure a smooth and legally sound transaction. Below is a list of related documents that may be useful.

- Property Deed: This document officially records the transfer of property ownership. It includes details about the property and the parties involved in the transaction.

- IRS Form 2553: This form is essential for small businesses to elect S corporation status, providing potential tax advantages. For more information, visit PDF Documents Hub.

- Affidavit of Identity: This sworn statement verifies the identity of the parties involved. It helps to prevent fraud and confirms that the individuals signing the documents are who they claim to be.

- Title Search Report: This report examines the property’s title history. It identifies any liens, claims, or other issues that could affect ownership.

- Gift Tax Return: If the donation exceeds a certain value, the donor may need to file a gift tax return. This document reports the value of the gift to the IRS.

- Power of Attorney: This document allows one person to act on behalf of another in legal matters. It can be useful if the donor is unable to sign the act of donation in person.

- Notice of Donation: This is a formal notification to inform interested parties about the donation. It can help prevent disputes by making the transfer public.

- Insurance Policy Transfer: If the property has insurance, this document transfers the policy to the new owner. It ensures that the property remains protected after the donation.

- Closing Statement: This document summarizes the financial details of the transaction. It outlines any fees, taxes, and other costs associated with the donation process.

Each of these documents plays a crucial role in the donation process, helping to clarify the terms and protect the interests of all parties involved. Proper documentation ensures that the transfer of property is legally recognized and minimizes the risk of future disputes.

Check out Popular Documents

Blank Pdf Invoice - Create invoices on-the-go with this mobile-friendly PDF solution.

In order to ensure seamless package delivery even in your absence, it is important to understand the role of the FedEx Release Form. This document allows you to authorize delivery at a designated location, eliminating any potential delivery issues. For those who anticipate being away during delivery times, completing this form correctly is vital. For more information, you can refer to the Fedex Door Tag Authorization to help guide your preparation.

Medication Administration Record Pdf Fillable - Abbreviations like R for refused and D for discontinued aid quick entries.

Key Details about Louisiana act of donation

What is the Louisiana Act of Donation Form?

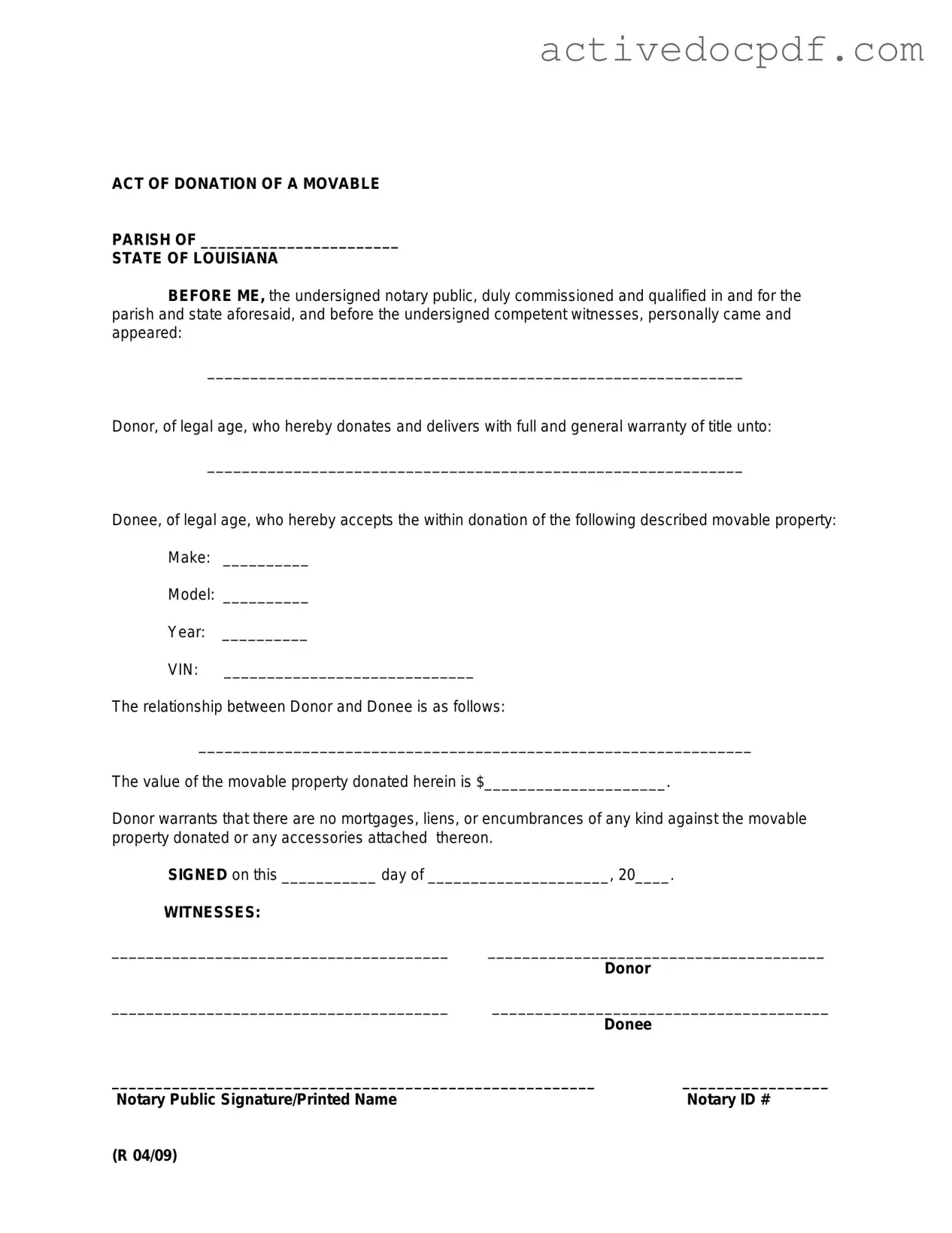

The Louisiana Act of Donation Form is a legal document that allows an individual, known as the donor, to give property or assets to another person, known as the donee, without expecting anything in return. This form is commonly used for the transfer of immovable property, such as real estate, and can also apply to movable property, such as vehicles or personal belongings. It is a formal way to ensure that the transfer is recognized under Louisiana law.

Who can use the Act of Donation Form?

Any individual who has the legal capacity to donate property can use the Louisiana Act of Donation Form. This typically includes adults who are of sound mind and not under any legal restrictions. Additionally, the donee must also have the legal capacity to accept the donation. It is important to ensure that both parties understand the implications of the donation.

What are the requirements for a valid donation?

To ensure that a donation is legally valid under Louisiana law, several requirements must be met:

- The donor must have the legal capacity to donate.

- The donation must be made voluntarily and without coercion.

- The property being donated must be clearly identified.

- The donation must be accepted by the donee.

- In some cases, a notary public and witnesses may be required for the document to be valid.

Is there a tax implication for donations made using this form?

Yes, there may be tax implications for both the donor and the donee when a donation is made. In general, the donor may be subject to gift tax if the value of the donated property exceeds the annual exclusion limit set by the IRS. The donee, on the other hand, may need to consider the basis of the property for future capital gains tax purposes. It is advisable to consult with a tax professional to understand the specific implications of a donation.

Can the Act of Donation be revoked?

In Louisiana, a donation can be revoked under certain circumstances. If the donor wishes to revoke the donation, it must be done formally, typically through a written document. Additionally, if the donee engages in misconduct or fails to fulfill certain conditions set forth in the donation, the donor may have grounds for revocation. It is essential to seek legal advice to navigate the revocation process appropriately.

Similar forms

- Gift Deed: Similar to the Louisiana act of donation form, a gift deed transfers ownership of property from one person to another without any exchange of money. Both documents require the intention to give and acceptance by the recipient.

- Will: A will outlines how a person’s property should be distributed after their death. Like the act of donation, it involves the transfer of ownership, but a will takes effect only upon death, while the act of donation is effective immediately.

- Trust Agreement: A trust agreement allows a person to transfer assets to a trustee for the benefit of another. Both the trust agreement and the act of donation require clear intent and can specify conditions for the transfer.

- Sales Agreement: While a sales agreement involves a transaction for consideration, it shares similarities with the act of donation in that both documents formally outline the transfer of property rights and responsibilities between parties.

- Lease Agreement: A lease agreement grants temporary possession of property in exchange for payment. Both documents define the rights of the parties involved, though the lease is typically for a limited time, while an act of donation is permanent.

- Power of Attorney: A power of attorney allows one person to act on behalf of another. Like the act of donation, it involves a transfer of authority and can specify the scope of the powers granted, although it does not transfer ownership of property.

-

The Florida Hold Harmless Agreement form ensures protection against liabilities stemming from activities or events. To learn more about this form, you can access and download the document.

- Charitable Donation Receipt: A charitable donation receipt documents a gift made to a nonprofit organization. Similar to the act of donation, it formalizes the transfer of property and may have tax implications for the donor.

Guide to Filling Out Louisiana act of donation

Filling out the Louisiana Act of Donation form is an important step in transferring property or assets to another person. Once completed, this form will need to be submitted to the appropriate authorities to finalize the donation process. Here are the steps to follow:

- Begin by obtaining the Louisiana Act of Donation form. You can find it online or at your local courthouse.

- Fill in the date at the top of the form. This should be the date you are completing the document.

- Provide the full name and address of the donor, the person making the donation.

- Next, enter the full name and address of the donee, the person receiving the donation.

- Clearly describe the property or assets being donated. Be specific about the details to avoid any confusion.

- Indicate whether the donation is made with any conditions or restrictions. If there are none, state that explicitly.

- Both the donor and donee should sign the form. Make sure to date the signatures.

- Have the form notarized. This step is essential to ensure the document is legally binding.

- Make copies of the completed form for your records before submitting it.

- Submit the original form to the appropriate local authority or office as required.