Free Membership Ledger PDF Form

Misconceptions

Misconceptions about the Membership Ledger form can lead to confusion and errors. Here are nine common misunderstandings:

- It is only for new members. The Membership Ledger form is used for both new and existing members. It tracks all transfers and issuances of membership interests.

- Only the company can fill it out. While the company initiates the form, members can also provide necessary information, especially during transfers.

- It is optional. Completing the Membership Ledger form is mandatory for accurate record-keeping and compliance with regulations.

- All transfers are immediate. Transfers may take time to process. Members should allow for potential delays and follow up as needed.

- Only one form is needed per year. Each transaction requires a separate form. This ensures that all transfers and issuances are documented accurately.

- It does not need to be updated regularly. The form must be updated promptly after any transaction to maintain accurate records.

- There are no consequences for inaccuracies. Errors can lead to legal issues and disputes. Accuracy is crucial for all entries.

- Members can ignore it if they are not transferring interests. All members should be aware of the form and its purpose, even if they are not currently transferring interests.

- It is only for financial records. The Membership Ledger form also includes important details about member identity and residency, which are essential for compliance.

Understanding these points will help ensure that the Membership Ledger form is used correctly and effectively. Stay informed and proactive to avoid potential pitfalls.

Documents used along the form

The Membership Ledger form serves as a crucial document in tracking the issuance and transfer of membership interests within a company. However, it is often accompanied by several other forms and documents that facilitate the management of membership interests. Below is a list of related documents that are commonly used alongside the Membership Ledger form, each serving a specific purpose.

- Membership Application Form: This document is filled out by individuals seeking to become members of a company. It collects essential information such as personal details, contact information, and the type of membership desired.

- Membership Agreement: This is a contract between the company and its members, outlining the rights and responsibilities of each party. It often includes terms regarding membership fees, voting rights, and the process for transferring membership interests.

- Employment Verification Form: This essential document is used by employers to validate an individual's employment history, including details such as job title and duration of employment. For more information on how to fill it out properly, visit documentonline.org/.

- Transfer of Membership Interest Form: When a member wishes to transfer their interest to another party, this form is used to document the transaction. It requires details about both the transferor and transferee, as well as the amount being transferred.

- Certificate of Membership: This certificate serves as proof of membership in the company. It typically includes the member's name, the number of interests held, and other relevant details, often signed by an authorized company representative.

- Meeting Minutes: These are official records of what transpired during company meetings, including discussions about membership interests. They provide context and transparency regarding decisions made by the members.

- Annual Report: Companies often prepare annual reports that include information about membership interests, financial performance, and future projections. This document helps members stay informed about the company's status.

- Membership Interest Valuation Report: This report assesses the current value of membership interests within the company. It is particularly useful during transfers and can help members make informed decisions.

- Tax Forms: Members may need to complete various tax forms related to their membership interests. These documents ensure compliance with federal and state tax regulations and provide necessary financial information for tax reporting.

Each of these documents plays a vital role in the administration of membership interests, ensuring clarity, compliance, and effective communication among members and the company. Understanding the purpose and function of these forms can significantly enhance the management of membership-related matters.

Check out Popular Documents

How to Make a Job Application Form - This application lays the groundwork for potential employment.

When forming a corporation, it's essential to prepare the New York Articles of Incorporation form, which provides a comprehensive overview of your business's foundational details. This legal document ensures compliance with state regulations and protects your entity's interests. For convenience, you can learn more about how to fill out this important document at PDF Documents Hub.

P45 What Is It - The form indicates the employee's tax code at the time of leaving.

Hazmat Bol Example - Proper markings and labels must accompany hazardous materials shipments.

Key Details about Membership Ledger

What is the Membership Ledger form used for?

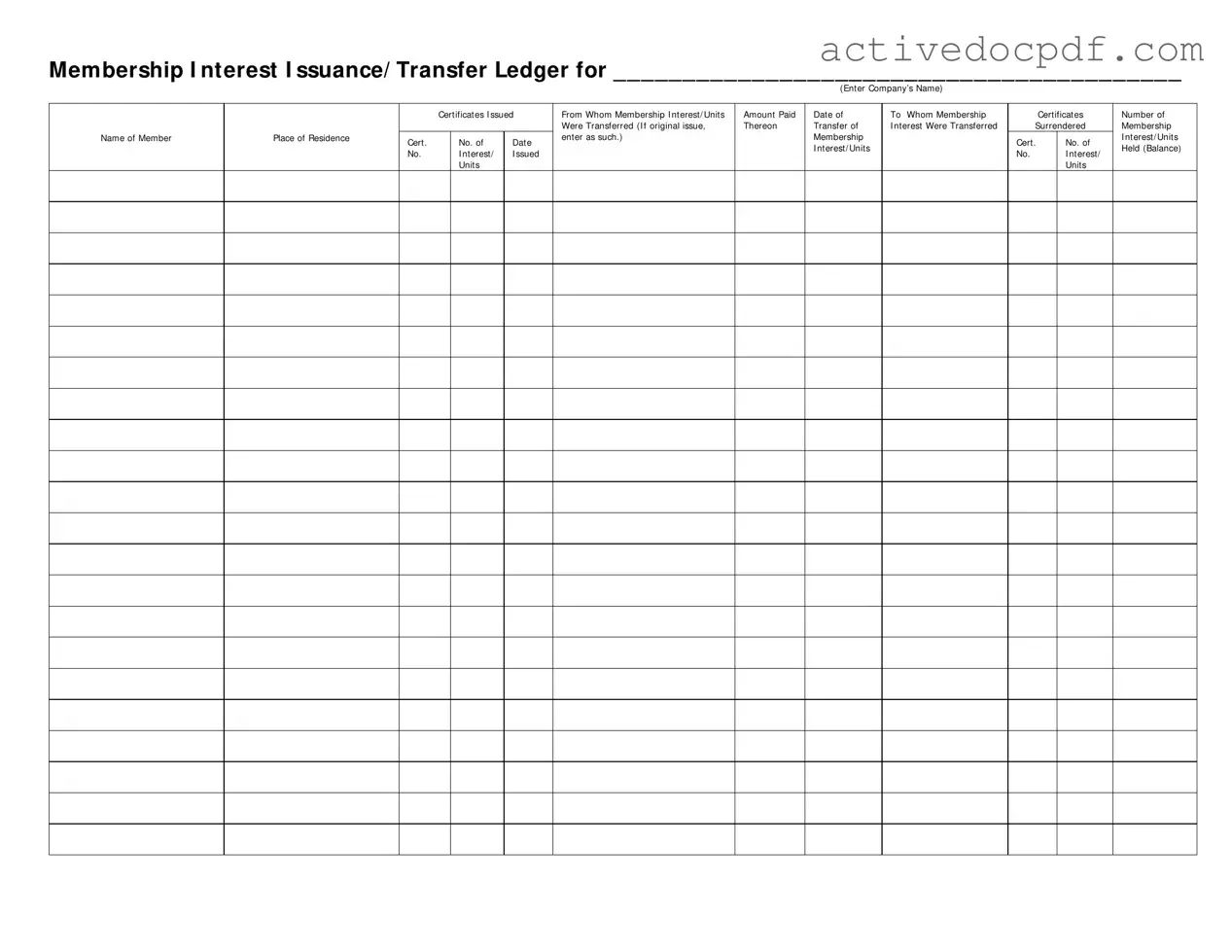

The Membership Ledger form tracks the issuance and transfer of membership interests or units within a company. It serves as a record of who holds membership interests, how many they hold, and any transactions involving those interests.

What information is required on the Membership Ledger form?

The form requires several key pieces of information, including:

- The name of the company.

- Details of certificates issued, including the amount paid and the date of issuance.

- Information about transfers, including the name of the member transferring the interest, the recipient's name, and the certificate number.

- The number of membership interests or units held after any transfers.

Who is responsible for filling out the Membership Ledger form?

The responsibility for completing the Membership Ledger form typically falls to the company's secretary or an authorized officer. This individual must ensure that all transactions are accurately recorded and that the ledger is kept up to date.

How often should the Membership Ledger form be updated?

The Membership Ledger should be updated each time there is a transaction involving membership interests. This includes the issuance of new certificates and any transfers of interests. Regular updates help maintain accurate records and facilitate transparency.

What happens if a mistake is made on the Membership Ledger form?

If an error occurs, it is essential to correct it promptly. The incorrect entry should be crossed out or noted, and the correct information should be added. It's important to maintain a clear and accurate record, as inaccuracies can lead to disputes or legal issues.

Can the Membership Ledger form be used for electronic records?

Yes, the Membership Ledger can be maintained electronically, provided that the electronic format captures all necessary information and is secure. Companies should ensure that electronic records comply with applicable regulations and can be easily accessed for audits or reviews.

Is there a specific format for the Membership Ledger form?

While there is no universally mandated format, the form should include all required information in a clear and organized manner. Companies may create their own template, but it must capture the essential details outlined in the Membership Ledger guidelines.

What are the consequences of not maintaining a Membership Ledger?

Failing to maintain an accurate Membership Ledger can lead to several issues, including disputes over ownership, difficulties in transferring interests, and potential legal ramifications. It is crucial for companies to keep this record updated to ensure compliance and protect their interests.

How long should the Membership Ledger be retained?

Companies should retain the Membership Ledger for as long as the membership interests are active. Additionally, it is advisable to keep historical records for a period of time after interests have been transferred or terminated, typically in line with state regulations.

Where can I find a template for the Membership Ledger form?

Templates for the Membership Ledger form can often be found online through legal resources or business compliance websites. Companies may also consult with legal professionals to create a customized ledger that meets their specific needs.

Similar forms

The Membership Ledger form serves as an important tool for tracking membership interests and transactions. Several other documents share similarities with this form, particularly in their purpose and structure. Here are seven such documents:

- Shareholder Ledger: Like the Membership Ledger, the Shareholder Ledger records the ownership of shares in a corporation. It tracks who owns shares, how many they own, and any transfers of ownership.

- Partnership Interest Ledger: This document is used to keep track of the ownership interests in a partnership. It details who the partners are, their respective ownership percentages, and any changes in those interests.

- Stock Transfer Ledger: Similar to the Membership Ledger, this ledger records the transfer of stock ownership. It includes information about the parties involved in the transfer and the number of shares exchanged.

- Membership Certificate: While the Membership Ledger tracks transactions, the Membership Certificate serves as proof of ownership. It provides details about the member and their interest in the organization.

- Unit Holder Register: This document is akin to the Membership Ledger but specifically for investment funds. It lists the names of unit holders and the number of units they own, along with any transfers that occur.

- Corporate Minutes: Although different in format, corporate minutes often include records of ownership changes and decisions related to membership interests. They document the actions taken during meetings, which can affect membership status.

-

Trailer Bill of Sale: This crucial document facilitates the sale of a trailer, outlining key information such as purchase price and trailer description. For detailed guidance and a template, visit nyforms.com/trailer-bill-of-sale-template.

- Transfer Agent Records: These records are maintained by a transfer agent and serve a similar function to the Membership Ledger. They keep track of ownership changes and ensure accurate records of who owns what.

Guide to Filling Out Membership Ledger

After gathering all necessary information, you can proceed to fill out the Membership Ledger form. This process will involve entering details about membership interests, transfers, and certificates. Follow the steps below to complete the form accurately.

- Begin by entering the Company’s Name at the top of the form.

- In the section labeled Certificates Issued From, provide the name of the individual or entity that issued the certificates.

- Next, fill in the Membership Interest/Units section with the appropriate details about the units being issued or transferred.

- Indicate the Amount Paid for the membership interest or units.

- Record the Date of Transfer for the transaction.

- In the To Whom Membership Were Transferred section, enter the name of the individual or entity receiving the membership interest.

- Provide the Name of Member who is transferring the interest.

- List the Place of Residence of the member transferring the interest.

- Document the Certificate Number associated with the membership interest being transferred.

- If applicable, indicate the Date Membership Interest/Units Were Transferred.

- In the section for Membership Interest/Units Surrendered, include the relevant details if any units were surrendered.

- Lastly, record the Number of Membership Interest/Units Held (Balance) to reflect the remaining interests after the transfer.