Free Mortgage Statement PDF Form

Misconceptions

Understanding your mortgage statement is crucial for managing your finances. However, several misconceptions can lead to confusion. Here are five common misunderstandings:

- Late Fees Are Automatic: Many believe that late fees are charged immediately after the due date. In reality, a grace period is often provided. Fees only apply if payment is not received by a specified date.

- Partial Payments Count Towards the Mortgage: Some homeowners think that making a partial payment will reduce their mortgage balance. This is not the case. Partial payments are typically held in a suspense account and do not apply to the mortgage until the full amount is paid.

- Escrow is Optional: There is a misconception that escrow for taxes and insurance is optional. In many cases, lenders require escrow to ensure that these important payments are made on time.

- All Fees Are Clearly Listed: Some assume that all fees associated with the mortgage will be explicitly detailed. While many fees are listed, some may not be included in the statement, leading to unexpected charges.

- Delinquency Notices Are Just Warnings: Many borrowers think that a delinquency notice is merely a reminder. However, it is a serious alert. Ignoring it can lead to additional fees or even foreclosure.

Being aware of these misconceptions can help you better understand your mortgage statement and avoid potential pitfalls. If you have questions, consider reaching out to your loan servicer for clarification.

Documents used along the form

When managing a mortgage, several important documents accompany the Mortgage Statement form. Each of these documents serves a unique purpose and helps borrowers understand their financial obligations. Below is a list of common forms and documents that often work alongside the Mortgage Statement.

- Loan Agreement: This document outlines the terms of the mortgage, including the loan amount, interest rate, repayment schedule, and any penalties for late payments. It is the foundational contract between the borrower and the lender.

- Amortization Schedule: This schedule breaks down each mortgage payment into principal and interest components over the life of the loan. It helps borrowers see how much they owe over time and how their payments affect the loan balance.

- Escrow Account Statement: This statement details the funds set aside for property taxes and insurance. It shows how much is collected, disbursed, and any adjustments that may be needed for the upcoming year.

- Property Tax Bill: This document indicates the amount of property tax owed on the home. It is essential for homeowners to keep track of these payments, as failure to pay can lead to penalties or even foreclosure.

- Employment Verification Form - This document is essential for confirming an employee's job status and can be crucial for processes such as securing housing or applying for loans. For a detailed template, you can visit Fast PDF Templates.

- Insurance Policy Document: This document provides proof of homeowners insurance coverage. It details the policy limits, coverage types, and any exclusions, ensuring that the property is protected against potential risks.

- Payment History Statement: This statement summarizes all payments made on the mortgage, including dates and amounts. It helps borrowers track their payment behavior and identify any discrepancies.

- Delinquency Notice: This notice alerts borrowers to missed payments and the potential consequences of continued delinquency. It often includes a timeline for bringing the loan current to avoid further action.

Understanding these documents is crucial for any borrower. They provide clarity on financial responsibilities and help maintain good standing with the lender. Keeping these forms organized can lead to a smoother mortgage experience.

Check out Popular Documents

Army Retirement Points - Commands are responsible for ensuring timely processing of this form.

Usda Aphis 7001 - This form is a vital step in ensuring compliance with both domestic and international travel standards.

To facilitate the transfer process, it's crucial for both the buyer and seller to have access to the necessary documents, including the Dirt Bike Bill of Sale. This form not only protects both parties but also helps to clarify the terms of the sale. For those looking to obtain this document quickly and efficiently, consider visiting PDF Documents Hub.

Florida 4 Point Inspection Form - This inspection report is not a guarantee of the systems' safety or longevity post-inspection.

Key Details about Mortgage Statement

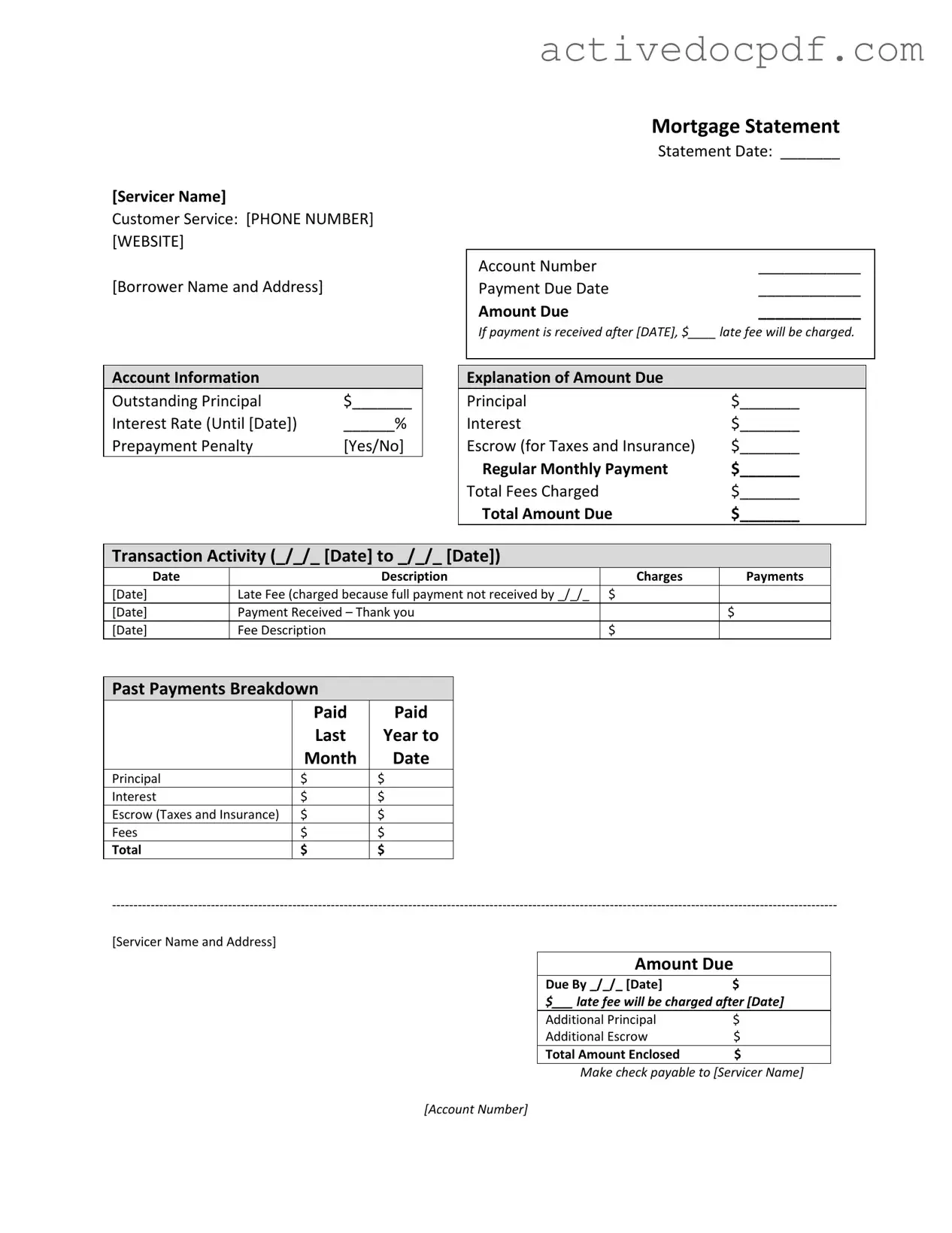

What is a Mortgage Statement?

A Mortgage Statement is a document provided by your mortgage servicer that outlines important information about your mortgage loan. It includes details such as the outstanding principal balance, interest rate, payment due date, and the amount you owe for the current billing cycle. This statement serves as a helpful tool for managing your mortgage payments and understanding your financial obligations.

What information can I find on my Mortgage Statement?

Your Mortgage Statement contains several key pieces of information, including:

- Account number

- Payment due date

- Outstanding principal balance

- Interest rate

- Escrow amounts for taxes and insurance

- Total amount due, including any fees

- Transaction activity, showing recent payments and charges

This information is crucial for tracking your mortgage and ensuring timely payments.

What happens if I miss a payment?

If you miss a payment, your Mortgage Statement will reflect a late fee, which is typically charged if the payment is not received by a specified date. Additionally, missing payments can lead to serious consequences, including potential foreclosure. It is important to address missed payments as soon as possible to avoid further complications.

What is a late fee, and how is it calculated?

A late fee is a charge that may be applied if your mortgage payment is not received by the due date. The amount of the late fee is typically specified on your Mortgage Statement and is calculated based on the terms of your loan agreement. It is essential to review your statement for the exact amount and conditions related to late fees.

What should I do if I cannot make my mortgage payment?

If you are experiencing financial difficulty and are unable to make your mortgage payment, it is crucial to reach out to your mortgage servicer as soon as possible. They may offer options such as mortgage counseling or assistance programs to help you navigate your situation. Taking action early can help prevent further financial distress.

What are partial payments, and how are they handled?

Partial payments are amounts that are less than the total mortgage payment due. Your Mortgage Statement will indicate that any partial payments are not applied directly to your mortgage balance. Instead, these funds are held in a separate suspense account until you pay the remaining balance. Once the full payment is made, the funds will then be applied to your mortgage.

How can I make my mortgage payment?

You can typically make your mortgage payment in several ways, including online through your servicer's website, by mail with a check, or through automatic bank deductions. Your Mortgage Statement will provide specific instructions on how to make your payment, including the address for mailing checks and any online payment options available.

What is an escrow account, and why is it important?

An escrow account is a separate account set up by your mortgage servicer to hold funds for property taxes and insurance premiums. Your Mortgage Statement will detail the escrow amounts included in your monthly payment. This account is important because it ensures that these essential expenses are paid on time, helping to protect your investment in your home.

What does it mean if I see a delinquency notice on my Mortgage Statement?

A delinquency notice indicates that you are behind on your mortgage payments. Your Mortgage Statement will specify how many days you are delinquent and the total amount required to bring your loan current. It is vital to address this issue promptly to avoid additional fees and the risk of foreclosure.

How can I contact my mortgage servicer for assistance?

Your Mortgage Statement will provide contact information for your mortgage servicer, including a customer service phone number and website. If you have questions or need assistance, do not hesitate to reach out to them. They are there to help you understand your mortgage and provide support as needed.

Similar forms

-

Billing Statement: Like a mortgage statement, a billing statement provides a summary of charges, payments, and balances due. It details what a customer owes for services rendered, including any late fees and previous payments, allowing for easy tracking of financial obligations.

-

Loan Statement: A loan statement outlines the terms and conditions of a loan, including the outstanding balance, interest rate, and payment history. Similar to a mortgage statement, it informs the borrower of their current financial standing and any amounts due.

Do Not Resuscitate Order: For those considering end-of-life care options, our comprehensive guide on Do Not Resuscitate Order forms is essential for ensuring that healthcare providers respect patient wishes.

-

Property Tax Statement: This document details the amount owed for property taxes, including any applicable penalties for late payments. Both the property tax statement and mortgage statement serve to inform the homeowner of their financial responsibilities related to property ownership.

-

Credit Card Statement: A credit card statement summarizes transactions made within a billing cycle, including charges, payments, and interest accrued. Like a mortgage statement, it provides a clear picture of what is owed and any potential fees for late payments.

-

Utility Bill: A utility bill outlines charges for services such as electricity, water, or gas. Similar to a mortgage statement, it includes the total amount due, payment due date, and any late fees that may apply if payment is not received on time.

-

Insurance Statement: This document details the premiums owed for various types of insurance, including homeowners insurance. Like a mortgage statement, it provides information on payment amounts, due dates, and any potential penalties for late payments.

Guide to Filling Out Mortgage Statement

Completing the Mortgage Statement form requires careful attention to detail. Accurate information ensures that all parties involved understand the current status of the mortgage account. Below are the steps to fill out the form correctly.

- Start by entering the Servicer Name at the top of the form.

- Provide the Customer Service Phone Number and Website for the servicer.

- Fill in the Borrower Name and Address section with the appropriate details.

- In the Statement Date field, write the date of the statement.

- Input the Account Number associated with the mortgage.

- Enter the Payment Due Date for the current month.

- Specify the Amount Due for the mortgage payment.

- Indicate the date after which a late fee will be charged, along with the amount of the fee.

- In the Account Information section, fill in the Outstanding Principal amount.

- Record the Interest Rate applicable until the specified date.

- State whether there is a Prepayment Penalty (Yes or No).

- Break down the Explanation of Amount Due into its components: Principal, Interest, Escrow, Regular Monthly Payment, Total Fees Charged, and Total Amount Due.

- For the Transaction Activity, enter the date range and detail any charges or payments made during that period.

- Document any Late Fees charged and any payments received, including the date and amount.

- In the Past Payments Breakdown, provide details for each payment made last year, including Principal, Interest, Escrow, Fees, and Total.

- Complete the Amount Due section, specifying the due date and any applicable late fees.

- State the Total Amount Enclosed if sending a payment.

- Make sure to note that checks should be made payable to the Servicer Name and include the Account Number.

- Review the Important Messages section for any relevant notes regarding partial payments and delinquency notices.