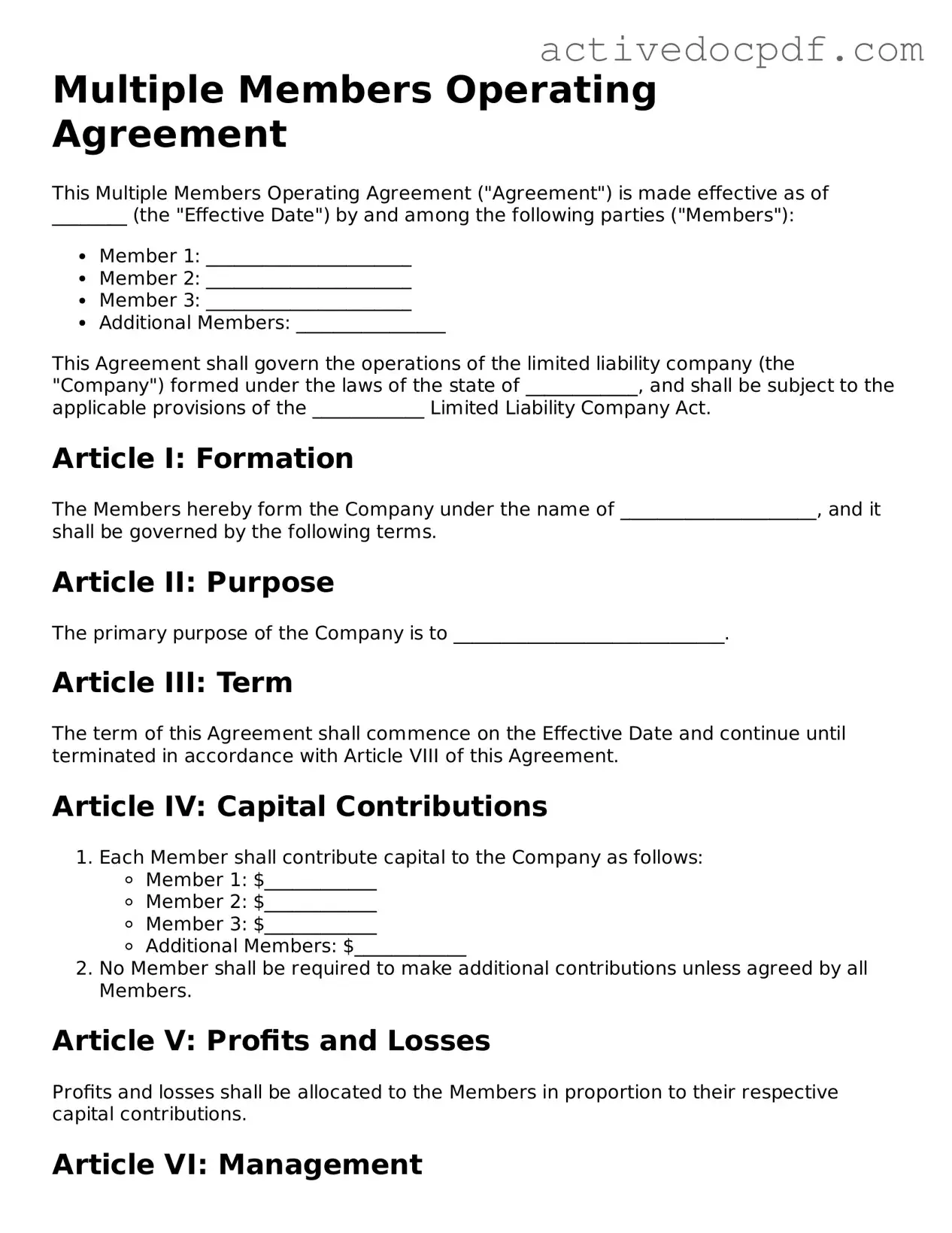

Legal Multiple Members Operating Agreement Template

Misconceptions

Understanding the Multiple Members Operating Agreement (MMOA) is essential for any business with multiple owners. However, several misconceptions can lead to confusion. Here are six common misconceptions:

- It is only for large businesses. Many believe that an MMOA is necessary only for corporations or large enterprises. In reality, any business with multiple members, regardless of size, can benefit from having this agreement in place.

- It is a one-time document. Some think that once the MMOA is created, it does not need to be revisited. However, as the business evolves, the agreement should be reviewed and updated to reflect changes in ownership, roles, or business goals.

- It is legally required in all states. While an MMOA is highly recommended, it is not legally mandated in every state. However, having one can help prevent disputes and clarify the responsibilities of each member.

- All members must agree on every decision. Many assume that unanimous consent is required for all decisions. In fact, the MMOA can outline specific decision-making processes, allowing for majority votes or designated authorities.

- It only covers financial aspects. Some people think the MMOA focuses solely on finances. In truth, it can address various topics, including member roles, dispute resolution, and exit strategies, providing a comprehensive framework for the business.

- It is too complicated to create. Many feel that drafting an MMOA is a daunting task. While it involves important considerations, templates and professional guidance can simplify the process, making it accessible for all business owners.

Documents used along the form

The Multiple Members Operating Agreement is a key document for any LLC with more than one owner. It outlines the management structure and operating procedures of the business. However, several other forms and documents often accompany this agreement to ensure clarity and compliance. Here’s a list of those important documents.

- Articles of Organization: This document officially establishes the LLC with the state. It includes basic information like the business name, address, and the names of the members.

- Member Consent Forms: These forms are used to document the approval of major decisions by all members. They help ensure that everyone is on the same page regarding significant changes.

- Bylaws: While not always required, bylaws outline the internal rules and procedures for the LLC. They can cover topics like meeting schedules and voting rights.

- Membership Certificates: These certificates serve as proof of ownership for each member. They can help clarify each member's share in the business.

- Operating Procedures Manual: This manual details the day-to-day operations of the business. It provides guidance on how to handle various situations that may arise.

- Capital Contribution Agreement: This document outlines the contributions each member is making to the LLC, whether in cash, property, or services.

- Tax Identification Number (TIN) Application: An application for a TIN is necessary for tax purposes. It allows the LLC to file taxes and hire employees.

- Annual Reports: Many states require LLCs to file annual reports. These documents provide updated information about the business and its members.

- Non-Disclosure Agreement (NDA): An NDA can protect sensitive information shared among members. It ensures that proprietary information remains confidential.

- Operating Agreement: This essential document outlines the management structure and operational procedures of the LLC. To start, complete the Operating Agreement form to define the rights and responsibilities of members.

- Transfer of Membership Interest Agreement: This agreement outlines the process for a member to sell or transfer their ownership interest in the LLC to another party.

Each of these documents plays a vital role in the smooth operation and management of an LLC. Having them in place can help prevent misunderstandings and provide a solid foundation for the business.

More Types of Multiple Members Operating Agreement Templates:

Maryland Operating Agreement - Helps avoid misunderstandings about business operations and ownership rights.

The Florida Operating Agreement form is a crucial document for LLCs operating within the state, outlining the governance structure and operational guidelines of the business. It serves as a binding agreement among members, detailing their rights, responsibilities, and share of interests. This document, while not mandatory, is essential for ensuring clarity and preventing disputes within a company. For those looking to formalize their agreements, you can view and download the form.

Key Details about Multiple Members Operating Agreement

What is a Multiple Members Operating Agreement?

A Multiple Members Operating Agreement is a legal document that outlines the management structure and operating procedures for a limited liability company (LLC) with multiple members. This agreement serves as a foundational framework, detailing how decisions will be made, how profits and losses will be distributed, and the roles and responsibilities of each member.

Why is an Operating Agreement important?

An Operating Agreement is crucial for several reasons:

- It helps clarify the expectations and responsibilities of each member.

- It can prevent conflicts by providing a clear dispute resolution process.

- It protects the limited liability status of the LLC by demonstrating that it operates as a separate entity.

- It is often required by banks and investors before they engage with the LLC.

Who should draft the Operating Agreement?

While any member of the LLC can draft the Operating Agreement, it is advisable to seek assistance from a legal professional. A lawyer can ensure that the document complies with state laws and adequately reflects the intentions of all members. This helps avoid potential pitfalls in the future.

What key elements should be included in the agreement?

When drafting a Multiple Members Operating Agreement, consider including the following elements:

- Member Information: Names and addresses of all members.

- Management Structure: Details on whether the LLC will be member-managed or manager-managed.

- Voting Rights: Explanation of how decisions will be made and the voting process.

- Profit and Loss Distribution: Guidelines on how profits and losses will be shared among members.

- Dispute Resolution: Procedures for resolving conflicts that may arise.

- Amendments: How the agreement can be modified in the future.

Can the Operating Agreement be amended?

Yes, the Operating Agreement can be amended. Typically, the process for making amendments is outlined within the agreement itself. Most often, it requires a majority or unanimous vote of the members, depending on what has been established in the original document.

Is it necessary to file the Operating Agreement with the state?

No, you do not need to file the Operating Agreement with the state. However, it is essential to keep it in a safe place and ensure that all members have access to it. Some states may require you to provide a copy if requested, especially if issues arise.

What happens if there is no Operating Agreement?

If an LLC does not have an Operating Agreement, the state’s default laws will govern the LLC’s operations. This can lead to unintended consequences, as the default rules may not reflect the members' intentions or the unique needs of the business.

Can a single-member LLC use this type of agreement?

A Multiple Members Operating Agreement is specifically designed for LLCs with multiple members. However, a single-member LLC can still benefit from having an Operating Agreement, even if it is a simpler version. It can help clarify the owner’s intentions and provide a clear structure for the business.

How often should the Operating Agreement be reviewed?

It is wise to review the Operating Agreement regularly, especially after significant changes in the business, such as adding new members or changing the management structure. Regular reviews help ensure that the agreement remains relevant and continues to meet the needs of the LLC.

Similar forms

- Partnership Agreement: This document outlines the terms and conditions under which partners operate a business together. Like the Operating Agreement, it specifies roles, responsibilities, and profit-sharing arrangements.

- Bylaws: Bylaws govern the internal management of a corporation. Similar to an Operating Agreement, they define the roles of officers, procedures for meetings, and voting rights.

- Shareholder Agreement: This agreement is used by corporations to outline the rights and obligations of shareholders. It parallels the Operating Agreement by detailing ownership stakes and management structure.

- Joint Venture Agreement: This document governs the relationship between two or more parties collaborating on a specific project. It shares similarities with the Operating Agreement in defining contributions and profit distribution.

- Limited Liability Company (LLC) Articles of Organization: This document is filed with the state to create an LLC. It complements the Operating Agreement by establishing the entity’s existence but does not detail internal operations.

- Limited Liability Company Operating Agreement: This essential document outlines the management structure and operational guidelines for your LLC, defining members' roles and responsibilities to maintain clarity and compliance with state regulations. For more information, check out the Limited Liability Company Operating Agreement.

- Non-Disclosure Agreement (NDA): While primarily focused on confidentiality, an NDA can be similar in nature to an Operating Agreement by protecting sensitive information shared among members during business operations.

- Employment Agreement: This document outlines the terms of employment for individuals within the organization. Like an Operating Agreement, it specifies roles and responsibilities but focuses on individual employees rather than the entire organization.

- Franchise Agreement: This contract details the rights and obligations of franchisors and franchisees. It is similar to the Operating Agreement in that it establishes a framework for business operations and governance.

Guide to Filling Out Multiple Members Operating Agreement

Filling out the Multiple Members Operating Agreement form is an important step for your business. This document will help clarify the roles and responsibilities of each member, ensuring smooth operations and clear communication. Follow the steps below to complete the form accurately.

- Begin by entering the name of your business at the top of the form.

- List the names of all members involved in the business. Make sure to include their full legal names.

- Specify the percentage of ownership for each member. This should reflect their investment and involvement in the business.

- Detail the roles and responsibilities of each member. Clearly outline what each person will handle within the company.

- Include information about how decisions will be made. Will it require a majority vote, or will certain decisions need unanimous consent?

- Discuss the process for adding new members. Outline how new members can join and what the requirements are.

- Address the procedure for handling disputes among members. This can help prevent conflicts from escalating.

- Sign and date the form at the end. Each member should also sign to acknowledge their agreement to the terms outlined.

Once you have completed the form, make sure to keep a copy for your records. Distributing copies to all members will help ensure everyone is on the same page moving forward.