Free Netspend Dispute PDF Form

Misconceptions

Many people have misunderstandings about the Netspend Dispute form. Here are some common misconceptions:

- Misconception 1: You can submit the form anytime after the transaction.

- Misconception 2: The form guarantees you will get your money back.

- Misconception 3: You don't need to contact the merchant before filing a dispute.

- Misconception 4: You are completely liable for unauthorized transactions.

- Misconception 5: You can dispute more than five transactions on one form.

- Misconception 6: You don’t need to provide supporting documents.

- Misconception 7: The dispute process will take a long time.

- Misconception 8: You can submit the form without a police report if your card was stolen.

- Misconception 9: You can fill out the form without providing a detailed explanation.

In reality, you must submit the form within 60 days of the transaction date to initiate a dispute.

Completing the form does not guarantee a refund. A decision will be made based on the information provided and supporting documentation.

It's advisable to reach out to the merchant first. This can sometimes resolve the issue more quickly.

You are not liable for unauthorized transactions that occur after you report your card lost or stolen.

The form allows you to dispute up to five transactions at a time. For more, you will need to submit additional forms.

While not mandatory, including supporting documents can significantly help your case.

Netspend aims to make a decision within 10 business days after receiving your completed form.

While it’s not strictly required, submitting a police report can strengthen your dispute.

A detailed explanation of what happened is necessary to help Netspend understand your situation better.

Documents used along the form

When filing a dispute with Netspend regarding unauthorized transactions, several forms and documents can support your case. Having the right paperwork ready can streamline the process and improve your chances of a favorable outcome. Below is a list of commonly used documents that may accompany the Netspend Dispute form.

- Police Report: If your card was lost or stolen, a police report provides official documentation of the incident. This report can strengthen your claim by showing that you took immediate action.

- Transaction Receipts: Copies of receipts for the disputed transactions can help verify your claims. They show proof of the transaction amount and the merchant involved.

- Email Correspondence: Any emails exchanged with the merchant regarding the dispute can serve as evidence. This includes communication about refunds or attempts to resolve the issue directly.

- Shipping or Tracking Information: If the dispute involves a purchase that was not received, providing shipping or tracking details can support your case. It shows that the product was expected but not delivered.

- Hold Harmless Agreement: To safeguard against liabilities in various activities, consider our essential Hold Harmless Agreement form for comprehensive protection during events and rentals.

- Cancellation Confirmation: If you canceled a service or order, including confirmation of that cancellation can be beneficial. This document shows that you took steps to prevent the charge.

- Account Statements: Recent bank or account statements can help illustrate unauthorized transactions. They provide a clear view of your account activity and highlight discrepancies.

- Affidavit of Loss: This sworn statement can be used to declare that your card was lost or stolen. It serves as a formal declaration of your situation and may be required by some institutions.

Having these documents ready when submitting your dispute can significantly enhance your case. Always ensure that you provide accurate and complete information to facilitate a smooth resolution process.

Check out Popular Documents

Straight Bol - This document should be stored securely as it contains sensitive shipment information.

To facilitate the ownership transfer process, it is important to use a reliable resource like PDF Documents Hub where you can find the New York Motorcycle Bill of Sale, ensuring all necessary details are accurately documented.

104r - Successful completion of the form supports future career opportunities in the Army.

Key Details about Netspend Dispute

What is the purpose of the Netspend Dispute Notification Form?

The Netspend Dispute Notification Form is designed for cardholders to report unauthorized credit or debit transactions on their cards. By completing this form, you initiate the dispute process, allowing Netspend to investigate the transactions in question. It is crucial to submit the form within 60 days of the transaction date to ensure timely handling of your dispute.

How long does it take to receive a decision on my dispute?

Once Netspend receives your completed Dispute Notification Form, they will review the information provided. A decision regarding the crediting of the disputed funds will be made within 10 business days. Prompt submission of the form and any supporting documentation can facilitate a quicker resolution.

What information do I need to provide on the form?

You will need to fill in several key details on the form, including:

- Your name, phone number, and address

- Your card or account number

- The disputed transaction details (amount, date, time, and merchant’s name)

- Whether you have contacted the merchant regarding the dispute

- A detailed explanation of what occurred

Additionally, if your card was lost or stolen, you should indicate this on the form. Providing a police report and any other supporting documents can strengthen your case.

What happens if my card was lost or stolen?

If your card was lost or stolen, it is important to report this immediately. Indicate on the form that your card was compromised. You should also reset your PIN and consider filing a police report. This step helps protect you from further unauthorized transactions and limits your liability for any charges made after you reported the loss.

Am I liable for unauthorized transactions?

Your liability for unauthorized transactions depends on when you report the loss of your card. If you report your card as lost or stolen before any unauthorized transactions occur, you will not be held liable for those charges. However, if transactions occur after you have reported the loss and instructed Netspend to block activity, you will not be responsible for those charges either. Always act quickly to minimize your liability.

Similar forms

The Netspend Dispute Form shares similarities with several other documents used in financial transactions and dispute resolution. Below is a list of six such documents, highlighting their similarities:

- Chargeback Request Form: Like the Netspend Dispute Form, a chargeback request form allows consumers to dispute unauthorized transactions. Both forms require details about the transaction and supporting documentation to process the dispute.

- Fraud Report Form: A fraud report form is similar in that it is used to report unauthorized activity on an account. Both documents emphasize the importance of timely submission and may require a detailed explanation of the incident.

- Transaction Dispute Letter: This letter serves to formally dispute a transaction with a financial institution. Similar to the Netspend form, it requires specific transaction details and a clear narrative of the dispute.

- Consumer Complaint Form: Used to file complaints with regulatory agencies, this form shares the requirement for detailed information about the issue at hand. Both documents aim to resolve disputes and protect consumer rights.

- Hold Harmless Agreement: This agreement is vital for parties engaging in activities with inherent risks. It serves to protect one party from legal claims made by the other, ensuring safety in various transactions. For those needing assistance, they can visit texasformspdf.com/fillable-hold-harmless-agreement-online/ to fill out the necessary forms effectively.

- Identity Theft Affidavit: This affidavit is used when someone’s identity has been stolen. Similar to the Netspend form, it requires a description of the fraudulent activity and may involve law enforcement documentation.

- Account Closure Request Form: When a consumer wishes to close an account due to unauthorized activity, this form is used. It, too, may require a statement of the circumstances leading to the closure, paralleling the need for detailed explanations in the Netspend Dispute Form.

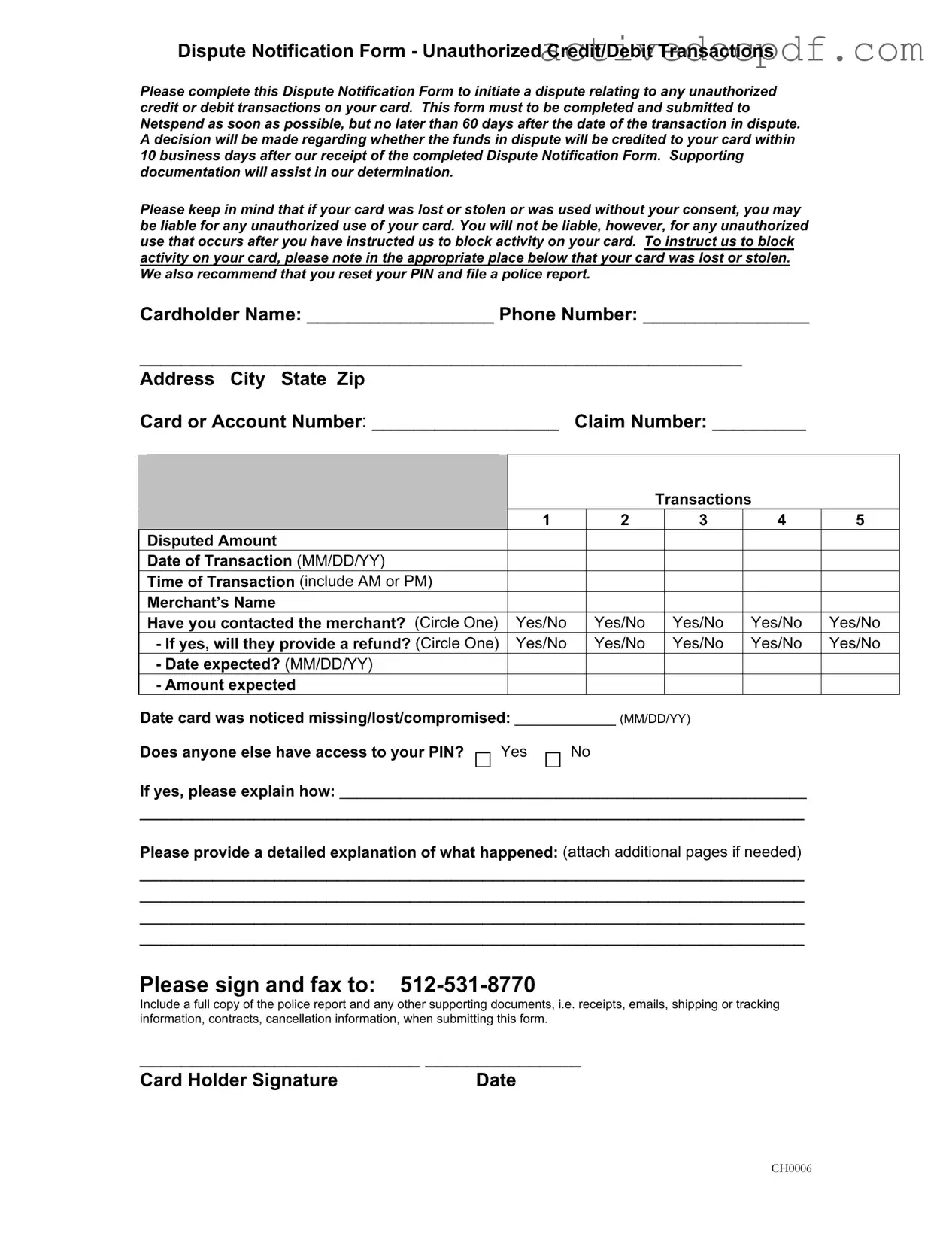

Guide to Filling Out Netspend Dispute

Once you have gathered all necessary information and documentation, you're ready to fill out the Netspend Dispute form. This form is essential for addressing unauthorized transactions on your card. Completing it accurately and promptly will help expedite the dispute process.

- Begin by entering your Cardholder Name in the designated space.

- Provide your Phone Number to ensure they can reach you if needed.

- Fill in your Address, including City, State, and Zip Code.

- Write down your Card or Account Number to identify your account.

- Enter your Claim Number if you have one.

- List the transactions you are disputing, up to five. For each transaction, fill out the following details:

- Disputed Amount

- Date of Transaction (format MM/DD/YY)

- Time of Transaction (include AM or PM)

- Merchant’s Name

- Indicate if you have contacted the merchant by circling Yes or No.

- If yes, circle whether they will provide a refund and note the Date expected for the refund (MM/DD/YY).

- Document the Date card was noticed missing/lost/compromised (MM/DD/YY).

- Answer whether anyone else has access to your PIN by circling Yes or No. If yes, provide an explanation.

- In the section for a detailed explanation, describe what happened. Attach additional pages if necessary.

- Sign and date the form at the bottom where indicated.

- Fax the completed form to 512-531-8770.

- Include a full copy of the police report and any supporting documents, such as receipts or emails, when submitting the form.