Legal Articles of Incorporation Document for New York State

Misconceptions

When it comes to the New York Articles of Incorporation form, several misconceptions often arise. Understanding these can help ensure a smoother incorporation process.

- Misconception 1: The Articles of Incorporation are the same as the business license.

- Misconception 2: Only large businesses need to file Articles of Incorporation.

- Misconception 3: The process of filing Articles of Incorporation is quick and straightforward.

- Misconception 4: Once filed, Articles of Incorporation cannot be changed.

This is not true. The Articles of Incorporation serve as the foundational document that establishes a corporation in New York. A business license, on the other hand, is a permit that allows a business to operate legally within a specific jurisdiction. Both documents are necessary, but they serve different purposes.

This is a common misunderstanding. Any entity that wants to operate as a corporation, regardless of size, must file Articles of Incorporation. Small businesses, startups, and even non-profits can benefit from incorporating, as it provides legal protections and can enhance credibility.

While it may seem simple, the process can be quite detailed. It requires careful attention to various components, such as naming the corporation, stating its purpose, and designating a registered agent. Any errors or omissions can lead to delays or rejections.

This is incorrect. While the Articles of Incorporation are a critical document, they can be amended if necessary. Changes in business structure, name, or purpose can all be addressed through a formal amendment process, allowing for flexibility as the business evolves.

Documents used along the form

When forming a corporation in New York, several documents complement the Articles of Incorporation. Each of these documents serves a specific purpose in ensuring compliance with state regulations and facilitating smooth business operations. Below is a list of essential forms and documents that are often required alongside the Articles of Incorporation.

- Bylaws: These are the internal rules governing the management of the corporation. Bylaws outline the responsibilities of directors and officers, the process for holding meetings, and how decisions are made.

- Initial Report: This document provides essential information about the corporation's structure and operations. It often includes details about the business address, officers, and the nature of the business.

- Employer Identification Number (EIN): Issued by the IRS, this number is necessary for tax purposes. It is required for hiring employees, opening bank accounts, and filing tax returns.

- Certificate of Incorporation: This document is filed with the state and includes fundamental information about the corporation, such as its name, purpose, and registered agent.

- Horse Bill of Sale Form: To properly document the transfer of horse ownership, utilize the clear Horse Bill of Sale form guide to ensure compliance with all necessary legal requirements.

- Statement of Information: Some states require this document to be filed periodically. It updates the state on key information about the corporation, such as its officers and address.

- Shareholder Agreements: These agreements outline the rights and responsibilities of shareholders. They can address issues like share transfer restrictions and dispute resolution methods.

- Business Licenses and Permits: Depending on the nature of the business, various licenses and permits may be required at the local, state, or federal level to operate legally.

- Operating Agreement: For LLCs, this document defines the management structure and operating procedures. It is crucial for outlining the roles of members and how profits and losses are distributed.

- Annual Report: Many states require corporations to file an annual report, which provides updated information about the business and confirms its continued compliance with state regulations.

Understanding these documents and their purposes is vital for anyone looking to establish a corporation in New York. Properly preparing and filing these forms ensures legal compliance and lays a strong foundation for future business operations.

Other State-specific Articles of Incorporation Forms

Florida Incorporation - Can specify the powers of the corporation within the articles.

To further assist you in navigating the complexities of rental agreements, you may find it helpful to access resources like PDF Documents Hub, which offers a comprehensive selection of documents and guidance on the New York Residential Lease Agreement.

How Much Is an Llc in Texas - Requirements for financial audits and reviews.

Key Details about New York Articles of Incorporation

What are the New York Articles of Incorporation?

The New York Articles of Incorporation is a legal document required to establish a corporation in the state of New York. This document outlines essential information about the corporation, such as its name, purpose, duration, and the address of its principal office. Filing this document with the New York Department of State is the first step in creating a corporation and grants the business legal recognition.

What information is needed to complete the Articles of Incorporation?

To complete the Articles of Incorporation, you will need to provide several key pieces of information:

- The name of the corporation, which must be unique and not already in use by another entity in New York.

- The purpose of the corporation, which describes the business activities it will engage in.

- The duration of the corporation, which can be perpetual or for a specified period.

- The address of the corporation's principal office.

- The name and address of the registered agent, who will receive legal documents on behalf of the corporation.

- The number of shares the corporation is authorized to issue, if applicable.

How do I file the Articles of Incorporation in New York?

Filing the Articles of Incorporation in New York can be done online or by mail. If filing online, you can use the New York Department of State’s website. For mail submissions, you will need to print the completed form and send it to the appropriate address. The filing fee must be paid at the time of submission, and it varies based on the type of corporation being formed. Ensure that all required information is accurately filled out to avoid delays.

What is the filing fee for the Articles of Incorporation?

The filing fee for the Articles of Incorporation in New York varies depending on the type of corporation. As of October 2023, the fee for a business corporation is typically $125. However, additional fees may apply for specific types of corporations or if expedited processing is requested. It is advisable to check the New York Department of State’s website for the most current fee schedule.

Can I amend the Articles of Incorporation after filing?

Yes, you can amend the Articles of Incorporation after they have been filed. If there are changes in the corporation’s name, purpose, or other key details, an amendment must be submitted to the New York Department of State. This involves completing the appropriate amendment form and paying any required fees. Keeping the Articles of Incorporation up to date is important for maintaining compliance with state laws.

What happens after I file the Articles of Incorporation?

Once the Articles of Incorporation are filed and accepted by the New York Department of State, the corporation is officially formed. You will receive a Certificate of Incorporation as proof of your corporation’s legal existence. After this, it is essential to comply with ongoing requirements, such as obtaining necessary licenses, holding initial meetings, and filing annual reports to maintain good standing.

Similar forms

-

Bylaws: Bylaws outline the internal rules and procedures for managing a corporation. Like the Articles of Incorporation, they are essential for establishing the framework within which the corporation operates. Both documents provide guidance on governance but focus on different aspects—Articles of Incorporation deal with formation, while Bylaws address operational guidelines.

-

Operating Agreement: For LLCs, an Operating Agreement serves a similar purpose to the Articles of Incorporation. It details the management structure and operational procedures of the LLC. Both documents are foundational, setting the stage for how the entity will function and be governed.

-

Certificate of Formation: This document is often used interchangeably with Articles of Incorporation in some states. It serves the same purpose of officially establishing a corporation or LLC. Both documents must be filed with the state to legally create the business entity.

-

Partnership Agreement: A Partnership Agreement outlines the terms and conditions of a partnership. Similar to Articles of Incorporation, it defines the roles and responsibilities of each partner. While Articles focus on corporations, both documents are crucial for establishing clear expectations and governance.

-

Shareholder Agreement: This document is designed for corporations with multiple shareholders. It governs the relationship between shareholders and the corporation, similar to how Articles of Incorporation establish the corporation's framework. Both documents are vital for ensuring smooth operations and protecting the interests of stakeholders.

Immigration Affidavit: This document is crucial for immigrants to demonstrate financial support and compliance with USCIS requirements. For more information, visit the Immigration Affidavit page.

-

Registration Statement: A Registration Statement is often required for companies that want to sell securities. It provides details about the company, similar to what Articles of Incorporation do for corporate structure. Both documents aim to inform stakeholders about the entity's operations and governance.

Guide to Filling Out New York Articles of Incorporation

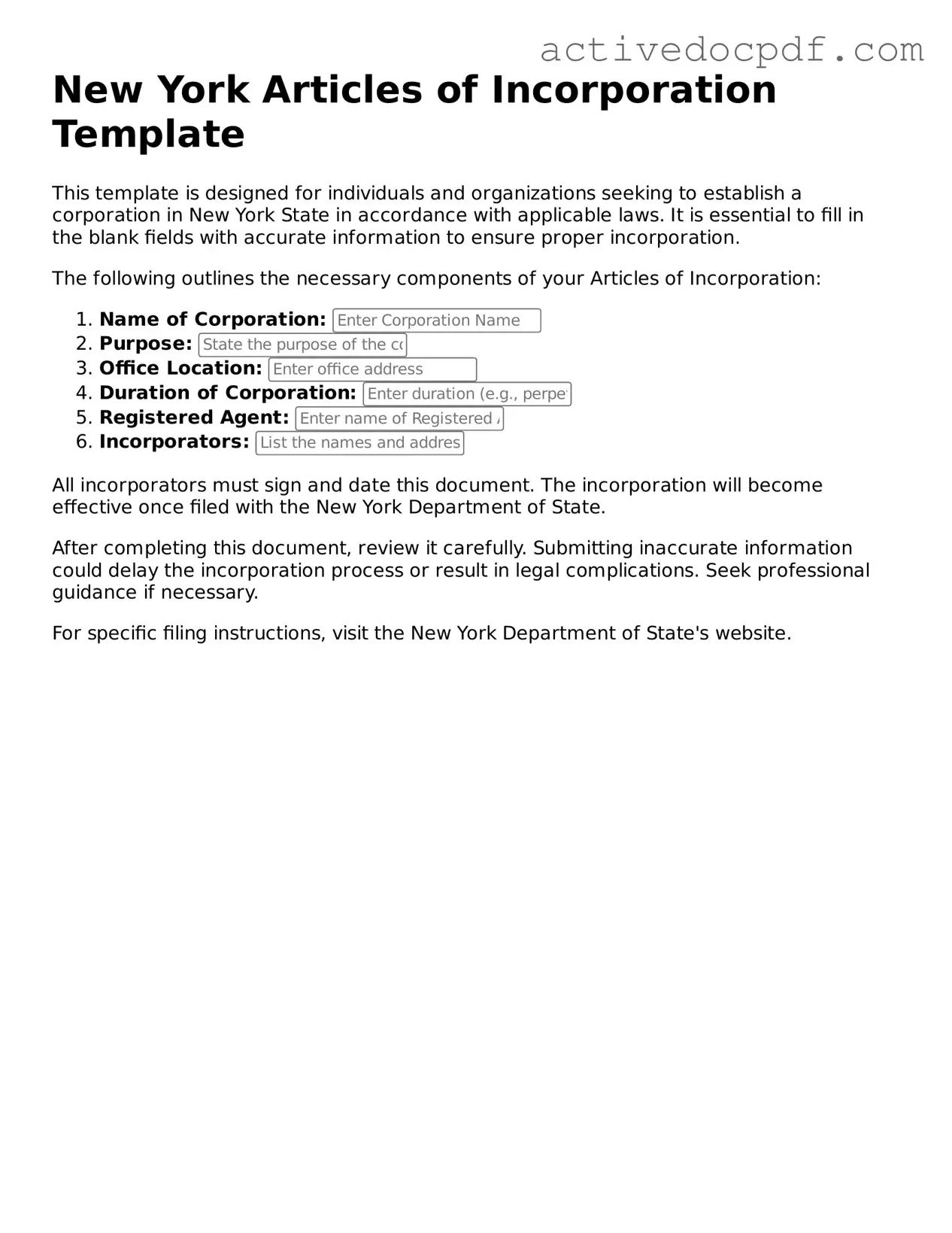

After gathering the necessary information, you’re ready to fill out the New York Articles of Incorporation form. Completing this form accurately is crucial for the establishment of your corporation. Follow these steps carefully to ensure a smooth filing process.

- Obtain the New York Articles of Incorporation form from the New York Department of State website or your local office.

- Begin with the corporation's name. Ensure it is unique and complies with New York naming rules.

- Provide the corporation's purpose. Be specific about what your business will do.

- Fill in the county where the corporation will be located.

- List the address of the corporation's principal office. Include street address, city, state, and zip code.

- Identify the registered agent. This is the person or entity designated to receive legal documents on behalf of the corporation.

- Include the registered agent's address. This should be a physical address in New York.

- State the number of shares the corporation is authorized to issue. Specify the classes of shares if applicable.

- Provide the names and addresses of the incorporators. Each incorporator must sign the form.

- Review the completed form for accuracy. Ensure all required fields are filled out and that there are no typos.

- Submit the form to the New York Department of State along with the required filing fee. This can typically be done online or by mail.

Once the form is submitted and approved, you will receive a Certificate of Incorporation. This document officially establishes your corporation and allows you to begin operations.