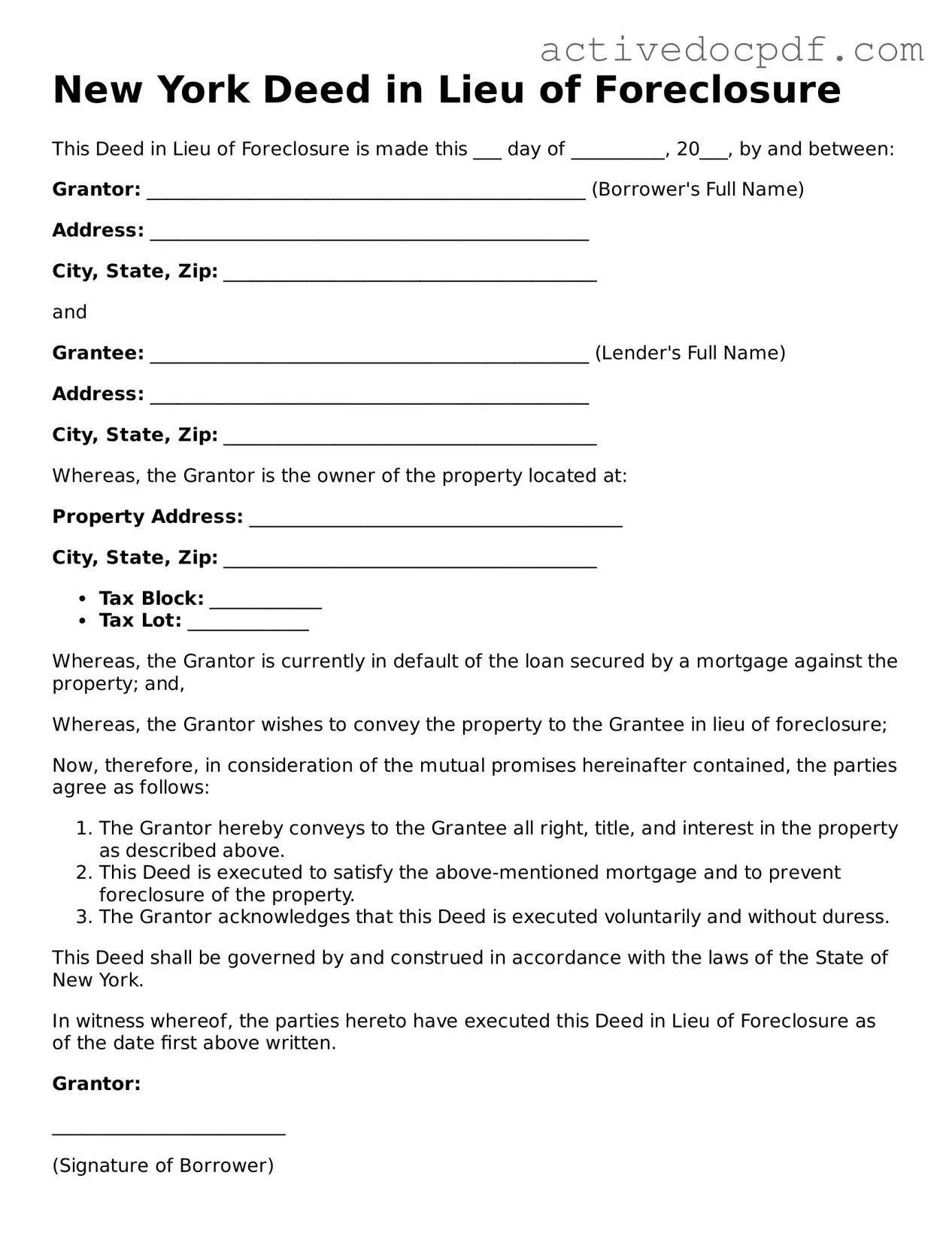

Legal Deed in Lieu of Foreclosure Document for New York State

Misconceptions

Understanding the New York Deed in Lieu of Foreclosure can be challenging. Here are five common misconceptions that often arise:

-

It eliminates all debt associated with the property.

Many people believe that signing a deed in lieu of foreclosure wipes out any remaining mortgage debt. However, this is not always the case. Depending on the terms negotiated with the lender, some debts may still persist, particularly if there are other liens on the property.

-

It is a quick and easy process.

While a deed in lieu of foreclosure can be faster than going through a full foreclosure process, it is not necessarily simple. Homeowners must still navigate negotiations with their lender, which can take time and require documentation.

-

It will always negatively impact credit scores.

Although a deed in lieu of foreclosure can impact credit scores, the extent varies. In some cases, it may be less damaging than a foreclosure. It’s essential to understand how each option affects credit before making a decision.

-

It is available to all homeowners.

Not every homeowner qualifies for a deed in lieu of foreclosure. Lenders often have specific criteria that must be met, such as demonstrating financial hardship and having a property that is in good condition.

-

It releases the homeowner from all future liability.

Signing a deed in lieu does not automatically release a homeowner from all future liabilities. If there are other obligations tied to the mortgage or if the lender chooses to pursue a deficiency judgment, the homeowner may still be liable for those debts.

Being informed about these misconceptions can help homeowners make better decisions regarding their financial futures. It's always advisable to consult with a knowledgeable professional before proceeding with any significant financial decisions.

Documents used along the form

When dealing with a Deed in Lieu of Foreclosure in New York, there are several other forms and documents that may be needed to ensure a smooth process. Each of these documents serves a specific purpose and can help clarify the terms of the agreement between the parties involved.

- Loan Modification Agreement: This document outlines any changes to the original loan terms, such as interest rates or payment schedules. It is often used to help borrowers avoid foreclosure by making their payments more manageable.

- Last Will and Testament: A crucial document that outlines how a person's assets and responsibilities should be handled after their death, ensuring that your wishes are honored and can provide peace of mind for both you and your loved ones. For more information, you can visit PDF Documents Hub.

- Notice of Default: This is a formal notification to the borrower that they have fallen behind on their mortgage payments. It serves as a warning that foreclosure proceedings may begin if the debt is not addressed.

- Release of Liability: This document releases the borrower from any further obligation to repay the mortgage after the deed is transferred. It ensures that the borrower is not held responsible for any remaining debt once the property is given back to the lender.

- Property Condition Disclosure Statement: This form provides information about the condition of the property being transferred. It helps the lender understand any potential issues or repairs needed before accepting the deed.

- Settlement Statement: This document outlines the financial details of the transaction, including any fees or costs associated with the deed transfer. It ensures transparency between the borrower and lender regarding the financial aspects of the agreement.

Having these documents prepared and understood can greatly assist in navigating the complexities of a Deed in Lieu of Foreclosure. Each plays a vital role in protecting the interests of both the borrower and the lender throughout the process.

Other State-specific Deed in Lieu of Foreclosure Forms

California Voluntary Property Surrender Document - A borrower must be in good standing with the lender to qualify for a Deed in Lieu.

Deed in Lieu Vs Foreclosure - Through this process, homeowners may be able to avoid unnecessary legal fees associated with foreclosure.

In addition to ensuring clarity in rental terms, landlords and tenants may find it beneficial to review the https://documentonline.org/ for a comprehensive understanding of the rights and obligations involved in a California Residential Lease Agreement.

Florida Deed in Lieu of Foreclosure - Submitting a Deed in Lieu may preserve some credit standing compared to a foreclosure.

Key Details about New York Deed in Lieu of Foreclosure

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is an agreement between a borrower and a lender where the borrower voluntarily transfers ownership of their property to the lender to avoid foreclosure. This option can help the borrower eliminate their mortgage debt while allowing the lender to take possession of the property without going through the lengthy foreclosure process.

What are the benefits of choosing a Deed in Lieu of Foreclosure?

There are several advantages to consider:

- Faster Process: The process is typically quicker than foreclosure, allowing for a smoother transition.

- Less Impact on Credit: While it will still affect your credit, the impact may be less severe than a foreclosure.

- Relief from Debt: The borrower can be relieved of the mortgage obligation, which can provide a fresh start.

- Avoiding Legal Fees: By opting for this route, borrowers can often avoid the legal fees associated with foreclosure.

Are there any downsides to a Deed in Lieu of Foreclosure?

Yes, there are some potential drawbacks to consider:

- Tax Implications: Depending on the circumstances, the borrower may face tax consequences if the lender forgives any remaining debt.

- Not Always Approved: Lenders may not always agree to a Deed in Lieu, especially if there are other liens on the property.

- Impact on Future Loans: This option can still affect your ability to secure future loans, as it is recorded on your credit report.

How do I initiate a Deed in Lieu of Foreclosure?

To start the process, follow these steps:

- Contact your lender to discuss your financial situation and express your interest in a Deed in Lieu.

- Gather necessary documents, such as your mortgage agreement and any financial statements that show your current situation.

- Submit a formal request to your lender, including the gathered documents and a letter explaining your circumstances.

- Work with the lender to negotiate terms and conditions of the deed transfer.

What should I do before signing a Deed in Lieu of Foreclosure?

Before signing, it's crucial to take a few important steps:

- Consult a Professional: Speak with a legal or financial advisor to understand the implications fully.

- Review Your Finances: Ensure you have a clear picture of your financial situation and any potential consequences.

- Understand the Terms: Carefully read and understand all terms outlined in the Deed in Lieu agreement.

Similar forms

- Loan Modification Agreement: This document allows a borrower to change the terms of their existing loan, often to make payments more manageable. Like a Deed in Lieu, it aims to avoid foreclosure by keeping the borrower in their home with new terms.

- Short Sale Agreement: In a short sale, the lender agrees to accept less than the full amount owed on the mortgage. Similar to a Deed in Lieu, it helps the homeowner avoid foreclosure while allowing the lender to recover some funds.

- Residential Lease Agreement: This agreement is crucial for defining the relationship between landlords and tenants, ensuring clarity on rent, deposits, and lease terms while safeguarding both parties' rights. For more details, you can refer to the https://nyforms.com/residential-lease-agreement-template/.

- Forbearance Agreement: This document temporarily suspends or reduces mortgage payments. It’s a way for borrowers to catch up on missed payments without facing foreclosure, much like a Deed in Lieu seeks to prevent it.

- Bankruptcy Filing: Filing for bankruptcy can halt foreclosure proceedings. While it’s a more drastic measure, it shares the goal of protecting the homeowner from losing their property.

- Repayment Plan: A repayment plan outlines how a borrower will pay back missed payments over time. This approach, similar to a Deed in Lieu, aims to keep the borrower in their home while addressing financial difficulties.

- Quitclaim Deed: This document transfers ownership of a property without any warranties. It can be used to transfer property to a lender, similar to a Deed in Lieu, where the borrower voluntarily gives up their interest in the home.

- Property Settlement Agreement: Often used in divorce cases, this agreement divides property between parties. It can resemble a Deed in Lieu when one party relinquishes their claim to avoid foreclosure or financial strain.

- Release of Mortgage: This document officially releases a borrower from their mortgage obligation. It can occur after a Deed in Lieu, signifying that the lender has accepted the property and the borrower is no longer responsible for the loan.

Guide to Filling Out New York Deed in Lieu of Foreclosure

Once you have decided to fill out the New York Deed in Lieu of Foreclosure form, you’ll need to gather some important information. Completing this form correctly is essential for a smooth process. After filling it out, you'll typically need to submit it to the appropriate parties involved in your mortgage agreement.

- Obtain the form: Download the New York Deed in Lieu of Foreclosure form from a reliable source or request a copy from your lender.

- Read the instructions: Familiarize yourself with any specific instructions that accompany the form. Understanding the requirements will help you fill it out accurately.

- Fill in your information: Start with your name and address as the borrower. Ensure that the details match those on your mortgage documents.

- Property details: Provide the full address of the property involved in the foreclosure process. This includes the street address, city, state, and zip code.

- Lender information: Enter the name and address of your lender or mortgage company. This is the entity you are working with regarding the deed in lieu of foreclosure.

- Sign the form: After reviewing all the information, sign the form. Your signature indicates your agreement to the terms outlined in the document.

- Notarization: Have the form notarized. This step is often required to ensure the document is legally binding.

- Submit the form: Send the completed and notarized form to your lender. Keep a copy for your records.

After submitting the form, you may need to follow up with your lender to confirm they have received it and to understand any next steps in the process. Staying engaged will help ensure everything proceeds smoothly.