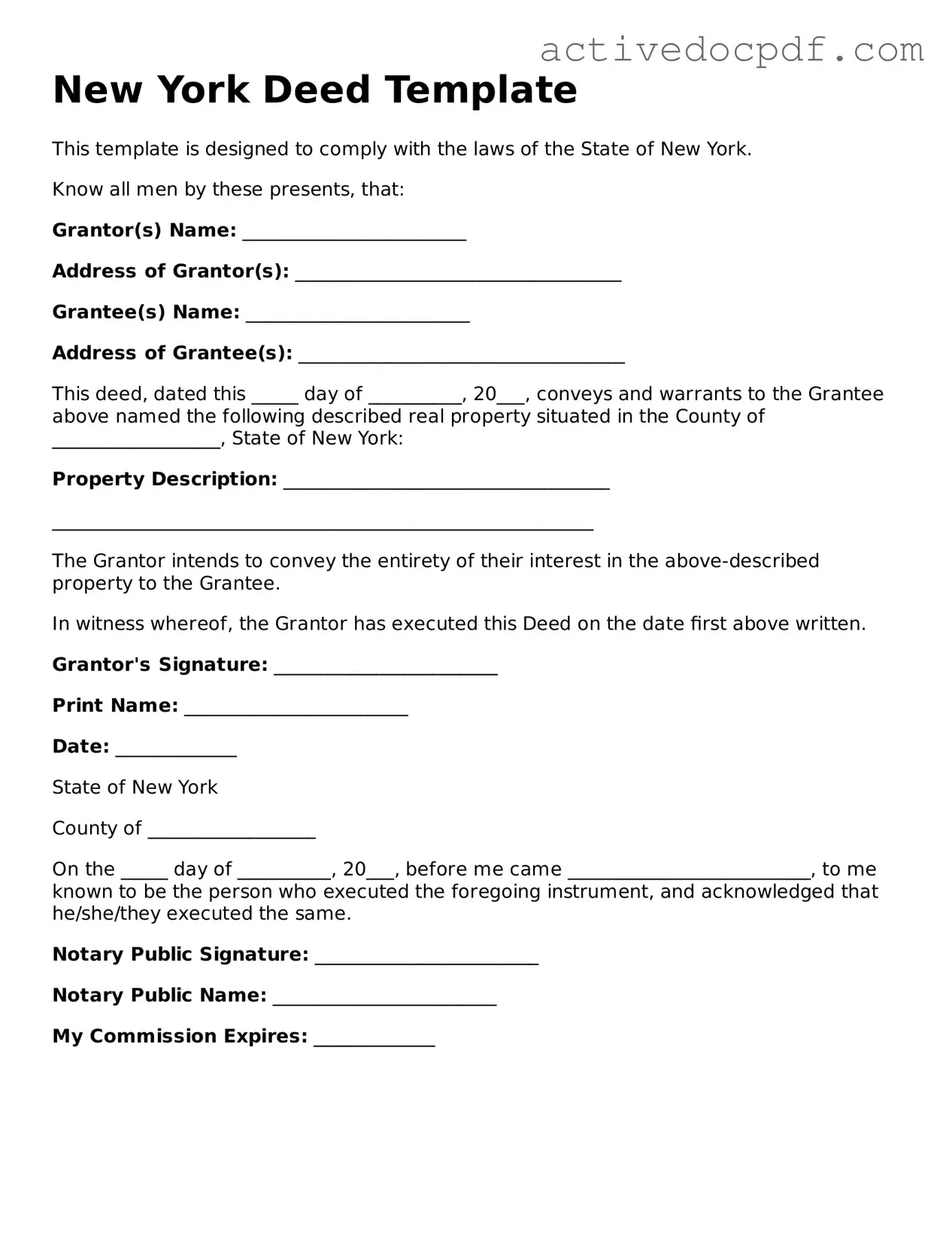

Legal Deed Document for New York State

Misconceptions

Many people have misunderstandings about the New York Deed form. Here are nine common misconceptions and clarifications to help clear things up.

-

All deeds are the same. Different types of deeds exist, such as warranty deeds and quitclaim deeds. Each serves a different purpose and offers varying levels of protection.

-

You don’t need a deed if you’re transferring property to a family member. Regardless of the relationship, a deed is still necessary to legally transfer ownership.

-

Only a lawyer can prepare a deed. While it’s advisable to seek legal advice, individuals can prepare their own deeds as long as they follow the correct format and requirements.

-

Once a deed is signed, it can’t be changed. Deeds can be modified or revoked, but this typically requires a new deed to be drafted and executed.

-

Not recording a deed means it’s invalid. A deed is valid once signed, but recording it provides public notice and protects against future claims.

-

All deeds need to be notarized. While notarization is common and often required, some types of deeds may not need a notary if they meet specific criteria.

-

Property taxes are not affected by a deed transfer. When property ownership changes, it can affect tax assessments, so it’s important to check with local authorities.

-

Only the seller needs to sign the deed. Both the seller and buyer must sign the deed to ensure a valid transfer of ownership.

-

Once a deed is recorded, it cannot be challenged. While recording provides protection, it does not prevent disputes over ownership or other claims.

Understanding these misconceptions can help ensure a smoother property transfer process in New York.

Documents used along the form

When engaging in real estate transactions in New York, several important documents accompany the deed form. Each of these documents serves a specific purpose and plays a crucial role in ensuring a smooth transfer of property ownership. Below is a list of commonly used forms and documents that are often associated with the New York Deed form.

- Title Search Report: This document provides a detailed history of the property's ownership. It identifies any liens, encumbrances, or claims against the property, ensuring that the buyer is fully informed before completing the transaction.

- Property Survey: A property survey outlines the exact boundaries and dimensions of the property. It can reveal any encroachments or disputes regarding property lines, which is essential for both buyers and sellers.

- Purchase Agreement: This legally binding contract outlines the terms of the sale between the buyer and seller. It includes details such as the sale price, closing date, and any contingencies that must be met prior to finalizing the transaction.

- Affidavit of Title: This sworn statement by the seller confirms their ownership of the property and discloses any known issues. It provides reassurance to the buyer that the seller has the right to sell the property.

- California Residential Lease Agreement: This essential document outlines the terms and conditions between a landlord and tenant renting a residential property in California. For further details, refer to documentonline.org.

- Closing Statement: Also known as a HUD-1 Settlement Statement, this document summarizes all financial aspects of the transaction. It details the costs involved in the sale, including closing costs, taxes, and any fees associated with the transfer of ownership.

- Transfer Tax Form: This form is required to report the transfer of property and calculate any applicable transfer taxes. It must be submitted to the appropriate government authorities to ensure compliance with local tax regulations.

Understanding these documents is vital for anyone involved in real estate transactions in New York. Each plays a significant role in protecting the interests of both buyers and sellers, facilitating a transparent and informed process. Proper attention to these forms can help prevent future disputes and ensure a successful transfer of property ownership.

Other State-specific Deed Forms

Who Has the Deed to My House - This form is a foundational piece of real estate law in the United States.

To facilitate a smooth rental experience, it is crucial for landlords and tenants to utilize a well-crafted lease agreement. This document not only clarifies expectations but also helps prevent disputes by providing a clear outline of obligations and rights. Those looking for a reliable template can find one at nyforms.com/residential-lease-agreement-template, ensuring all necessary elements are covered without ambiguity.

Key Details about New York Deed

What is a New York Deed form?

A New York Deed form is a legal document used to transfer ownership of real property from one party to another within the state of New York. This form serves as proof of the transaction and outlines the details of the transfer, including the names of the parties involved, a description of the property, and any terms or conditions associated with the transfer.

What types of Deeds are available in New York?

In New York, there are several types of Deeds that can be used, including:

- Warranty Deed: Guarantees that the grantor holds clear title to the property and has the right to transfer it.

- Quitclaim Deed: Transfers any interest the grantor has in the property without making any guarantees about the title.

- Special Warranty Deed: Similar to a warranty deed, but only guarantees the title against claims arising during the grantor's ownership.

- Deed in Lieu of Foreclosure: Used when a property owner voluntarily transfers the property to the lender to avoid foreclosure.

Who needs to sign the New York Deed form?

The New York Deed form must be signed by the grantor, who is the person transferring the property. In some cases, the grantee, or the person receiving the property, may also be required to sign. Additionally, the signatures should be notarized to ensure the document is legally binding.

How do I fill out a New York Deed form?

To fill out a New York Deed form, follow these steps:

- Begin by entering the names and addresses of both the grantor and grantee.

- Provide a legal description of the property being transferred. This can usually be found in the property's existing deed or tax records.

- Include any terms or conditions related to the transfer, if applicable.

- Sign and date the form in the presence of a notary public.

Is a New York Deed form required to be recorded?

Yes, while it is not mandatory to record a New York Deed form, it is highly recommended. Recording the deed with the county clerk's office protects the new owner's rights and provides public notice of the property transfer. This helps prevent future disputes regarding ownership.

What are the fees associated with filing a New York Deed form?

Filing fees for a New York Deed form can vary by county. Generally, there may be a nominal fee for recording the deed, as well as possible transfer taxes. It is advisable to check with the local county clerk’s office for specific fee amounts and any additional costs that may apply.

Can I create my own New York Deed form?

While it is possible to create your own New York Deed form, it is recommended to use a standardized form or seek legal assistance. Ensuring that the deed complies with state requirements is crucial to avoid potential issues in the future. Consulting with a legal professional can provide peace of mind and help navigate the complexities of property transfers.

Similar forms

-

Title Transfer Document: This document serves a similar purpose as a deed by officially transferring ownership of property from one party to another. It includes essential details such as the names of the parties involved, a description of the property, and the terms of the transfer.

-

Bill of Sale: A bill of sale is akin to a deed in that it transfers ownership of personal property. It outlines the items being sold, the purchase price, and the signatures of both the buyer and seller, ensuring a clear transfer of ownership.

- IRS Form 2553: This form enables small businesses to elect S corporation status, potentially offering significant tax advantages. For more information on the form, visit PDF Documents Hub.

-

Lease Agreement: While primarily used for rental arrangements, a lease agreement shares similarities with a deed in that it grants rights to use a property. It details the terms of use, duration, and responsibilities of both the landlord and tenant.

-

Mortgage Document: This document is similar to a deed as it secures a loan with real property. It outlines the borrower's obligation to repay the loan and gives the lender a claim to the property if the borrower defaults.

Guide to Filling Out New York Deed

Once you have the New York Deed form in front of you, it's time to get started on filling it out. This form is crucial for transferring property ownership, so accuracy is key. Make sure to have all necessary information at hand, such as the names of the parties involved, property details, and any relevant identification numbers. Follow these steps carefully to complete the form correctly.

- Begin by entering the date at the top of the form. This should reflect the date on which the deed is being executed.

- Fill in the names of the grantor (the person transferring the property) and the grantee (the person receiving the property). Ensure that the names are spelled correctly and match official identification.

- Provide the address of the property being transferred. This should include the street address, city, state, and zip code.

- Next, include a legal description of the property. This may involve referencing a previous deed or property survey. If you are unsure, consult public records or a real estate professional.

- Indicate the type of deed being used (for example, warranty deed or quitclaim deed). This information may be specified in the form or may require additional documentation.

- Check the box or write in the appropriate section if the property is subject to any liens or encumbrances. This ensures transparency in the transaction.

- Sign the form where indicated. The grantor must sign in the presence of a notary public. Ensure that the notary’s information is also filled in accurately.

- After signing, ensure that the date of the signature is included. This is important for record-keeping purposes.

- Finally, make copies of the completed deed for both parties and any other relevant stakeholders. This helps maintain accurate records of the transaction.