Legal Durable Power of Attorney Document for New York State

Misconceptions

Understanding the New York Durable Power of Attorney (DPOA) form is crucial for effective estate planning. Here are eight common misconceptions about this important legal document:

- It only applies to financial decisions. Many people believe that a DPOA is limited to financial matters. However, it can also encompass health care decisions if specified.

- It automatically becomes effective. Some assume that the DPOA is immediately effective upon signing. In reality, it can be set to activate only under certain conditions, such as incapacity.

- Anyone can be appointed as an agent. While you can choose someone you trust, there are restrictions. The agent must be at least 18 years old and mentally competent.

- It remains valid after death. A DPOA ceases to be effective once the principal passes away. It does not grant authority to act on behalf of the deceased.

- It cannot be revoked. Some people think that once a DPOA is created, it cannot be changed. In fact, the principal can revoke or modify it at any time while competent.

- All DPOAs are the same. Not all durable power of attorney forms are identical. Each state has its own requirements and variations, so it’s important to use the correct form for New York.

- It gives unlimited power to the agent. A DPOA does not grant unrestricted authority. The document can specify the powers granted and may include limitations.

- Legal advice is unnecessary. Some believe that they can complete the DPOA without any assistance. Seeking legal advice can ensure that the document meets all legal requirements and reflects the principal's wishes.

Clarifying these misconceptions can help individuals make informed decisions about their estate planning needs.

Documents used along the form

When creating a New York Durable Power of Attorney, it’s beneficial to consider additional forms and documents that can complement it. Each of these documents serves a specific purpose and can help ensure that your wishes are respected in various situations.

- Health Care Proxy: This document allows you to designate someone to make medical decisions on your behalf if you become unable to do so. It’s crucial for ensuring your healthcare preferences are followed.

- Living Will: A living will outlines your wishes regarding medical treatment in situations where you cannot communicate. It can guide your health care proxy and medical professionals.

- Last Will and Testament: This document specifies how your assets will be distributed after your death. It can help prevent disputes among heirs and ensure your wishes are honored.

- Revocable Living Trust: A trust can manage your assets during your lifetime and after your death. It helps avoid probate and can provide for your family in a tax-efficient manner.

- Georgia Bill of Sale Form: When transferring ownership of personal property in Georgia, refer to our essential Georgia bill of sale form guide to ensure all legal aspects are properly documented.

- Advance Directive: Similar to a living will, this document provides instructions about your medical care preferences, particularly in end-of-life situations.

- Beneficiary Designations: For certain accounts, like life insurance or retirement plans, this document specifies who will receive the assets upon your death, bypassing probate.

- Property Deed: If you own real estate, a property deed may need to be updated to reflect your wishes, particularly if you wish to transfer ownership to a trust or another individual.

- Financial Power of Attorney: This document grants someone the authority to manage your financial affairs. It can be separate from the Durable Power of Attorney and focus solely on financial matters.

- Guardian Designation: If you have minor children, this document allows you to name a guardian for them in the event of your death or incapacitation.

Considering these documents alongside the New York Durable Power of Attorney can provide a comprehensive approach to managing your affairs and ensuring your wishes are honored. Each document plays a vital role in protecting your interests and those of your loved ones.

Other State-specific Durable Power of Attorney Forms

Free Durable Power of Attorney Form Florida - It is a fundamental part of any comprehensive estate plan, allowing for seamless transitions.

Obtaining a proper understanding of the requirements for a Homeschool Letter of Intent can significantly ease the homeschooling process. Parents are encouraged to explore the necessary documentation at the Homeschool Letter of Intent guidelines to ensure they fulfill all legal obligations while tailoring their approach to education.

California Durable Power of Attorney - The Durable Power of Attorney is designed to remain in effect, providing long-term financial stability.

Key Details about New York Durable Power of Attorney

What is a Durable Power of Attorney in New York?

A Durable Power of Attorney (DPOA) is a legal document that allows you to appoint someone you trust to manage your financial and legal affairs on your behalf. Unlike a regular power of attorney, a DPOA remains effective even if you become incapacitated. This means that if you are unable to make decisions for yourself due to illness or injury, your appointed agent can still act on your behalf.

Who can be appointed as my agent?

You can choose anyone you trust to be your agent, as long as they are at least 18 years old and mentally competent. Common choices include family members, close friends, or professionals like attorneys or accountants. It’s important to select someone who understands your wishes and will act in your best interests.

What powers can I grant to my agent?

You can grant your agent a wide range of powers, including:

- Managing bank accounts

- Paying bills

- Handling real estate transactions

- Making investment decisions

- Filing taxes

You can also limit the powers if there are specific areas you want to restrict. It’s crucial to be clear about what you want your agent to be able to do.

How do I create a Durable Power of Attorney in New York?

To create a DPOA, you must fill out the appropriate form provided by New York State. The form must be signed by you, the principal, in the presence of a notary public. You can also have one or two witnesses sign the document, depending on your preferences. Once completed, it’s a good idea to provide copies to your agent and any institutions that may need it, such as banks or healthcare providers.

Does a Durable Power of Attorney need to be notarized?

Yes, in New York, a Durable Power of Attorney must be notarized to be legally valid. This means that you must sign the document in front of a notary public, who will then acknowledge your signature. This step helps to ensure that the document is recognized and respected by third parties.

Can I revoke a Durable Power of Attorney?

Absolutely. You can revoke a DPOA at any time as long as you are mentally competent. To do this, you should create a written revocation document and notify your agent and any institutions that had been relying on the DPOA. It’s also wise to destroy any copies of the original DPOA to prevent confusion.

What happens if I become incapacitated and don’t have a Durable Power of Attorney?

If you become incapacitated without a DPOA, your loved ones may need to go through a court process to obtain guardianship over you. This can be time-consuming and costly. Having a DPOA in place ensures that someone you trust can make decisions for you without the need for court intervention.

Is a Durable Power of Attorney the same as a Health Care Proxy?

No, a Durable Power of Attorney primarily deals with financial and legal matters. A Health Care Proxy, on the other hand, allows you to designate someone to make medical decisions on your behalf if you are unable to do so. While both documents are important for planning your future, they serve different purposes. It’s advisable to have both in place to ensure comprehensive coverage of your wishes.

Similar forms

- General Power of Attorney: Like the Durable Power of Attorney, a General Power of Attorney allows an individual to designate someone to make decisions on their behalf. However, it typically becomes invalid if the person becomes incapacitated, unlike the Durable version which remains effective.

- Healthcare Power of Attorney: This document is specifically focused on medical decisions. It grants authority to a designated person to make healthcare choices when the individual is unable to do so. It parallels the Durable Power of Attorney in that both empower someone to act on behalf of another in critical situations.

- Living Will: A Living Will outlines an individual’s preferences regarding medical treatment in the event of terminal illness or incapacity. While the Durable Power of Attorney allows someone to make decisions, the Living Will specifies the individual’s wishes, providing guidance to that decision-maker.

- Operating Agreement: The New York Operating Agreement is essential for clarifying management roles within an LLC, ensuring compliance with state laws, and can be accessed through PDF Documents Hub.

- Trust: A Trust allows a person to transfer assets to a trustee for the benefit of beneficiaries. While a Durable Power of Attorney grants authority to manage affairs, a Trust provides a structured way to manage and distribute assets, often with specific instructions for the trustee.

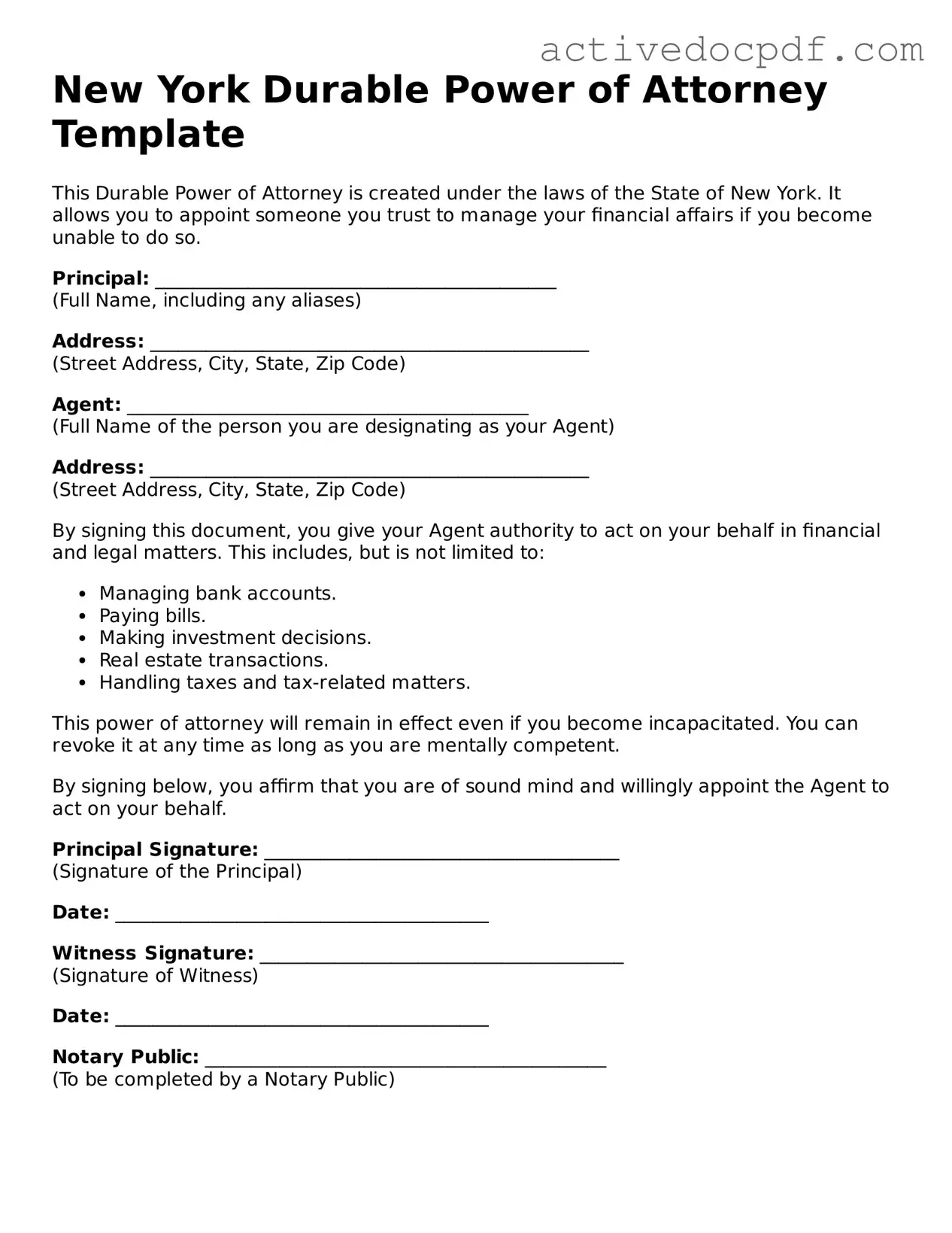

Guide to Filling Out New York Durable Power of Attorney

Filling out the New York Durable Power of Attorney form is an important step in ensuring that your financial and legal matters are handled according to your wishes. After completing the form, you will need to have it signed and notarized to make it legally binding. Here’s how to fill it out step by step.

- Obtain the Form: Download the New York Durable Power of Attorney form from a reliable source or request a hard copy from a legal office.

- Fill in Your Information: Begin by entering your full name and address at the top of the form. This identifies you as the principal.

- Designate an Agent: Choose a trusted person to act as your agent. Write their full name and address in the designated section.

- Specify Powers: Clearly list the powers you wish to grant to your agent. You can choose general powers or specific ones, depending on your needs.

- Include Successor Agents: If desired, name one or more successor agents who can take over if your primary agent is unable or unwilling to serve.

- Sign and Date: Sign and date the form in the presence of a notary public. This step is crucial for the document to be valid.

- Notarization: Have the notary public witness your signature and complete their section on the form. This adds an extra layer of authenticity.

- Distribute Copies: Provide copies of the completed and notarized form to your agent, any successor agents, and relevant financial institutions or healthcare providers.

Once you have completed these steps, your Durable Power of Attorney will be ready for use. It’s a good idea to keep a copy for your records and ensure that your agent understands their responsibilities.