Legal Last Will and Testament Document for New York State

Misconceptions

When it comes to creating a Last Will and Testament in New York, several misconceptions can lead to confusion. Understanding the facts can help ensure that your wishes are honored and your estate is handled according to your intentions. Here are five common misconceptions:

- All Wills Must Be Notarized - Many people believe that a will must be notarized to be valid. In New York, while notarization can add an extra layer of authenticity, it is not a requirement. A will can be valid if it is signed by the testator and witnessed by at least two individuals.

- Handwritten Wills Are Not Valid - Some think that only typed wills are legally recognized. However, New York does allow handwritten wills, known as holographic wills, as long as they are signed by the testator and reflect their intentions. Keep in mind, though, that these can be more easily challenged in court.

- You Cannot Change Your Will Once It Is Written - A common belief is that once a will is created, it cannot be altered. In reality, you can modify your will at any time, as long as you follow the legal requirements for making changes. This could involve creating a new will or adding a codicil.

- Only Wealthy Individuals Need a Will - Some assume that only those with significant assets need a will. In fact, everyone can benefit from having a will. It ensures that your wishes regarding guardianship, asset distribution, and other important matters are clearly stated, regardless of your financial situation.

- Verbal Wills Are Acceptable - There is a misconception that a verbal will can be considered valid. New York law requires that wills be in writing and properly executed. Verbal wishes may not hold up in court, making it crucial to document your intentions in a formal will.

By addressing these misconceptions, individuals can approach the process of creating a Last Will and Testament with greater confidence and clarity. Taking the time to understand the legal framework will ensure that your final wishes are respected.

Documents used along the form

When creating a New York Last Will and Testament, several other forms and documents may be beneficial to ensure that your estate is managed according to your wishes. Each of these documents serves a specific purpose and can help streamline the process of estate planning. Here’s a brief overview of some commonly used forms.

- Living Will: This document outlines your preferences regarding medical treatment and interventions in case you become unable to communicate your wishes. It focuses on end-of-life care and can guide healthcare providers and family members in making decisions that align with your values.

- ATV Bill of Sale: To facilitate the ownership transfer of ATVs, refer to our essential ATV bill of sale document for clear guidelines and legal compliance.

- Durable Power of Attorney: This form allows you to designate someone to manage your financial affairs if you become incapacitated. The person you choose can handle tasks such as paying bills, managing investments, and making financial decisions on your behalf.

- Health Care Proxy: Similar to a durable power of attorney, a health care proxy specifically appoints someone to make medical decisions for you if you cannot do so yourself. This ensures that your healthcare preferences are respected even when you are unable to voice them.

- Revocable Living Trust: This document holds your assets during your lifetime and allows for their distribution after your death without going through probate. A living trust can provide privacy and flexibility in managing your estate.

- Beneficiary Designations: These are forms used to specify who will receive certain assets, such as life insurance policies and retirement accounts, upon your death. Keeping these designations updated is crucial to ensure your assets go to the intended recipients.

- Letter of Instruction: While not a legally binding document, this letter can provide guidance to your loved ones regarding your wishes for your funeral, distribution of personal items, and other important matters that may not be covered in your will.

- Pet Trust: If you have pets, a pet trust ensures that they will be cared for according to your wishes after your death. This document outlines the care and financial provisions for your pets, ensuring their well-being.

- Guardianship Designation: If you have minor children, this document allows you to specify who you would like to care for them in the event of your passing. This is an important step in ensuring their future is secure and aligns with your values.

Incorporating these documents into your estate planning can provide peace of mind and clarity for both you and your loved ones. It's essential to review and update these documents regularly to reflect any changes in your circumstances or wishes.

Other State-specific Last Will and Testament Forms

Template for a Will - A legal document outlining an individual's final wishes regarding the distribution of their assets.

In order to effectively manage and track shipments, utilizing the FedEx Bill of Lading form is essential; for further insights and resources regarding this document, you can visit https://documentonline.org/, which provides valuable information and templates to ensure your shipping process is efficient and compliant.

Free Last Will and Testament Forms - Provides guidance to the executor on how to administer the estate fairly.

Key Details about New York Last Will and Testament

-

What is a Last Will and Testament?

A Last Will and Testament is a legal document that outlines how an individual's assets and affairs should be handled after their death. It specifies who will inherit property, appoints guardians for minor children, and can even include instructions for funeral arrangements. This document ensures that a person's wishes are honored and can help prevent disputes among family members.

-

Who can create a Last Will and Testament in New York?

In New York, any individual who is at least 18 years old and of sound mind can create a Last Will and Testament. Sound mind means that the person understands the nature of the document and the effects of their decisions. It is essential that the will reflects the true intentions of the individual.

-

What are the requirements for a valid Last Will and Testament in New York?

To be valid in New York, a Last Will and Testament must meet several requirements:

- The will must be in writing.

- It must be signed by the testator (the person making the will) at the end of the document.

- Two witnesses must sign the will, attesting that they witnessed the testator's signature.

- Witnesses should not be beneficiaries of the will to avoid potential conflicts of interest.

-

Can I change my Last Will and Testament after it has been created?

Yes, you can change your Last Will and Testament at any time while you are still alive and of sound mind. Changes can be made by creating a new will or by adding a codicil, which is an amendment to the existing will. It is important to follow the same legal requirements when making changes to ensure the will remains valid.

-

What happens if I die without a Last Will and Testament?

If an individual dies without a Last Will and Testament, they are said to have died "intestate." In such cases, New York state laws determine how the deceased's assets will be distributed. Typically, assets will go to surviving relatives, such as spouses, children, or parents, following a specific order outlined by law. This process can lead to complications and may not reflect the deceased's wishes.

-

Can I name guardians for my children in my Last Will and Testament?

Yes, one of the essential functions of a Last Will and Testament is to name guardians for minor children. This allows parents to specify who they trust to care for their children in the event of their passing. It is crucial to discuss this decision with the chosen guardians beforehand to ensure they are willing and able to take on this responsibility.

-

Is it necessary to hire a lawyer to create a Last Will and Testament?

While it is not legally required to hire a lawyer to create a Last Will and Testament in New York, consulting with one can be beneficial. A lawyer can help ensure that the will meets all legal requirements, reflects your wishes accurately, and addresses any complex family situations or assets. However, many individuals choose to use online templates or resources to create a simple will on their own.

-

How can I ensure my Last Will and Testament is properly executed?

To ensure that your Last Will and Testament is properly executed, follow these steps:

- Make sure the will is in writing and signed by you.

- Have at least two witnesses sign the document, confirming they saw you sign it.

- Store the will in a safe place, such as a safe deposit box or with a trusted family member.

- Consider informing your executor and family members about the location of the will.

-

Can I revoke my Last Will and Testament?

Yes, you can revoke your Last Will and Testament at any time. This can be done by creating a new will that explicitly states that the previous will is revoked or by physically destroying the old will. It is advisable to inform your executor and any relevant parties when you revoke a will to avoid confusion.

-

What is an executor, and what is their role in a Last Will and Testament?

An executor is the person appointed in a Last Will and Testament to manage the deceased's estate after their death. The executor's responsibilities include gathering assets, paying debts and taxes, and distributing the remaining assets to beneficiaries according to the terms of the will. Choosing a trustworthy and responsible executor is essential, as they will play a crucial role in ensuring that the deceased's wishes are carried out effectively.

Similar forms

- Living Will: A living will outlines an individual's preferences regarding medical treatment in the event they become incapacitated. Like a Last Will and Testament, it addresses personal wishes but focuses on health care decisions rather than asset distribution.

- Motor Vehicle Bill of Sale: Essential for the transfer of ownership, this document ensures that both parties are protected in a vehicle sale. For more details, you can refer to this page.

- Durable Power of Attorney: This document allows an individual to designate someone to make financial or legal decisions on their behalf if they become unable to do so. Similar to a Last Will, it ensures that an individual's wishes are respected, but it is active during their lifetime.

- Trust Document: A trust document establishes a legal entity that holds assets for the benefit of specific individuals or entities. Both a trust and a will can dictate how assets are distributed, but a trust can take effect during a person’s lifetime, while a will only takes effect after death.

- Health Care Proxy: A health care proxy appoints someone to make medical decisions for an individual if they are unable to do so. Similar to a Last Will, it ensures that personal preferences are honored, but it specifically pertains to health care rather than asset management.

- Beneficiary Designation Forms: These forms specify who will receive certain assets, such as life insurance policies or retirement accounts, upon an individual's death. Like a Last Will, they direct the distribution of assets, but they operate outside of probate and can supersede a will.

- Letter of Instruction: This informal document provides guidance on personal matters and preferences after an individual's death. While a Last Will and Testament is a legal document, a letter of instruction offers additional context and personal wishes that may not be covered in a will.

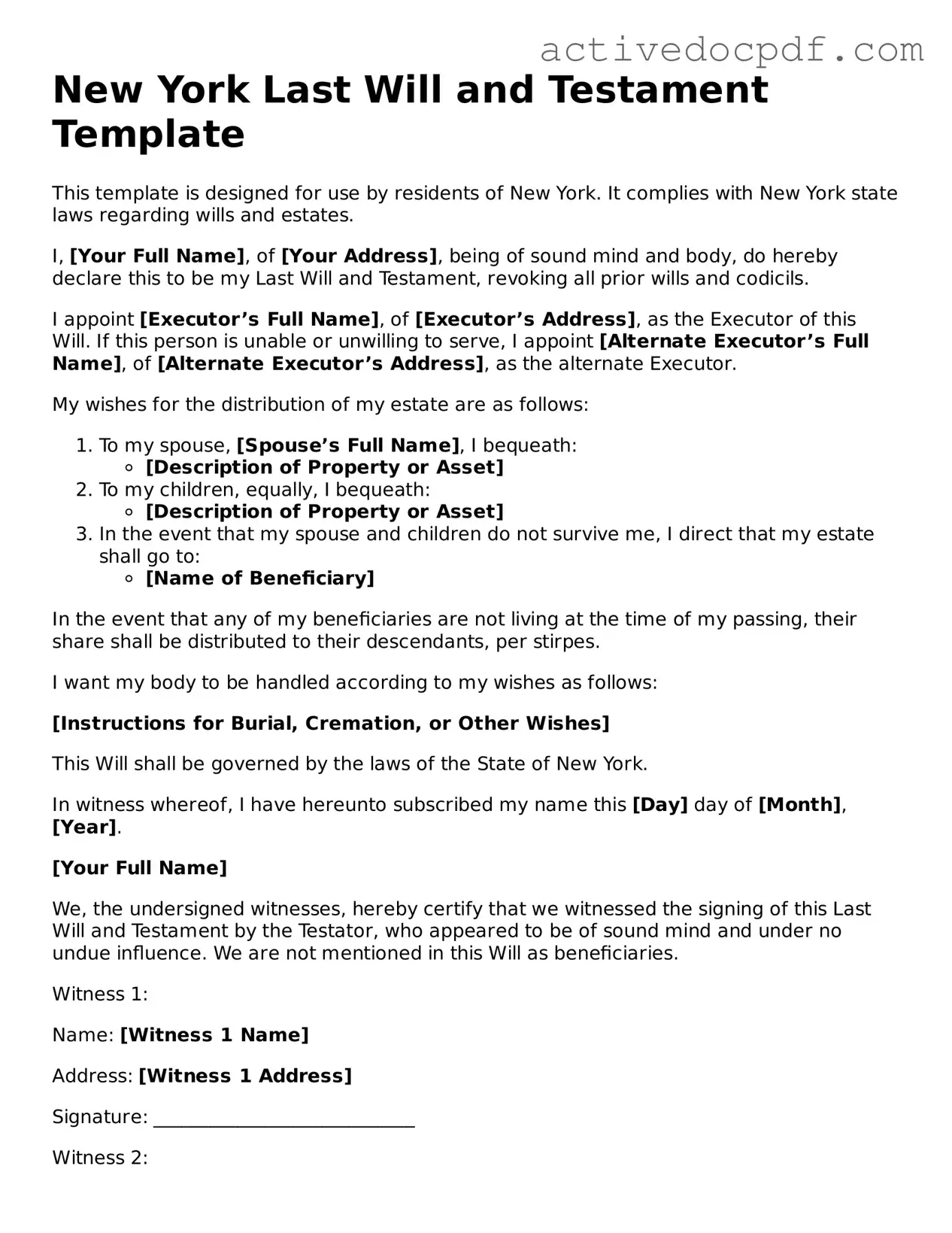

Guide to Filling Out New York Last Will and Testament

After gathering the necessary information, you are ready to fill out the New York Last Will and Testament form. This document will help ensure that your wishes regarding your estate are followed after your passing. Carefully follow the steps below to complete the form accurately.

- Begin by writing your full name at the top of the form. Include your address and date of birth.

- Clearly state that this document is your Last Will and Testament.

- List your beneficiaries. These are the people or organizations who will receive your assets. Include their full names and relationships to you.

- Designate an executor. This person will be responsible for carrying out your wishes as outlined in the will. Provide their name and contact information.

- Detail your assets. Include a description of your property, bank accounts, investments, and any personal belongings you wish to bequeath.

- Specify how you want your assets distributed. Be clear about who receives what to avoid confusion later.

- Include a section for any additional wishes, such as guardianship for minor children or specific funeral arrangements.

- Sign and date the form at the end. Your signature must be witnessed by at least two individuals who are not beneficiaries.

- Have the witnesses sign the document, including their names and addresses. Make sure they understand that they are witnessing your signature.

Once you have completed the form, keep it in a safe place. It’s also wise to share its location with your executor and trusted family members. Regularly review and update your will as needed, especially after major life changes.