Legal Loan Agreement Document for New York State

Misconceptions

Understanding the New York Loan Agreement form is crucial for anyone involved in borrowing or lending money. However, several misconceptions can lead to confusion. Here are eight common misunderstandings:

- The form is only for large loans. Many people believe that the New York Loan Agreement is only necessary for substantial amounts. In reality, it is beneficial for any loan, regardless of size, to ensure clarity and protection for both parties.

- Verbal agreements are sufficient. Some think that a verbal agreement is enough to secure a loan. However, having a written loan agreement provides legal protection and clarity, reducing the risk of misunderstandings.

- Only banks can use this form. While banks often use loan agreements, private lenders and individuals can also utilize this form. It is designed for anyone involved in lending or borrowing money.

- Once signed, the agreement cannot be changed. Many believe that a signed loan agreement is set in stone. In fact, parties can amend the agreement if both agree to the changes, as long as they are documented properly.

- The form guarantees loan approval. Signing a loan agreement does not guarantee that a loan will be approved. Approval depends on various factors, including creditworthiness and the lender's policies.

- All loan agreements are the same. There is a misconception that all loan agreements are identical. Each agreement can vary based on the specific terms negotiated between the lender and borrower, including interest rates and repayment schedules.

- Only the lender needs to sign. Some borrowers think that only the lender's signature is required. However, both parties must sign the agreement to make it legally binding.

- Loan agreements are only for personal loans. Many people assume that loan agreements apply only to personal loans. In truth, they are also used for business loans, real estate transactions, and more.

By dispelling these misconceptions, individuals can better navigate the loan process and ensure their interests are protected.

Documents used along the form

When entering into a loan agreement in New York, several other documents often accompany the Loan Agreement form. These documents help clarify terms, protect both parties, and ensure compliance with legal requirements. Below are four commonly used forms and documents.

- Promissory Note: This document outlines the borrower's promise to repay the loan. It includes details such as the loan amount, interest rate, repayment schedule, and any penalties for late payments.

- Security Agreement: If the loan is secured, this agreement specifies the collateral backing the loan. It details the rights of the lender to claim the collateral if the borrower defaults.

- Personal Guarantee: This document is often required from business owners or individuals. It makes them personally liable for the loan, ensuring the lender has recourse beyond the business's assets.

- Release of Liability: This form is essential for safeguarding organizers from claims related to injuries during specific activities. For more information, you can visit documentonline.org/.

- Disclosure Statement: This statement provides important information about the loan terms, including fees, interest rates, and any other costs associated with the loan. It helps borrowers understand their obligations fully.

Each of these documents plays a crucial role in the loan process. They protect the interests of both the lender and the borrower, ensuring clarity and legal compliance throughout the lending relationship.

Other State-specific Loan Agreement Forms

Free Promissory Note Template Florida - A Loan Agreement outlines the terms between a borrower and lender.

The New York Rental Application form is a critical document used by landlords to assess and evaluate potential tenants before signing a lease agreement. It collects comprehensive information to ensure the applicant is a good fit for the property, making it essential that landlords utilize reliable resources, such as nyforms.com/rental-application-template/, to facilitate this process. This form plays a pivotal role in the New York housing process, setting the stage for a successful landlord-tenant relationship.

Loan Agreement Template California - Modification of terms can occur only if agreed upon by both sides.

Key Details about New York Loan Agreement

What is a New York Loan Agreement form?

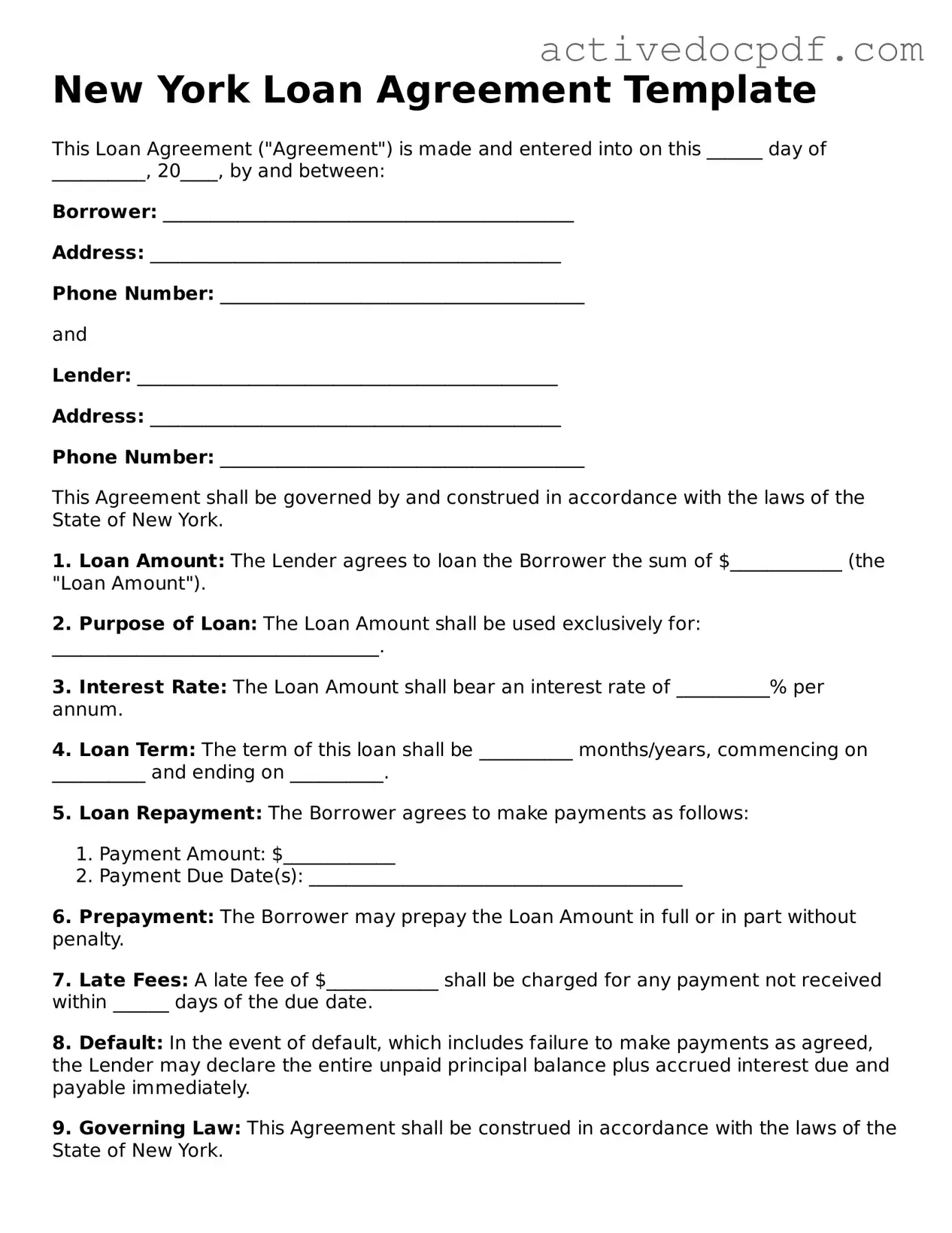

The New York Loan Agreement form is a legal document that outlines the terms and conditions of a loan between a lender and a borrower. This agreement specifies the amount borrowed, the interest rate, repayment schedule, and any collateral involved. It serves as a formal record of the loan and protects the rights of both parties.

Who typically uses a New York Loan Agreement?

Individuals and businesses often use the New York Loan Agreement. Lenders, such as banks or private investors, utilize this form to ensure that their interests are safeguarded. Borrowers, whether they are individuals seeking personal loans or businesses looking for capital, also rely on this agreement to understand their obligations.

What are the key components of a New York Loan Agreement?

A comprehensive New York Loan Agreement generally includes the following components:

- Loan Amount: The total sum of money being borrowed.

- Interest Rate: The percentage charged on the borrowed amount, which can be fixed or variable.

- Repayment Terms: The schedule for repayment, including the frequency of payments and the duration of the loan.

- Collateral: Any assets pledged by the borrower to secure the loan.

- Default Clauses: Conditions under which the borrower may be considered in default and the lender's rights in such cases.

Is a New York Loan Agreement legally binding?

Yes, a New York Loan Agreement is legally binding once both parties sign the document. This means that both the lender and the borrower are obligated to adhere to the terms outlined in the agreement. If either party fails to comply, the other party may seek legal remedies.

Can a New York Loan Agreement be modified?

Yes, a New York Loan Agreement can be modified if both parties agree to the changes. It is important to document any modifications in writing and have both parties sign the updated agreement. This helps prevent misunderstandings and ensures that all changes are legally enforceable.

What happens if the borrower defaults on the loan?

If the borrower defaults, the lender has several options. These may include:

- Initiating legal proceedings to recover the owed amount.

- Seizing collateral if it was pledged as security for the loan.

- Negotiating a repayment plan or settlement with the borrower.

The specific actions taken will depend on the terms outlined in the Loan Agreement and the laws governing such agreements in New York.

Are there any specific laws governing Loan Agreements in New York?

Yes, Loan Agreements in New York are governed by state laws, including the New York General Obligations Law and the New York Uniform Commercial Code. These laws establish the framework for contracts and financial transactions, ensuring that they are fair and enforceable. It is advisable for both parties to be aware of these laws when entering into a loan agreement.

Where can I obtain a New York Loan Agreement form?

A New York Loan Agreement form can be obtained from various sources, including:

- Online legal document providers that offer customizable templates.

- Attorneys who specialize in contract law.

- Local banks or financial institutions that may provide standard forms.

It is essential to ensure that any form used complies with New York state laws and adequately addresses the specific needs of the parties involved.

Similar forms

Promissory Note: This document is a written promise to pay a specified amount of money to a lender under agreed terms. Like a Loan Agreement, it outlines the repayment schedule and interest rate but is typically simpler and focuses solely on the borrower's commitment to repay.

- IRS Form 2553: This form allows small businesses to elect to be taxed as an S corporation, enabling potential tax benefits. For more information, visit PDF Documents Hub, which provides resources to help you understand the application process.

Mortgage Agreement: This document secures a loan with real property as collateral. Similar to a Loan Agreement, it details the loan amount, interest rate, and repayment terms, but it also includes provisions about what happens if the borrower defaults on the loan.

Security Agreement: This document outlines the collateral that secures a loan. It is similar to a Loan Agreement in that it specifies the terms of the loan, but it places a greater emphasis on the collateral and the lender's rights in the event of default.

Credit Agreement: This document governs the terms of a credit facility, such as a line of credit. It shares similarities with a Loan Agreement by detailing the terms of borrowing, repayment, and interest rates, but it often includes provisions for ongoing borrowing and repayment flexibility.

Guide to Filling Out New York Loan Agreement

Completing the New York Loan Agreement form is an important step in formalizing a loan arrangement. Once the form is filled out accurately, it will need to be signed by all parties involved. This ensures that everyone understands the terms of the loan and agrees to them.

- Begin by entering the date at the top of the form.

- Fill in the names and addresses of both the lender and the borrower. Ensure that all information is accurate.

- Specify the loan amount in both numerical and written form to avoid any confusion.

- Clearly state the interest rate applicable to the loan. Make sure to confirm that this rate is agreed upon by both parties.

- Outline the repayment terms, including the payment schedule and due dates.

- Include any fees or additional charges that may apply to the loan.

- Provide a section for any collateral that may secure the loan, if applicable.

- Ensure that all parties read and understand the terms outlined in the agreement.

- Finally, have both the lender and the borrower sign and date the form at the designated areas.