Legal Operating Agreement Document for New York State

Misconceptions

Understanding the New York Operating Agreement form is essential for anyone involved in forming a limited liability company (LLC) in New York. However, there are several misconceptions that can lead to confusion. Below is a list of common misconceptions along with clarifications.

- All LLCs are required to have an Operating Agreement. Many people believe that an Operating Agreement is mandatory for all LLCs in New York. While it is not legally required, having one is highly recommended for clarity and protection.

- The Operating Agreement must be filed with the state. Some assume that the Operating Agreement needs to be submitted to the New York Department of State. In reality, this document is kept internally and does not need to be filed.

- Only multi-member LLCs need an Operating Agreement. A common belief is that single-member LLCs do not require an Operating Agreement. However, having one can still provide important protections and clarify management structure.

- The Operating Agreement is the same as the Articles of Organization. Many confuse these two documents. The Articles of Organization are filed with the state to form the LLC, while the Operating Agreement outlines the management and operational procedures.

- Operating Agreements are set in stone. Some people think that once an Operating Agreement is created, it cannot be changed. In fact, members can amend the agreement as needed, provided all parties agree.

- The Operating Agreement can only address financial matters. It is a misconception that the Operating Agreement is limited to financial arrangements. It can cover a wide range of topics, including management roles, decision-making processes, and dispute resolution.

- All members must agree on the Operating Agreement's terms. Some believe that unanimous consent is necessary for every aspect of the Operating Agreement. While consensus is important, the agreement can specify different voting thresholds for various decisions.

- Operating Agreements are only for large businesses. There is a notion that only larger businesses need an Operating Agreement. However, even small businesses benefit from having clear guidelines and structures in place.

- The Operating Agreement can be verbal. Some may think that a verbal agreement suffices. However, a written Operating Agreement is crucial for legal protection and clarity among members.

- Once the Operating Agreement is established, it is irrelevant. Many believe that the Operating Agreement loses importance after being created. In fact, it should be regularly reviewed and updated to reflect any changes in the business or membership.

By addressing these misconceptions, individuals can better understand the importance and function of the New York Operating Agreement in managing their LLC.

Documents used along the form

The New York Operating Agreement is a crucial document for Limited Liability Companies (LLCs) as it outlines the management structure and operational procedures. However, several other forms and documents complement the Operating Agreement, ensuring comprehensive governance and compliance. Below is a list of these important documents.

- Articles of Organization: This is the foundational document filed with the New York Department of State to officially create an LLC. It includes basic information about the company, such as its name, address, and registered agent.

- Bylaws: Although not always required for LLCs, bylaws establish the rules for the internal management of the company. They can cover topics like meeting procedures, voting rights, and member responsibilities.

- Trailer Bill of Sale: This essential document outlines the details of the sale and transfer of ownership for a trailer, ensuring both buyer and seller are protected in the transaction. For more information, you can refer to PDF Documents Hub.

- Member Resolutions: These are formal decisions made by the members of the LLC. Resolutions can address various issues, such as approving significant expenditures or changes in management structure.

- Membership Certificates: These documents serve as proof of ownership in the LLC. They can outline the percentage of ownership held by each member and may include information about capital contributions.

- Tax Identification Number (EIN) Application: An EIN is essential for tax purposes. This document is filed with the IRS to obtain a unique number for the LLC, which is necessary for opening bank accounts and filing taxes.

- Operating Procedures Manual: This document details the day-to-day operations of the LLC. It can include policies on employee conduct, customer service standards, and other operational guidelines.

- Annual Reports: Depending on state requirements, LLCs may need to file annual reports to maintain good standing. These reports typically include updated information about the company and its members.

Each of these documents plays a vital role in ensuring the effective operation and legal compliance of an LLC in New York. Together, they provide a comprehensive framework for governance, helping members navigate the complexities of running a business.

Other State-specific Operating Agreement Forms

Operating Agreement Llc Florida Template - The agreement can establish guidelines for communicating with members regarding business operations.

For those seeking to understand the documentation process, the Employment Verification form is a key element in confirming work history and income. Proper completion of this form is vital for applicants aiming to present their qualifications effectively. To learn more about how this essential document functions in job applications, visit the important Employment Verification form guidelines.

Llc Operating Agreement California - The Operating Agreement can guide the company’s compliance with state regulations.

Key Details about New York Operating Agreement

What is a New York Operating Agreement?

An Operating Agreement is a crucial document for LLCs (Limited Liability Companies) in New York. It outlines the management structure, responsibilities of members, and operational procedures of the business. Although New York does not require LLCs to have an Operating Agreement, having one is highly recommended to ensure clarity and avoid disputes among members.

Why is an Operating Agreement important?

An Operating Agreement serves several essential purposes:

- It defines the roles and responsibilities of each member, which helps prevent misunderstandings.

- It establishes how profits and losses will be distributed among members.

- It provides guidelines for decision-making and resolving disputes.

- It can help protect your limited liability status by showing that your LLC is a separate entity.

Who should draft the Operating Agreement?

While any member of the LLC can draft the Operating Agreement, it’s often beneficial to involve a legal professional. A lawyer familiar with New York business law can ensure that the document complies with state regulations and addresses the specific needs of your business.

What should be included in the Operating Agreement?

A comprehensive Operating Agreement typically includes:

- The name and address of the LLC.

- The purpose of the LLC.

- The names and contributions of each member.

- Details on how profits and losses will be allocated.

- Procedures for adding or removing members.

- Rules for meetings and voting.

- Guidelines for dissolving the LLC if necessary.

How often should the Operating Agreement be updated?

It’s wise to review and update your Operating Agreement regularly, especially when there are significant changes in the business, such as adding new members or changing ownership percentages. Keeping the document current ensures that it reflects the current state of your LLC and helps avoid conflicts.

Can members change the Operating Agreement?

Yes, members can change the Operating Agreement. Typically, the process for making amendments is outlined within the agreement itself. Most often, a majority vote of the members is required to approve any changes. It’s important to document any amendments in writing to maintain clarity and legal standing.

Is the Operating Agreement filed with the state?

No, the Operating Agreement is not filed with the New York State. Instead, it is kept internally by the LLC. However, it’s a good idea to keep a signed copy with your business records, as it may be needed for various legal or financial matters.

What happens if an LLC does not have an Operating Agreement?

If an LLC does not have an Operating Agreement, New York state laws will govern the operation of the LLC. This could lead to unintended consequences, such as default rules that may not align with the members' intentions. Without a clear agreement, disputes may arise more easily, potentially jeopardizing the business and its members.

Similar forms

The Operating Agreement is a crucial document for LLCs, outlining the management structure and operational procedures. It shares similarities with several other legal documents that govern business relationships and organizational structures. Below are nine documents that have comparable functions or purposes:

- Partnership Agreement: This document outlines the terms of a partnership, detailing each partner's contributions, responsibilities, and profit-sharing arrangements. Like the Operating Agreement, it defines the roles and expectations of each party involved.

- Bylaws: Typically used by corporations, bylaws establish the rules for the management of the company. They cover similar ground to an Operating Agreement by detailing governance, meetings, and the roles of directors and officers.

- Shareholder Agreement: This document is used by corporations to outline the rights and responsibilities of shareholders. It parallels the Operating Agreement by addressing ownership stakes and decision-making processes within the company.

- Joint Venture Agreement: This agreement is formed between two or more parties to undertake a specific project. Like an Operating Agreement, it specifies the contributions, responsibilities, and profit-sharing of each party involved.

- Franchise Agreement: This contract governs the relationship between a franchisor and a franchisee. It includes operational guidelines and obligations, similar to how an Operating Agreement outlines the operational framework of an LLC.

- Employment Agreement: This document defines the relationship between an employer and an employee. It includes job responsibilities, compensation, and termination conditions, akin to how an Operating Agreement outlines member roles and responsibilities.

- Independent Contractor Agreement: This agreement specifies the terms of engagement between a business and a contractor. It shares similarities with the Operating Agreement in that it defines the scope of work and expectations for both parties.

- Non-Disclosure Agreement (NDA): While primarily focused on confidentiality, an NDA can be part of the operational framework of a business. It complements the Operating Agreement by protecting sensitive information shared among members.

-

Bill of Sale form: The Bill of Sale form is a crucial document for formalizing the sale of personal property, ensuring that both buyers and sellers fulfill their legal obligations and protect their interests during the transaction.

- Buy-Sell Agreement: This document outlines the process for buying and selling ownership interests in a business. It is similar to the Operating Agreement in that it addresses ownership transitions and member rights.

Each of these documents plays a vital role in establishing clear expectations and responsibilities within various types of business structures, much like the Operating Agreement does for LLCs.

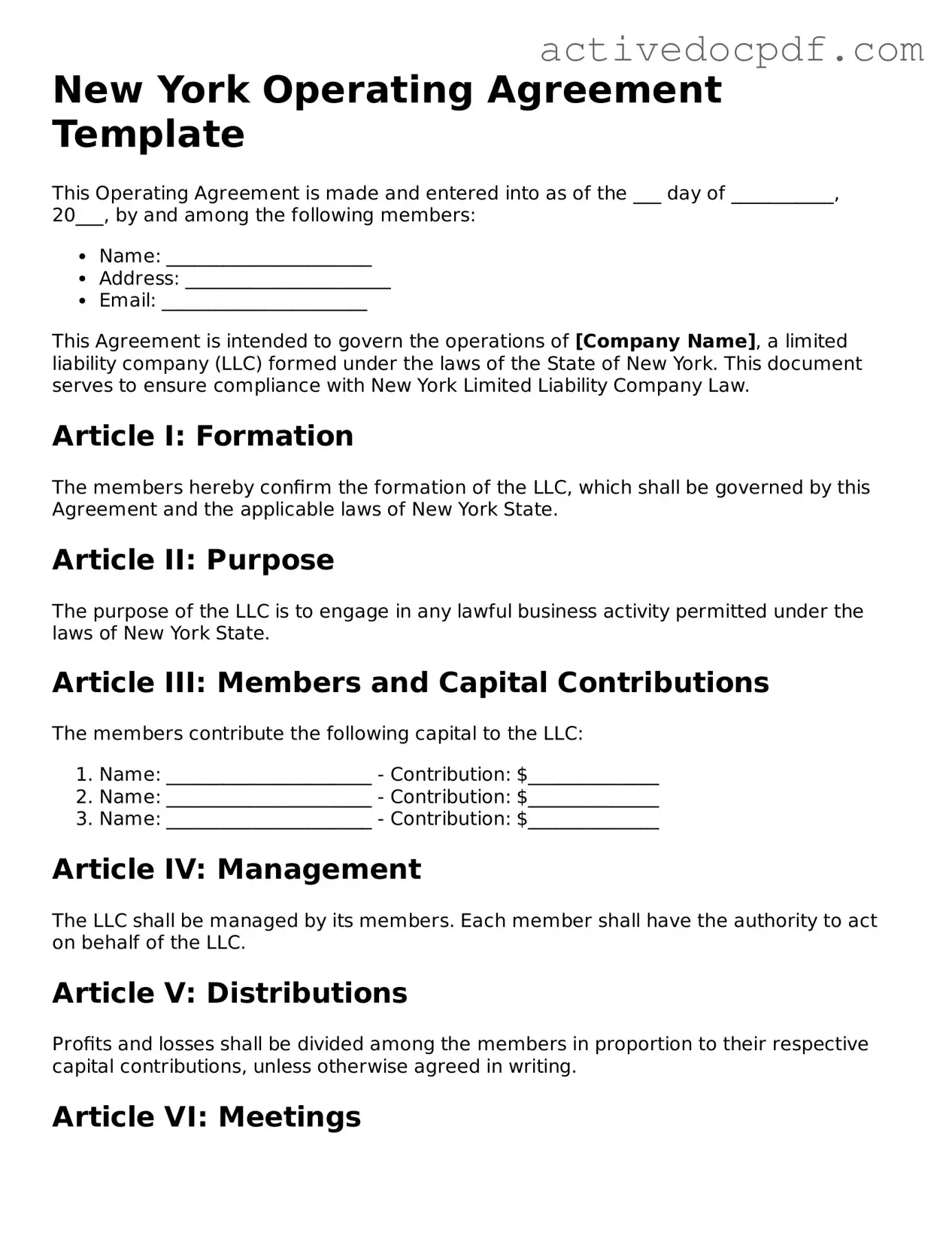

Guide to Filling Out New York Operating Agreement

Completing the New York Operating Agreement form is an essential step in establishing the structure and rules for your business. After filling out the form, you will need to ensure that all members sign it and keep it on file for future reference.

- Begin by downloading the New York Operating Agreement form from a reliable source.

- Enter the name of your LLC at the top of the form.

- List the principal office address of the LLC. This should be a physical address, not a P.O. Box.

- Provide the date on which the LLC was formed.

- Identify the members of the LLC. Include the full names and addresses of all members.

- Outline the management structure. Indicate whether the LLC will be member-managed or manager-managed.

- Specify the percentage of ownership for each member. This should reflect their contributions and agreements.

- Detail the voting rights of members. Indicate how decisions will be made within the LLC.

- Include provisions for profit and loss distribution. Clearly state how profits and losses will be allocated among members.

- Review the form for accuracy. Ensure all information is correct and complete.

- Have all members sign the agreement. Make sure to date the signatures.

- Keep a copy of the signed agreement in your business records for future reference.