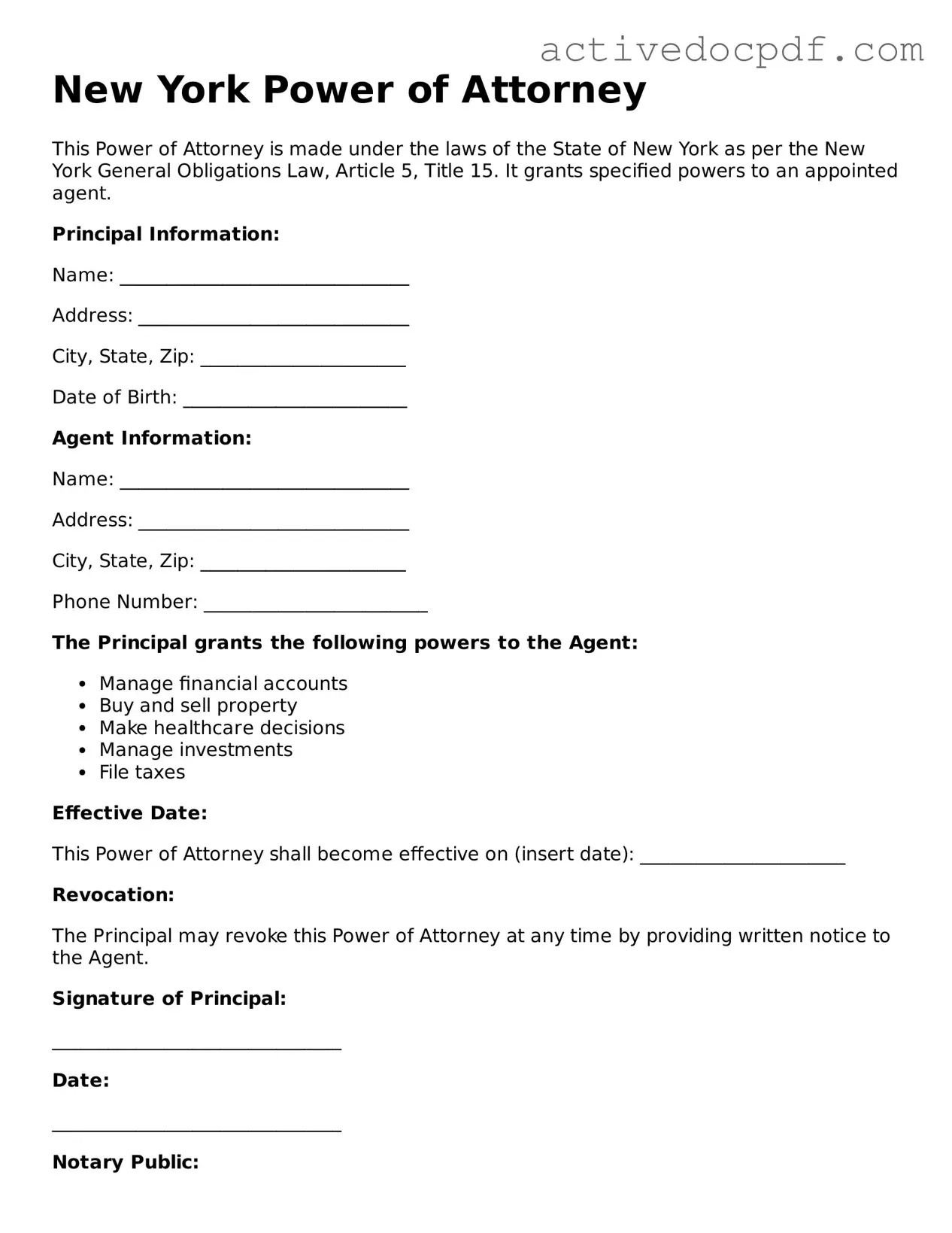

Legal Power of Attorney Document for New York State

Misconceptions

Understanding the New York Power of Attorney form can be challenging, and misconceptions often arise. Here are eight common misunderstandings about this important legal document:

-

All Power of Attorney forms are the same.

In reality, Power of Attorney forms vary by state. New York has specific requirements and language that must be included for the form to be valid.

-

A Power of Attorney can only be used for financial matters.

This is not true. While many people associate Power of Attorney with financial decisions, it can also cover healthcare decisions, legal matters, and more, depending on how it is drafted.

-

Once signed, a Power of Attorney cannot be revoked.

Contrary to this belief, a principal can revoke a Power of Attorney at any time, as long as they are mentally competent to do so.

-

Only lawyers can create a Power of Attorney.

While it is advisable to consult with a legal professional, individuals can create a Power of Attorney on their own, using the New York State form as a guide.

-

A Power of Attorney is only necessary for the elderly.

This misconception overlooks the fact that anyone, regardless of age, may need a Power of Attorney due to health issues, travel, or other circumstances that prevent them from managing their affairs.

-

The agent must be a family member.

While many choose family members, anyone can be designated as an agent, including friends or professionals, as long as they are trustworthy and willing to act in the principal's best interest.

-

A Power of Attorney is effective immediately upon signing.

This is not always the case. A Power of Attorney can be set up to become effective immediately, or it can be designed to only take effect under certain conditions, such as when the principal becomes incapacitated.

-

Once a Power of Attorney is created, it lasts forever.

Power of Attorney documents can have an expiration date or can be limited to specific transactions. It is important to understand the terms and duration outlined in the document.

Documents used along the form

When creating a Power of Attorney (POA) in New York, several other documents may be useful or necessary to ensure comprehensive management of your affairs. Each of these forms serves a specific purpose and can complement the POA to provide clarity and legal authority. Below is a list of documents often associated with a Power of Attorney.

- Living Will: This document outlines an individual's preferences for medical treatment in situations where they cannot communicate their wishes. It serves as a guide for healthcare providers and loved ones regarding end-of-life decisions.

- Health Care Proxy: A Health Care Proxy designates a person to make medical decisions on behalf of someone who is incapacitated. This ensures that someone trusted can advocate for the individual’s health care preferences.

- Advance Directive: An Advance Directive combines both a Living Will and Health Care Proxy, providing clear instructions about medical care and appointing someone to make decisions when necessary.

- Will: A Will outlines how a person's assets will be distributed upon their death. It designates beneficiaries and can name an executor to manage the estate, ensuring that the individual’s wishes are honored.

- Trust: A Trust is a legal arrangement that holds assets for the benefit of specific individuals or entities. It can help avoid probate and provide more control over how and when assets are distributed.

- Property Deed: This document transfers ownership of real estate from one party to another. It may be relevant if the Power of Attorney includes real estate transactions or management.

- Financial Power of Attorney: While a general Power of Attorney may cover various aspects, a Financial Power of Attorney specifically focuses on financial matters, allowing an agent to handle banking, investments, and other financial transactions.

- Durable Power of Attorney (Texas): This form allows an individual in Texas to grant another person the authority to make decisions on their behalf, remaining effective even if they become incapacitated. For those interested in taking this significant step, a convenient option to fill out the form is just a click away: https://texasformspdf.com/fillable-durable-power-of-attorney-online.

- Authorization to Release Information: This form permits designated individuals to access personal information, such as medical records or financial statements, ensuring that those managing affairs have the necessary information to act effectively.

Understanding these documents can help individuals prepare for their future and ensure that their wishes are respected. Each document plays a vital role in the overall management of personal, medical, and financial affairs, providing peace of mind and clarity for all involved.

Other State-specific Power of Attorney Forms

Power of Attorney Form Florida Pdf - State laws govern the use of Power of Attorney.

The IRS Form 2553 is used by small businesses to elect to be treated as an S Corporation for federal tax purposes. This designation allows income, deductions, and credits to flow through to shareholders, thus avoiding double taxation. Completing this form correctly is essential for ensuring compliance and optimizing tax benefits. For more information, you can visit https://documentonline.org/.

Free Power of Attorney Form California - This document can enhance your autonomy by allowing you to choose your decision-maker.

Key Details about New York Power of Attorney

What is a Power of Attorney in New York?

A Power of Attorney (POA) is a legal document that allows one person, known as the principal, to grant another person, known as the agent or attorney-in-fact, the authority to act on their behalf. This authority can cover a wide range of financial and legal matters, depending on how the document is drafted. In New York, a POA must comply with specific state laws to be valid.

What are the different types of Power of Attorney in New York?

In New York, there are several types of Power of Attorney, including:

- General Power of Attorney: This grants broad authority to the agent to handle various matters, such as financial transactions and property management.

- Limited Power of Attorney: This restricts the agent's authority to specific tasks or a defined period.

- Durable Power of Attorney: This remains effective even if the principal becomes incapacitated, ensuring that the agent can continue to act on their behalf.

- Springing Power of Attorney: This only becomes effective under certain conditions, typically when the principal becomes incapacitated.

How do I create a Power of Attorney in New York?

To create a Power of Attorney in New York, follow these steps:

- Choose an agent you trust to act on your behalf.

- Obtain a New York Power of Attorney form. This form can be found online or through legal resources.

- Fill out the form, specifying the powers you wish to grant your agent.

- Sign the document in the presence of a notary public and have it witnessed by at least one person.

Ensure that the form is completed accurately to avoid any issues with its validity.

Do I need a lawyer to create a Power of Attorney?

While it is not legally required to hire a lawyer to create a Power of Attorney in New York, consulting with one can be beneficial. A lawyer can help ensure that the document meets all legal requirements and accurately reflects your wishes. This can prevent potential disputes or misunderstandings in the future.

Can I revoke a Power of Attorney in New York?

Yes, a Power of Attorney can be revoked at any time as long as the principal is competent. To revoke a POA, the principal must create a written revocation document and provide it to the agent. It is advisable to notify any third parties who may have relied on the original Power of Attorney to avoid confusion.

What happens if I do not have a Power of Attorney?

If you do not have a Power of Attorney and become incapacitated, a court may appoint a guardian to make decisions on your behalf. This process can be lengthy and costly. Having a POA in place allows you to choose someone you trust to handle your affairs without the need for court intervention.

Similar forms

The Power of Attorney (POA) form is a powerful legal tool that allows one person to act on behalf of another in various matters. While it serves a unique purpose, several other documents share similarities with the POA in terms of granting authority or managing affairs. Here are five documents that are akin to the Power of Attorney:

- Living Will: A Living Will outlines an individual's wishes regarding medical treatment in case they become incapacitated. Like a POA, it allows someone to make decisions on behalf of another, particularly in health-related situations.

- Health Care Proxy: This document designates a specific person to make medical decisions for someone who is unable to do so. Similar to a POA, it empowers another individual to act in the best interest of the person who is incapacitated.

- Durable Power of Attorney: This variation of the standard Power of Attorney remains effective even if the principal becomes incapacitated. It serves the same purpose as a regular POA but offers additional security in long-term situations.

- Financial Power of Attorney: This specific type of POA focuses solely on financial matters. It allows someone to manage another person's financial affairs, much like a general POA but with a clear focus on economic responsibilities.

- Mobile Home Bill of Sale: The PDF Documents Hub provides essential resources to help you prepare the necessary documents for the transfer of ownership for a mobile home in New York State.

- Trust Agreement: A Trust Agreement involves the management of assets for the benefit of another person. While it typically involves a trustee managing the assets, it parallels a POA in that it allows one party to act on behalf of another in financial matters.

Understanding these documents can empower individuals to make informed choices about who will manage their affairs in various situations. Each document has its unique features, yet they all share the common goal of ensuring that someone can step in and act when needed.

Guide to Filling Out New York Power of Attorney

Filling out the New York Power of Attorney form is a straightforward process that allows you to designate someone to act on your behalf in financial matters. After completing the form, ensure that it is signed and notarized to make it legally binding.

- Obtain the New York Power of Attorney form. You can download it from the New York State government website or request a copy from a legal professional.

- Fill in your name and address in the designated section. This identifies you as the principal.

- Enter the name and address of the person you are appointing as your agent. This person will have the authority to act on your behalf.

- Specify the powers you wish to grant to your agent. You can choose general powers or limit them to specific transactions.

- Indicate whether the Power of Attorney is durable. A durable Power of Attorney remains effective even if you become incapacitated.

- Sign and date the form in the presence of a notary public. This step is crucial for the form to be valid.

- Provide a copy of the signed form to your agent and keep a copy for your records.