Legal Prenuptial Agreement Document for New York State

Misconceptions

Many people hold misconceptions about prenuptial agreements, especially in a complex legal landscape like New York. Understanding the truth behind these beliefs is crucial for anyone considering a prenup. Here are ten common misconceptions:

- Prenups are only for the wealthy. This is false. Prenuptial agreements can benefit anyone, regardless of financial status. They help clarify financial responsibilities and protect individual assets.

- Prenups are unromantic. While discussing a prenup may feel awkward, it can actually foster open communication about finances, which is vital for a healthy relationship.

- Prenups can’t be changed. In reality, prenuptial agreements can be modified after marriage if both parties agree. Flexibility is possible.

- Prenups are only for divorce. Many people overlook that a prenup can provide clarity and guidance during the marriage, not just in the event of a divorce.

- Prenups are not legally binding. This is incorrect. When properly drafted and executed, prenuptial agreements are enforceable in court.

- Prenups can include anything. There are limits. Prenups cannot dictate child custody arrangements or child support, as those decisions must be made in the best interest of the child.

- Prenups are only for heterosexual couples. This misconception is outdated. Same-sex couples can and should consider prenuptial agreements to protect their interests.

- Prenups are a sign of distrust. Instead of indicating a lack of trust, a prenup can be seen as a proactive measure to ensure both parties are on the same page financially.

- Prenups are only necessary if one partner has significant assets. Even if both partners have modest assets, a prenup can help clarify financial expectations and responsibilities.

- Prenups are complicated and expensive. While they do require careful drafting, many find that the peace of mind a prenup provides is worth the investment.

Understanding these misconceptions can empower individuals to make informed decisions about their financial futures and relationships. A prenuptial agreement may not be the right choice for everyone, but it deserves serious consideration.

Documents used along the form

When preparing for marriage, many couples consider a prenuptial agreement to outline their financial rights and responsibilities. However, there are several other important documents that often accompany this agreement. Each serves a unique purpose in ensuring clarity and protection for both parties.

- Postnuptial Agreement: Similar to a prenuptial agreement, this document is created after marriage. It helps couples address financial matters and property rights, often in response to changing circumstances or to clarify existing agreements.

- Financial Disclosure Statement: This form requires both parties to provide a detailed account of their financial situation, including assets, debts, and income. Transparency in finances is crucial for a fair prenuptial agreement.

- Separation Agreement: In the event that a couple separates, this document outlines the terms of their separation, including asset division, support obligations, and child custody arrangements. It can be a helpful tool for couples looking to clarify their rights during a challenging time.

- Motor Vehicle Bill of Sale: This important document records the sale of a vehicle between the buyer and seller, detailing essential information such as the make, model, year, and VIN. It serves to establish ownership transfer and is vital for legal protection and registration purposes. You can learn more.

- Will: While not directly related to a prenuptial agreement, a will is essential for determining how assets will be distributed after one spouse passes away. Couples may want to update their wills to reflect their new marital status and any changes in asset ownership.

Understanding these documents can help couples navigate the complexities of marriage and financial planning. Each plays a vital role in protecting individual interests and fostering a healthy partnership.

Other State-specific Prenuptial Agreement Forms

California Prenup Contract - This form can help couples navigate complex financial landscapes together.

The Georgia Tractor Bill of Sale form is essential for anyone looking to complete the sale of a tractor in Georgia, as it provides a legal record of the transaction. To ensure that both buyers and sellers are protected throughout the process, it is important to include all relevant details, including the purchase price and vehicle identification. For a streamlined experience, you can access the necessary documentation through the Tractor Bill of Sale form.

Key Details about New York Prenuptial Agreement

- To protect personal assets acquired before marriage.

- To define financial responsibilities during the marriage.

- To simplify the divorce process by outlining asset division.

- To provide peace of mind for both partners.

- Division of property and assets.

- Debt responsibilities.

- Spousal support or alimony terms.

- Inheritance rights.

- Provisions for children from previous relationships.

- Discuss your financial situation openly with your partner.

- Consult with separate attorneys to ensure both parties understand their rights.

- Draft the agreement, detailing all terms clearly.

- Both parties must sign the agreement voluntarily.

- Consider having the agreement notarized for added legal weight.

What is a prenuptial agreement?

A prenuptial agreement, often called a prenup, is a legal document that couples create before getting married. It outlines how assets and debts will be handled in the event of divorce or separation. This agreement can help clarify financial expectations and protect individual interests.

Why should I consider a prenuptial agreement?

There are several reasons to consider a prenup:

Who should get a prenuptial agreement?

Anyone entering into a marriage may benefit from a prenuptial agreement. It is particularly advisable for individuals with significant assets, business ownership, or children from previous relationships. However, every couple can find value in discussing their financial future openly.

What can be included in a prenuptial agreement?

A prenuptial agreement can cover various topics, such as:

Are there any limitations on what can be included?

Yes, certain topics cannot be included in a prenuptial agreement. For example, agreements regarding child custody and child support cannot be predetermined in a prenup. Courts typically want to ensure that any decisions made about children are in their best interests at the time of divorce.

How do I create a prenuptial agreement in New York?

To create a prenuptial agreement in New York, follow these steps:

Can a prenuptial agreement be changed after marriage?

Yes, a prenuptial agreement can be modified after marriage. Both parties must agree to the changes, and it is advisable to document any modifications in writing. Just like the original agreement, changes should ideally be reviewed by legal counsel.

What happens if we don't have a prenuptial agreement?

If a couple does not have a prenuptial agreement, New York state laws will govern the division of assets and debts in the event of divorce. This may lead to outcomes that neither party anticipated or desired, making it essential to understand the implications of not having a prenup.

Is a prenuptial agreement enforceable in New York?

Yes, a prenuptial agreement is generally enforceable in New York, provided it meets certain legal standards. The agreement must be in writing, signed by both parties, and entered into voluntarily. If a court finds that the agreement was made under duress or is unconscionable, it may not be enforced.

How much does it cost to create a prenuptial agreement?

The cost of creating a prenuptial agreement can vary widely based on several factors, including the complexity of the agreement and the attorneys involved. On average, couples may expect to spend anywhere from a few hundred to several thousand dollars. Investing in legal advice can help ensure the agreement is valid and comprehensive.

Similar forms

- Postnuptial Agreement: Similar to a prenuptial agreement, this document is created after marriage. It outlines the financial and property arrangements between spouses, providing clarity on asset division in case of divorce or separation.

- Separation Agreement: This document is used when couples decide to live apart. It details the terms of the separation, including asset division, child custody, and support obligations, similar to how a prenuptial agreement lays out expectations before marriage.

- Divorce Settlement Agreement: This agreement is finalized during the divorce process. It addresses the division of assets, debts, and any child-related issues, paralleling the financial considerations outlined in a prenuptial agreement.

- Co-habitation Agreement: For couples living together without marriage, this document establishes the rights and responsibilities of each partner regarding shared property and finances, akin to a prenuptial agreement's focus on asset management.

- Living Will: While primarily focused on healthcare decisions, a living will can include financial directives. Both documents reflect personal wishes and intentions, although in different contexts.

- Limited Liability Company Agreement: Essential for LLCs, this agreement outlines the management structure and operational guidelines necessary for compliance. For a comprehensive understanding, refer to the Limited Liability Company Agreement.

- Power of Attorney: This document grants someone the authority to make decisions on another's behalf. Like a prenuptial agreement, it is a proactive measure to ensure that personal and financial matters are managed according to one's preferences.

- Trust Agreement: This legal document establishes a trust to manage assets for beneficiaries. Similar to a prenuptial agreement, it involves the arrangement of financial matters and can help protect assets from potential future disputes.

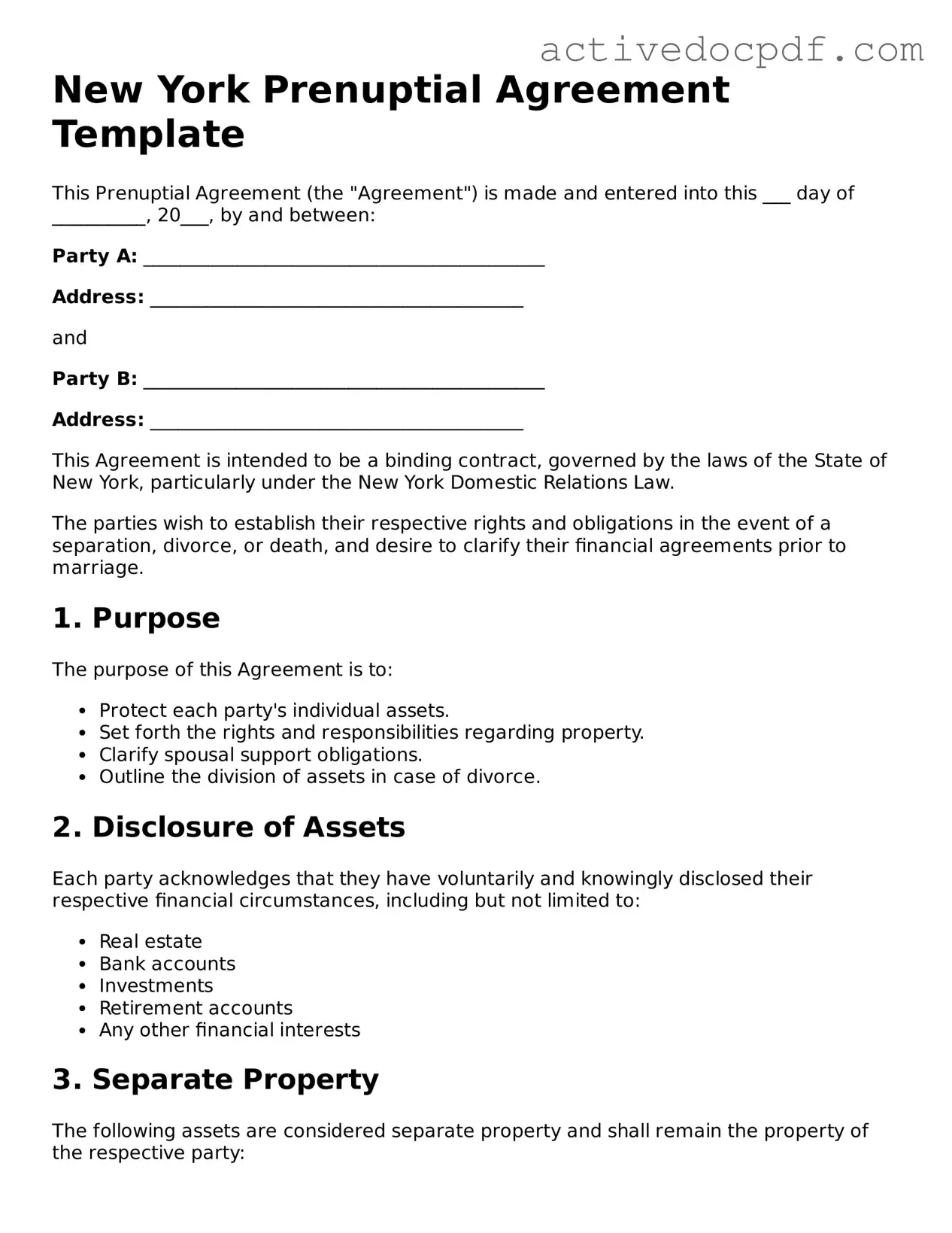

Guide to Filling Out New York Prenuptial Agreement

Filling out a New York Prenuptial Agreement form requires careful attention to detail. This document will outline the financial arrangements and responsibilities between partners before marriage. Completing it accurately is crucial to ensure that both parties understand their rights and obligations.

- Begin by downloading the New York Prenuptial Agreement form from a reliable legal website or obtaining a physical copy from a legal office.

- Read through the entire form carefully to understand all sections and requirements.

- At the top of the form, fill in the names of both parties. Include full legal names and any relevant titles.

- Next, provide the current addresses for both individuals. This information helps establish residency.

- In the designated section, outline the assets and debts of each party. Be thorough and honest, listing all property, bank accounts, investments, and liabilities.

- Detail any specific agreements regarding the division of assets and debts in the event of a divorce. Clearly state how each party wishes to handle their financial responsibilities.

- If applicable, include any provisions regarding spousal support or alimony. Specify the terms that both parties agree upon.

- After completing the financial sections, both parties should review the document together to ensure accuracy and mutual understanding.

- Sign and date the form in the presence of a notary public. This step is essential to validate the agreement legally.

- Keep multiple copies of the signed agreement for both parties and consider filing one with a trusted attorney.