Legal Promissory Note Document for New York State

Misconceptions

The New York Promissory Note form is often misunderstood. Here are six common misconceptions:

- All Promissory Notes are the Same: Many people believe that all promissory notes function identically. In reality, the terms and conditions can vary significantly based on the specific agreement between the parties involved.

- Notarization is Required: Some assume that a promissory note must be notarized to be valid. While notarization can provide additional legal protection, it is not a strict requirement for the note to be enforceable in New York.

- Only Written Notes are Valid: There is a misconception that only written promissory notes hold legal weight. However, verbal agreements can also constitute a promissory note, though they may be harder to prove in court.

- Interest Rates are Fixed: Many believe that the interest rates on promissory notes are always fixed. In fact, the interest rate can be variable, depending on what the parties agree upon in the note.

- They Cannot be Transferred: Some think that once a promissory note is created, it cannot be transferred to another party. This is incorrect; promissory notes can be assigned or sold, provided the terms allow for it.

- Defaulting on a Note is Simple: A common belief is that if someone defaults on a promissory note, the process to recover the owed amount is straightforward. In reality, the recovery process can involve complex legal procedures and may require court intervention.

Understanding these misconceptions can help individuals navigate the complexities of promissory notes more effectively.

Documents used along the form

A New York Promissory Note is a crucial document that outlines a borrower's promise to repay a loan under specified terms. However, several other forms and documents often accompany this note to ensure clarity and legal protection for both parties involved in the transaction. Below is a list of commonly used forms that complement the New York Promissory Note.

- Loan Agreement: This document details the terms of the loan, including the amount, interest rate, repayment schedule, and any collateral involved. It serves as a comprehensive guide to the obligations of both the lender and the borrower.

- Florida Motor Vehicle Bill of Sale: This form is essential for documenting the sale of a vehicle, capturing key details about the transaction. It ensures both the buyer and seller are protected, and the form is available here the form is available here.

- Security Agreement: If the loan is secured by collateral, this document outlines the specific assets pledged by the borrower. It provides the lender with rights to the collateral in case of default.

- Guaranty Agreement: In situations where a third party agrees to take responsibility for the loan if the borrower defaults, a guaranty agreement is used. This document adds an extra layer of security for the lender.

- Disclosure Statement: This form provides essential information about the loan, including any fees, terms, and conditions. It ensures that the borrower fully understands the financial implications before signing the promissory note.

Utilizing these documents alongside the New York Promissory Note can help both parties navigate the complexities of a loan agreement. Each form plays a vital role in ensuring that the terms are clear, obligations are understood, and protections are in place, ultimately fostering a smoother transaction process.

Other State-specific Promissory Note Forms

Promissory Note Template Florida Pdf - It can be used in various types of loans, including student and personal loans.

Free Loan Agreement Template Texas - The length of the loan is specified within the promissory note, detailing the repayment period.

The Employment Verification form is a crucial document used by employers to confirm the employment status of an individual. This form serves as a means of validating a person's work history, including job titles, dates of employment, and responsibilities. For more information about this process, you can visit https://documentonline.org. Understanding its purpose can benefit both job seekers and employers alike.

Simple Promissory Note Template California - The terms can be tailored to fit the needs of both the lender and borrower.

Key Details about New York Promissory Note

What is a New York Promissory Note?

A New York Promissory Note is a legal document that outlines a borrower's promise to repay a specified amount of money to a lender under agreed-upon terms. This document serves as a written record of the loan and includes details such as the loan amount, interest rate, repayment schedule, and any penalties for late payment.

Who can use a Promissory Note?

Any individual or business can use a Promissory Note in New York. It is commonly utilized by:

- Individuals borrowing money from friends or family.

- Businesses seeking loans from investors or financial institutions.

- Real estate transactions where buyers need to finance a portion of the purchase price.

What information should be included in a Promissory Note?

A well-crafted Promissory Note should include the following key elements:

- The names and addresses of both the borrower and the lender.

- The principal amount being borrowed.

- The interest rate, if applicable.

- The repayment schedule, including due dates and payment amounts.

- Any late fees or penalties for missed payments.

- Signatures of both parties to validate the agreement.

Is a Promissory Note legally binding?

Yes, a Promissory Note is a legally binding document. Once signed by both parties, it creates an enforceable obligation for the borrower to repay the loan according to the terms outlined in the note. If the borrower fails to make payments, the lender has the right to take legal action to recover the owed amount.

Can a Promissory Note be modified?

Yes, a Promissory Note can be modified, but both parties must agree to the changes. It is advisable to document any modifications in writing, and both the borrower and lender should sign the revised note. This ensures clarity and protects both parties' interests.

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults, meaning they fail to make payments as agreed, the lender may take several actions. These can include:

- Contacting the borrower to discuss the missed payments.

- Charging late fees as specified in the note.

- Initiating legal proceedings to recover the owed amount.

It is important for both parties to communicate openly to resolve any issues before they escalate.

Where can I obtain a New York Promissory Note form?

A New York Promissory Note form can be obtained from various sources, including:

- Legal document preparation services.

- Online legal form websites.

- Local banks or credit unions that may provide templates.

Always ensure that the form complies with New York laws and is tailored to your specific needs.

Similar forms

A Promissory Note is a financial document that outlines a promise to pay a specific amount of money to a designated party under agreed-upon terms. Several other documents share similarities with a Promissory Note in their purpose and structure. Here are six such documents:

- Loan Agreement: Like a Promissory Note, a loan agreement details the terms of a loan, including the amount borrowed, interest rates, and repayment schedule. However, it often includes more comprehensive terms and conditions governing the entire loan process.

- ATV Bill of Sale: The New York ATV Bill of Sale form is essential for documenting the sale and transfer of ownership of an all-terrain vehicle, serving as proof of the transaction and ensuring all necessary details are captured. For more information, visit PDF Documents Hub.

- IOU (I Owe You): An IOU is a simple acknowledgment of a debt. While it lacks the formal structure of a Promissory Note, it serves a similar purpose by confirming that one party owes money to another.

- Mortgage Agreement: This document is specifically used in real estate transactions. It outlines the terms of a loan secured by real property, much like a Promissory Note, but it also includes details about the collateral involved.

- Credit Agreement: A credit agreement establishes the terms under which a borrower can access credit. Similar to a Promissory Note, it specifies repayment terms, but it usually covers a broader range of financial activities.

- Lease Agreement: In a lease agreement, one party agrees to pay another for the use of property over a specified period. While it focuses on rental terms, it shares the obligation to make payments, akin to a Promissory Note.

- Personal Loan Agreement: This document outlines the terms of a personal loan between individuals. It includes repayment terms and interest rates, similar to a Promissory Note, but it often involves less formalities.

Understanding these documents can help you navigate financial agreements more effectively. Each serves a unique purpose but shares the common thread of outlining obligations between parties.

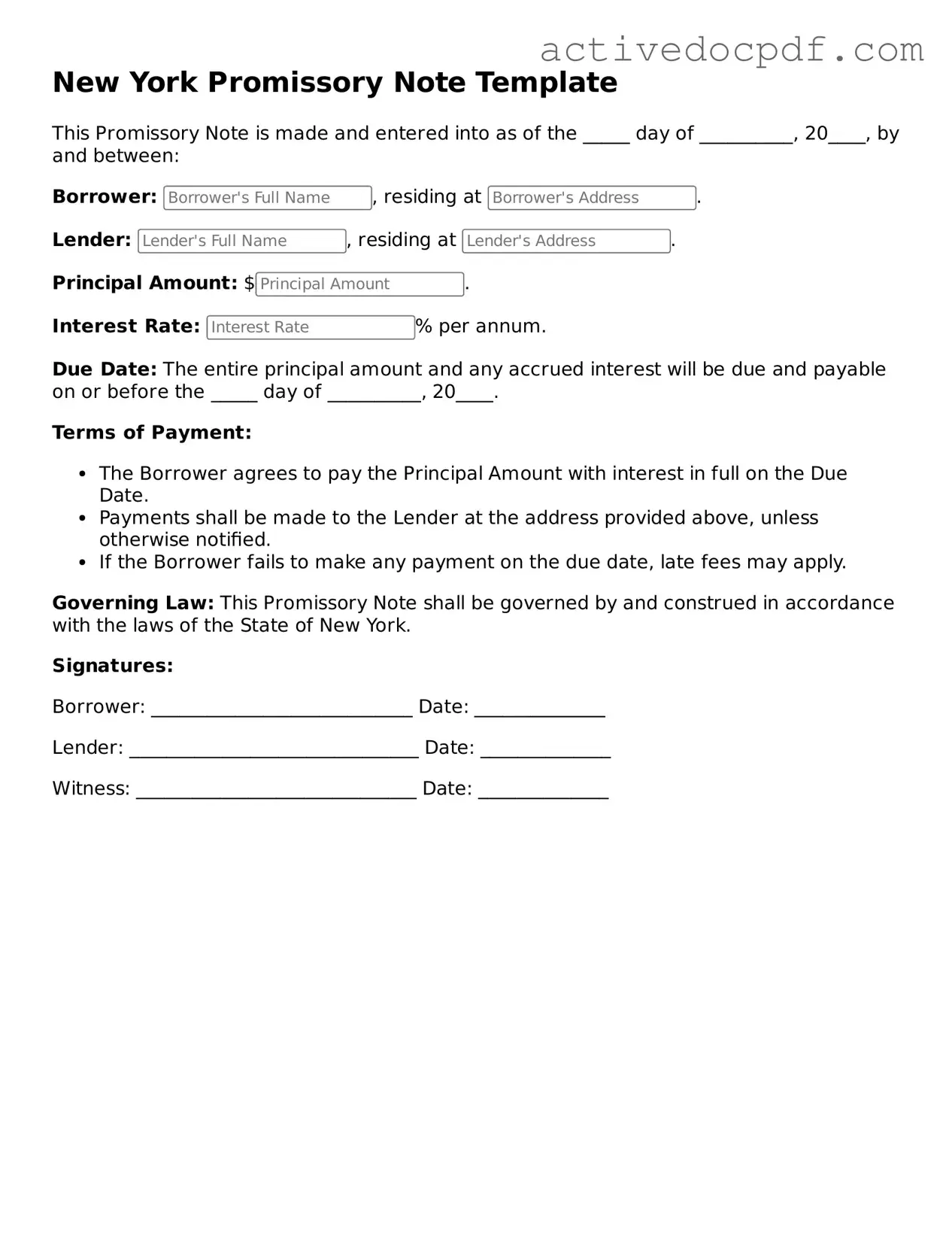

Guide to Filling Out New York Promissory Note

After gathering the necessary information, you’re ready to fill out the New York Promissory Note form. This document will require specific details about the loan agreement between the lender and the borrower. Make sure you have all the required information at hand, as accuracy is crucial.

- Begin by entering the date at the top of the form. This is the date when the note is created.

- Next, write the name and address of the borrower. This identifies the person responsible for repaying the loan.

- Then, provide the name and address of the lender. This is the individual or entity providing the loan.

- Specify the principal amount of the loan. This is the total amount borrowed and should be clearly stated.

- Indicate the interest rate. If the loan has an interest component, mention the percentage rate applicable.

- Detail the repayment terms. Outline how and when the borrower will repay the loan. This may include the payment schedule, such as monthly or quarterly payments.

- Include any late fees or penalties for missed payments, if applicable. This ensures both parties understand the consequences of late payments.

- Provide a section for signatures. Both the borrower and lender should sign and date the form to make it legally binding.

Once you have completed the form, review it carefully to ensure all information is accurate and complete. After that, both parties should keep a copy for their records. This will help avoid misunderstandings in the future.