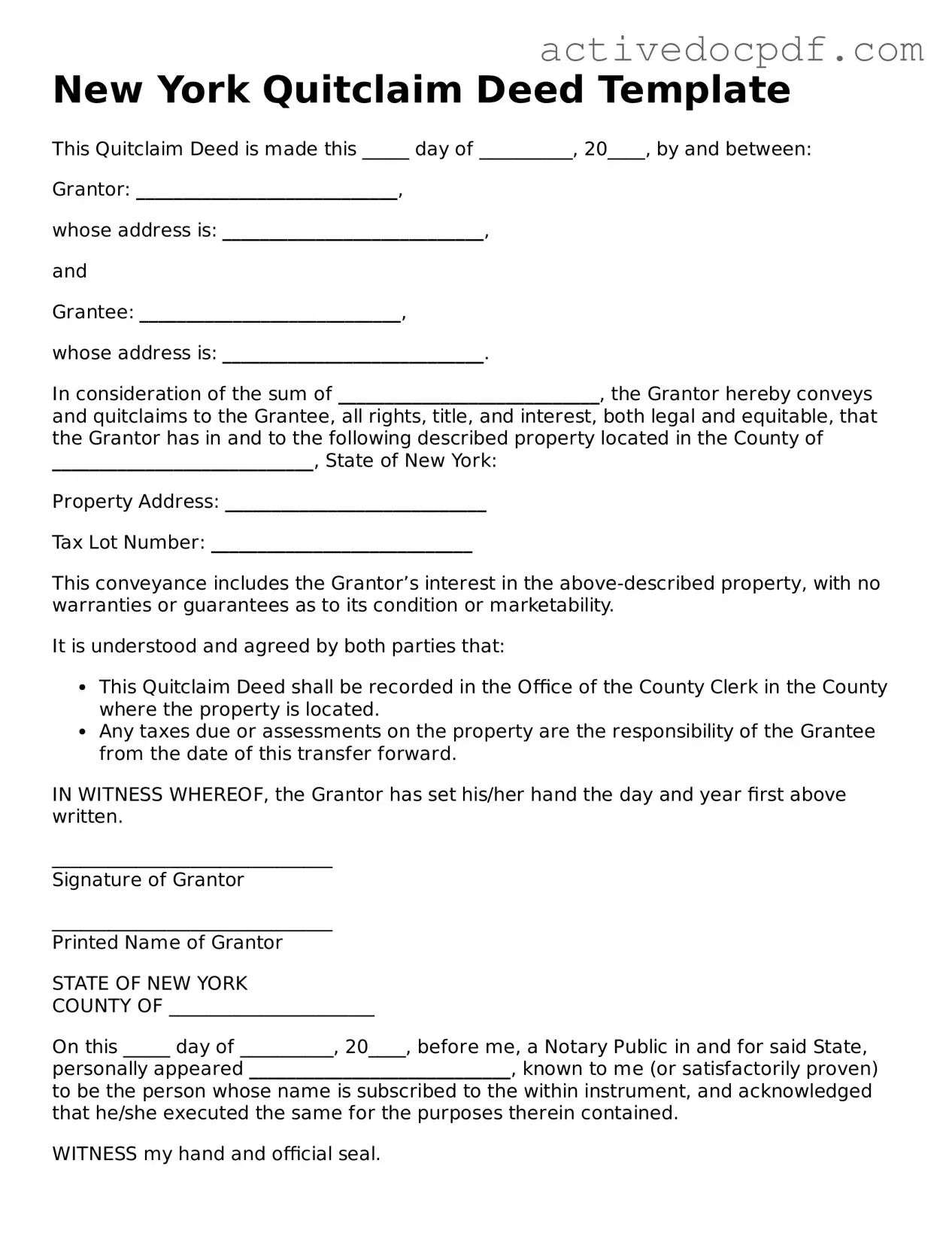

Legal Quitclaim Deed Document for New York State

Misconceptions

When it comes to real estate transactions in New York, the Quitclaim Deed form often raises eyebrows. Many people hold misconceptions about what it actually entails. Here are seven common misunderstandings:

- It transfers ownership without any guarantees. Many believe that a Quitclaim Deed guarantees that the property is free of liens or other claims. In reality, it simply transfers whatever interest the grantor has, if any, without any warranties.

- It is only used between family members. While Quitclaim Deeds are frequently used in family transactions, they are not limited to such situations. They can be used in any transaction where the parties agree to the transfer.

- It is a quick and easy way to sell property. Although the process may seem straightforward, using a Quitclaim Deed does not eliminate the need for due diligence. Buyers should still investigate the property’s title and any existing claims.

- It is the same as a Warranty Deed. This is a significant misconception. A Warranty Deed provides guarantees about the title, while a Quitclaim Deed does not. Understanding this difference is crucial for any transaction.

- It can be used to remove a spouse from the title after divorce. While a Quitclaim Deed can be used for this purpose, it is essential to ensure that the divorce settlement explicitly allows for such a transfer. Legal advice is often necessary.

- It is not legally binding. A Quitclaim Deed is indeed a legally binding document once it is properly executed and recorded. It is important to follow the necessary steps to ensure its validity.

- It does not need to be recorded. Although it is not mandatory to record a Quitclaim Deed, doing so is highly recommended. Recording protects the new owner’s interest and provides public notice of the transfer.

Understanding these misconceptions can help individuals make informed decisions when dealing with property transfers in New York. Always consider consulting with a legal professional for guidance tailored to your specific situation.

Documents used along the form

The New York Quitclaim Deed form is often accompanied by several other documents to ensure a smooth transfer of property ownership. Each of these documents serves a specific purpose in the transaction process. Below is a list of commonly used forms and documents that may be necessary when executing a quitclaim deed.

- Property Transfer Tax Return (TP-584): This form is required by the New York State Department of Taxation and Finance. It reports the transfer of real property and calculates any applicable taxes.

- Affidavit of Title: This document certifies the seller's ownership of the property and confirms that there are no liens or claims against it. It provides assurance to the buyer about the title's status.

- Notice of Sale: This is a formal notification to interested parties that the property is being sold. It may be required in certain situations to inform creditors and other stakeholders.

- Title Search Report: A title search is often conducted to verify the property's ownership history and to uncover any potential issues, such as liens or encumbrances.

- Homeowner's Association (HOA) Documents: If the property is part of an HOA, these documents outline the rules and regulations governing the community. They may also include information about fees and assessments.

- New York ATV Bill of Sale: This legal document is necessary to record the sale of an all-terrain vehicle, serving as proof of transaction between buyer and seller. For more information, visit PDF Documents Hub.

- Closing Statement (HUD-1): This document summarizes the financial details of the transaction, including the purchase price, closing costs, and any adjustments. It is typically reviewed and signed at closing.

- Power of Attorney: If the seller cannot be present at the closing, a power of attorney may be used to authorize another person to act on their behalf during the transaction.

- Deed of Trust (if applicable): In some cases, a deed of trust may be used to secure the loan taken out to purchase the property. This document outlines the terms of the loan and the rights of the lender.

Understanding these documents is crucial for anyone involved in a property transaction. Each plays a vital role in ensuring the process is legally sound and that both parties are protected. Be sure to gather all necessary forms to facilitate a successful transfer of ownership.

Other State-specific Quitclaim Deed Forms

Quit Claim Deed Instructions - A quitclaim deed is authorized by the grantor’s signature.

For those looking to navigate the process of transferring ownership, understanding the Colorado ATV Bill of Sale is crucial. This document not only records the sale but also protects both parties involved. You can find further insights on this topic by visiting the essential Colorado ATV Bill of Sale document guide.

Fl Quit Claim Deed - It can be used when transferring property into a trust.

Key Details about New York Quitclaim Deed

What is a Quitclaim Deed in New York?

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another in New York. Unlike other types of deeds, a Quitclaim Deed does not guarantee that the person transferring the property has clear title to it. Instead, it simply conveys whatever interest the grantor may have in the property. This type of deed is often used among family members or in situations where the parties know each other well.

How do I complete a Quitclaim Deed in New York?

Completing a Quitclaim Deed involves several steps:

- Identify the parties involved: The grantor (the person transferring the property) and the grantee (the person receiving the property).

- Provide a legal description of the property: This should include the address and any relevant details that define the property boundaries.

- Sign the deed: The grantor must sign the Quitclaim Deed in the presence of a notary public.

- File the deed: After notarization, the deed must be filed with the county clerk’s office in the county where the property is located.

Ensure that all information is accurate to avoid complications in the transfer process.

Are there any fees associated with filing a Quitclaim Deed?

Yes, there are typically fees associated with filing a Quitclaim Deed in New York. These fees can vary by county. Generally, you can expect to pay:

- A recording fee, which is charged by the county clerk for processing the document.

- Possible transfer taxes, depending on the value of the property being transferred.

It’s advisable to check with your local county clerk’s office for the most accurate fee schedule.

Do I need an attorney to prepare a Quitclaim Deed?

While it is not legally required to have an attorney prepare a Quitclaim Deed, consulting with one can be beneficial. An attorney can help ensure that the deed is correctly filled out and that all legal requirements are met. This can help prevent future disputes regarding property ownership. If you are comfortable with the process and understand the implications, you may choose to prepare the deed yourself.

Similar forms

- Warranty Deed: This document guarantees that the grantor has clear title to the property and the right to transfer it. Unlike a quitclaim deed, it offers more protection to the grantee.

- Grant Deed: Similar to a warranty deed, a grant deed transfers property and includes some assurances about the title. However, it does not provide as extensive a guarantee as a warranty deed.

- Special Warranty Deed: This deed transfers property with a limited warranty. The grantor only guarantees that they have not encumbered the property during their ownership, unlike a quitclaim deed which offers no guarantees.

-

Dog Bill of Sale: The California Dog Bill of Sale form serves as a written record of the transfer of ownership of a dog from one party to another. This document outlines important details, ensuring both the buyer and the seller have a clear understanding of the transaction. By using this form, individuals can protect their interests and promote responsible pet ownership. For a convenient template, you can refer to Fast PDF Templates.

- Deed of Trust: This document secures a loan by transferring property to a trustee until the borrower repays the loan. While it serves a different purpose, it also involves the transfer of property rights.

- Lease Agreement: A lease allows a tenant to occupy a property for a specified time. Though it does not transfer ownership, it establishes rights related to the property, similar to how a quitclaim deed transfers ownership rights.

- Life Estate Deed: This deed allows a person to use a property for their lifetime, after which the property passes to another party. It involves the transfer of property rights, akin to a quitclaim deed.

- Transfer on Death Deed: This document allows a property owner to designate beneficiaries who will inherit the property upon their death. It functions similarly to a quitclaim deed in transferring property rights but is effective only after death.

- Affidavit of Heirship: This document establishes a person’s right to inherit property when the owner dies without a will. It serves to clarify ownership, similar to how a quitclaim deed clarifies property transfer.

Guide to Filling Out New York Quitclaim Deed

Once you have your New York Quitclaim Deed form, it’s time to fill it out accurately. This form transfers property ownership from one party to another. After completing the form, you will need to sign it in front of a notary public, and then file it with the appropriate county office.

- Begin by entering the date at the top of the form.

- Fill in the name of the grantor (the person transferring the property) in the designated space.

- Provide the grantor's address, including city, state, and zip code.

- Next, write the name of the grantee (the person receiving the property) in the appropriate section.

- Include the grantee's address, ensuring it is complete with city, state, and zip code.

- Describe the property being transferred. Include details such as the street address, city, and any relevant tax identification numbers.

- Specify the consideration amount, which is typically the price paid for the property, or state “for love and affection” if applicable.

- Have the grantor sign the form where indicated. This signature must be done in front of a notary public.

- Complete the notary section by having the notary sign and stamp the document.

- Make copies of the completed deed for your records.

- Finally, file the original deed with the county clerk’s office where the property is located.