Legal Real Estate Purchase Agreement Document for New York State

Misconceptions

When dealing with the New York Real Estate Purchase Agreement, many misconceptions can arise. Understanding these can help buyers and sellers navigate the process more smoothly. Here are eight common misunderstandings:

- It's just a formality. Many believe that the Purchase Agreement is merely a formality. In reality, it is a legally binding document that outlines the terms of the sale.

- All agreements are the same. Some think that all Purchase Agreements are identical. However, each agreement can be tailored to fit the specific needs and circumstances of the transaction.

- Verbal agreements are enough. A common myth is that verbal agreements suffice. In New York, a written Purchase Agreement is essential to protect both parties.

- It’s easy to change later. Many assume that changes can be made easily after signing. Modifications often require mutual consent and can complicate the process.

- Only real estate agents need to understand it. Some believe that only agents need to comprehend the Purchase Agreement. In fact, both buyers and sellers should fully understand its terms.

- It guarantees a successful sale. A Purchase Agreement does not guarantee that the sale will go through. Contingencies and other factors can still derail the transaction.

- It covers everything. Many think that the Purchase Agreement addresses all aspects of the sale. However, some issues may require separate agreements or disclosures.

- Legal advice is unnecessary. Some individuals believe they can navigate the agreement without legal guidance. Consulting an attorney can provide valuable insights and protections.

By dispelling these misconceptions, both buyers and sellers can approach the New York Real Estate Purchase Agreement with a clearer understanding, ensuring a smoother transaction process.

Documents used along the form

The New York Real Estate Purchase Agreement is a critical document in the property buying process. However, it is often accompanied by several other forms and documents that help clarify terms, outline responsibilities, and ensure a smooth transaction. Below is a list of commonly used documents that complement the purchase agreement.

- Disclosure Statement: This document provides buyers with essential information about the property, including any known issues or defects. It helps ensure transparency and allows buyers to make informed decisions.

- Lead-Based Paint Disclosure: Required for homes built before 1978, this form informs buyers about the potential presence of lead-based paint. It is crucial for protecting the health of occupants, especially children.

- Trailer Bill of Sale: The documentonline.org/ provides the California Trailer Bill of Sale form, crucial for legally recording the sale and ownership transfer of a trailer, ensuring a smooth transaction for both parties involved.

- Title Report: A title report outlines the legal ownership of the property and identifies any liens or encumbrances. This document is vital for ensuring that the seller has the right to sell the property free of any legal disputes.

- Closing Statement: Also known as a HUD-1 statement, this document details all financial transactions involved in the sale, including closing costs and adjustments. It provides a clear summary of what each party owes or will receive at closing.

- Home Inspection Report: This report is generated after a professional inspection of the property. It highlights any structural or mechanical issues, allowing buyers to negotiate repairs or reconsider their purchase.

Understanding these documents is essential for anyone involved in a real estate transaction. Each plays a unique role in protecting the interests of both buyers and sellers, ensuring a transparent and efficient process.

Other State-specific Real Estate Purchase Agreement Forms

Buyer Agreement - The agreement outlines the closing date, a key deadline for both parties to finalize the sale.

In addition to clarifying your wishes regarding the distribution of your estate, a Last Will and Testament can often be accessed through resources such as PDF Documents Hub, making it easier to create and finalize your legal document.

Key Details about New York Real Estate Purchase Agreement

What is a New York Real Estate Purchase Agreement?

A New York Real Estate Purchase Agreement is a legally binding document that outlines the terms and conditions of a real estate transaction between a buyer and a seller. This agreement details the property being sold, the purchase price, and any contingencies that must be met for the sale to proceed. It serves to protect the interests of both parties throughout the transaction process.

What information is typically included in the agreement?

The agreement generally includes the following key components:

- Identification of the buyer and seller

- Description of the property, including its address and legal description

- Purchase price and payment terms

- Contingencies, such as financing or inspection requirements

- Closing date and any conditions for closing

- Disclosures regarding the property’s condition

Is the agreement required to be in writing?

Yes, under New York law, a real estate purchase agreement must be in writing to be enforceable. This requirement helps ensure that both parties have a clear understanding of the terms and conditions of the sale, reducing the potential for disputes later on.

What are contingencies, and why are they important?

Contingencies are specific conditions outlined in the agreement that must be satisfied for the sale to proceed. Common contingencies include:

- Financing contingency: This allows the buyer to secure a mortgage before finalizing the purchase.

- Inspection contingency: This gives the buyer the right to have the property inspected for any issues.

- Appraisal contingency: This ensures that the property is appraised at or above the purchase price.

Including contingencies protects the buyer’s interests and provides an opportunity to back out of the agreement if certain conditions are not met.

What happens if either party wants to back out of the agreement?

If either party wishes to back out of the agreement, they must review the terms outlined in the contract. If the buyer or seller has not met the contingencies specified in the agreement, they may have grounds to withdraw without penalty. However, if one party tries to back out without valid reasons, they could face legal consequences or be required to compensate the other party.

Can the agreement be modified after it is signed?

Yes, the agreement can be modified after it is signed, but both parties must agree to the changes. Any modifications should be documented in writing and signed by both the buyer and seller to ensure clarity and enforceability. This helps prevent misunderstandings and protects the rights of both parties.

What is the role of an attorney in this process?

While it is not legally required to have an attorney for a real estate transaction in New York, having legal representation is highly recommended. An attorney can help review the agreement, ensure that all legal requirements are met, and provide guidance on any potential issues that may arise during the transaction. Their expertise can be invaluable in protecting your interests.

What should I do if I have questions about the agreement?

If you have questions about the New York Real Estate Purchase Agreement, consider reaching out to a qualified real estate attorney or a licensed real estate agent. They can provide clarity on specific terms, answer your concerns, and guide you through the process to ensure that you fully understand your rights and obligations.

Similar forms

Lease Agreement: This document outlines the terms and conditions under which a tenant rents property from a landlord. Like the Real Estate Purchase Agreement, it specifies the rights and responsibilities of both parties, including payment terms and duration of the lease.

Option to Purchase Agreement: This document grants a potential buyer the right to purchase a property at a specified price within a certain timeframe. Similar to the Real Estate Purchase Agreement, it includes details about the property, purchase price, and conditions for the sale.

-

Residential Lease Agreement: A vital document for renting, this agreement outlines the terms between a landlord and tenant, similar to the above agreements. For detailed templates, you can refer to https://nyforms.com/residential-lease-agreement-template.

Real Estate Listing Agreement: This agreement is between a property owner and a real estate agent, allowing the agent to market the property for sale. It contains terms regarding commission and duration of the listing, akin to how a Real Estate Purchase Agreement details the sale terms.

Seller's Disclosure Statement: This document requires the seller to disclose known issues or defects with the property. Like the Real Estate Purchase Agreement, it is crucial for ensuring transparency and protecting both buyer and seller during the transaction.

Closing Disclosure: This form provides a detailed account of the final costs associated with a real estate transaction. Similar to the Real Estate Purchase Agreement, it ensures that both parties are aware of financial obligations and fees before finalizing the sale.

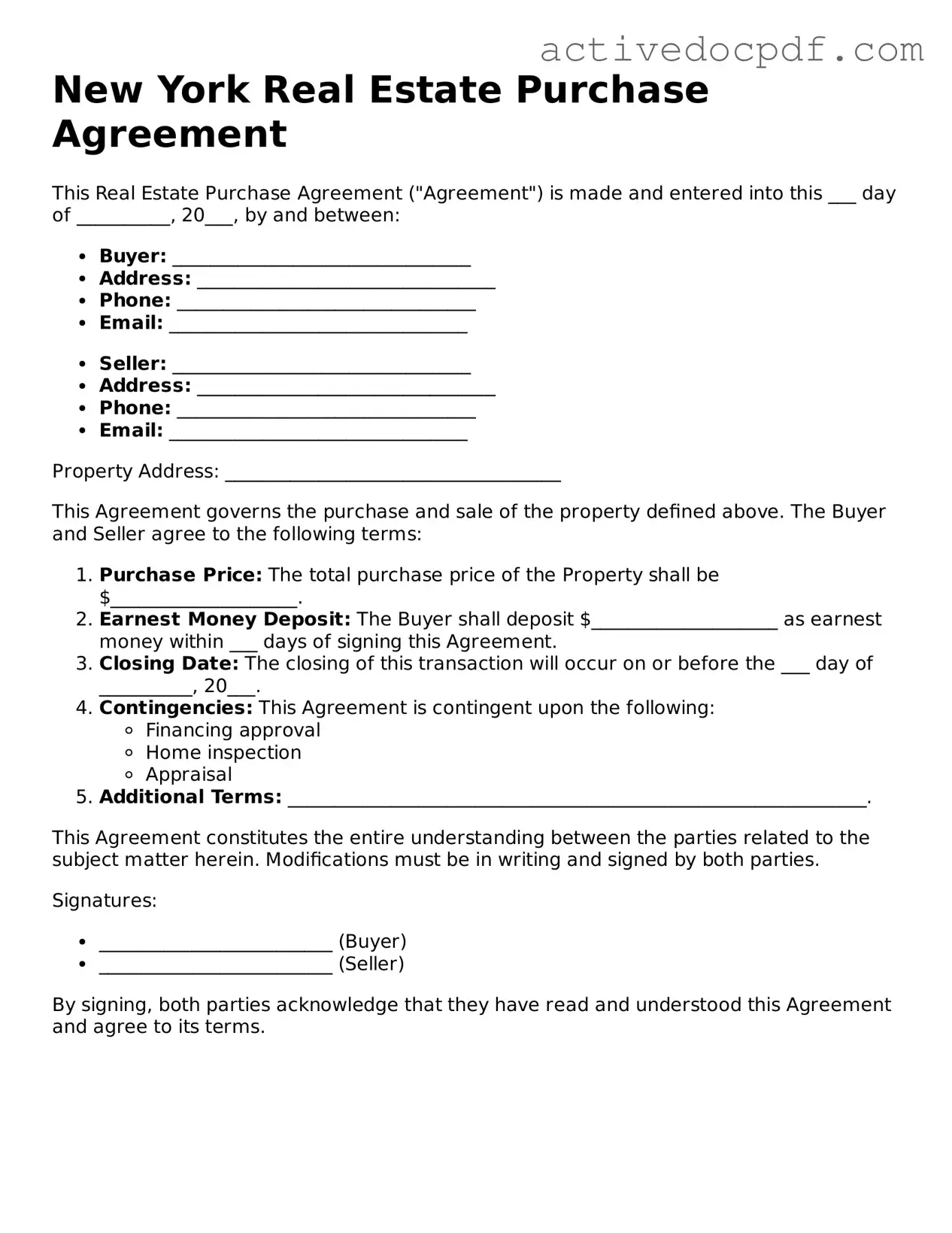

Guide to Filling Out New York Real Estate Purchase Agreement

After gathering all necessary information, you are ready to fill out the New York Real Estate Purchase Agreement form. This document serves as a crucial part of the home buying process, outlining the terms and conditions of the sale. Follow these steps to ensure you complete the form accurately.

- Obtain the Form: Access the New York Real Estate Purchase Agreement form from a reliable source, such as a real estate agent or an official website.

- Fill in Buyer Information: Enter the full names and contact information of all buyers. Ensure that spelling is correct.

- Fill in Seller Information: Provide the full names and contact details of the sellers, similar to the buyer section.

- Property Description: Clearly describe the property being sold. Include the address, legal description, and any relevant details about the property type.

- Purchase Price: Specify the agreed-upon purchase price for the property. Be clear and precise in this section.

- Deposit Amount: Indicate the amount of the deposit that will be made as part of the agreement.

- Financing Contingency: If applicable, state any financing conditions that must be met for the sale to proceed.

- Closing Date: Enter the proposed date for the closing of the sale. This is when the ownership will officially transfer.

- Additional Terms: Include any additional terms or conditions that both parties have agreed upon, such as repairs or inclusions of appliances.

- Signatures: Ensure that both buyers and sellers sign and date the form. This step is essential for the agreement to be valid.

Once the form is completed, it is advisable to review it carefully. Both parties should ensure that all information is accurate and that they fully understand the terms before proceeding to the next steps in the real estate transaction.