The New York Rental Application form is a document that potential tenants fill out when applying to rent a property. This form helps landlords assess the suitability of applicants by collecting essential information, such as employment history, rental history, and credit background. It is an important step in the rental process, as it allows landlords to make informed decisions about who to rent to.

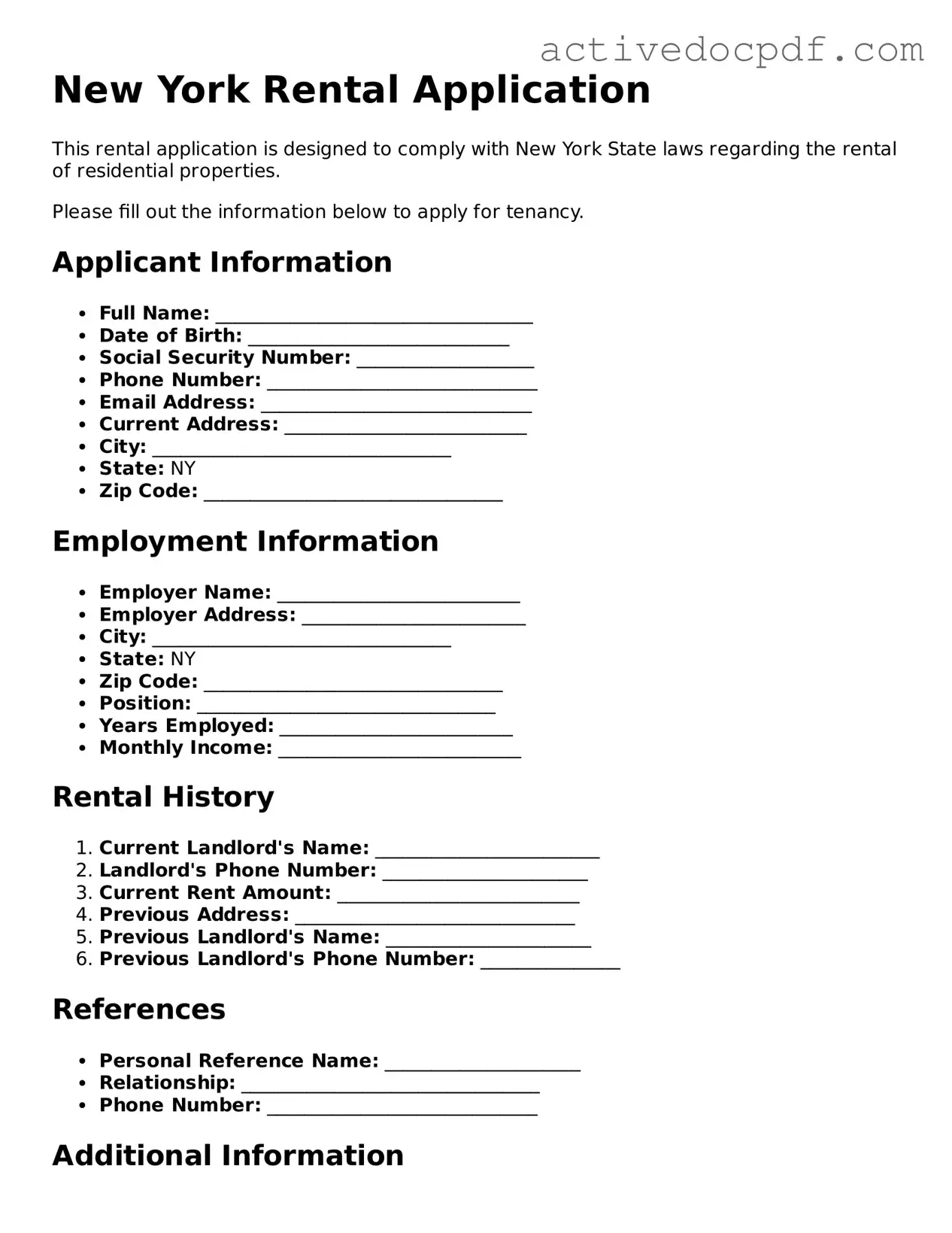

A typical New York Rental Application form may require the following information:

-

Personal details, including name, address, and contact information

-

Social Security number or Tax Identification number

-

Employment information, including current employer and income

-

Rental history, detailing previous addresses and landlord contacts

-

References, which may include personal or professional contacts

-

Consent for a background and credit check

Do I have to pay a fee when submitting the application?

Yes, landlords in New York can charge an application fee to cover the costs of background and credit checks. However, this fee is capped at a specific amount, which may change, so it's important to confirm the current limit. Always ask for a receipt when you pay the fee, as it provides proof of payment.

How long does the application process take?

The duration of the application process can vary. Generally, landlords may take anywhere from a few days to a week to review applications. Factors affecting the timeline include the number of applications received and the thoroughness of background checks. If you haven’t heard back within a week, it’s reasonable to follow up with the landlord or property manager.

Can I be denied a rental application? If so, why?

Yes, a rental application can be denied for several reasons. Common reasons include:

-

Poor credit history or low credit score

-

Insufficient income to cover rent

-

Negative rental history, such as previous evictions

-

Inaccurate or incomplete information provided on the application

If you are denied, landlords are typically required to inform you of the reason, especially if it is related to your credit report.

What should I do if I am denied?

If your application is denied, you have a few options. First, ask the landlord for the specific reasons behind the denial. This information can help you address any issues. You may also want to check your credit report for errors and dispute any inaccuracies. Additionally, consider providing references or a co-signer to strengthen your next application.

Is it possible to appeal a rental application denial?