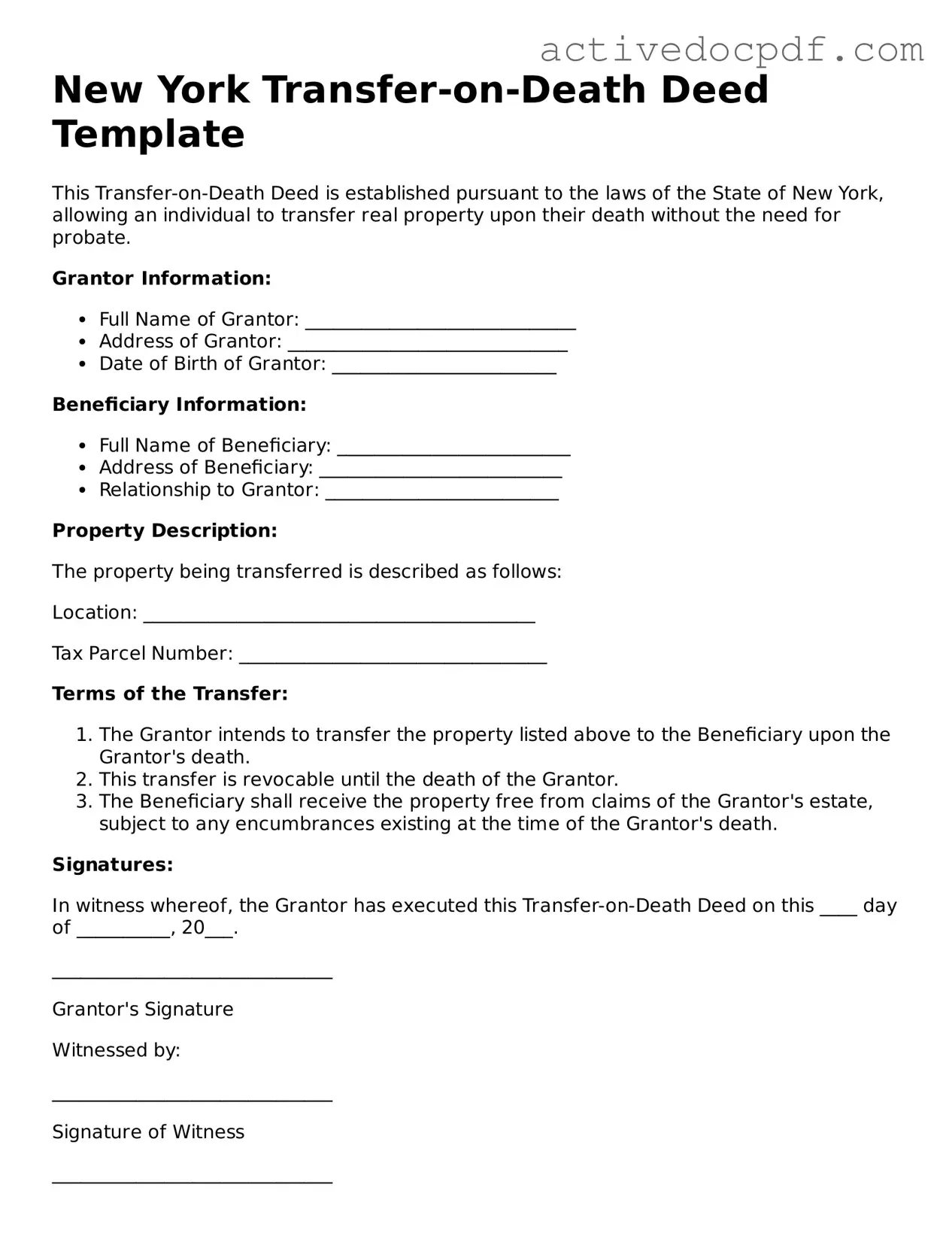

Legal Transfer-on-Death Deed Document for New York State

Misconceptions

Understanding the New York Transfer-on-Death Deed form can be challenging, especially with the presence of various misconceptions. Here are four common misunderstandings surrounding this legal instrument:

- Misconception 1: The Transfer-on-Death Deed automatically transfers property upon death.

- Misconception 2: A Transfer-on-Death Deed avoids probate entirely.

- Misconception 3: All types of property can be transferred using a Transfer-on-Death Deed.

- Misconception 4: Once a Transfer-on-Death Deed is filed, it cannot be changed.

This is not entirely accurate. While the deed does facilitate a transfer upon the death of the property owner, it does not take effect until the owner passes away. Until that time, the owner retains full control over the property.

While it does allow for property to pass directly to beneficiaries without going through the lengthy probate process, it does not eliminate the need for probate for other assets or debts that may exist. Thus, it’s important to consider the entire estate when planning.

This is misleading. Only certain types of real property can be transferred in this manner. For example, personal property or intangible assets cannot be conveyed through a Transfer-on-Death Deed.

This is incorrect. The property owner can revoke or modify the deed at any time prior to their death, provided they follow the proper legal procedures. Flexibility exists for property owners to adjust their plans as circumstances change.

Documents used along the form

When dealing with a New York Transfer-on-Death Deed, several other forms and documents may be necessary to ensure a smooth transfer of property. Understanding these documents can help you navigate the process more effectively.

- Last Will and Testament: This document outlines how a person's assets should be distributed after their death. It can complement the Transfer-on-Death Deed by addressing any other assets not covered by the deed.

- Affidavit of Death: This form is used to confirm the death of the property owner. It may be required to finalize the transfer of the property to the designated beneficiary.

- Property Deed: The original deed of the property is essential. It provides proof of ownership and may need to be referenced or updated during the transfer process.

- Beneficiary Designation Forms: If the property owner has designated beneficiaries for other assets, these forms will outline who will receive those assets. They can provide clarity on the overall estate plan.

- Power of Attorney: This document allows an individual to appoint someone else to make legal decisions on their behalf, which can be important while managing property prior to death. For more information, visit nyforms.com/power-of-attorney-template/.

- Estate Tax Return: Depending on the value of the estate, this form may be necessary to report any taxes owed. It ensures compliance with state and federal tax laws.

- Notice of Transfer: This document notifies interested parties of the transfer of property upon the owner's death. It can help prevent disputes among potential heirs.

Being aware of these additional documents can help you prepare for the transfer process. Each form plays a role in ensuring that your wishes are honored and that the transition is as smooth as possible for your loved ones.

Other State-specific Transfer-on-Death Deed Forms

Transfer on Death Deed Florida Form - This deed can be part of a larger estate plan, working alongside wills and trusts.

For those seeking necessary documentation for vehicle transactions, the detailed Motor Vehicle Bill of Sale form serves as an essential tool to ensure legal compliance and proper ownership transfer in Washington.

Key Details about New York Transfer-on-Death Deed

What is a Transfer-on-Death Deed?

A Transfer-on-Death Deed (TOD Deed) is a legal document that allows an individual to transfer real property to a beneficiary upon their death. This type of deed bypasses the probate process, enabling a smoother and often quicker transfer of property ownership.

Who can use a Transfer-on-Death Deed in New York?

Any property owner in New York can use a Transfer-on-Death Deed. This includes individuals who own real estate solely or as joint tenants. However, it is important to ensure that the deed is executed properly according to state laws to be effective.

How do I create a Transfer-on-Death Deed?

To create a Transfer-on-Death Deed, follow these steps:

- Obtain the appropriate form for a Transfer-on-Death Deed.

- Fill out the form with the required information, including the property details and beneficiary's name.

- Sign the deed in the presence of a notary public.

- Record the deed with the county clerk's office where the property is located.

What information is required on the Transfer-on-Death Deed?

The following information is typically required:

- The name and address of the property owner(s).

- The legal description of the property.

- The name and address of the beneficiary.

- The signature of the property owner(s) and a notary public.

Can I change or revoke a Transfer-on-Death Deed?

Yes, a Transfer-on-Death Deed can be revoked or changed at any time before the property owner’s death. This can be done by executing a new deed that explicitly revokes the previous one or by recording a revocation document with the county clerk.

What happens if the beneficiary predeceases the property owner?

If the named beneficiary dies before the property owner, the Transfer-on-Death Deed will become ineffective. It is advisable to name alternate beneficiaries to avoid complications in such situations.

Are there any tax implications with a Transfer-on-Death Deed?

Generally, a Transfer-on-Death Deed does not trigger immediate tax consequences. However, the property may be subject to estate taxes upon the owner's death. Consulting with a tax professional is recommended to understand the specific implications.

Is legal advice necessary to use a Transfer-on-Death Deed?

While it is not legally required to seek legal advice, it is often beneficial. An attorney can help ensure that the deed is completed correctly and that it aligns with the property owner’s overall estate planning goals.

Where can I find the Transfer-on-Death Deed form?

The Transfer-on-Death Deed form can typically be found on the New York State government website or through local county clerk offices. It is important to use the most current version of the form to ensure compliance with state laws.

Similar forms

- Will: A will specifies how a person's assets will be distributed after their death. Like a Transfer-on-Death Deed, it allows individuals to designate beneficiaries for their property.

- Invoice Template: Utilizing an efficient invoice template can significantly expedite the billing process. For an excellent resource, check out PDF Documents Hub to find tools that help create customized invoices effortlessly.

- Living Trust: A living trust holds assets during a person's lifetime and specifies how they should be managed after death. Both documents facilitate the transfer of property outside of probate.

- Beneficiary Designation Forms: These forms are used for financial accounts and insurance policies to name beneficiaries. Similar to a Transfer-on-Death Deed, they allow direct transfer of assets upon death.

- Payable-on-Death Accounts: These bank accounts allow the account holder to designate a beneficiary who will receive the funds upon the account holder's death, similar to how a Transfer-on-Death Deed operates.

- Joint Tenancy with Right of Survivorship: This form of property ownership allows co-owners to inherit the property automatically upon the death of one owner, akin to the transfer mechanism of a Transfer-on-Death Deed.

- Life Estate Deed: A life estate deed allows a person to retain use of a property during their lifetime, with the property passing to designated beneficiaries after death, similar to the intentions behind a Transfer-on-Death Deed.

- Transfer-on-Death Registration for Vehicles: Some states allow vehicle owners to register a transfer-on-death designation for their vehicles, which works similarly to a Transfer-on-Death Deed for real estate.

- Retirement Account Beneficiary Designations: Retirement accounts often allow account holders to name beneficiaries who will inherit the funds upon death, paralleling the beneficiary designations in a Transfer-on-Death Deed.

- Community Property with Right of Survivorship: In some states, this form of property ownership allows one spouse to inherit the property automatically upon the death of the other, similar to the Transfer-on-Death Deed's function.

- Trustee-to-Beneficiary Transfers: Some trust documents allow for direct transfers to beneficiaries upon the death of the trustee, which is akin to the immediate transfer of property through a Transfer-on-Death Deed.

Guide to Filling Out New York Transfer-on-Death Deed

Filling out the New York Transfer-on-Death Deed form is a straightforward process that allows you to designate a beneficiary for your property. Once completed, this form will need to be filed with the county clerk in the county where the property is located. Follow these steps to ensure that your form is filled out correctly.

- Begin by downloading the New York Transfer-on-Death Deed form from the official state website or obtaining a physical copy from your local county clerk's office.

- In the top section of the form, clearly write your name and address as the current owner of the property.

- Next, provide a detailed description of the property you wish to transfer. Include the address, parcel number, and any other identifying information.

- Designate the beneficiary by writing their full name and address. Ensure that this information is accurate to avoid any future complications.

- Specify the relationship between you and the beneficiary, if applicable. This can help clarify your intentions.

- Sign and date the form in the designated area. Your signature must be notarized to make the document legally binding.

- After notarization, make a copy of the completed form for your records.

- Finally, file the original form with the county clerk’s office in the county where the property is located. Be prepared to pay any associated filing fees.